- June noticed all Bitcoin ETFs noting important outflows, led by Grayscale Bitcoin Belief with $559 million

- BlackRock’s World Allocation Fund disclosed possession of 43,000 IBIT shares

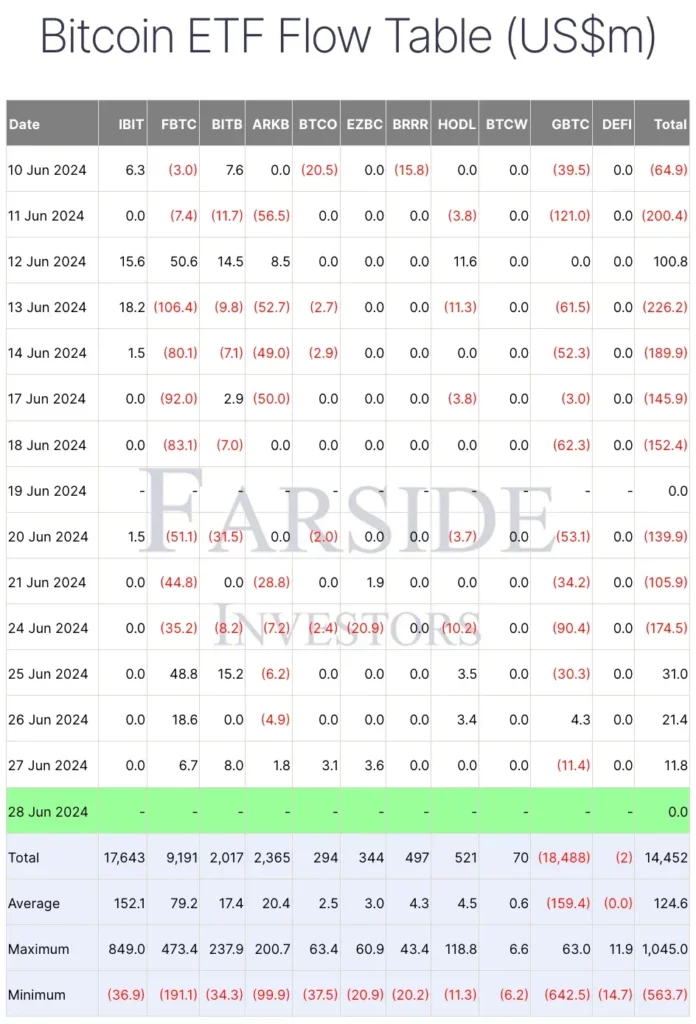

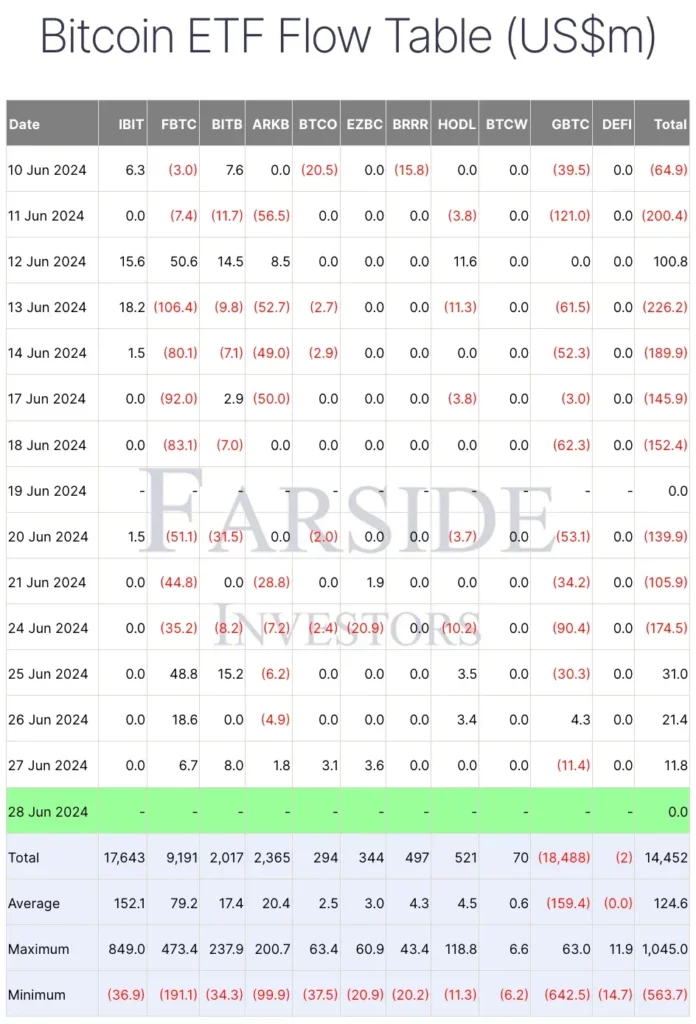

We’re nearing the ultimate approval of the spot Ethereum [ETH] ETFs scheduled for 4 July. And but, in line with a latest CNF report, Bitcoin [BTC] ETFs have persistently seen important outflows over the course of the month.

