- Per a crypto hedge fund founder, a BTC pullback to $52K or $45K could be regular.

- Regardless of the BTC dump, cycle prime indicators signaled extra room for progress.

Bitcoin [BTC] was down 13% on the weekly charts and traded under $55K. This week’s dump erased many of the important good points made in Q1 after the US spot BTC ETF approval.

The plunge has frightened the market, with some insinuating that the bull run may very well be over.

Nevertheless, crypto hedge fund Capriole Investments founder Charles Edwards claimed the dump was ‘regular.’

“$52K or $45K could be a traditional 30-40% bull market pullback.”

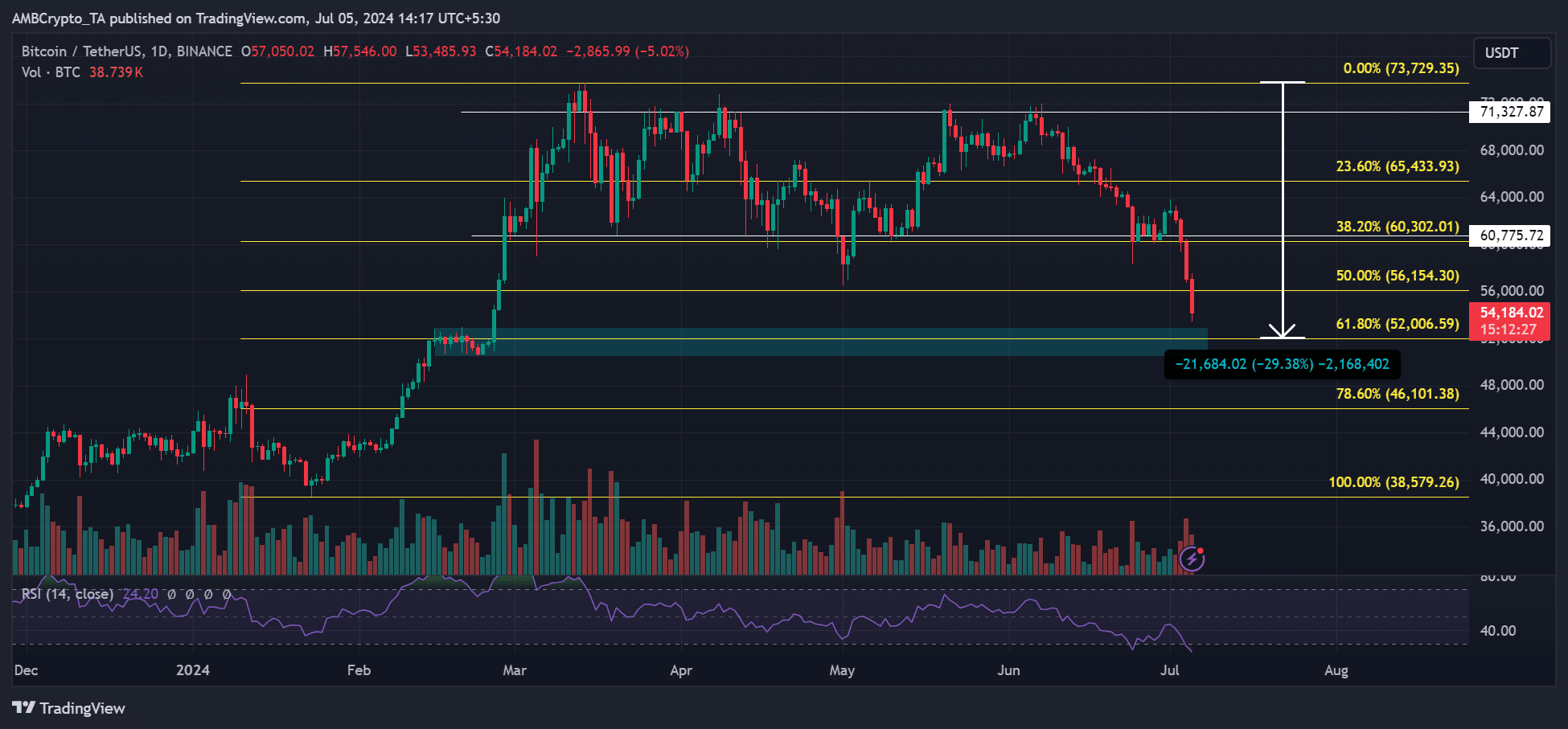

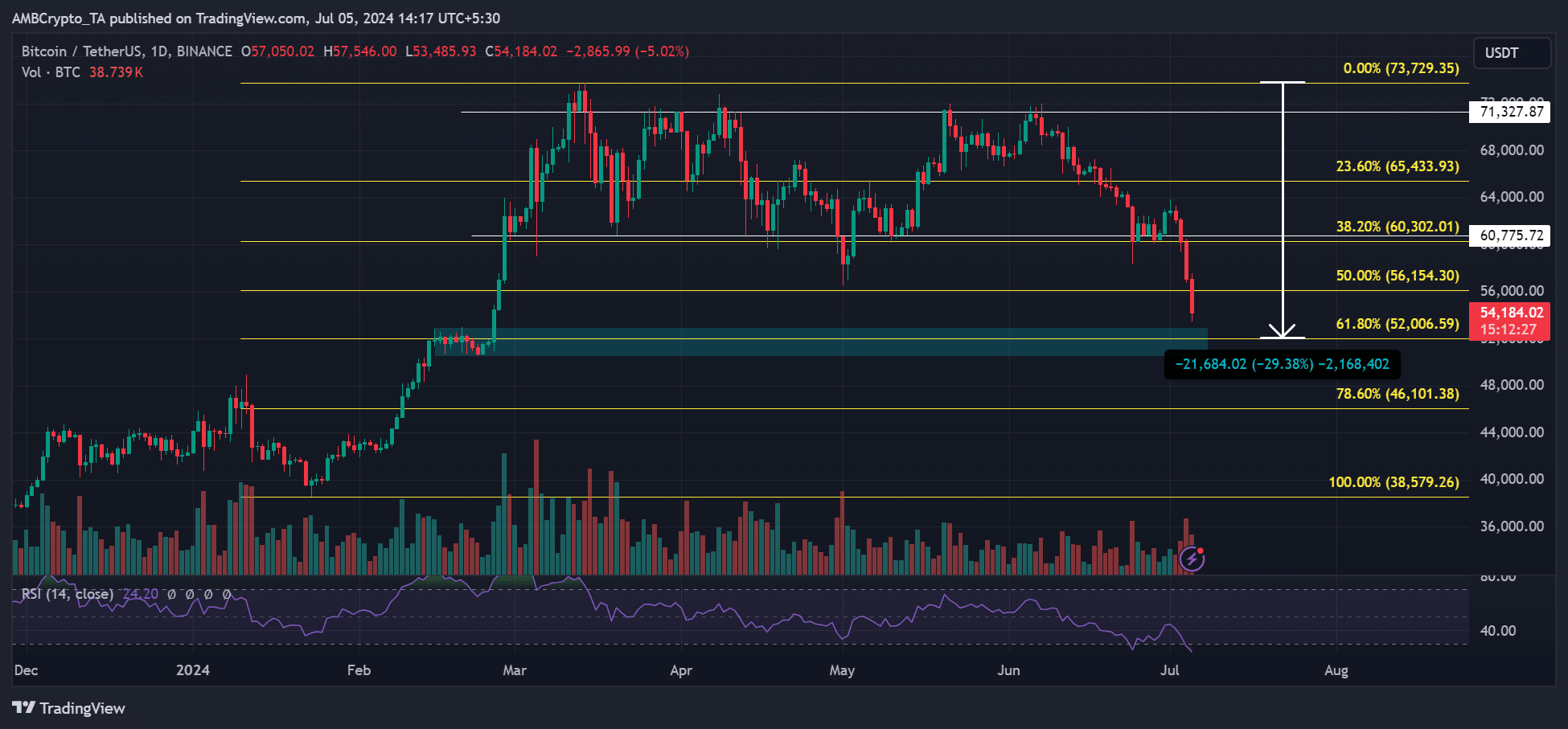

BTC has misplaced practically $20K from its March peak of $73.7K to latest lows of $53.4K. That’s a couple of 26% decline.

An additional drop to the consolidation zone (marked in cyan) in February would translate to a 30% pullback.

