- Bitcoin is exhibiting indicators of weakening demand as September, a month typically related to declining costs, approaches

- Doable rate of interest cuts within the U.S and different bullish catalysts might stir volatility

August was a unstable month for Bitcoin’s (BTC) value. BTC began buying and selling at round $63k on 1 August and barely one week into the month, the crypto’s value tanked to round $49,000. Whereas the worth later rebounded to the touch $65,000 in late August, it has since dropped to commerce at $59,190 at press time.

Regardless of Bitcoin being down by almost 8% over the previous month, merchants anticipate additional declines in September if the coin follows previous value actions. In truth, based on fashionable analyst Ali Martinez,

“When you assume August was robust for Bitcoin, take into account that September typically brings unfavourable returns as properly.”

As an example, again in September 2023, the crypto’s value oscillated between $24,000-$27,000, with out making any important positive aspects. A pointy 17% drop in value was additionally seen in September 2021.

So, will historical past repeat itself or will Bitcoin break this sample?

A take a look at key metrics

A number of key metrics are already exhibiting that bears are taking on and positioning themselves for a possible drop in September.

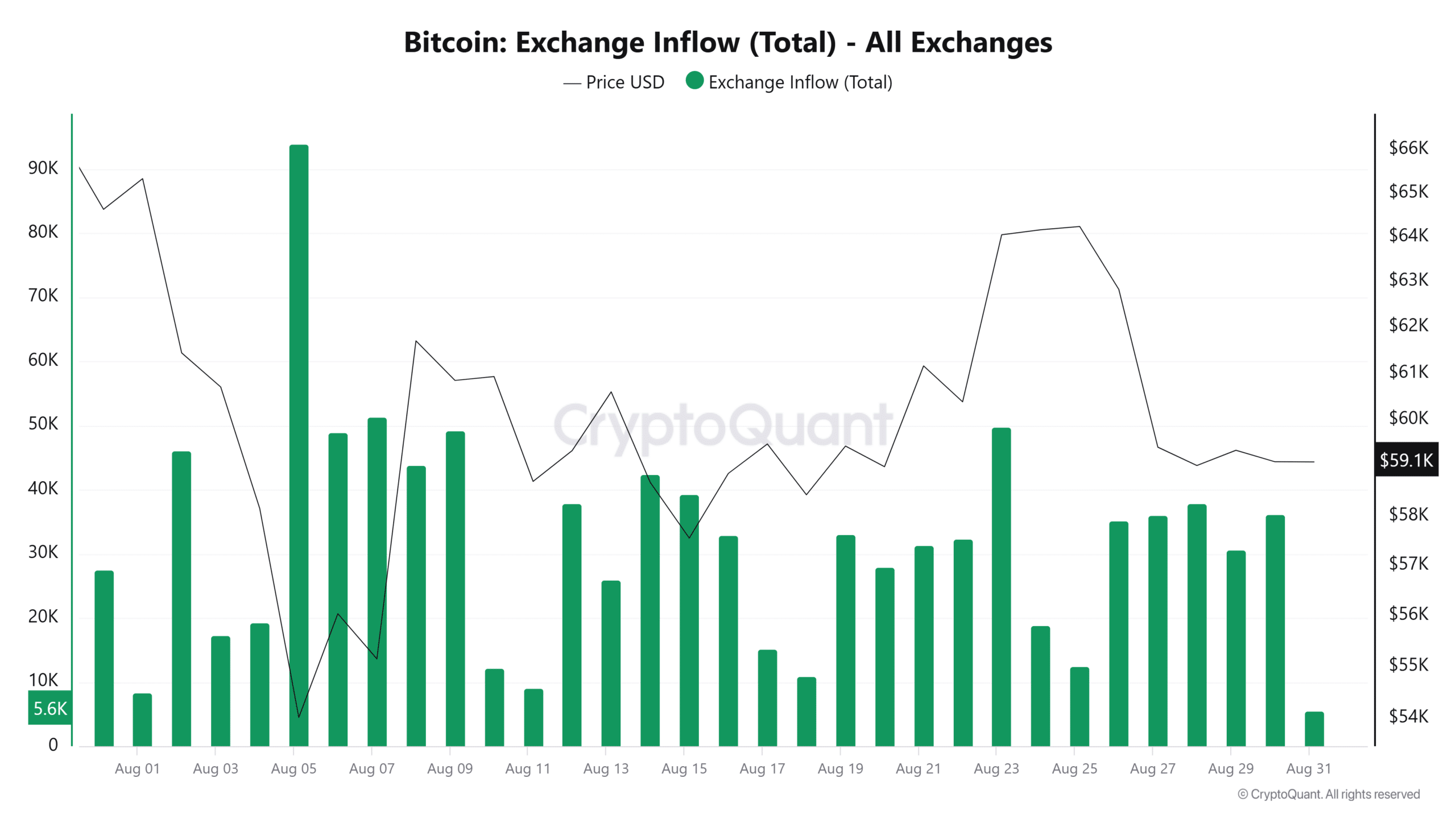

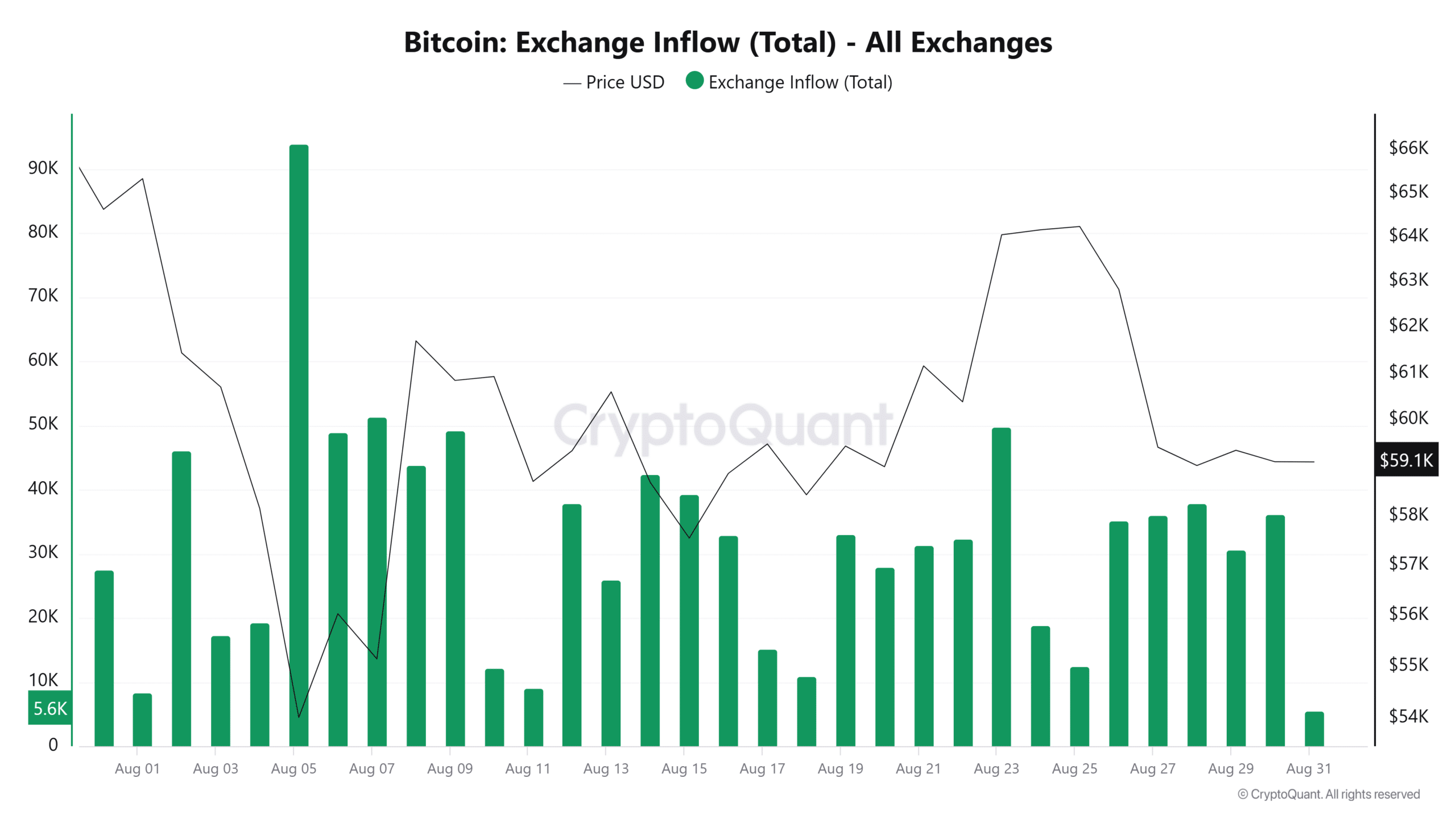

As an example – Knowledge from CryptoQuant revealed a big improve in alternate inflows since late August. The inflows got here shortly after BTC’s value rebounded above $64k.

(Supply: CryptoQuant)

This indicator might imply that after the latest rebound in costs, a big variety of merchants selected to promote and decrease dangers in case of additional dips forward.

