- The rise confirmed that focus was shifting again to the chain.

- BNB’s value would possibly fall to $580 regardless of the rise in TVL.

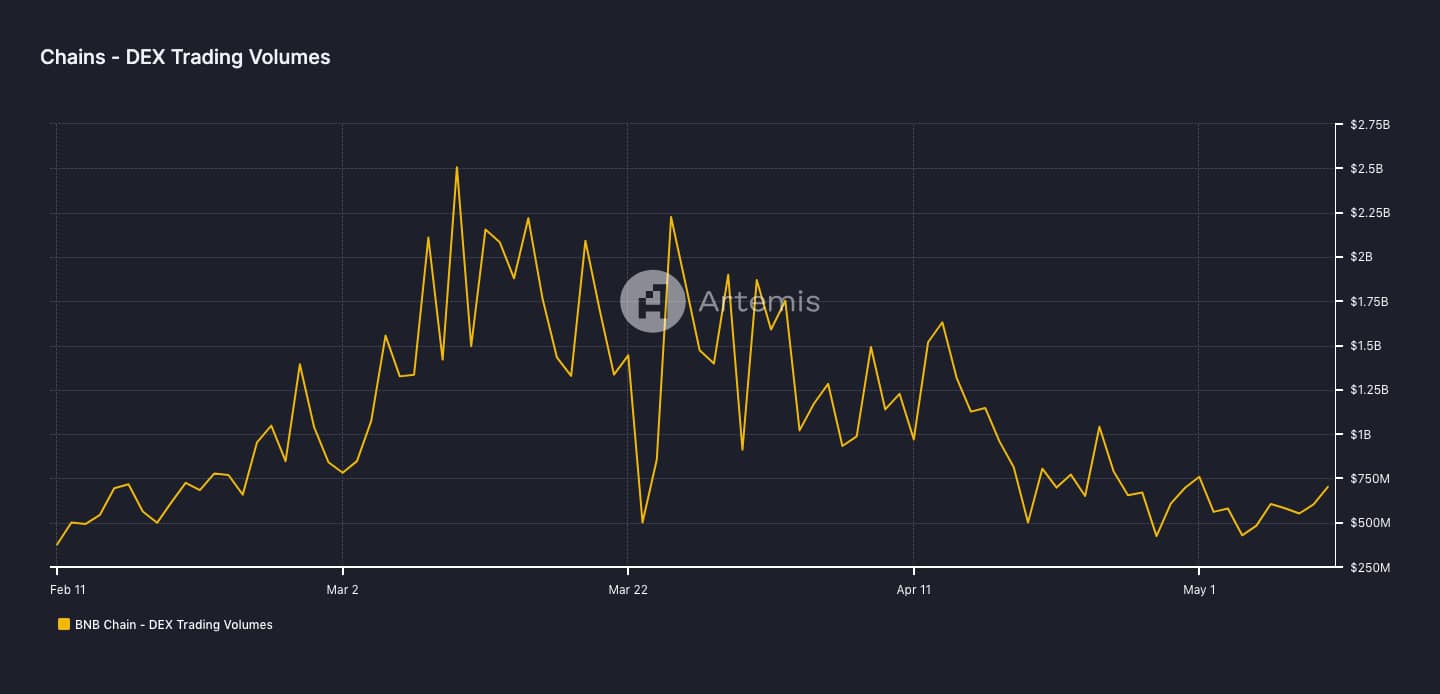

For the primary time because the 2nd of Could, BNB Chain’s DEX buying and selling quantity climbed greater than $700 million. This was in line with Artemis information.

For context, DEX is a brief kind for Decentralized Alternate. Artemis, alternatively, is an analytics platform for crypto metrics.

Has a brand new race begun?

Prior to now, the DEX quantity on the blockchain has been on a downward slope since mid-April. As such, the worth has didn’t hit or surpass $1 billion since that interval.

Nevertheless, the current rise implies a rising consumer exercise on BNB Chain. For these unfamiliar, Binance [BNB] is the cryptocurrency used for transactions on the community.

Due to this fact, a low DEX quantity might indicate a lower in transaction exercise on the chain.

Supply: Artemis

A better DEX quantity suggests a rise in community participation, indicating a rise within the coin’s demand.