Bitcoin ETFs underperform

In truth, information from Farside Investors revealed that this was the case throughout most Bitcoin ETFs in June. At press time, Grayscale Bitcoin Belief (GBTC) led the pack with almost $559 million in outflows since 10 June.

Supply: Farside Traders

As of 27 June, GBTC was the one BTC ETF to report $11.4 million in outflows, whereas others recorded inflows or remained impartial with zero inflows or outflows.

BlackRock’s shocking transfer

Whereas BTC’s Spot ETF market has seen its fair proportion of volatility since its approval, it’s price noting that at press time, iShares Bitcoin Belief (IBIT) by BlackRock was the one one which stood out with zero outflows since 10 June.

Nevertheless, surprisingly, a latest SEC filing revealed that BlackRock’s World Allocation Fund now holds 43,000 shares of the IBIT. This makes it the third inner BlackRock fund to put money into BTC.

The identical was first highlighted by a blockchain evaluation agency – MacroScope. Its tweet claimed,

“In an SEC submitting right this moment, BlackRock’s World Allocation Fund disclosed proudly owning 43,000 shares of the iShares Bitcoin Belief as of April 30.

Additional increasing on the identical, the agency added,

“This follows two filings that BlackRock made on Might 28 disclosing Bitcoin publicity in its Strategic World Bond Fund and in its Strategic Earnings Alternatives Portfolio (see my tweets on that day).”

Different ETFs within the pipeline

This information got here on the again of VanEck submitting for an S-1 registration assertion on Thursday for its “VanEck Solana Belief,” This marks the primary public try and launch a spot Solana [SOL] ETF in the US.

For sure, with the crypto-community now eagerly anticipating the launch of a Spot Ethereum ETF and on the again of VanEck’s Solana replace, BlackRock’s shocking revelation has despatched ripples throughout the market.

Reiterating the identical, an X person – Bam – stated,

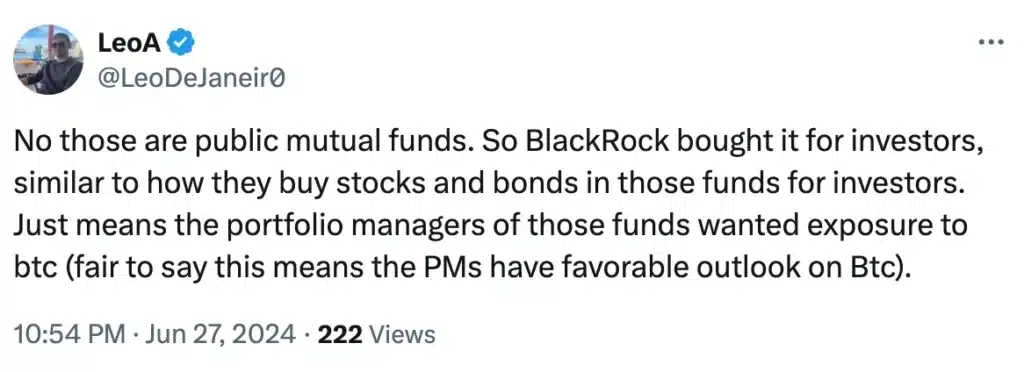

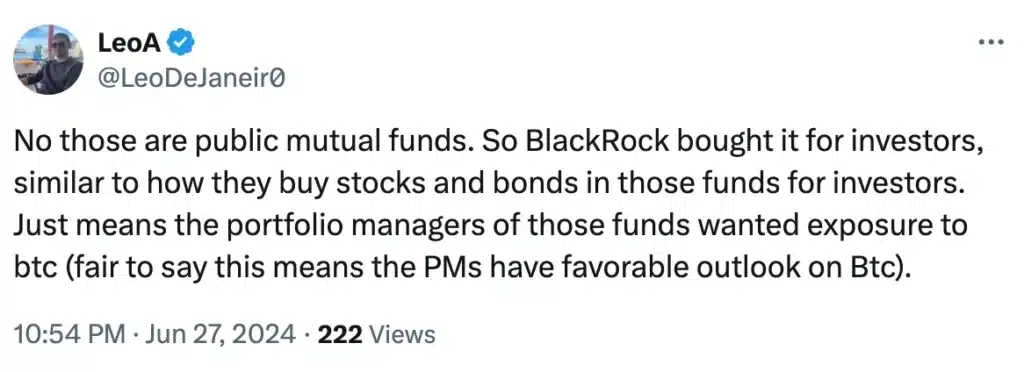

“Does this imply they personal Bitcoin themselves and never solely on their clients behalf? That is information proper ?”

Price declaring, nonetheless, that some additionally got here out to defend BlackRock. One in all them claimed,

Supply: LeoA/X

Impression on Bitcoin’s worth

On the again of those updates, BTC noticed a modest hike of 0.35%, with the crypto buying and selling at $61,401 on the time of writing.

And but, Bitcoin was nonetheless struggling to interrupt into the bullish zone on the charts, as confirmed by the RSI remaining nicely under the impartial stage.

Supply: TradingView