- BNB’s worth motion and Chaikin Cash Stream have created a bearish divergence.

- Different key technical indicators have hinted at the opportunity of a worth decline.

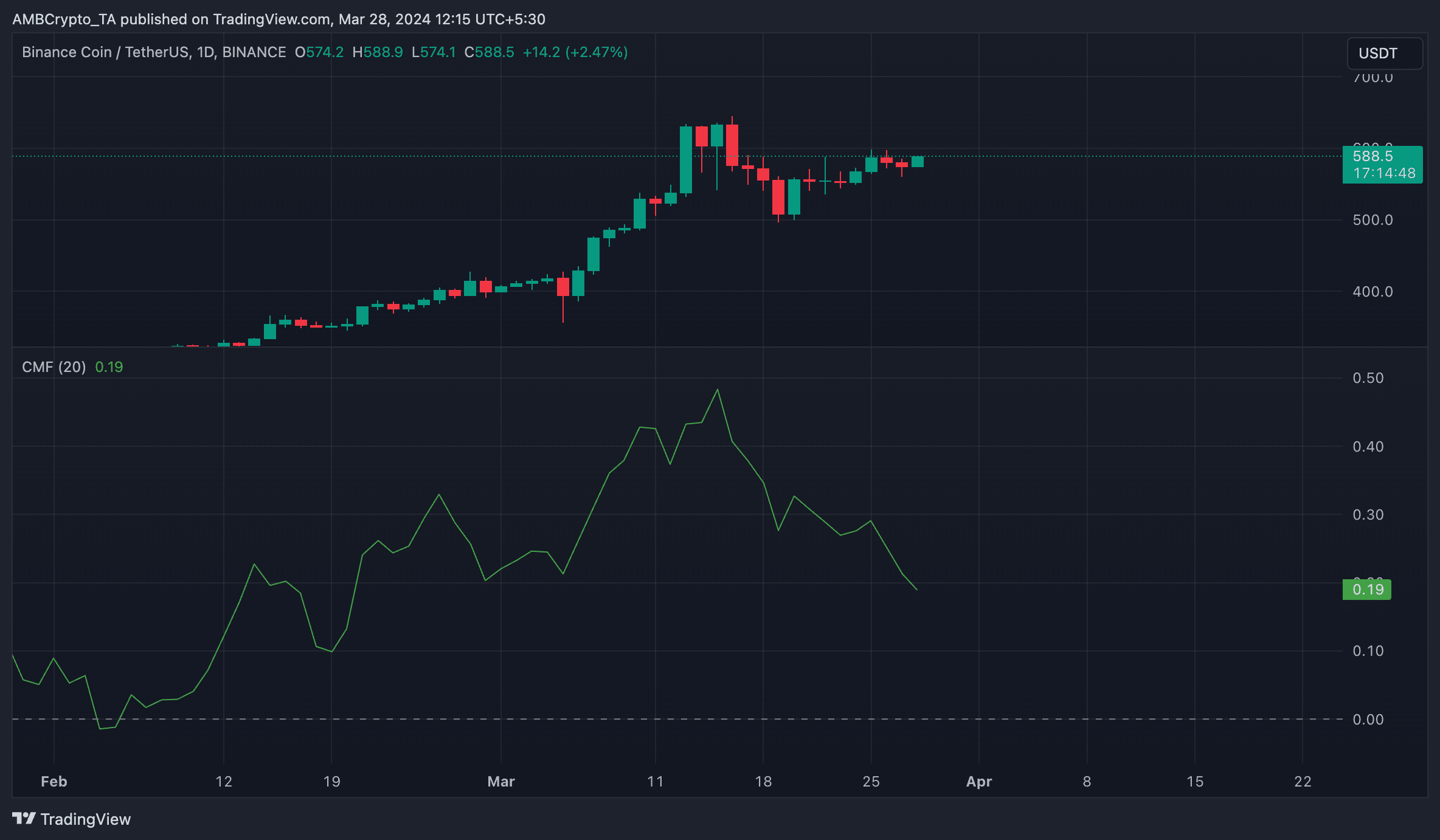

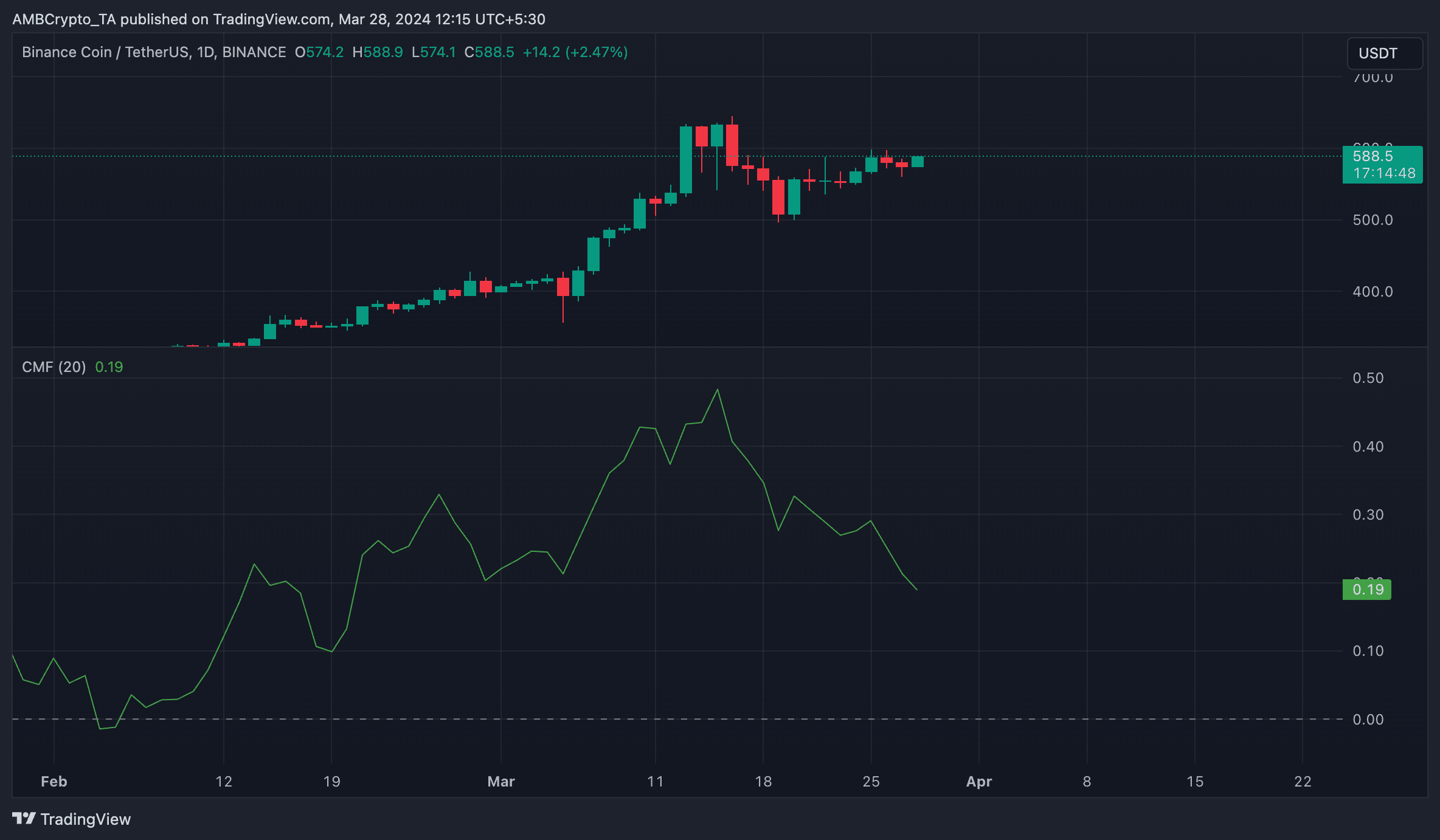

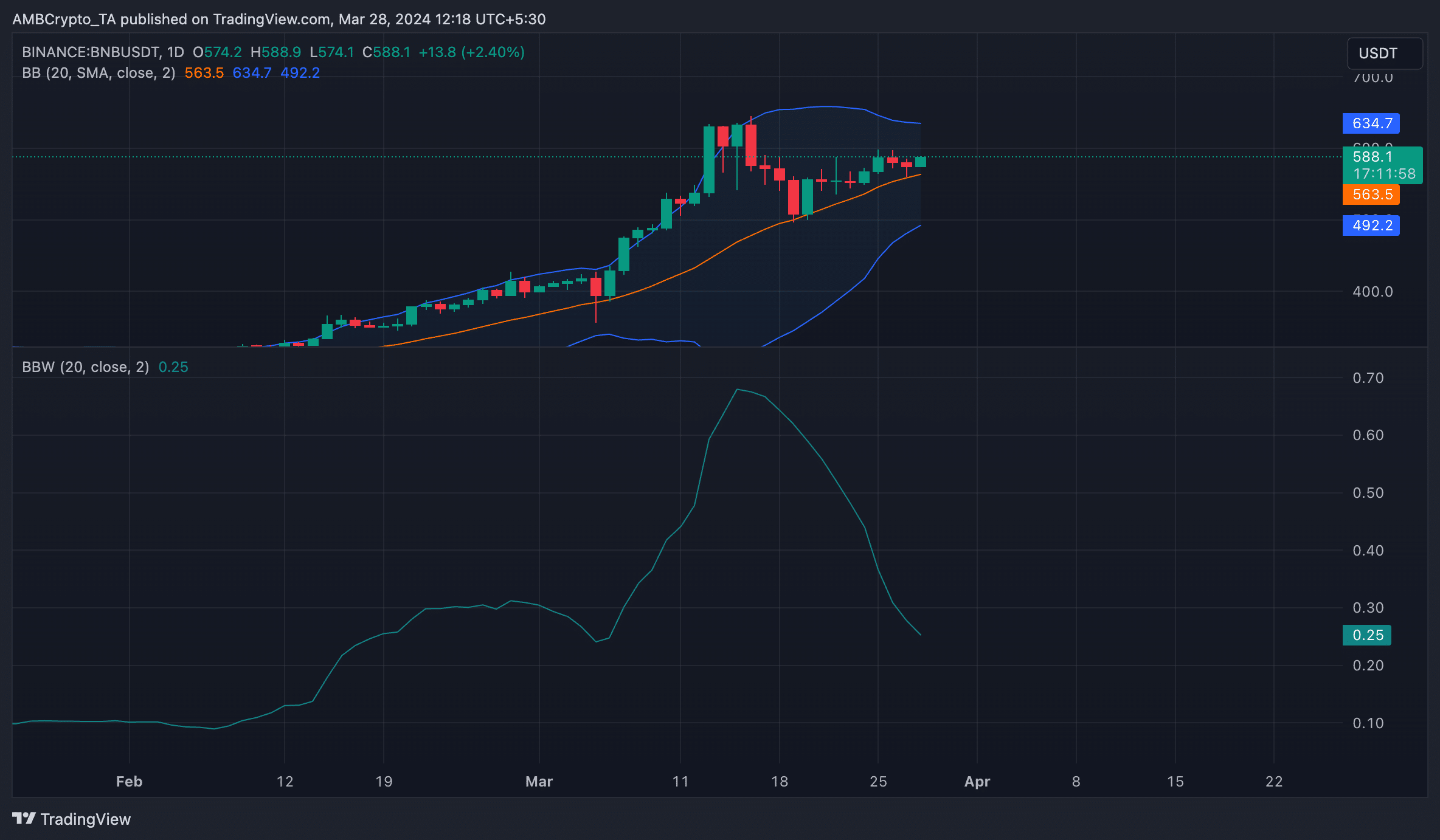

The previous week’s surge within the worth of Binance Coin [BNB], coupled with the downtrend of its Chaikin Cash Stream (CMF), has created a bearish divergence, suggesting a possible worth reversal.

At press time, BNB traded at $586. In keeping with CoinMarketCap, the altcoin’s worth rallied by virtually 10% within the final week.

Throughout the identical interval, its CMF indicator assessed on a 24-hour chart initiated a downtrend. This indicator measures cash stream into and out of an asset over a specified interval.

A bearish divergence happens when an asset’s worth will increase whereas its CMF craters. The discrepancy signifies that regardless of the value improve, shopping for stress is weak. Weakened shopping for stress is usually adopted by a downward correction as soon as consumers out there are unable to maintain any additional worth rally.

Supply: TradingView

Ought to BNB holders count on a pullback?

A take a look at a few of BNB’s technical indicators on a every day chart revealed that it might shed a few of final week’s good points within the quick time period.

