- On-chain metrics revealed that promoting sentiment was dominant throughout the market

- A key market indicator hinted at a development reversal, however others remained bearish

Bitcoin’s [BTC] week-long bull rally got here to a halt as its each day chart turned purple over the previous couple of hours. In reality, BTC misplaced some momentum between 16 and 17 Might after a promote sign flashed on its value chart. Therefore, it’s price taking a look at Bitcoin’s state to see whether or not this development is more likely to proceed within the near-term.

Bitcoin hits the pause button

In response to CoinMarketCap, Bitcoin was having a snug weekly rally as its value hiked by greater than 4%. The worth uptrend allowed BTC to climb as excessive as $66k. Nonetheless, the king coin quickly hit a roadblock after the emergence of a promote sign.

Ali, a well-liked crypto analyst, shared a tweet highlighting this growth. The tweet additionally talked about that he expects one to 4 candlestick corrections for BTC.

The evaluation turned out to be correct, because the king of cryptos’ value did drop. BTC’s value declined by 0.71% and on the time of writing, the coin was buying and selling at $65,464.76 with a market capitalization of over $1.29 trillion.

AMBCrypto then assessed CryptoQuant’s data to see whether or not this halt to BTC’s rally would last more. As per our evaluation, BTC’s aSORP was purple, that means that extra buyers are actually promoting at a revenue. In the course of a bull market, it could possibly point out a market prime.

Additionally, its Internet Unrealized Revenue and Loss (NULP) revealed that buyers are in a perception part, one the place they’re presently in a state of excessive unrealized earnings.

Supply: CryptoQuant

Will this development final?

Upon nearer inspection, AMBCrypto discovered that promoting sentiment usually appeared dominant throughout the market. In reality, BTC’s web deposit on exchanges was excessive, in comparison with the final 7 days’ common.

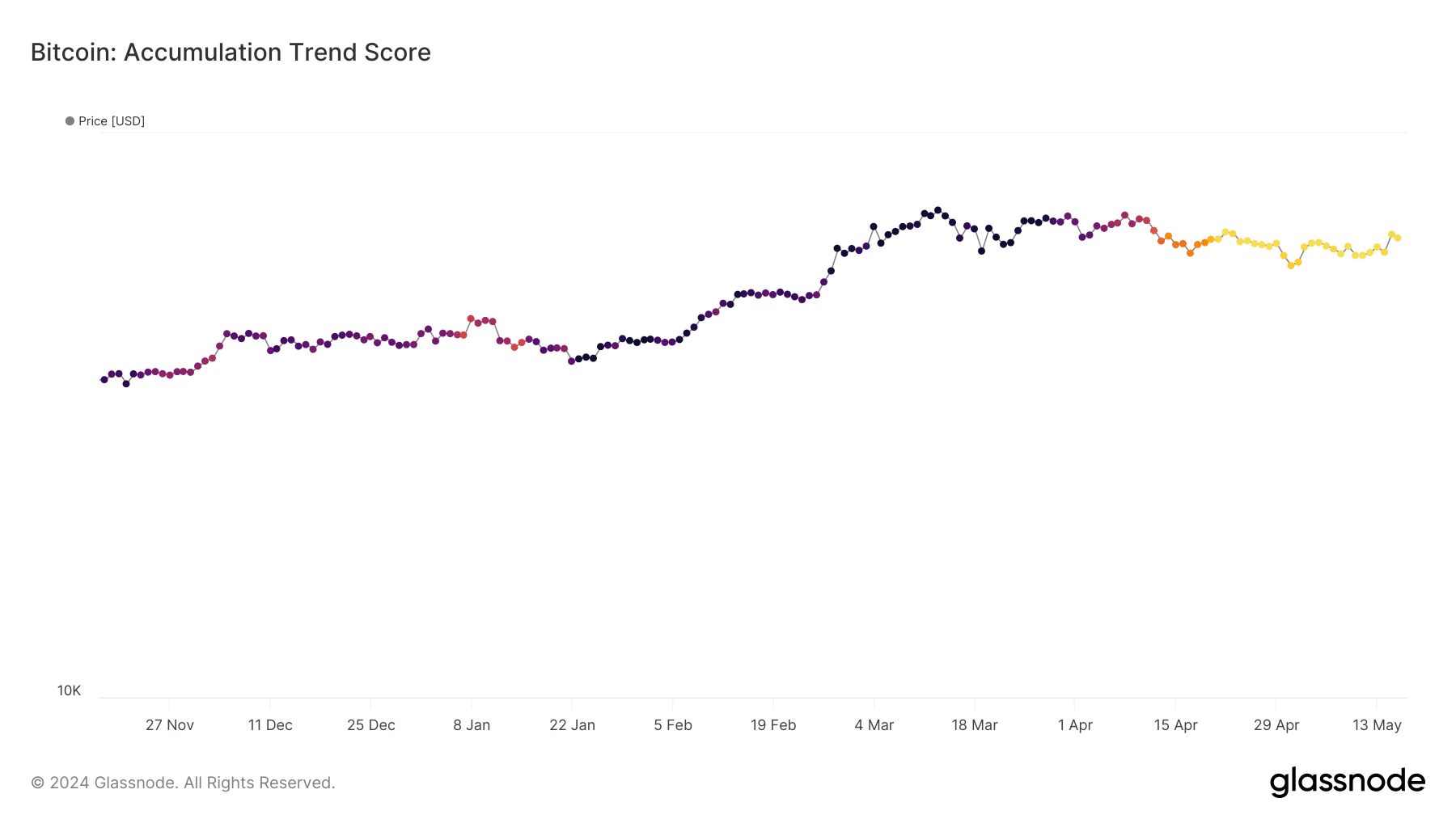

A have a look at Glassnode’s knowledge revealed yet one more bearish metric. Bitcoin’s accumulation development rating had a price of 0.0061 at press time, indicating that buyers haven’t been stockpiling BTC.

