Boeing shares tumbled in premarket buying and selling in New York after an emergency door separated from an Alaska Airways 737-9 Max jet over Portland on Friday night, forcing the Federal Aviation Administration and European Union Aviation Security Company to floor the jets for inspections.

Bloomberg Intelligence’s George Ferguson and Melissa Balzano imagine the mid-cabin exit door that ripped off the Max jet on Friday “in all probability stems from a producing oversight, an indication of deficiency at Spirit AeroSystems, Boeing’s key provider.”

“Manufacturing coaching and oversight seem like missing, as Spirit’s element flaws have develop into an unsettling sample,” the analysts continued.

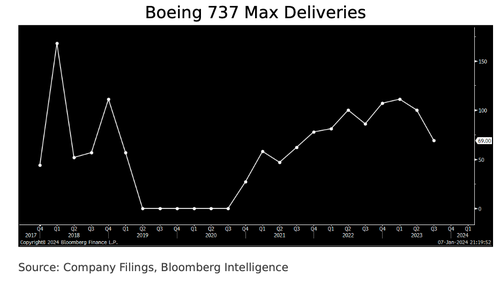

Persisting high quality management points pose a big risk to Boeing’s turnaround efforts. The elevated manufacturing charges of the 737, for which Spirit is the highest fuselage provider, are essential for enhancing income and money stream for each corporations.

A faltering turnaround plan is why Boeing shares plunged 9%, and shares of Spirit AeroSystems crashed 20%. In the meantime, competitor Airbus shares rose 1.5% in European buying and selling.

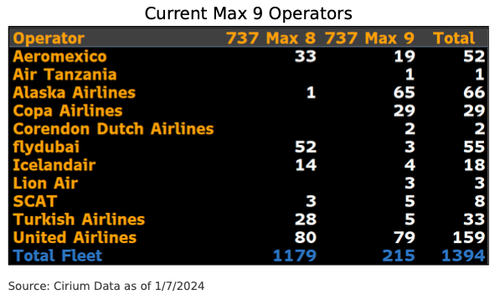

Listed below are the present operators of the 737-9 Max jets:

Wall Avenue analysts stated continued high quality management points at Boeing and Spirit AeroSystems might derail the 737 Max manufacturing ramp (checklist courtesy of Bloomberg):

Morgan Stanley (equal-weight, PT $255)

- Analyst Kristine Liwag expects the market to obtain the Alaska Air incident negatively for each Boeing and its fuselage provider, Spirit AeroSystems

- With out vital enchancment in high quality management, a steep ramp-up in plane manufacturing for Boeing could be unlikely and “imprudent;” sees improve in regulatory scrutiny on Boeing, probably inflicting certification delays to the 737 Max 7 and Max 10

JPMorgan (chubby, PT $270)

- The incident is just not useful with regard to Boeing’s key job of ramping manufacturing over the subsequent two years, analyst Seth Seifman writes, although the extent of the setback is just not but clear – notes focus additionally on provider Spirit Aero

- Whereas FAA’s preliminary requirement for a 4 to eight hour inspection didn’t seem to be a serious obstacle to a return to service, path again has develop into much less clear since then; it’s crucial for each Spirit Aero and Boeing to shore up high quality of manufacturing

Citi (purchase, PT $315)

- The 737 difficulty is probably going a producing difficulty with this explicit plane given the novelty of the plane and reality the Max has been in service since 2015 with out a comparable occasion, analyst Jason Gursky says

- This possible limits Boeing’s monetary publicity to an immaterial quantity in context of longer-term targets; analyst doesn’t count on difficulty to affect different variants of the 737 given the 9 is just one permitting for a plugged door

Truist Securities

- Expects bulk of the eye to concentrate on Spirit AeroSystems (maintain), which has been “plagued” with high quality escape points over the previous 12 months, analyst Michael Ciarmoli says, and is the biggest Max provider to Boeing

- Doesn’t imagine the difficulty with derail Max manufacturing, however the investigation continues to be in early phases

Keep in mind this.

As a reminder, the 737 Max was “designed by clowns who in flip are supervised by monkeys”.https://t.co/Z5rt2LoI3e

— zerohedge (@zerohedge) January 6, 2024

Boeing is beginning the brand new yr on the improper foot.

Loading…