By Garfield Reynolds, Bloomberg Markets Stay reporter and strategist

Bonds are cruising towards a possible bruising by pricing in an virtually rapid Federal Reserve pivot to fast, deep interest-rate cuts. The danger is that they are going to immediate the central financial institution to push again laborious sufficient to set off contemporary cross-asset turmoil.

Markets see about an 80% likelihood the Fed will trim its benchmark in March. Whereas inflation has slowed considerably and jobs progress has cooled, it’s laborious to see the justification for such one-sided bets. Certainly, the newest consumer-price and payroll numbers shocked modestly to the upside, suggesting the Fed remains to be prone to be removed from satisfied its coverage of returning inflation to focus on has been successful.

The arrogance in a March reduce can be puzzling given the brief runway. There are simply two extra units of experiences earlier than that month’s assembly, contemplating payrolls and the 2 most related inflation readings: the Bureau of Labor Statistics figures, and the PCE deflator the Fed targets.

The Fed could nicely search to handle this dislocation by way of an “intervention” a lot because it did again in early 2017. That was when then Chair Janet Yellen led a concerted marketing campaign from officers to say future conferences have been “stay.” Merchants responded by quickly boosting odds of a charge hike to 90% from lower than 30%.

Fed Chicago President Austan Goolsbee took a step in that course on the finish of final week by saying the market had gotten forward of itself. There’s additionally potential for additional pushback from speeches this week. Policymakers have constantly insisted that charge cuts are a good distance off, even after acknowledging in December that they’re unlikely to ship any extra hikes.

If a reduce in March presently appears a stretch, the 6 1/2 reductions priced in by year-end seem much more outlandish. That kind of trajectory would require a full-blown recession, which flies within the face of current information pointing to resilience within the economic system. Monetary situations are additionally as free as they’ve been in additional than a 12 months, highlighting the chance that early charge cuts would revive inflation.

The disconnect between the market and the Fed could owe a lot to the heady impression on buyers of bonds that when extra have respectable yields. With merchants sure they’ve the course of Fed coverage proper, increased coupon funds relative to current historical past appear to supply a big sufficient buffer to journey out any contemporary bursts of central-bank hawkishness.

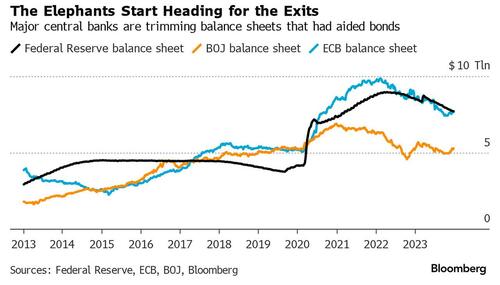

That enthusiasm might simply evaporate, particularly if there are contemporary fears about rising US bond provide. Most governments are forecast to increase bond issuance this 12 months, whilst the vast majority of central banks will both be working down their steadiness sheets or transferring towards that course of.

On the similar time, markets stay weak to Fed surprises, particularly as many firms have to refinance borrowings that have been taken out within the period of record-low rates of interest. The burden of expectations for a fast shift to decrease charges means equities are uncovered to any uptick in low cost charges, with ahead P/E ratios sitting nicely above pre-pandemic norms.

Bonds could present extra resilience to a stubbornly hawkish Fed than equities are prone to do given the way in which investor demand has elevated at any time when at any time when yields have risen. However each asset lessons stay weak till the divergence between market pricing and the Fed is resolved.

Loading…