- BNB trades inside a slim vary as merchants keep their arms.

- Its worth can get away in both route relying on market sentiment.

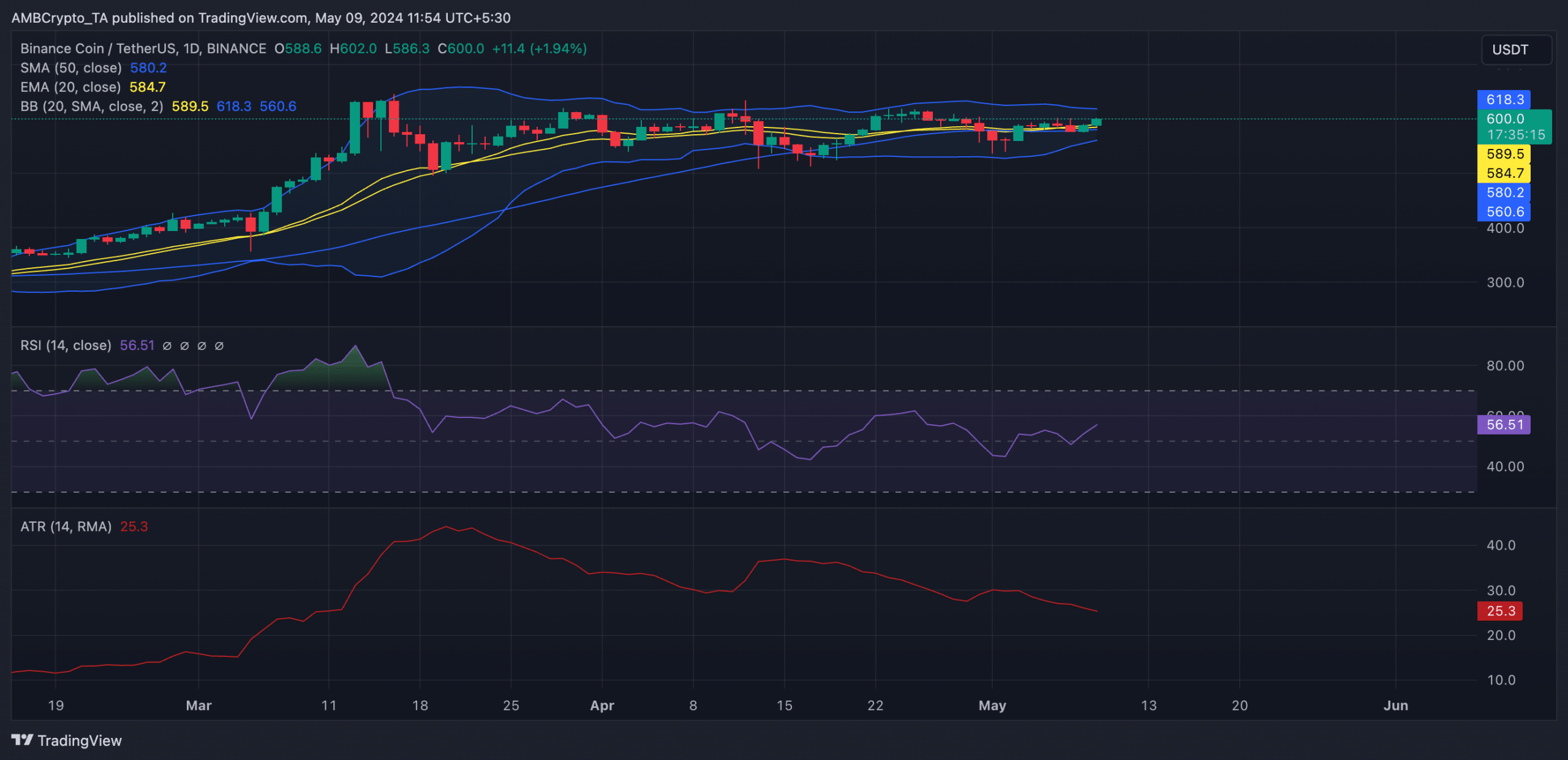

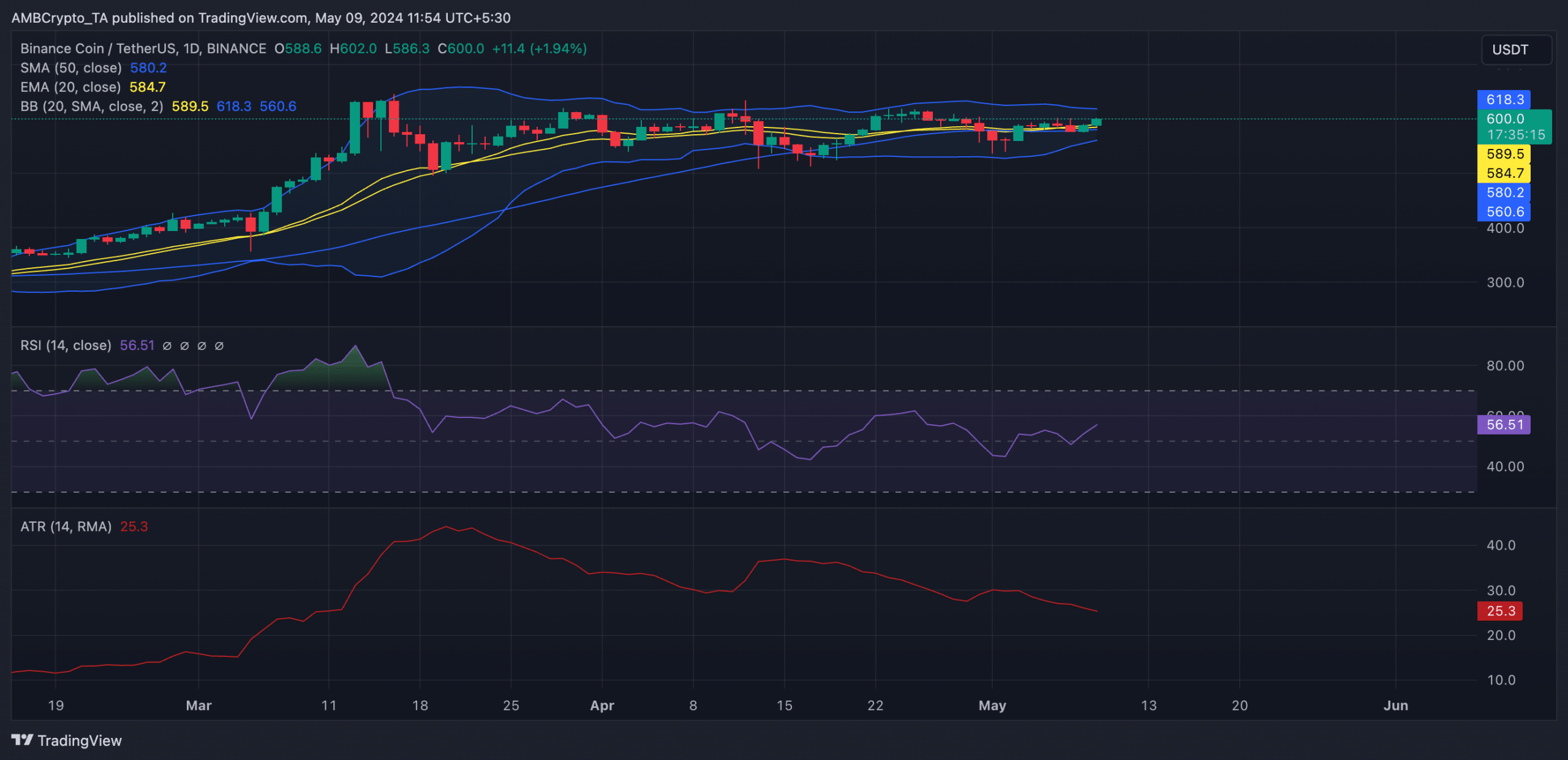

Binance Coin [BNB] has traded close to its 20-day Exponential Shifting Common (EMA) and 50-day Easy Shifting Common (SMA) prior to now few days, signaling a interval of market consolidation.

An asset’s 20-day EMA is a short-term transferring common that reacts rapidly to cost adjustments. It displays the typical closing worth of an asset over the previous 20 days.

The 50-day SMA, however, is a longer-term transferring common that displays an asset’s common closing worth over the previous 50 days.

When an asset’s worth trades shut to those averages, it means that neither the consumers nor sellers are dominating the market. It signifies that the asset’s worth shouldn’t be convincingly buying and selling in both route however as a substitute transferring inside a slim vary.

BNB strikes inside a good vary

AMBCrypto’s evaluation of different technical indicators, together with BNB’s Bollinger Bands, confirmed BNB’s slim worth actions.

This indicator tracks market volatility and intervals of consolidation. When the hole between this indicator’s higher and decrease bands contracts, with an asset’s worth within the center, the market is within the consolidation part.

