- BONK’s worth has fallen by nearly 30% within the final month.

- Readings from its worth charts recommend the potential for an extra lower.

Solana-based meme coin Bonk [BONK] bucks the development and recorded a 27% worth decline within the final month, regardless of the rally within the memecoin market throughout that interval, CoinMarketCap’s knowledge has proven.

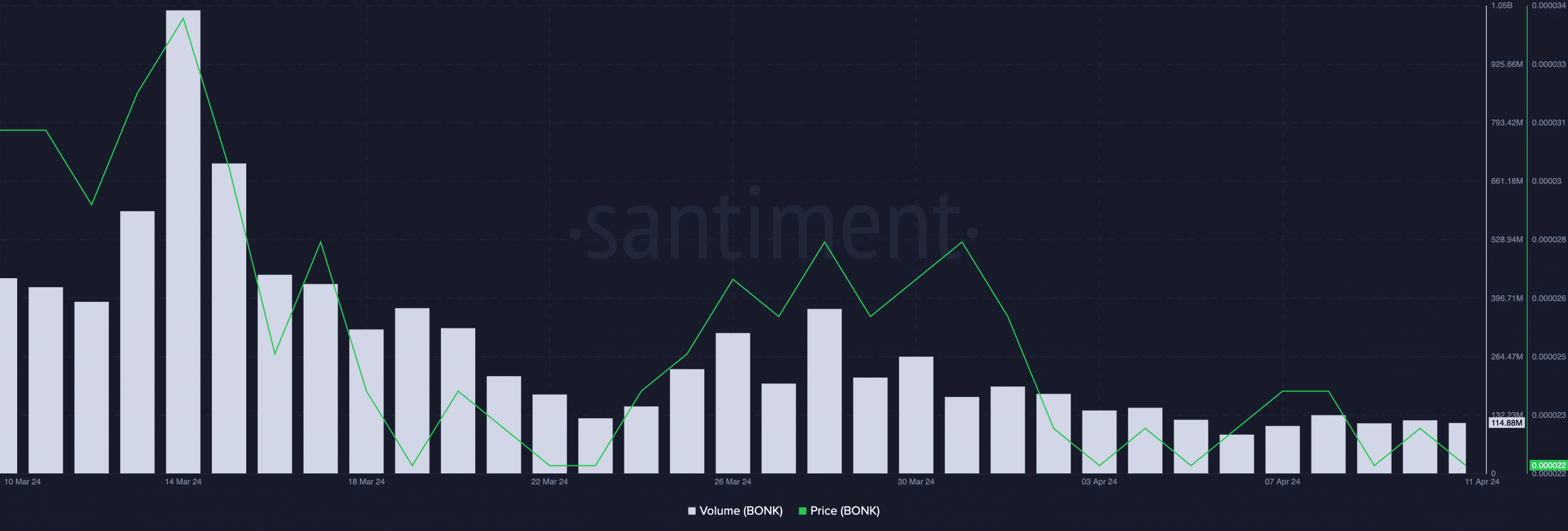

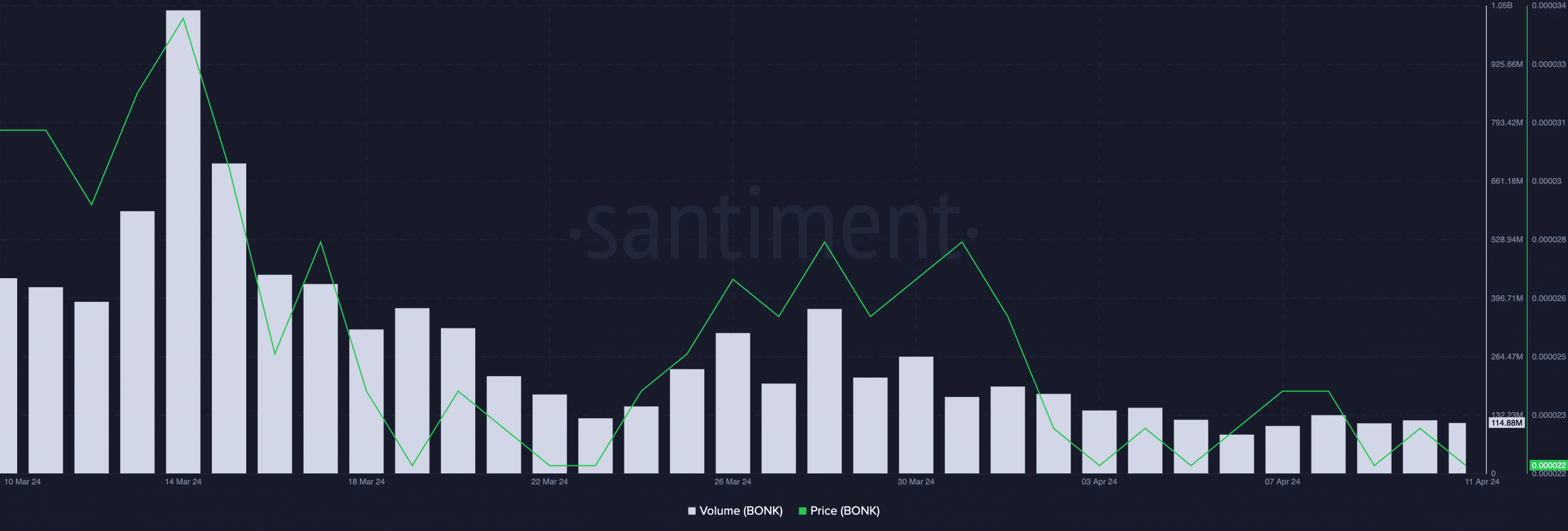

The 30-day interval below evaluate has seen a major fall within the token’s every day buying and selling quantity. In line with Santiment’s knowledge, BONK’s every day buying and selling quantity has fallen by 73% within the final month.