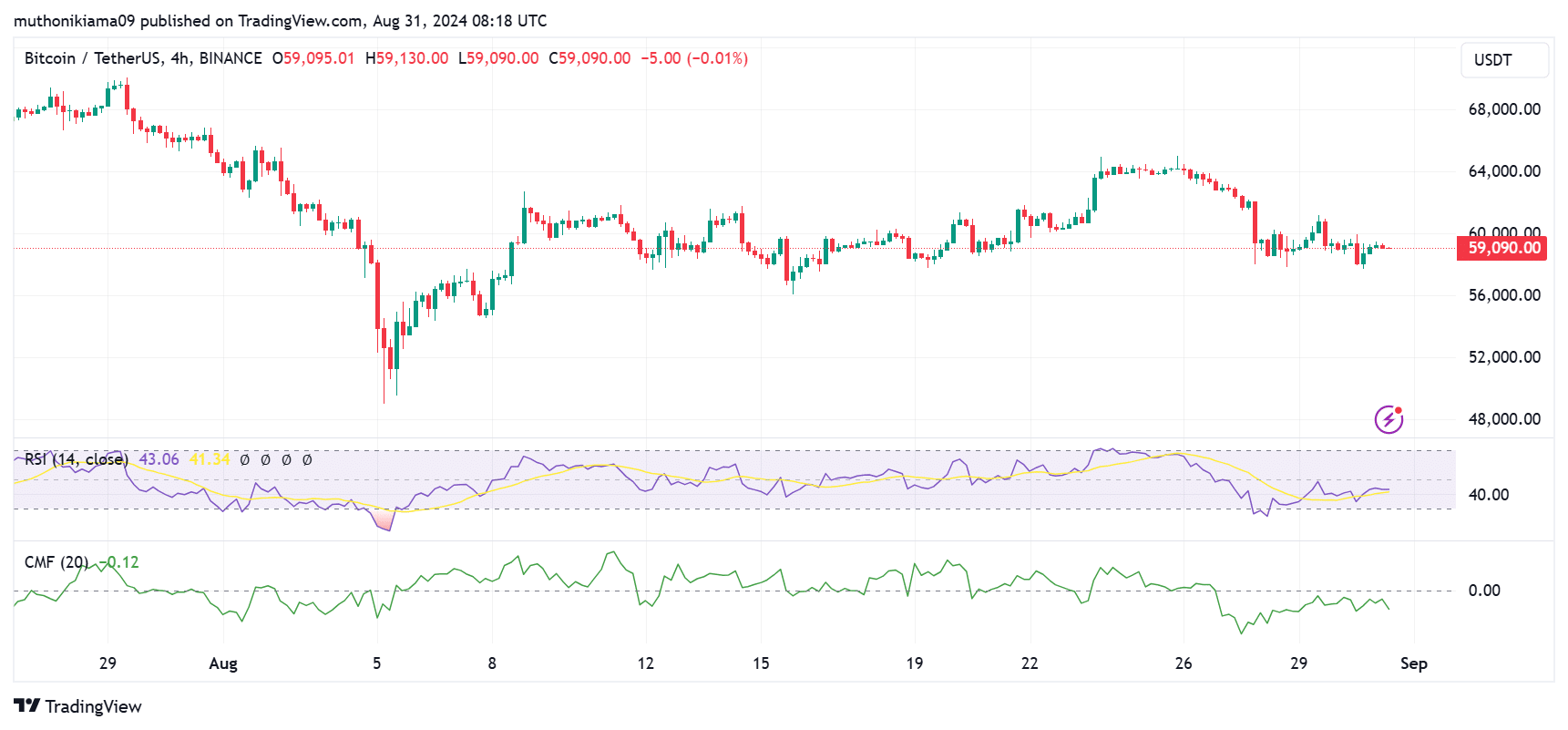

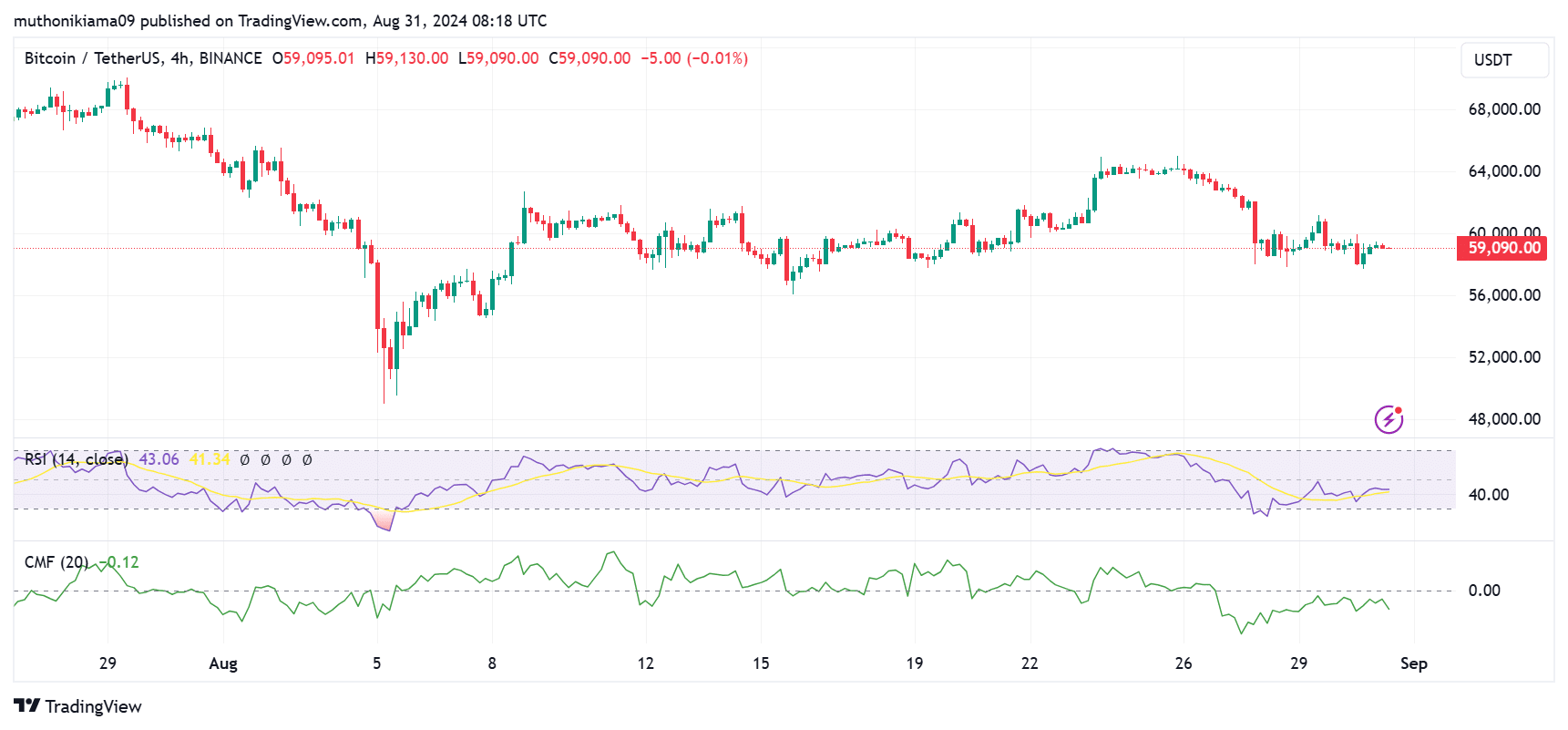

Consumers are additionally exhibiting hesitance to get again into the market. A number of key indicators, the Relative Power Index (RSI) and the Chaikin Cash Circulate (CMF), confirmed waning purchaser curiosity at press time.

