- BONK has gained 52% at press time because the lows of the nineteenth of April.

- The bounce might have been pushed virtually completely by the futures market.

Bonk [BONK] was trending upward within the decrease timeframes and its momentum was bullish as soon as once more. A latest AMBCrypto report highlighted how the social sentiment behind the memecoin has improved.

Its buying and selling quantity additionally jumped increased within the aftermath of Bitcoin’s [BTC] halving. Whereas they seemed to be constructive developments, there was nonetheless a troubling issue for merchants and traders to watch out for.

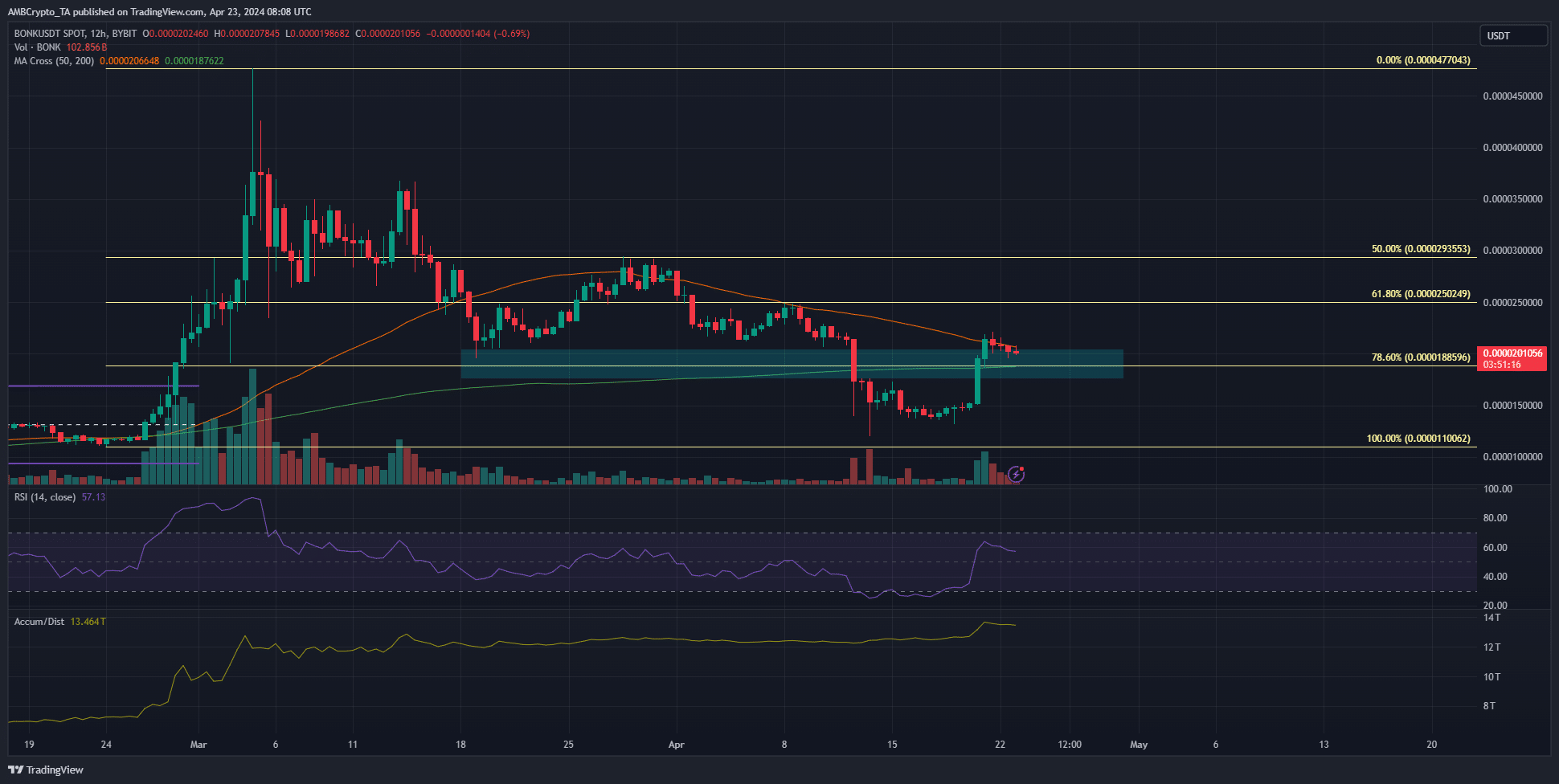

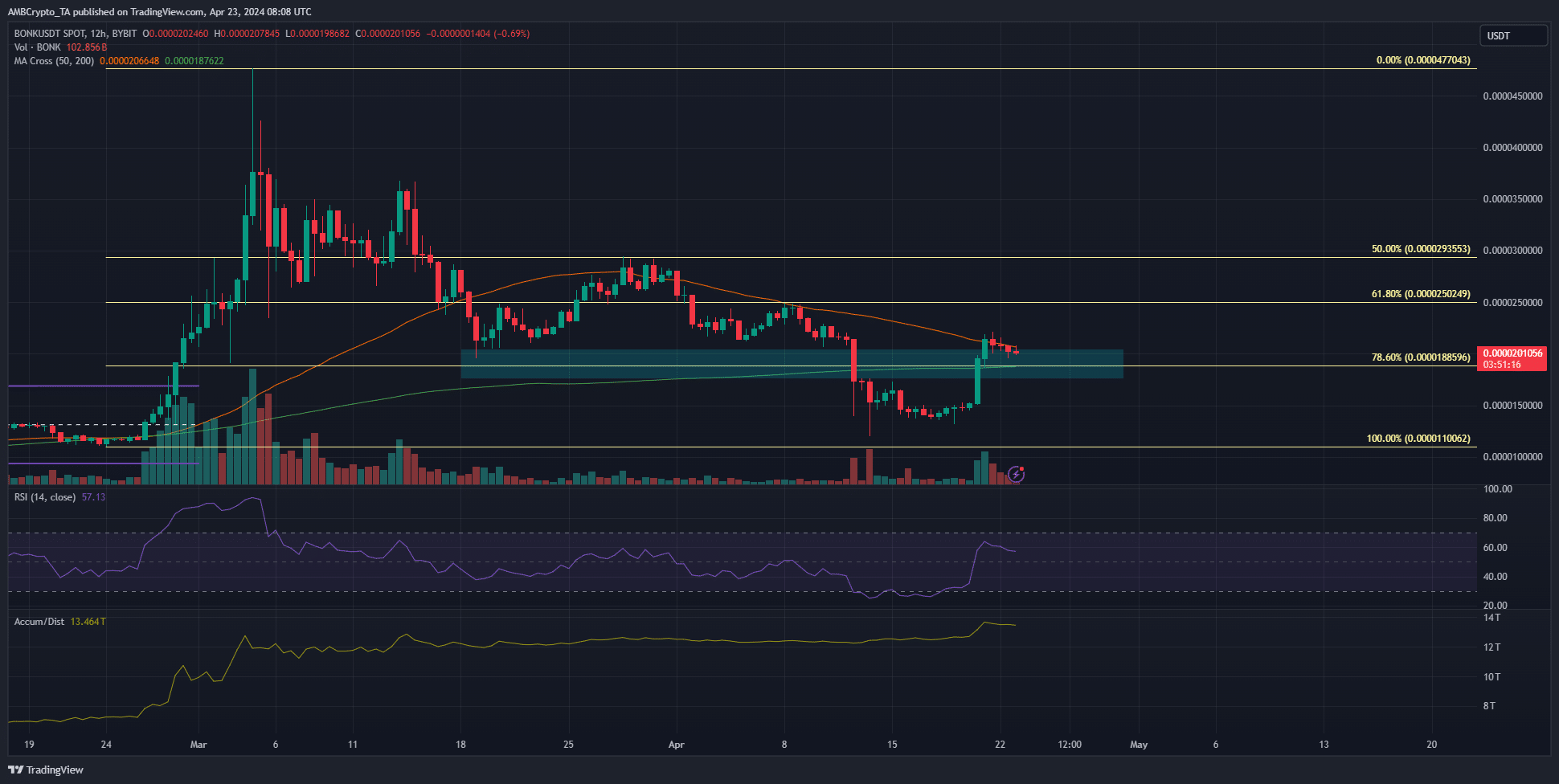

The inner construction of BONK remained bearishly biased

Supply: BONK/USDT on TradingView

The upper timeframe construction remained bullish for BONK after the late February rally. The inner construction of BONK in latest weeks was bearish, even after the most recent bounce took costs again above the 78.6% retracement stage at $0.00001885.

The easy shifting averages ought to function a help to the memecoin, alongside the demand zone highlighted in cyan. The H12 RSI has moved again above impartial 50 to underline bullish momentum.

Equally, the Accumulation/Distribution indicator additionally favored the consumers. It has slowly moved increased over the previous week. A transfer previous the decrease timeframe swing excessive at $0.000025 would encourage bulls to shift their short-term bias bullishly as soon as extra.

