miniseries

Funding Thesis

Since its bubble burst in late 2021, Block (NYSE:SQ) inventory has did not recapture optimistic market sentiment, underperforming the broader market. But the standard of Block’s underlying companies stays strong. Regardless of legitimate investor criticisms and a extra unsure progress trajectory, Block’s long-term alternative nonetheless appears compelling. A extra disciplined managerial strategy has led to early indicators of bettering profitability, which is changing into extra important as general topline progress slows. Ought to the corporate proceed this development, SQ is a purchase at present ranges.

Fintech out of Favor

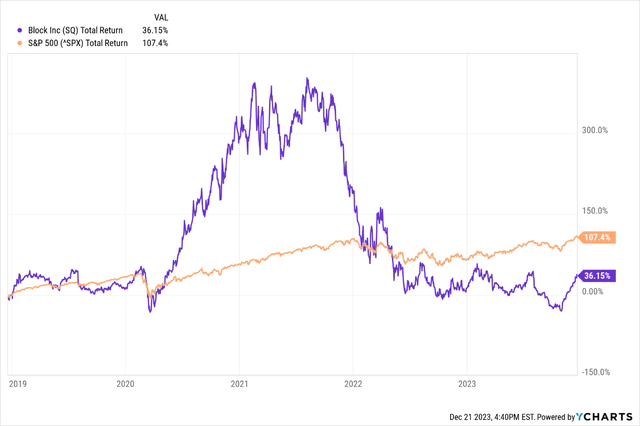

After popping a valuation-driven bubble in late 2021, Block has struggled to retake floor vs the S&P 500. My final article on Block was shortly after the sell-off – and SQ has hovered in the identical vary since.

YCharts

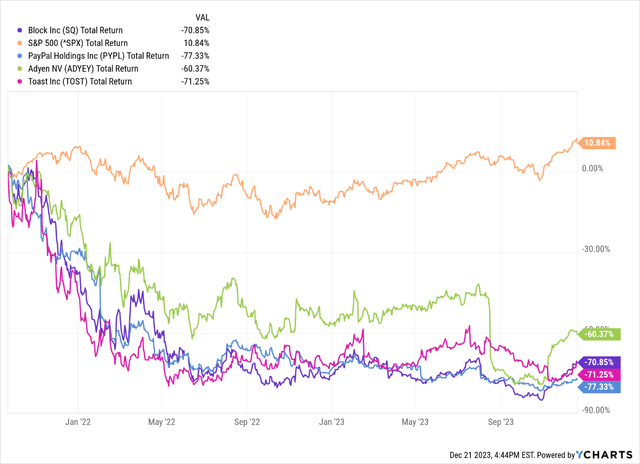

Curiously, the identical has been the case for a number of of its fintech friends:

YCharts

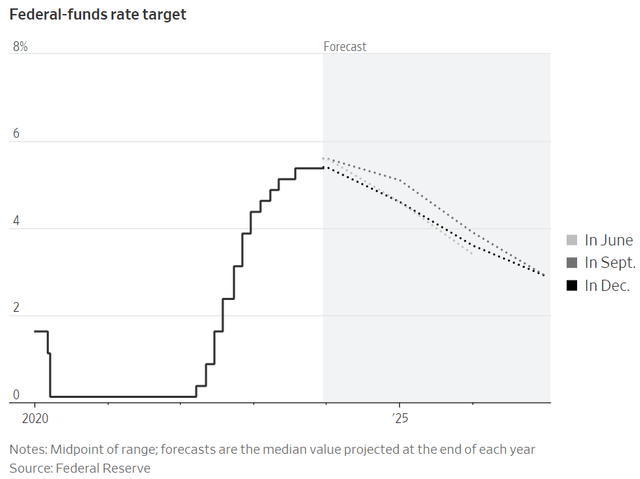

Solely lately has the fintech sector seen some energy – maybe Mr. Market is altering his thoughts. A lot of the market’s apprehension has been pushed by a tenuous macro image. Rising rates of interest and inflation by 2022 and 2023 helped put riskier (and fewer worthwhile) sectors like fintech on the chopping block. Current optimism was largely spurred by more and more seemingly rate cuts in 2024 and 2025 together with cooling inflation and wage progress.