For starters, the Accumulation Development Rating is an indicator that displays the relative dimension of entities which can be actively accumulating cash on-chain by way of their BTC holdings. A worth nearer to 1 signifies excessive accumulation, and a price nearer to 0 suggests buyers are distributing or not accumulating.

Supply: Glassnode

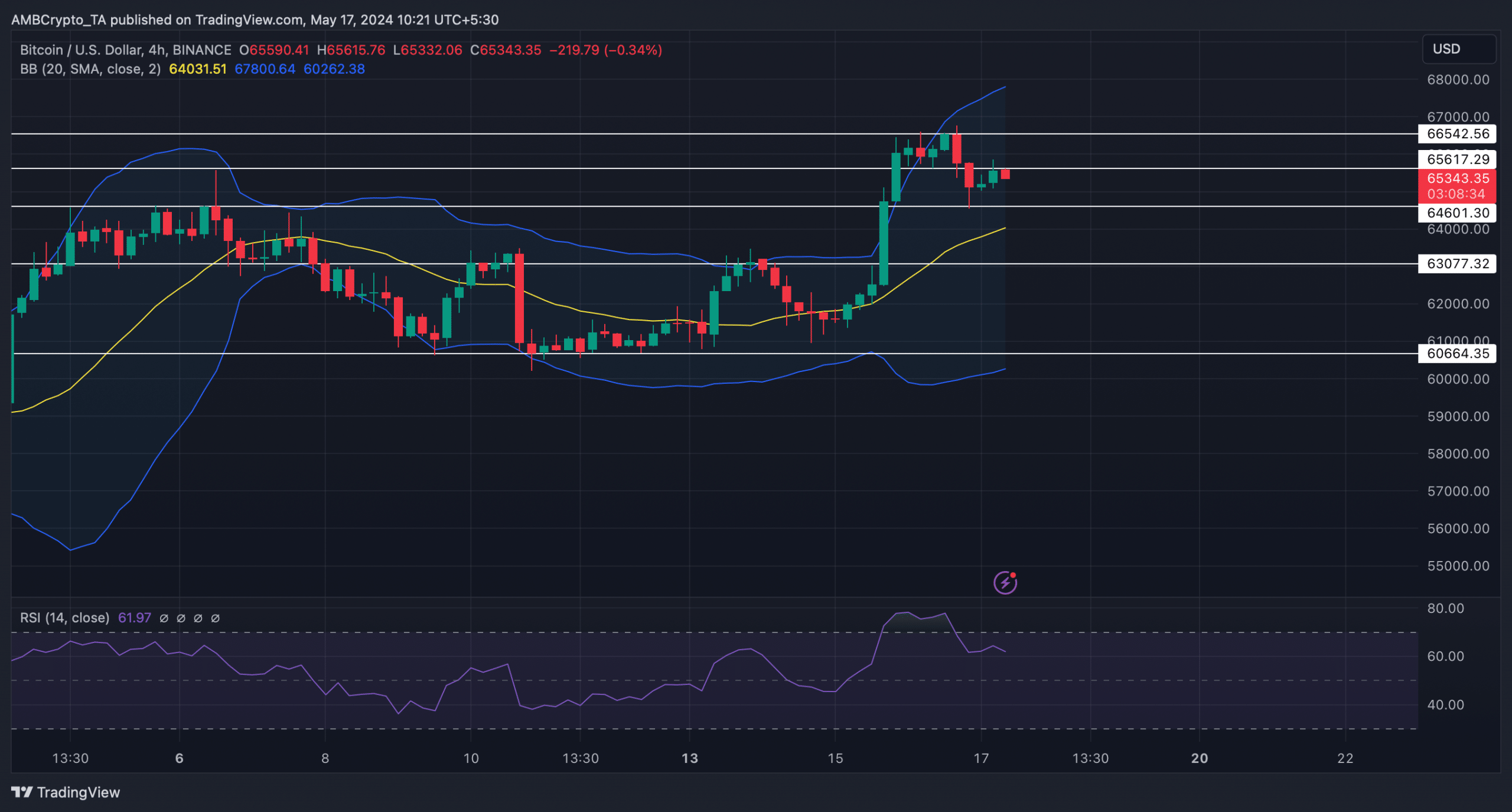

Lastly, AMBCrypto analyzed BTC’s 4-hour chart to raised perceive the potential for Bitcoin resuming its bull rally anytime quickly. On the time of writing, BTC was testing its resistance at $65.6k. A profitable breakout above that stage would permit BTC to show bullish once more.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Additionally, the Bollinger Bands revealed that BTC was buying and selling properly above its 20-day easy shifting common (SMA) – A bullish sign. Nonetheless, the Relative Energy Index (RSI) registered a decline. This could possibly be an indication that BTC won’t handle to breach its resistance within the quick time period.

Supply: TradingView