BNB’s worth actions noticed on a 1-day chart confirmed that the altcoin has been arrange this manner since 4 April.

Likewise, the coin’s Common True Vary (ATR) has declined steadily because the starting of Could. This indicator measures an asset’s common volatility over a specified interval. When it declines on this method, an asset’s worth is claimed to be in consolidation. At press time, the worth of BNB’s ATR was 25.3. It has declined by 14% since 1 Could.

Additional, BNB’s Relative Power Index (RSI) has moved sideways because the starting of the month. A “flat” RSI akin to this typically implies a scarcity of sturdy shopping for or promoting stress available in the market.

Supply: BNB/USDT on TradingView

Is your portfolio inexperienced? Examine the BNB Revenue Calculator

What subsequent for BNB?

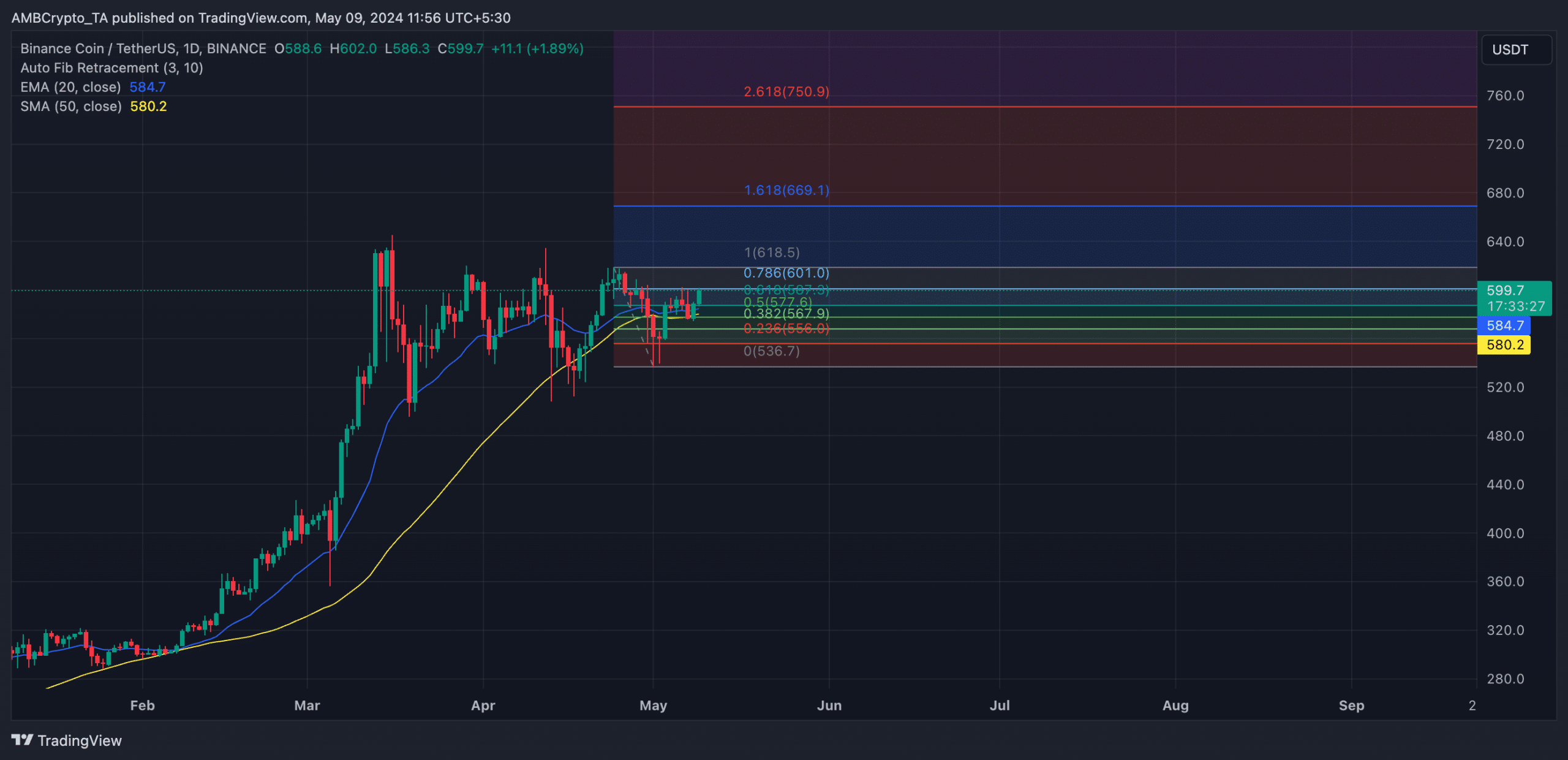

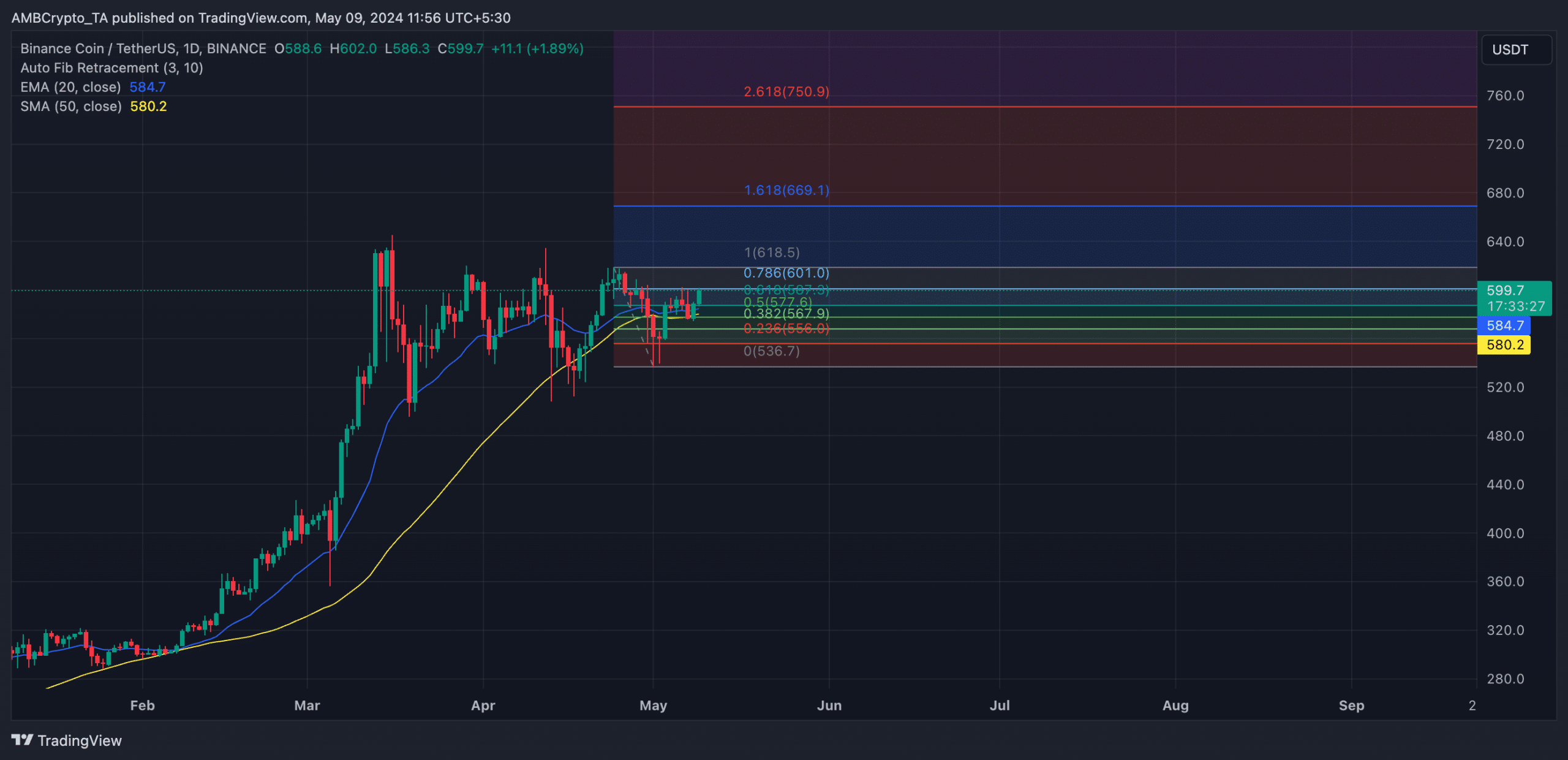

If bullish momentum climbs and BNB breaks out of the slim vary in an uptrend, the coin might rally to trade arms at $618.

Nonetheless, if optimistic sentiment nosedives and bearish exercise develop into vital, the altcoin might break help to commerce beneath $556.

Supply: BNB/USDT on TradingView