Wall Avenue Journal

A loosening financial system may spur simply as sturdy of a rally for fintech shares because the tight financial system drove the downturn. The issue is, making an attempt to guage short-term sentiment across the financial system is a idiot’s errand. Buyers are higher off focusing their consideration on the first driver of long-term returns: underlying enterprise efficiency. And Block’s have proven sturdiness even in a troublesome financial surroundings.

Underlying Enterprise Energy

Sq.

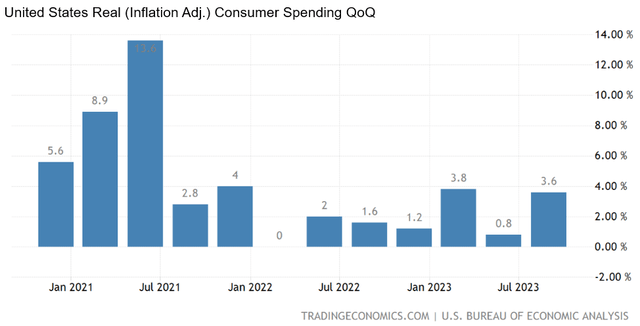

My final article dove into the highly effective cohort economics, speedy payback durations, and excessive ROIs that Block’s service provider enterprise, Sq., has been capable of routinely produce. Since then, Sq. has handled some headwinds because it’s closely tied to shopper spending, which dipped the previous two years.

Buying and selling Economics

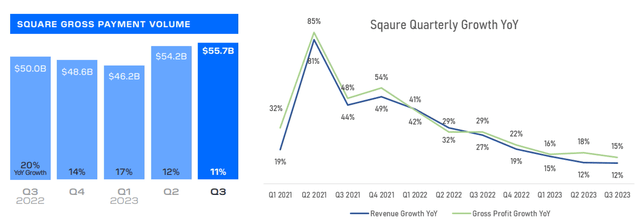

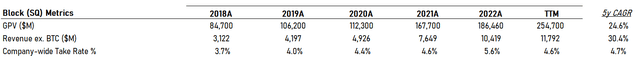

The outcome was successful to general gross fee quantity (‘GPV’) which trickled all the way down to slower income and gross revenue progress.

Block Q3 ’23 Letter and Monetary Complement

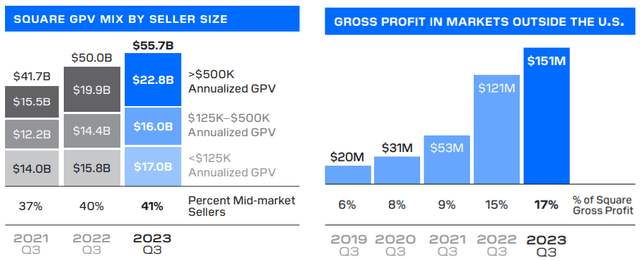

This marked drop off in progress is sufficient to scare loads of buyers, but it surely makes extra sense inside the context of a stimulated 2021 financial system and subsequent 2022 occasions. Block cofounder, Jack Dorsey, additionally lately retook the function of Sq. Head (nice title). He kicked off the Q3 shareholder letter highlighting a number of inner inefficiencies and roadblocks hampering the potential of the enterprise – and what management plans to do about it. Sq. is a top quality and progressive enterprise well-positioned to trip quite a few tailwinds inside omnichannel commerce – this elevated self-discipline ought to assist the enterprise seize it. To get an concept of the remaining runway, administration estimated a total addressable market (‘TAM’) for Sq. of $120B in 2022, representing lower than 3% penetration based mostly on Sq.’s TTM gross revenue. On the innovation entrance, Sq. began with point-of-sale merchandise and has expanded its providing to 35+ merchandise for sellers. Moreover, the enterprise has seen momentum each upmarket and internationally.

Block Q3 ’23 Letter

Sq.’s transfer upmarket is a optimistic as giant sellers are likely to undertake extra merchandise and carry extra secure budgets. The result’s expanded recurring income and larger buyer lock-in. Worldwide GPV climbed 30% in Q3 2023, highlighting extra significant progress on this $25B TAM runway.

Banking has been one other enticing space for Sq., with its respective gross revenue rising 24% YoY in Q3. Administration sees Banking as a key for long-term buyer acquisition and retention inside Sq.:

“…we see banking immediately as extra retaining our clients and when somebody comes into the Sq. ecosystem, signing up for a mortgage or a card, a debit card or bank card or financial savings account, helps preserve them. Sooner or later, we do imagine that it will turn out to be an increasing number of an acquisition channel for us as properly. And I feel it is considered one of our strongest differentiators.”

