- Key occasions that might influence BTC’s worth are arising this week.

- BTC has misplaced some good points from its earlier buying and selling session.

Bitcoin [BTC] has encountered risky worth actions in current days, exemplified by a notable over 3% decline on the tenth of Could, which drove its worth all the way down to $60,000.

Nevertheless, indications recommend that these uneven fluctuations could persist, largely influenced by the upcoming Federal Reserve conferences.

Bitcoin buyers await BLS occasions outcomes

The upcoming occasions scheduled by the US Bureau of Labor Statistics (BLS) this week are noteworthy for buyers resulting from their potential influence on funding choices.

Historic knowledge means that bulletins from the Federal Reserve (Fed) have influenced Bitcoin costs previously.

Due to this fact, the upcoming speech by Fed Chair Jerome Powell, scheduled for the 14th of Could, is especially important.

The BLS schedule signifies two key occasions: the Producer Value Index (PPI) immediately and the Client Value Index (CPI) on the fifteenth of Could.

The PPI measures adjustments in costs obtained by producers for items and providers, whereas the CPI tracks adjustments in costs paid by shoppers for those self same items and providers.

Each indices function important financial indicators that buyers depend on to gauge the state of the economic system.

Moreover, the BLS web site signifies an upcoming occasion targeted on employment claims later within the week.

These macroeconomic occasions are poised to affect Bitcoin worth actions as buyers intently monitor them to tell their funding methods.

What to anticipate from Bitcoin worth strikes

AMBCrypto’s evaluation of Bitcoin’s worth pattern on a each day timeframe chart indicated a sluggish efficiency over current weeks.

On the tenth of Could, the value skilled a major drop from over $63,000 to round $60,000, reflecting a lack of over 3%.

Whereas trying to recuperate for the reason that eleventh of Could, Bitcoin may solely attain roughly $62,900. On the time of this writing, it was buying and selling at round $62,000, with a decline of over 1%.