Supply: Santiment

BONK to increase losses

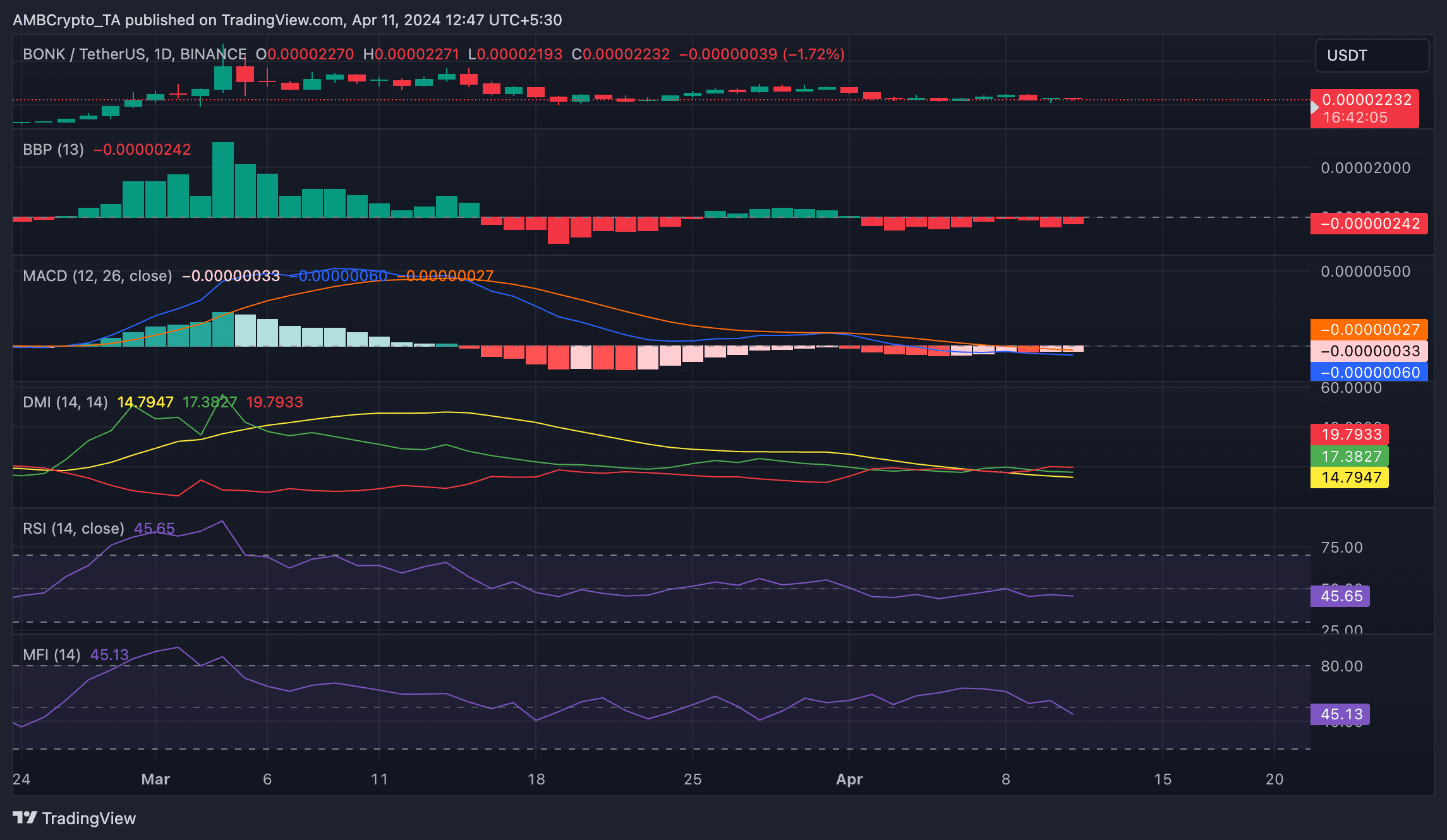

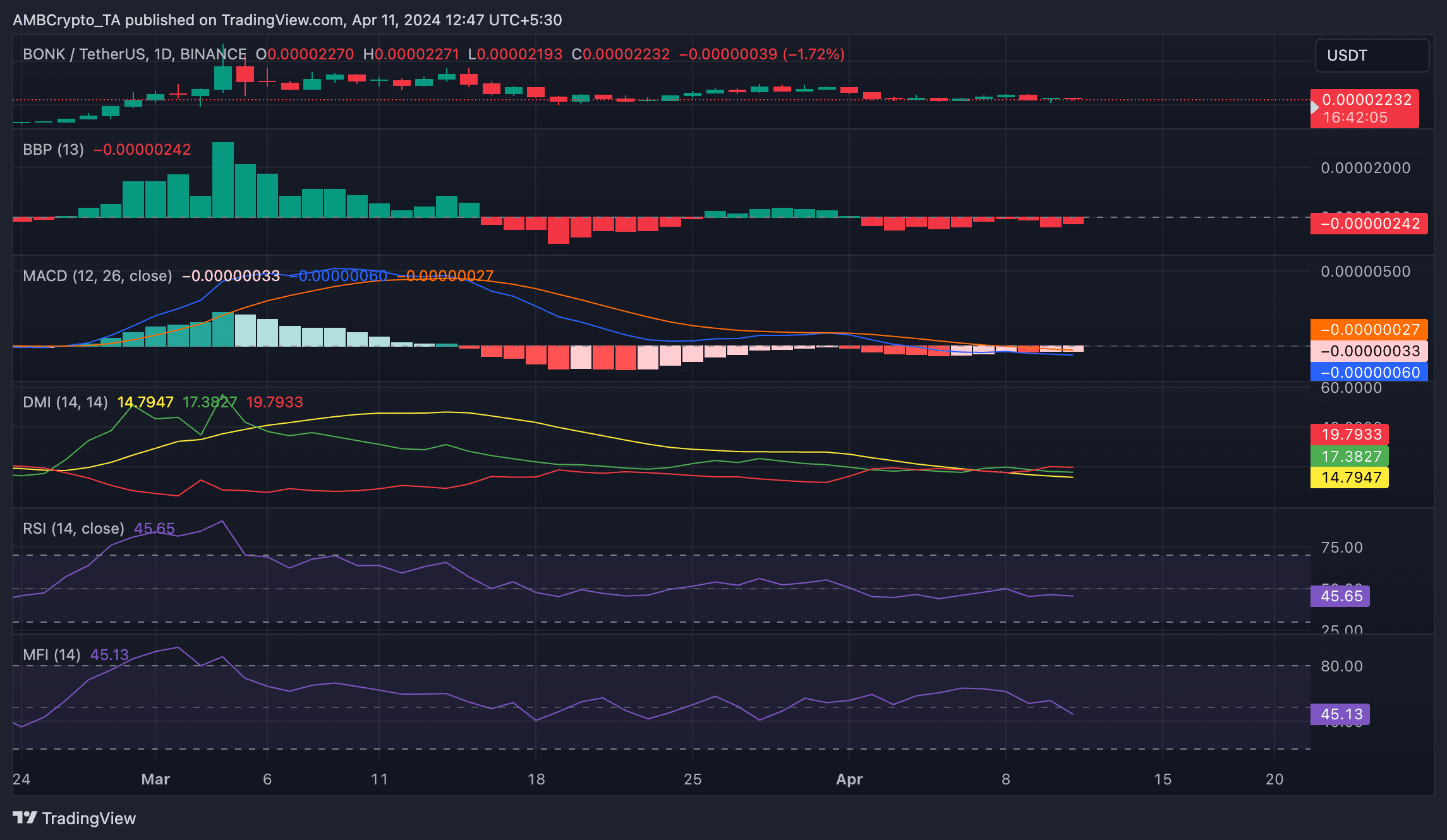

An evaluation of BONK’s key technical indicators on a 1-day chart hinted at the potential for an extra decline within the memecoin’s worth.

Signaling that bears are in charge of the market, readings from its Directional Motion Index (DMI) confirmed its constructive directional index (blue) resting under its detrimental index (pink). These strains have been so positioned since ninth April.

When an asset’s DMI is about up this manner, it means that its downward worth motion is stronger than any potential for an upward correction.

Additional, the altcoin’s key momentum indicators had been noticed under their respective impartial strains on the time of writing. BONK’s Relative Energy Index (RSI) was 45.28, and its Cash Circulate Index (MFI) was 45.09.

These values confirmed that BONK distribution outpaced its accumulation, thereby placing downward strain on its worth.

As well as, its Elder-Ray Index has posted solely detrimental values since 2nd April. This indicator measures the connection between the energy of patrons and sellers out there.

When its worth is detrimental, it means there’s an uptick in promoting exercise as bear energy turns into extra vital.

Confirming the energy of the bears, BONK’s MACD line was under the sign and 0 strains as of this writing.

When an asset’s MACD line falls under its sign line and returns a detrimental worth, it’s a bearish sign. This implies that its short-term development is weaker than its longer-term development. Merchants take this as an indication to exit lengthy positions and take brief ones.

Supply: BONK/USDT on TradingView

Is your portfolio inexperienced? Examine the Bonk Revenue Calculator

Merchants refuse to relent

In BONK’s derivatives market, its futures open curiosity has cratered by 65% since fifth March, per Coinglass knowledge. Nevertheless, regardless of this decline, its funding fee throughout cryptocurrency exchanges has remained constructive.

This implies that futures market individuals have continued to take lengthy positions in anticipation of an uptrend.