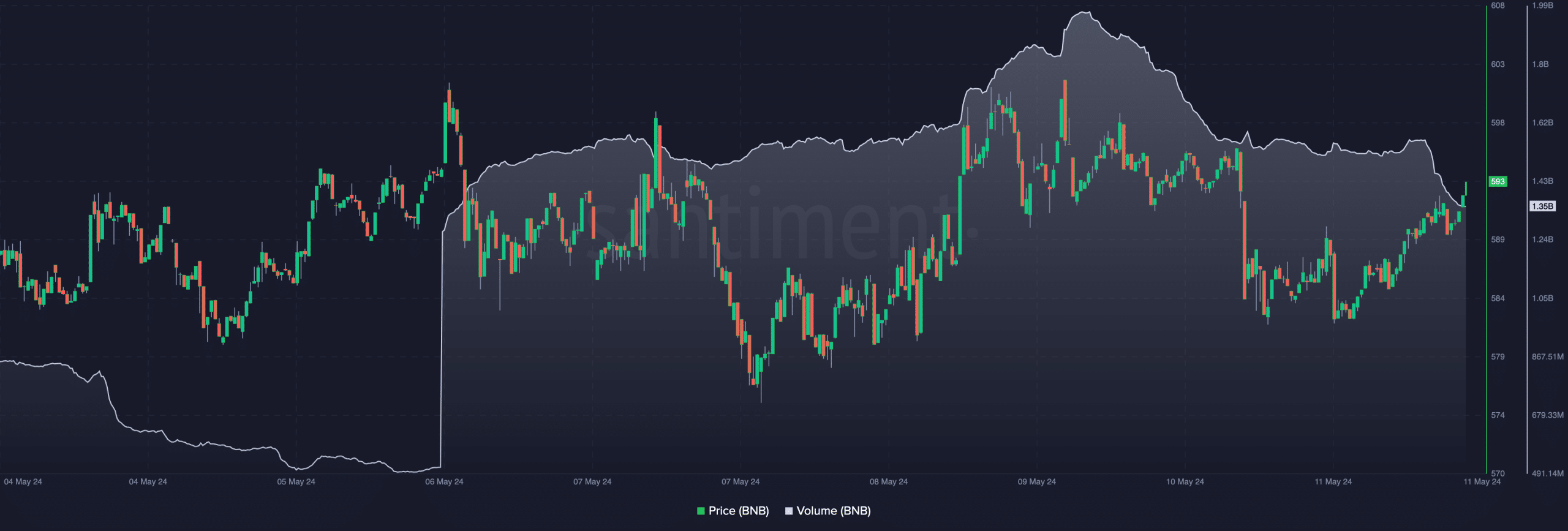

BNB’s value was $593.70 at press time, representing a slight 1.23% enhance within the final 24 hours. If the amount on the chain continues to rise, the worth motion might enhance.

However the coin has not skilled important shopping for stress not too long ago. If it does, then a return to $620 could be doable.

By way of the on-chain quantity, AMBCrypto noticed that it has been declining because the tenth of Could.

BNB’s transfer could also be false

Rising quantity and an rising value point out that an upswing would possibly proceed. Nevertheless, BNB’s current value rise, accompanied by the lowering quantity, suggests weakness within the uptrend.

Thus, the BNB may need witnessed a false breakout. If so, a downward transfer to the $580 help could possibly be subsequent for the cryptocurrency.

Supply: Santiment

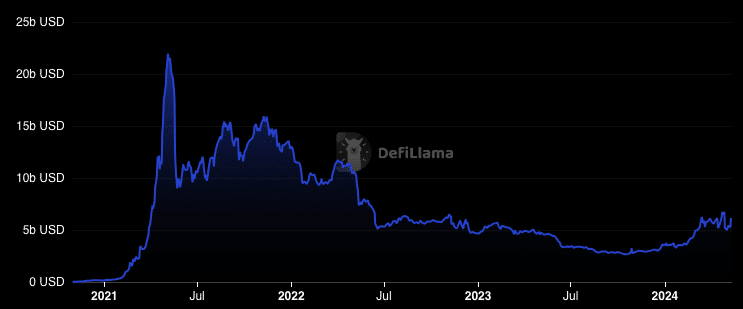

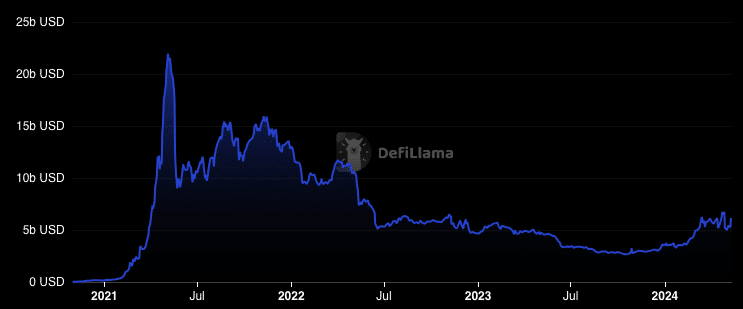

One other space AMBCrypto analyzed was the Whole Worth Locked (TVL). TLV is an indicator of the well being of a community. With this metric, one can inform if market individuals are staking or locking property on a protocol.

If the TVL will increase, it’s a signal of perceived belief for a undertaking. On this case, the worth of property locked will need to have elevated in anticipation of higher yield.

Nevertheless, a lowering TVL means that property are being taken out, and individuals don’t consider that the protocol concerned can produce good rewards.

In keeping with DeFiLlama, Binance Sensible Chain’s TVL was $61.2 billion. An intensive have a look at the protocols underneath the chain confirmed notable will increase throughout the previous week.

Supply: DeFiLlama

Therefore, this rise throughout the board implies that individuals are assured within the chain’s well being and safety. Nevertheless, the metric stays far under the height it hit in 2021.

Practical or not, right here’s BNB’s market cap in BTC phrases

Ought to the TVL proceed to extend, BNB’s value may additionally observe, Nevertheless, the doable prediction of $1,000 would possibly solely occur if the metric rises previous $10 billion for a begin.

If not, that forecast won’t come to go. Nonetheless, you will need to do not forget that different elements would possibly affect the worth aside from this.