DjordjeDjurdjevic

By no means ask for small loans. – Aristotle Onassis

Final week might have been a game-changer. The Fed mainly saying {that a} “delicate touchdown” is not their base case means that they might really desire a credit score occasion to interrupt inflation meaningfully by some type of a deflationary shock. Mixed with different intermarket dynamics, I believe we might have began getting into a credit score occasion as I maintain noting in my writings. This could, oddly sufficient, excite traders. Why? As a result of if I am proper, credit score spreads widen, overreact, and sooner or later then change into too enticing to move up with regards to yield in company loans.

To that finish, that is why the Invesco Senior Mortgage ETF (BKLN) is value maintaining on a watchlist. BKLN is an funding automobile designed to trace the efficiency of the Morningstar LSTA US Leveraged Mortgage 100 Index. This index displays the market-value-weighted efficiency of the biggest institutional leveraged loans within the U.S. market, that are primarily senior secured, U.S. dollar-denominated money owed with a minimal preliminary time period of 1 12 months and a minimal par worth of $50 million. The fund invests 80% of its complete belongings within the element securities that represent the index. With its bi-annual rebalancing and reconstitution, the fund adheres to a “sampling” methodology to reflect the underlying index’s efficiency.

Key Options of the Invesco Senior Mortgage ETF

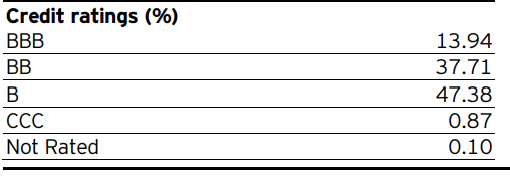

Traders are drawn to BKLN for its compelling yield and portfolio positioning. The fund’s 30-day SEC yield, as of September 22, 2023, stands at a powerful 8.38%. This excessive yield is primarily because of the fund’s funding in senior secured loans, which normally provide increased rates of interest than conventional bonds because of the elevated danger related to lending to corporations with decrease credit score scores.

invesco.com

One other noteworthy function of the fund is its positioning. Senior loans, being collateralized and having a better declare on an organization’s belongings, provide a level of safety throughout market downturns. Moreover, as senior loans are floating-rate devices, they might fare higher in periods of rising rates of interest, making them a pretty choice for traders in search of to protect their portfolios from rate of interest danger.

Analyzing the Fund’s Efficiency

BKLN’s efficiency is noteworthy when in comparison with different asset courses. As an example, the Bloomberg US Mixture Bond Index (AGG), a broad measure of the U.S. investment-grade fixed-rate bond market, has underperformed meaningfully on a relative foundation (and sure – the development is because of reverse).

stockcharts.com

As of June 30, 2023, the fund held 129 securities, with a major chunk allotted to Company sector. The fund’s holdings are diversified throughout a number of industries, decreasing the danger related to any single sector. Nonetheless, the geographic allocation is closely tilted in direction of america, making up 90.16% of the entire belongings. The remaining portion is unfold throughout Luxembourg, Canada, Netherlands, United Kingdom, Germany, and France.

Evaluating BKLN with Related ETFs

When evaluating BKLN with comparable ETFs, it is necessary to think about components akin to efficiency, yield, and danger. As an example, the SPDR Blackstone Senior Mortgage ETF (SRLN) and the First Belief Senior Mortgage Fund (FTSL) are two funds that additionally spend money on senior loans. One other comparable ETF is the iShares Broad USD Excessive Yield Company Bond ETF (USHY), which additionally targets high-yield alternatives. Nonetheless, in contrast to BKLN, USHY primarily invests in high-yield company bonds, which might behave in another way than leveraged loans in sure market situations.

For me, that is extra of a macro argument. Credit score spreads are too tight, and whereas some higher-yielding funds will carry out higher than others, your complete area doubtless would undergo in heightened risk-off dynamics. One of many main dangers related to BKLN is credit score danger. Because the fund invests in lower-rated loans, there is a increased likelihood of default by the issuing corporations, which might result in important losses. Rate of interest danger is one other potential concern. Whereas the floating-rate nature of senior loans might provide some insulation in opposition to rising rates of interest, fast charge hikes might result in increased default charges, particularly for corporations with important floating-rate debt.

The Backside Line

The Invesco Senior Mortgage ETF presents a pretty alternative for traders in search of excessive earnings. Its give attention to senior secured loans supplies a measure of safety throughout market downturns and a possible hedge in opposition to rising rates of interest. Nonetheless, the fund’s credit score and rate of interest dangers, coupled with its heavy focus within the U.S. market, make it dangerous within the right here and now. I would maintain off on this till after some type of actual stress takes place to then purchase into.

Anticipate Crashes, Corrections, and Bear Markets

Anticipate Crashes, Corrections, and Bear Markets

Are you bored with being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis device designed to provide you a aggressive edge.

The Lead-Lag Report is your day by day supply for figuring out danger triggers, uncovering excessive yield concepts, and gaining invaluable macro observations. Keep forward of the sport with essential insights into leaders, laggards, and every thing in between.

Go from risk-on to risk-off with ease and confidence. Subscribe to The Lead-Lag Report at the moment.

Click on right here to achieve entry and check out the Lead-Lag Report FREE for 14 days.