Robust GDP development (however cool inflation), robust new house gross sales (however cool house costs), robust labor market information (jobless declare rose however stay close to multi-decade lows) all set the tone for the day as merchants ignored weak Nationwide Exercise information from The Chicago Fed, weak manufacturing information from The Kansas Metropolis Fed, and weak headline sturdy items orders.

However, the macro shock index is accelerating proper when it’s anticipated to because the lagged affect of the huge easing of monetary circumstances floods into the economic system…

Supply: Bloomberg

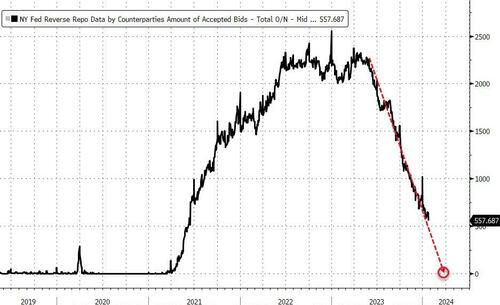

Moreover, an enormous $81BN of liquidity was pulled out of The Fed’s Reverse Repo facility at present (after the surge in invoice issuance), making a complete of $460BN withdrawn from the power in January to this point – on monitor for by far the most important month-to-month decline ever.

Supply: Bloomberg

Apparently, amid all that, STIRs shifted dovishly – with the percentages of a March reduce rising modestly and the scale of 2024 cuts rising (maybe forward of tomorrow’s pivotal Core PCE print)…

Supply: Bloomberg

Treasuries had been bid throughout all the curve with the short-end outperforming on the day (3Y -7bps, 30Y -3bps), leaving simply the long-end nonetheless larger in yield on the week…

Supply: Bloomberg

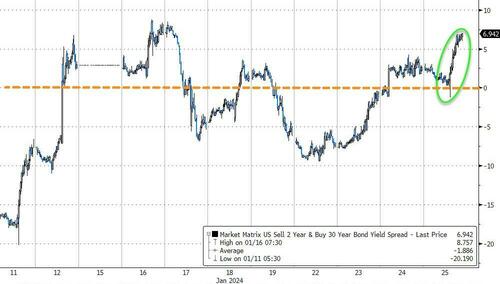

The yield curve bull-steepened at present, with 2s30s leaping to +7bps – its ‘steepest/uninverted’ since July 2022…

Supply: Bloomberg

Nasdaq lagged on the day – thanks largely to TSLA – as Small Caps outperformed. Every part closed inexperienced (even Nasdaq)… with a late-day meltup forward of Core PCE…

That is the fifth file every day shut in a row for the S&P 500

TSLA’s tumbled over 12% for its worst day since 2020 to its lowest since Could 2023…

TSLA weighed down The Magnificent 7 at present, erasing most of yesterday’s conferences…

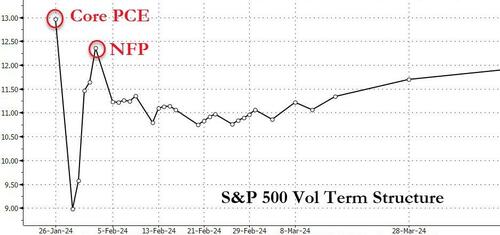

Vol is extraordinarily low forward of tomorrow’s Core PCE print (and subsequent week’s NFP), however the time period construction does acknowledge it…

Supply: Bloomberg

The greenback rallied through the US session, recovering from in a single day promoting stress…

Supply: Bloomberg

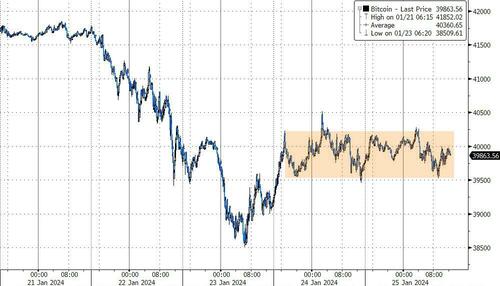

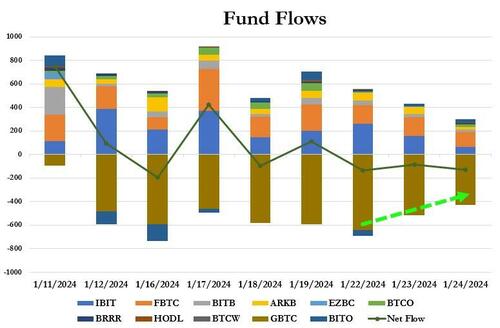

Bitcoin went sideways once more at present hovering round $40,000…

Supply: Bloomberg

…as GBTC outflows shrank once more…

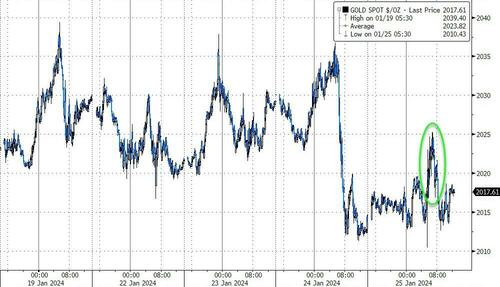

Gold went sideways at present, testing as much as $2025 intraday earlier than fading again…

Supply: Bloomberg

Oil costs properly and really broke out of their current rangebound buying and selling bracket with WTI ripping as much as virtually $78 – its highest since 11/30 (when OPEC+ did not impress with its announcement of further – voluntary – manufacturing cuts…

Supply: Bloomberg

WTI examined all the way in which as much as its 200DMA at present…

Supply: Bloomberg

Lastly, as Goldman’s Lee Coppersmith famous at present, the dichotomy between the primary half of February and the second half from a seasonal perspective is dramatic to say the least…

For these fearful about any froth within the US markets, the final two weeks in February are traditionally the worst 2 weeks of the 12 months.

Given how properly markets adopted the historic analog final 12 months, it’s one thing to have on the radar.

Loading…