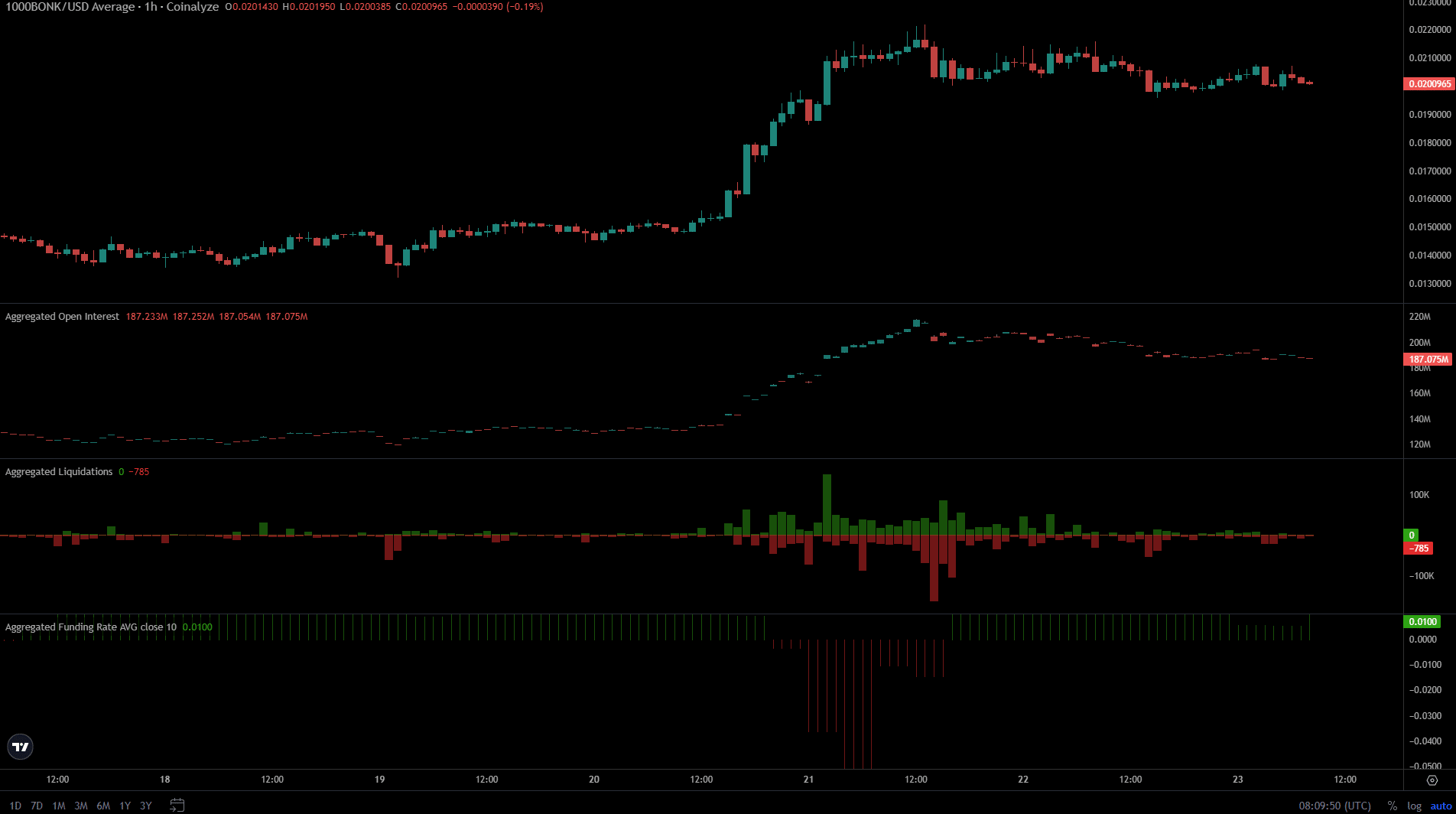

The waning Open Curiosity pointed to a disheartening thought

The funding charge of BONK fell deep into the pink area on the twenty first of April however has recovered since then. This meant individuals weren’t as bearish, however the Open Curiosity nonetheless waned over the previous two days.

The inference was that speculators had been shifting in the direction of the sidelines and lacked bullish conviction.

Lifelike or not, right here’s BONK’s market cap in BTC’s phrases

Moreover, the liquidated brief positions in the course of the bounce had been additionally remarkably excessive. Collectively, the OI and the liquidations recommend that the latest bounce in costs was seemingly pushed by the futures market, and never by spot demand.

Due to this fact, a bullish restoration might be tougher within the coming days.

Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.