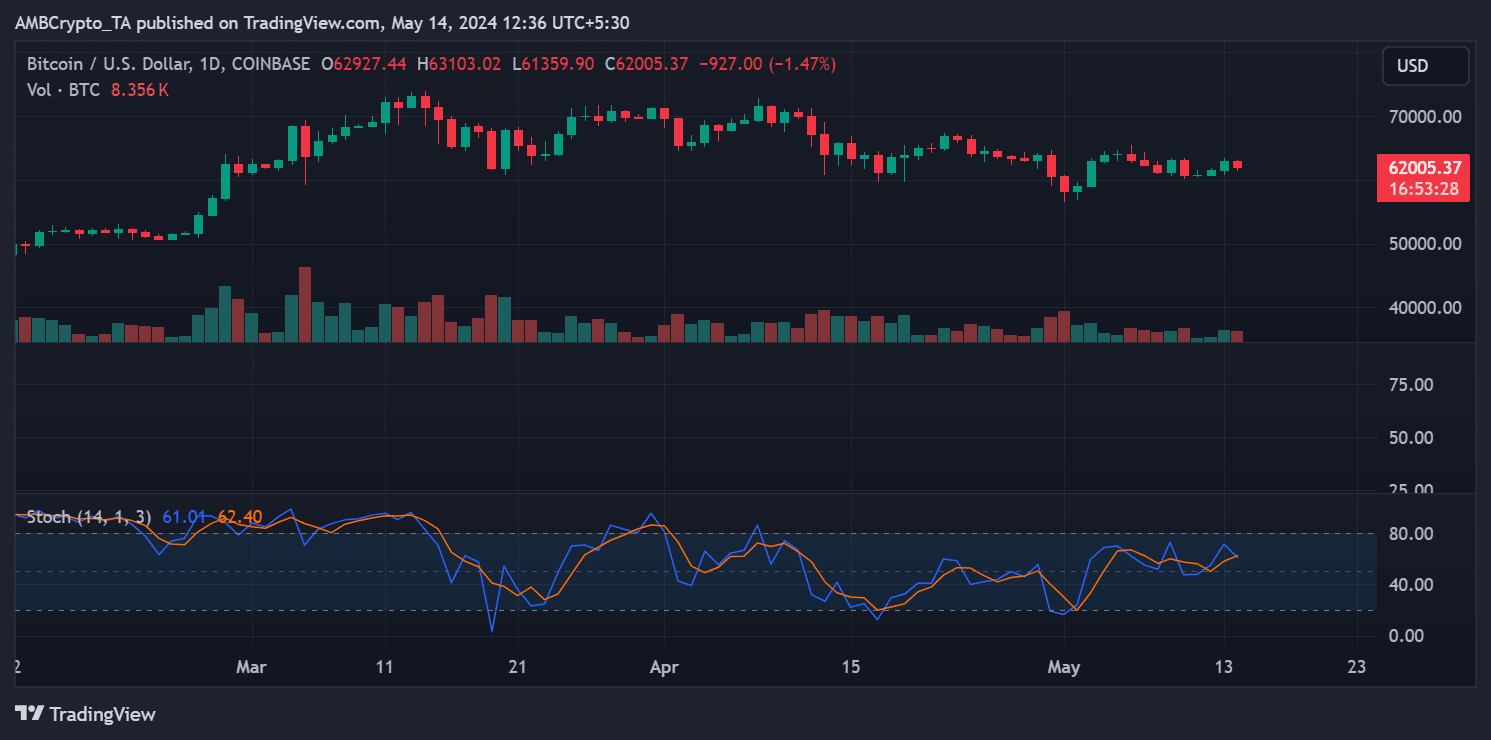

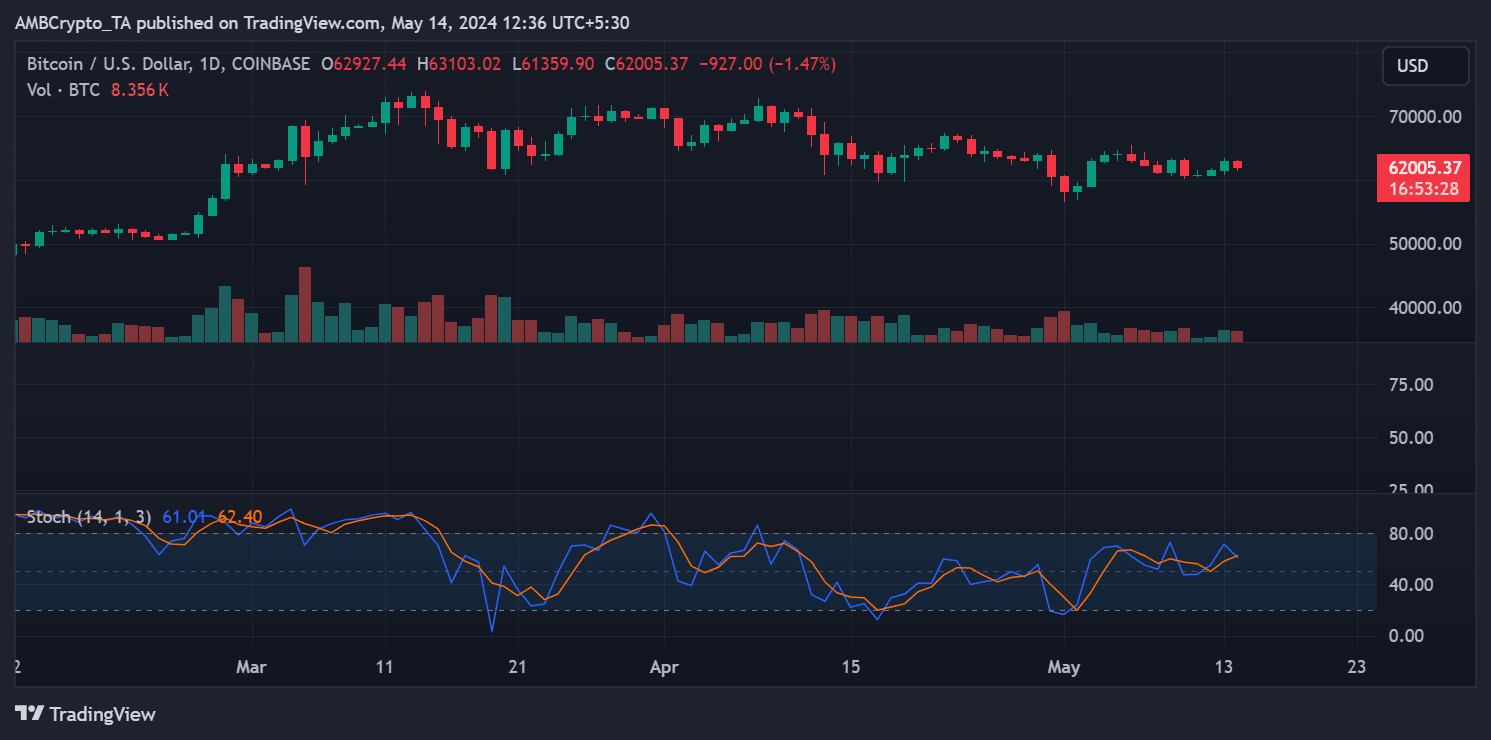

Supply: TradingView

Examination of the stochastic indicator instructed the opportunity of additional decline, as a crossover was nonetheless ongoing.

Nevertheless, primarily based on current worth motion, the $60,000 degree seems to function a robust assist area. Ought to the value drop additional, round $57,000 would possibly act as one other degree of assist to forestall additional decline.