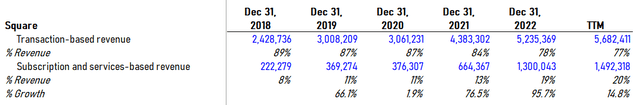

Sq. has constructed a buyer base of now over 4 million retailers and just about controls the point-of-sale market at a 30% market share (by variety of domains) in keeping with 6-sense. What’s extra is there was a transparent deal with merchandise that generate extra recurring income by subscriptions & companies. This high-margin portion of income has seen an uptick in progress and now represents a bigger portion of Sq. revenues:

Block Historic Financials Complement

Sq. has achieved properly in cross and up promoting its product suite to drive additional progress and improve buyer lifetime worth. Regardless of its near-term headwinds, Sq.’s high quality stays strong with loads of long-term alternative forward.

Money App

Block’s shopper finance enterprise, Money App, has been a shining star for the corporate, now eclipsing Sq. when it comes to gross revenue and practically doubling its progress charges. My earlier article centered on Money App’s inherent community results by its 80+ million annual actives. The main target then was growing Money App’s monetization by peripheral merchandise, monetary companies, and commerce – all of which have resonated since. Administration’s framework for evaluating Money App’s profitability has three pillars: month-to-month transacting actives, inflows per energetic, and monetization price – every noticed wholesome YoY progress in Q3:

- Month-to-month transacting actives: 55 million, up 11%

- Inflows per energetic: $1,132, up 8%

- Monetization price (gross revenue/inflows): 1.43%, up 8 foundation factors

Enhancements in Money App’s profitability have been largely pushed by success within the classes simply talked about. Money App Card reached 22 million month-to-month actives in Q3 up from 18 million final 12 months, Money App Pay recorded 2 million month-to-month actives which doubled for the reason that prior quarter, and Money App Borrow noticed 2 million month-to-month actives, originating $900M in loans. Every of those mixed helped generate 29% YoY progress in subscriptions income for Money App. Just like Sq., Money App has been capable of rely much less on buyer acquisition in favor of monetizing present clients. Lengthy-term, Money App is aiming to turn out to be the monetary dwelling for its clients, which might create extra sustainable inflows and cross-sell alternatives. The enterprise’s early progress on that entrance is promising.

One other piece of Block’s long-term technique is additional integration between its suite of ecosystems, primarily by Block’s acquired buy-now-pay-later (‘BNPL’) enterprise, Afterpay. The potential synergies listed here are compelling, as I alluded to in my final article. There has not been a ton of progress on this entrance moreover tying the BNPL capabilities into Sq. and Money App. BNPL contributed a small $94 million to Sq. and Money app in Q3 however grew gross merchandise worth (‘GMV’) 24% to $6.7B YoY. Administration will now be reporting BNPL completely inside Money App as the main focus is on driving actives to commerce.

Total, the market is discounting the standard and remaining potential of Block’s underlying companies for my part. Close to-term headwinds and slower progress have weighed down sentiment, whilst operational self-discipline is bettering.

Working Enhancements & Outlook

Despite the fact that I imagine the slowdown in Block’s progress is probably going momentary, it does create larger reliance on bettering profitability inside the firm’s long-term thesis. This was an space of focus again in 2022 however with little fruit – partly attributable to a troublesome financial surroundings. Nonetheless, administration is finally accountable. Lack of historic price self-discipline, questionable capital allocation, and extreme stock-based compensation (‘SBC’) are all legitimate criticisms of management. Within the firm’s Q3 letter, Dorsey opened discussing administration’s renewed self-discipline round operations, calling again to the target goal they set earlier this 12 months:

“Block and every ecosystem should present a plausible path to Gross Revenue Retention of over 100% and Rule of 40 on Adjusted Working Earnings (‘AOI’)… We imagine this framework balances creating long run worth for patrons with the identical for our shareholders. We imagine we are going to attain Rule of 40 in 2026, with an preliminary composition of at the very least mid-teens gross revenue progress and a mid-20% Adjusted Working Earnings margin.”

