- Analysts expressed views on BTC’s sensitivity to international liquidity circumstances.

- BlackRock’s Mitchnick noticed BTC as a ‘danger off’ asset; Alden considered it as a ‘danger on gold.’

Bitcoin [BTC] was reportedly extra delicate to international liquidity circumstances than gold and different asset courses.

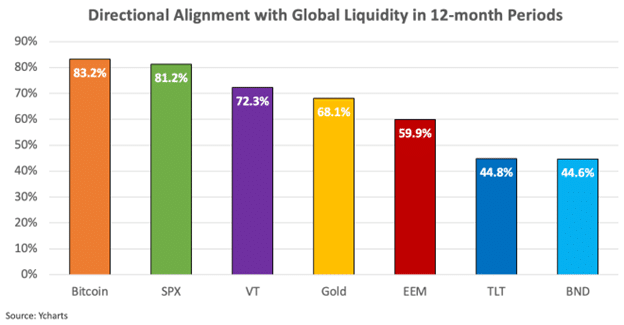

In line with Lyn Alden, a good macro analyst, BTC reacts 83% of the time to international liquidity circumstances than some other asset.

“Bitcoin strikes within the directional of world M2 83% of the time; greater than different belongings.”

Supply: Lyn Alden

BTC: A ‘danger on’ or ‘risk-off’ asset?

U.S. equities, as denoted by SPX, are the second most reactive asset to international liquidity circumstances, whereas gold got here in fourth.

This indicated that BTC was extra of a ‘risk-on’ asset that carried out higher when rates of interest have been low or throughout quantitative easing cycles.

That additionally means that BTC is much less of a relative hedging asset than gold. Per Alden, BTC is ‘risk-on gold’ as a result of it’s new sound cash, however some capital allocators have restricted understanding of it and deal with it as a ‘risk-on’ asset.

She added that the correlation may proceed for one more 5–10 years earlier than BTC begins appearing like gold.

“If it will get actually massive, then it may swap extra to gold-like correlation, which isn’t that far off.”

Nevertheless, BlackRock’s Head of Digital Belongings, Robbie Mitchnick, sees BTC as a ‘risk-off’ and hedging asset. For context, ‘risk-off’ belongings are likely to carry out effectively in periods of uncertainty and turmoil.

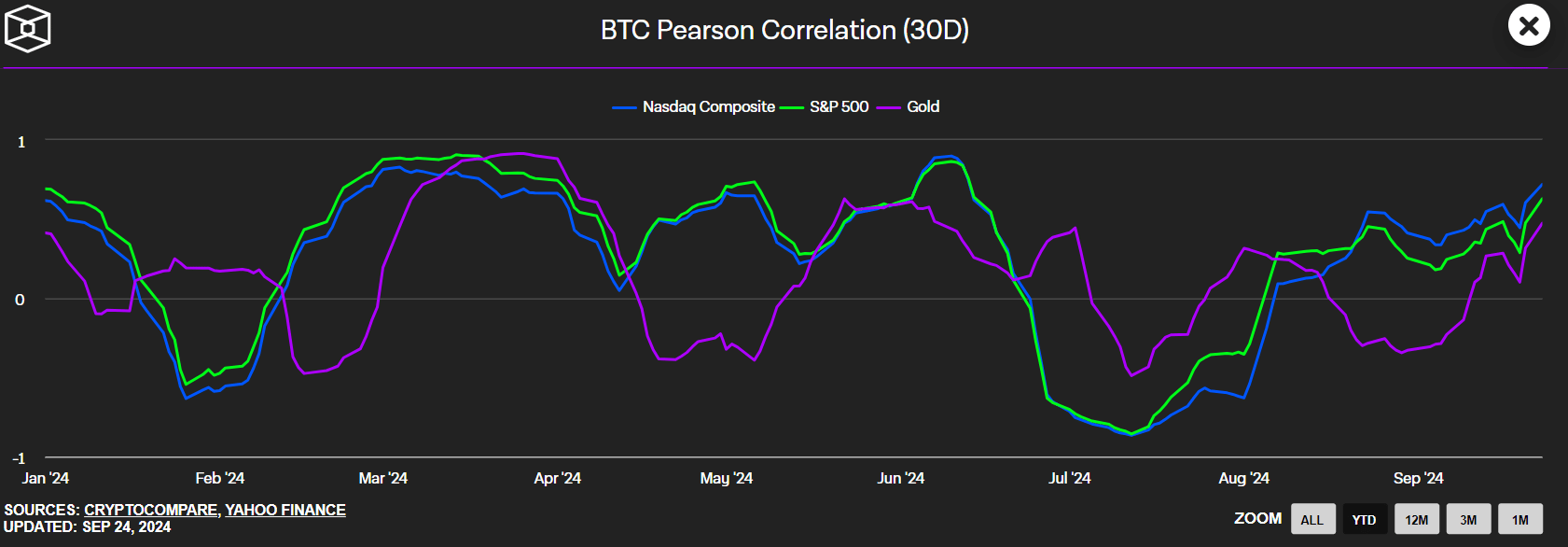

Mitchnick noted that BTC and gold have nearly zero long-term correlations to U.S. shares, with occasional and momentary constructive valuations. He added,

“After we take into consideration Bitcoin, we take into consideration primarily as an rising international financial different…Scarce, international, decentralized, non-sovereign asset. And it’s an asset that has no country-specific danger, that has no counterparty danger.”

Per Mitchnick, rising inflation and traders’ issues about U.S. political/fiscal sustainability will probably be key progress drivers for BTC, making it a ‘risk-off’ asset.

That stated, there have been ongoing debates about whether or not BTC is extra sound cash with additional upside potential in comparison with gold.

Nevertheless, within the brief time period, Alden’s projections look extra possible. BTC behaves like a ‘risk-on’ asset.

The truth is, per the BTC Pearson Correlation, the cryptocurrency has more and more grow to be positively correlated with U.S. shares in Q3.

Supply: The Block

Put in another way, BTC’s worth motion could possibly be forward-looking to U.S. Fed financial coverage updates relatively than crypto-specific occasions within the close to time period.

Briefly, the U.S. PCE (private consumption expenditure) knowledge, which will probably be launched on the twenty seventh of September will drive BTC volatility.

Moreover, the current Chinese language financial stimulus and expected easing cycle may also enhance BTC within the medium run.

Ergo, monitoring this entrance might be useful as a part of a macro-approach to danger administration technique for BTC traders and merchants.