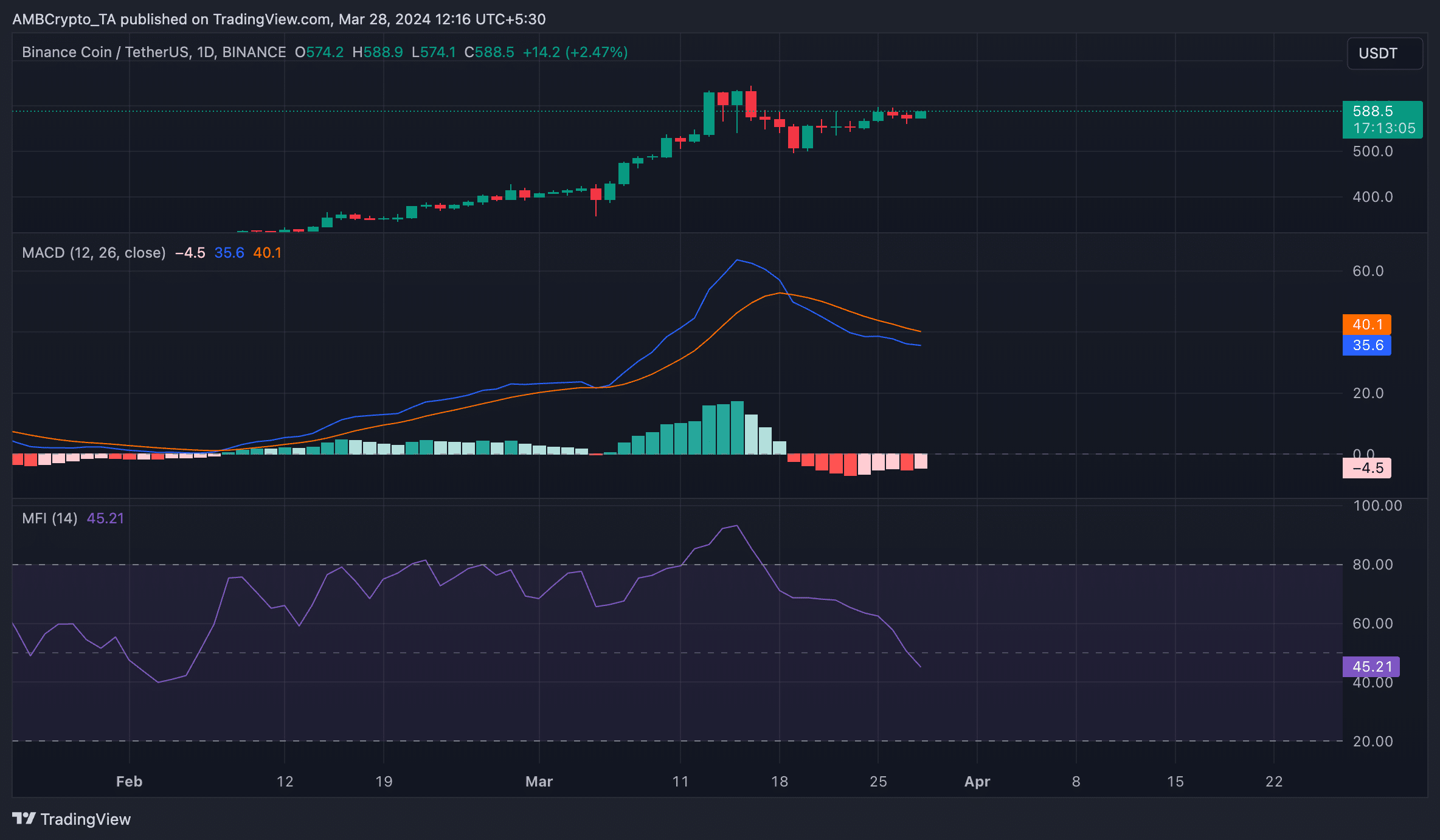

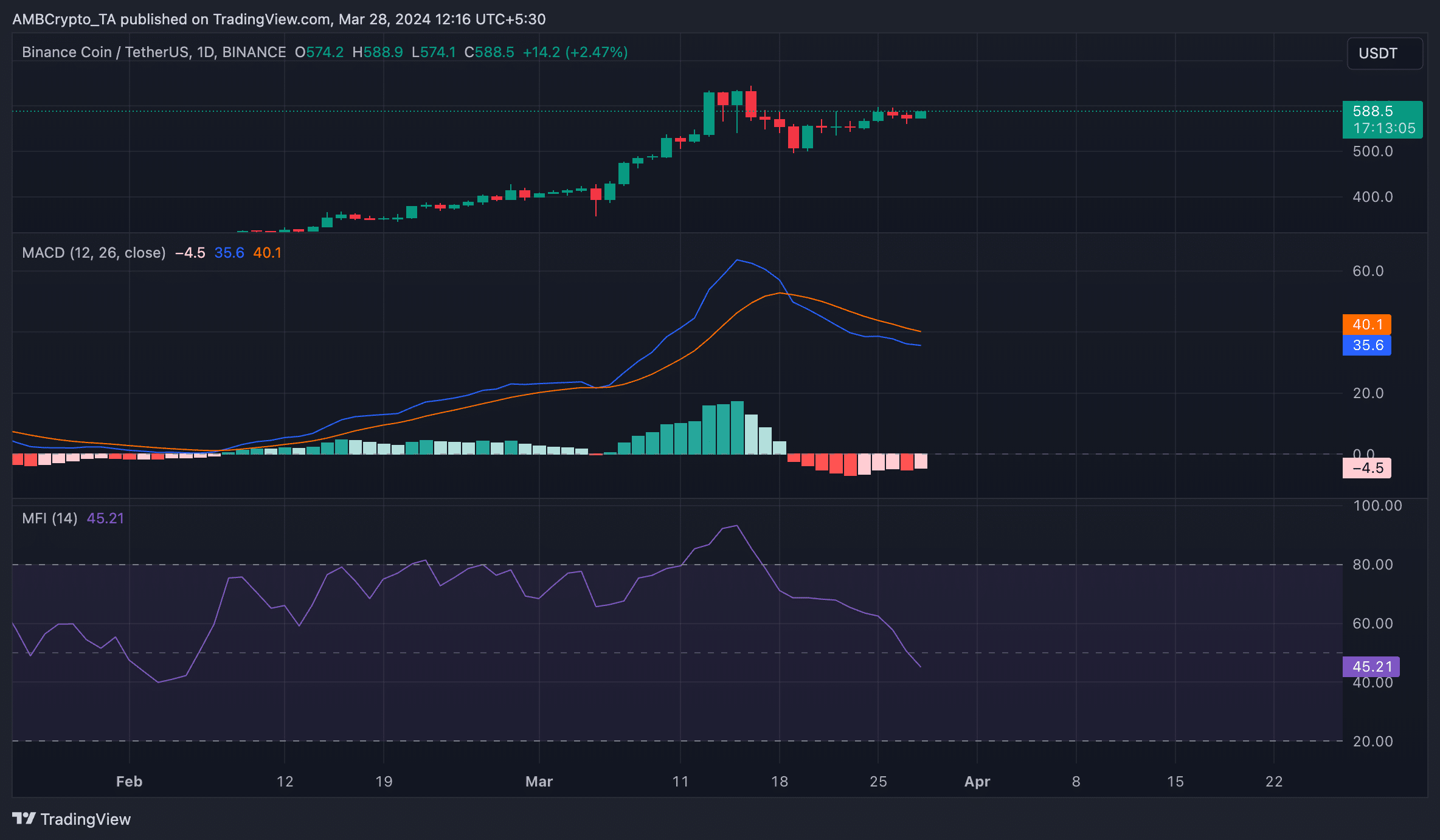

In keeping with readings from its Transferring Common Convergence Divergence (MACD) indicator, its MACD line crossed beneath its sign line on nineteenth March.

A downward intersection of the MACD line with the sign line is taken into account a bearish signal, suggesting that an asset’s shorter-term transferring common is shedding power relative to its longer-term transferring common.

When merchants spot this intersection, they take it as a affirmation that market sentiment has shifted from bullish to bearish and that the expansion in promoting stress may doubtlessly drive down an asset’s worth.

Though BNB’s worth has grown by 10% since this intersection, this merely mirrors basic market efficiency. Its worth rally has not been backed by any vital demand.

Its Cash Stream Index (MFI) indicator, which returned a price of 48.18 and trended downward at press time, confirmed that promoting stress outpaced shopping for exercise amongst market contributors.