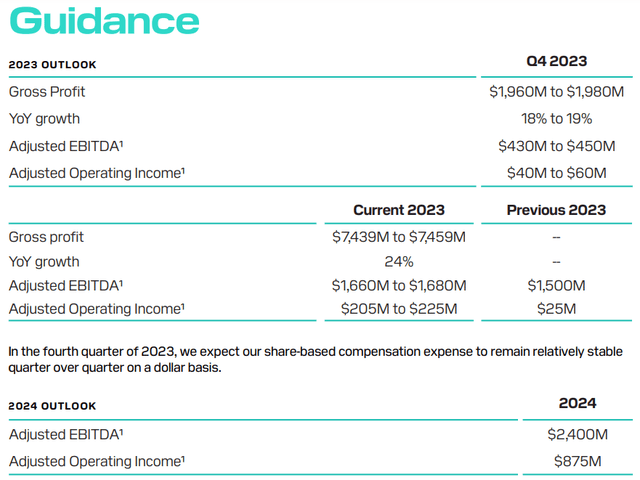

Administration seems to acknowledge the price of SBC to shareholders by each reporting AOI (which incorporates SBC bills) and by authorizing a $1B share repurchase to offset a few of its dilution. Moreover, management is capping headcount at 12,000 which is able to cut back SBC expense. This additionally means they will be trimming their workforce by 1,000 by the tip of 2024, creating leverage inside worker prices. Gross sales & marking bills had been down 1% in Q3 exhibiting early indicators of working enhancements. Block’s general profitability is already benefiting from this elevated deal with shareholder worth. AOI climbed to $90 million from $32 million final 12 months and GAAP working losses improved from -$49 million to -$10 million.

Trying ahead, management expects document profitability in 2024 and revised earlier estimates upward:

Block Q3 ’23 Letter

Conserving this enchancment in operations in thoughts, let’s transfer to valuation.

Valuation

Administration expects gross revenue progress within the mid-twenties for 2023 and the mid-teens for the foreseeable future, with Money App rising barely above and Sq. barely under. Given Block’s historic capability to develop at unimaginable charges and the progressive nature of its companies, I imagine this medium-term estimate considerably understates Block’s potential. Even administration identified the estimates are based mostly on present run charges, which have been hampered by the macro surroundings.

“So, what you see right here with 2026 progress, what we have shared up to now actually relies on our present run price tendencies. And naturally, we’ll periodically replace this as we be taught extra, whether or not it is from a macro perspective or based mostly on our personal execution and skill to speed up.

And relative to that present view of at the very least mid-teens progress, we would anticipate Money App’s progress to be barely above that and Sq.’s progress barely under. However our focus is on exploring new progress initiatives, after which we’ll incorporate these as acceptable into our outlook over time. We’ve got a historical past right here of unlocking new innovation on merchandise and throughout new audiences to proceed driving outsized progress and we’ll proceed that work.”

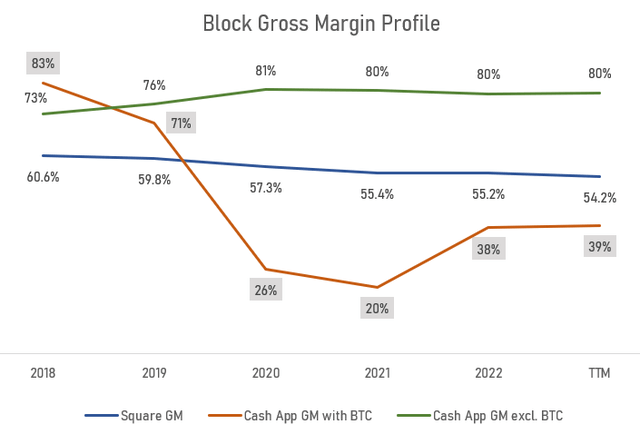

Moreover, the P2P and PoS international markets are anticipated to develop at a 18% and 15% CAGR by 2030 respectively. Nonetheless for conservatism, my base case has revenues rising at a CAGR of 13% by 2032. Gross margin will get a bit blurry because of Block’s funding and holding of buyer funds in Bitcoin, which closely crush Money App’s margins:

Block Financials Complement

For consistency I assumed a impartial impression from Bitcoin leading to gross margins staying close to 35% for the forecast interval – comparatively near historic averages. For working margins, I anticipate continued leverage inside SG&A however much less in R&D because the agency continues investing in future merchandise. The result’s base case working margins reaching 11% in 2032. Moreover, my base case holds that fastened and dealing capital funding will stay near historic averages:

- Capex at 1% of revenues

- Depreciation & Amortization at 90% of Capex

- Change in Internet Working Capital averaging about 0.5% of revenues.