Potential rise in BTC quantity anticipated

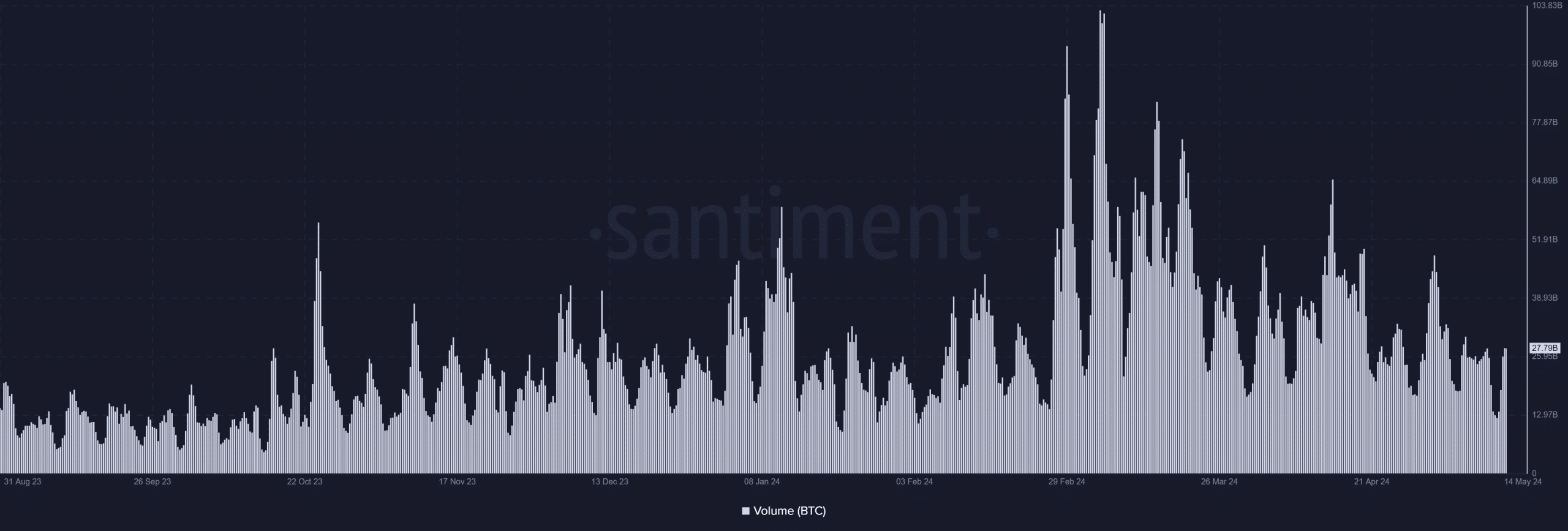

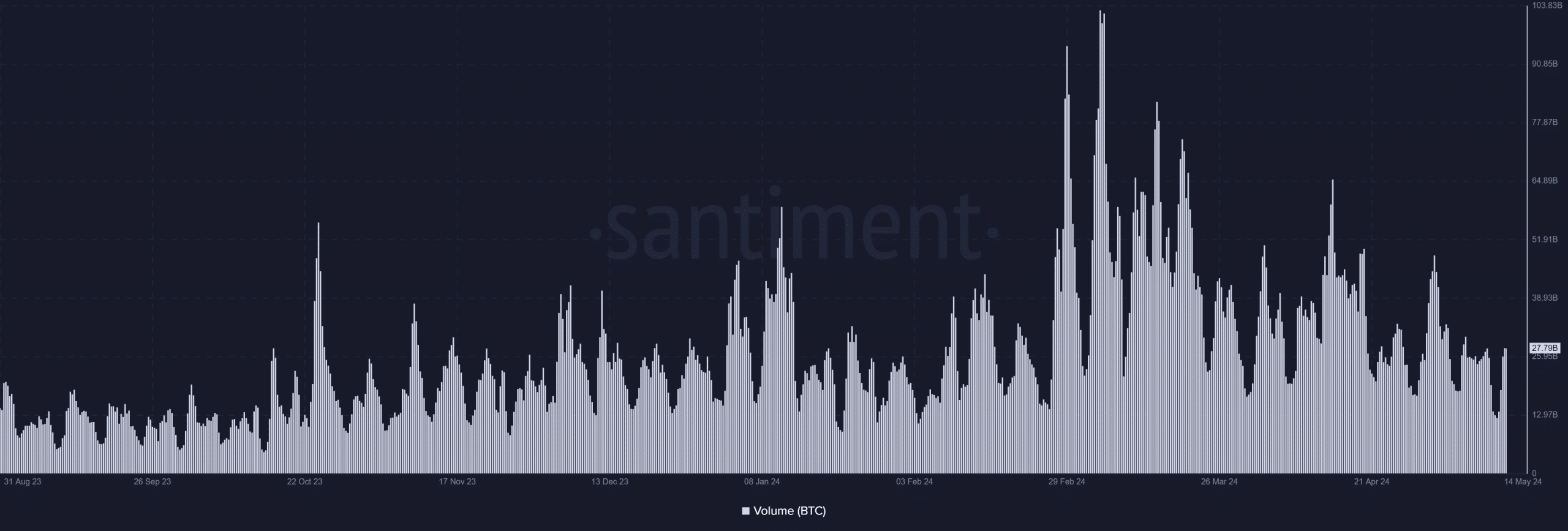

The quantity metric for Bitcoin may expertise elevated exercise if the value begins to say no.

The chart revealed that through the earlier buying and selling session, when the Bitcoin worth was rising, the quantity was roughly $25 billion.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Nevertheless, on the time of writing, because the BTC worth has dropped, the quantity has already surged to just about $28 billion.

This uptick in quantity suggests heightened buying and selling exercise, doubtlessly indicating elevated promoting strain if the value continues to fall.

Supply: Santiment