Supply: TradingView

Is your portfolio inexperienced? Verify the Binance Coin Revenue Calculator

No trigger for alarm

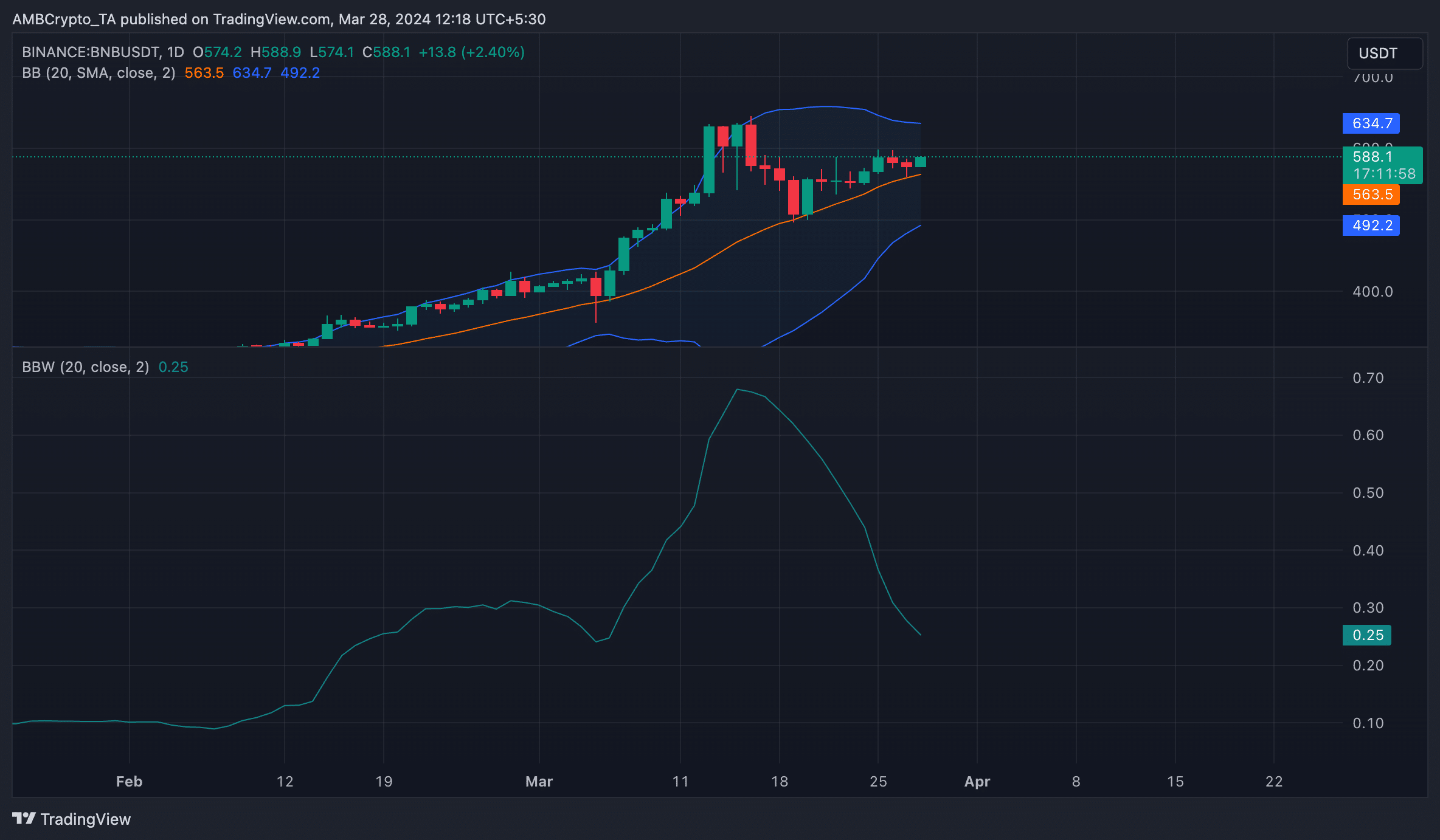

Whereas BNB could seem poised to lose a few of its good points, volatility markers confirmed a low chance of great worth swings in both route.

The hole between the higher and decrease bands of the coin’s Bollinger Bands (BB) indicator was significantly slender. Because of this worth volatility is comparatively low. Confirming this, the coin’s Bollinger BandWidth (BBW) trended downward at press time.

Supply: TradingView