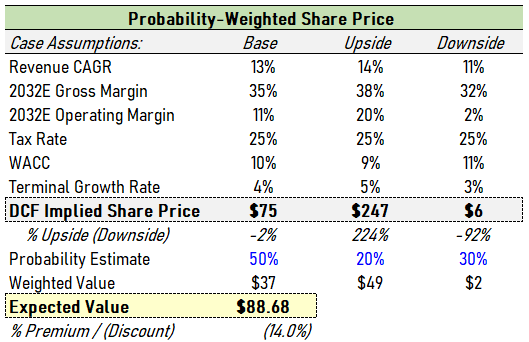

Lastly, I launched an upside and draw back case and assigned possibilities to every. This permits us to check a spread of assumptions and estimate the probability of potential outcomes. As you possibly can see from the under outcomes, every case has huge variability in implied share value, with extra upside than draw back based mostly on the case assumptions. Block’s outcomes carry uncertainty, however ought to the corporate proceed to enhance fundamentals, the upside is critical at present costs. Moreover, I assigned a likelihood to every case, with the heaviest weight given to my base case. The result’s an anticipated worth of $88.68 or 14% upside.

Creator Estimates

Dangers & Uncertainty

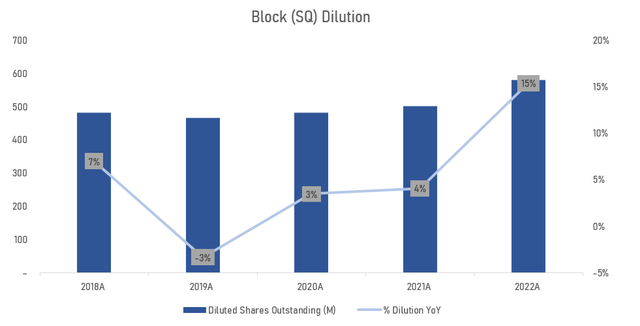

With Block’s uncertainty comes a number of inner and exterior dangers buyers ought to concentrate on. As touched on earlier, Block has had a historical past of diluting shares largely by SBC.

Block SEC Filings

Fortunately administration has begun to cope with this price to shareholders through the $1B share repurchase plan. Capital allocation has been a criticism on the a part of management the previous few years with Block paying a hefty $29B for BNPL platform Afterpay, a number of acquisitions that do not appear so as to add worth to its core providing, and the corporate’s sizable funding in Bitcoin. Nonetheless, management has achieved properly in fortifying Block’s stability sheet with $6.3B in money and a debt-to-equity of 30%. The Afterpay acquisition was additionally achieved with all fairness at a time when SQ inventory was priced close to all-time-highs. The deal was introduced in August of 2021 at a price of $29B. However by the point the deal closed in January of 2022, SQ inventory had fallen, and the deal was valued at $14B. Ought to management’s rhetoric on a extra disciplined strategy come to fruition, capital allocation turns into much less of a priority for my part.

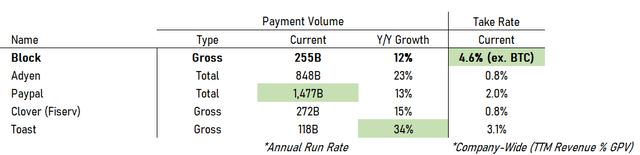

Externally, Block continues to face aggressive pressures however has achieved properly in defending its market share for each Money App and Sq.. Although it is not an ‘apples-to-apples’ comparability throughout fintech companies given their various choices, Block holds its personal when it comes to fee quantity and take charges:

Firm Filings, Creator Calculations

Block SEC Filings, Creator Calculations

As we noticed, Fintech has been out of favor largely because of a extra tenuous shopper. Block and friends are extra delicate to shopper demand and the general macro surroundings. Information is blended on how the financial system will carry out in 2024, however both means, that is at most a near-term danger for my part.

Lastly, SQ has seen a pleasant run-up for the reason that starting of November and could also be overextended, presenting the potential of near-term draw back:

Koyfin

Conclusion

At present ranges, Block carries extra upside than draw back for my part. Market sentiment the previous two years pushed Block and fintech friends out of favor, overlooking the corporate’s underlying enterprise energy and potential. Regardless of slowing progress and near-term uncertainty, management has turn out to be extra disciplined on a number of fronts, most significantly on producing long-term shareholder worth.

Editor’s Observe: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please concentrate on the dangers related to these shares.