The RSI at 43 advised sellers are nonetheless in management, and consumers are unwilling to enter at its prevailing costs. The CMF has additionally oscillated within the unfavourable area since 26 August – An indication of bearish dominance.

(Supply: Tradingview)

On 30 August, the U.S introduced that the core PCE value index for July got here in at 2.6% year-on-year. This was decrease than the anticipated 2.70%.

Such optimistic macro components normally result in a bounce in Bitcoin’s value. Nonetheless, that did not occur yesterday.

In accordance with QCP, with the latest macro information having barely any impact on crypto costs, BTC will proceed to commerce rangebound inside $58k-$65k within the quick time period.

Moreover, inflows to identify Bitcoin exchange-traded funds (ETFs) have weakened. Within the final 4 consecutive days, as an example, BTC has seen constant outflows, as per SoSoValue knowledge.

Will September 2024 be completely different?

Weakening demand for Bitcoin seems to be merchants hesitating to enter the market in case September seems to be one other gloomy month.

Nonetheless, a number of bullish components might stir a rally in September. The optimistic knowledge across the U.S financial system has fuelled hypothesis that the U.S will trim rates of interest within the subsequent Federal Open Market Committee (FOMC) assembly.

Knowledge from the CME FedWatch Tool confirmed {that a} majority of buyers anticipate the Fed to desert financial coverage tightening for the primary time since March 2020. If that occurs, it would gasoline a rally in danger property similar to Bitcoin.

One other bullish catalyst is the discharge of former Binance CEO Changpeng Zhao from jail. His launch date is ready for 29 September, and a few already anticipate it’d ignite a bull run.

Lastly, former U.S President Donald Trump will debate U.S Vice President Kamala Harris in September. If there may be any point out of crypto, it might spike volatility.

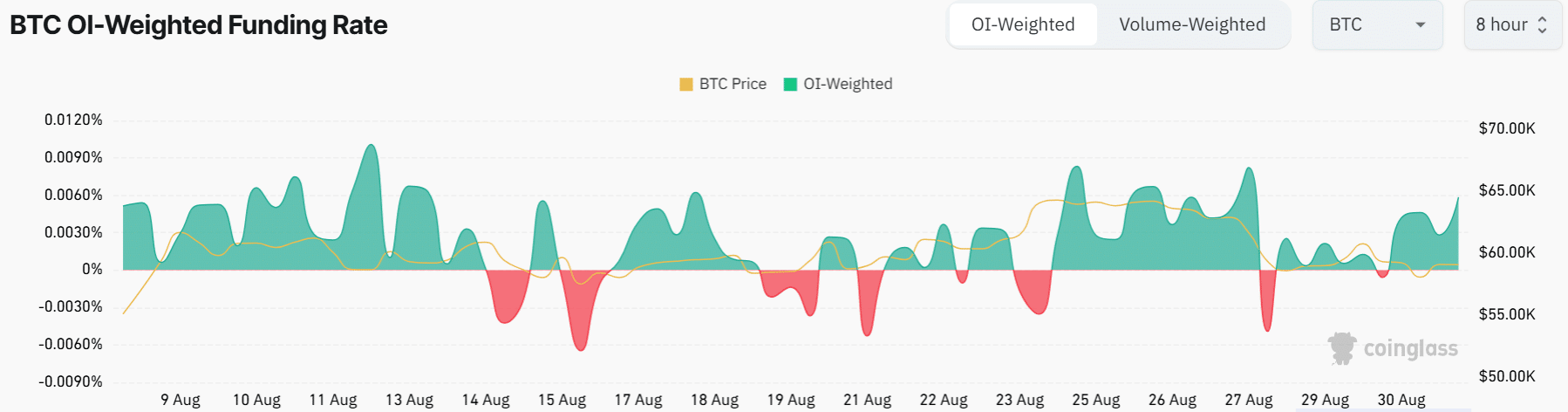

Bitcoin’s funding charges have additionally flipped optimistic and risen considerably over the previous few days. This suggests a surge in lengthy positions – A bullish sign as merchants anticipate future positive aspects.

(Supply: Coinglass)