Supply: BTC/USDT, TradingView

Within the inventory market, a 5-10% drop may very well be thought-about a pullback. Something above that may affirm a downtrend.

Nevertheless, per Edwards, this won’t be the case for BTC. As such, the $50K psychological degree may very well be a key goal to look at.

Is bull run over as Bitcoin plunges in the direction of $50K?

Curiously, the unfavorable market sentiment was linked to Mt. Gox and German Bitcoin sell-offs, per market observers.

Some have welcomed the sell-offs as an effective way of clearing the pending provide overhang for a good better tailwind in Q3 2024.

“Come late Q3/This autumn with seasonality, election, liquidity presumably on crypto’s aspect, there’ll not be main provide overhangs which have been looming over the marketplace for years.”

However evidently the Mt. Gox distribution may very well be delayed. An update on the fifth of July indicated that different collectors may wait longer for repayments.

The defunct Japanese trade has 141.6K BTC, value round $7.6 billion primarily based on present costs, to dump. On the fifth of July, it moved $2.7 billion and forwarded BTC value $148 million to Bitbank.

Supply: Arkham Intelligence

Will the market see reduction if Mt. Gox delays repayments to different collectors? That continues to be to be seen.

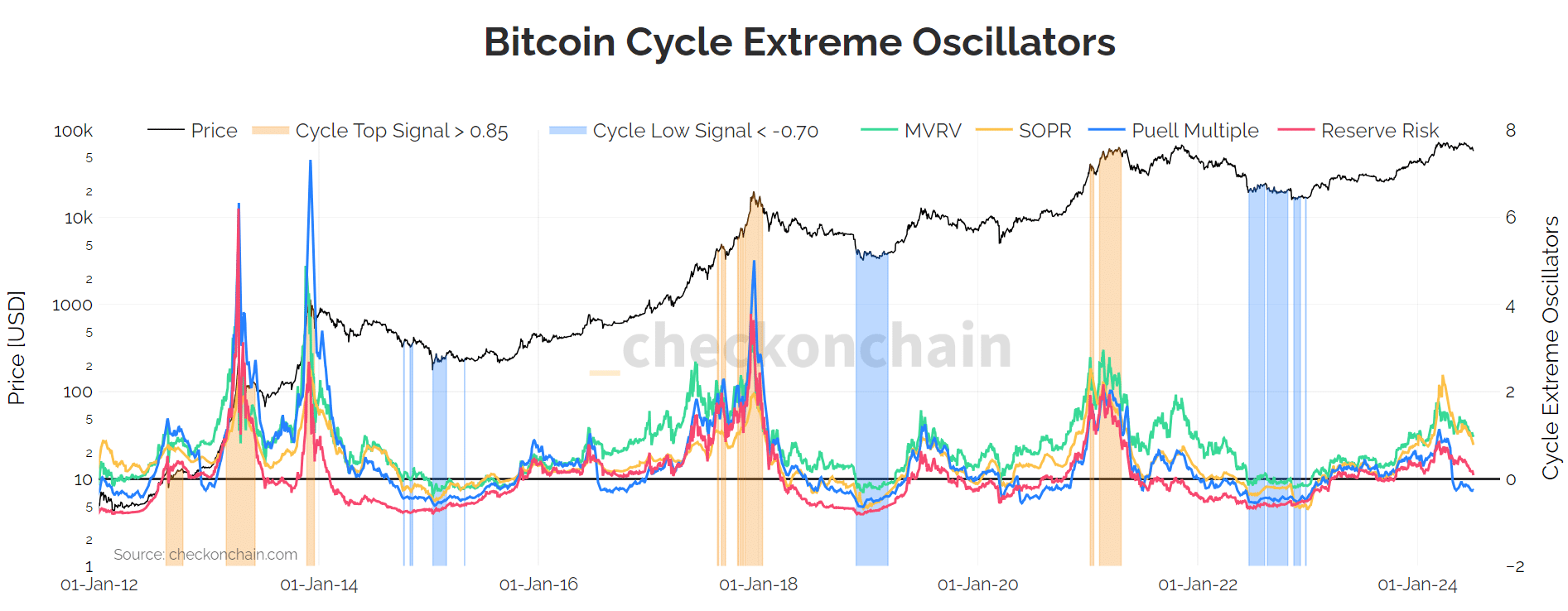

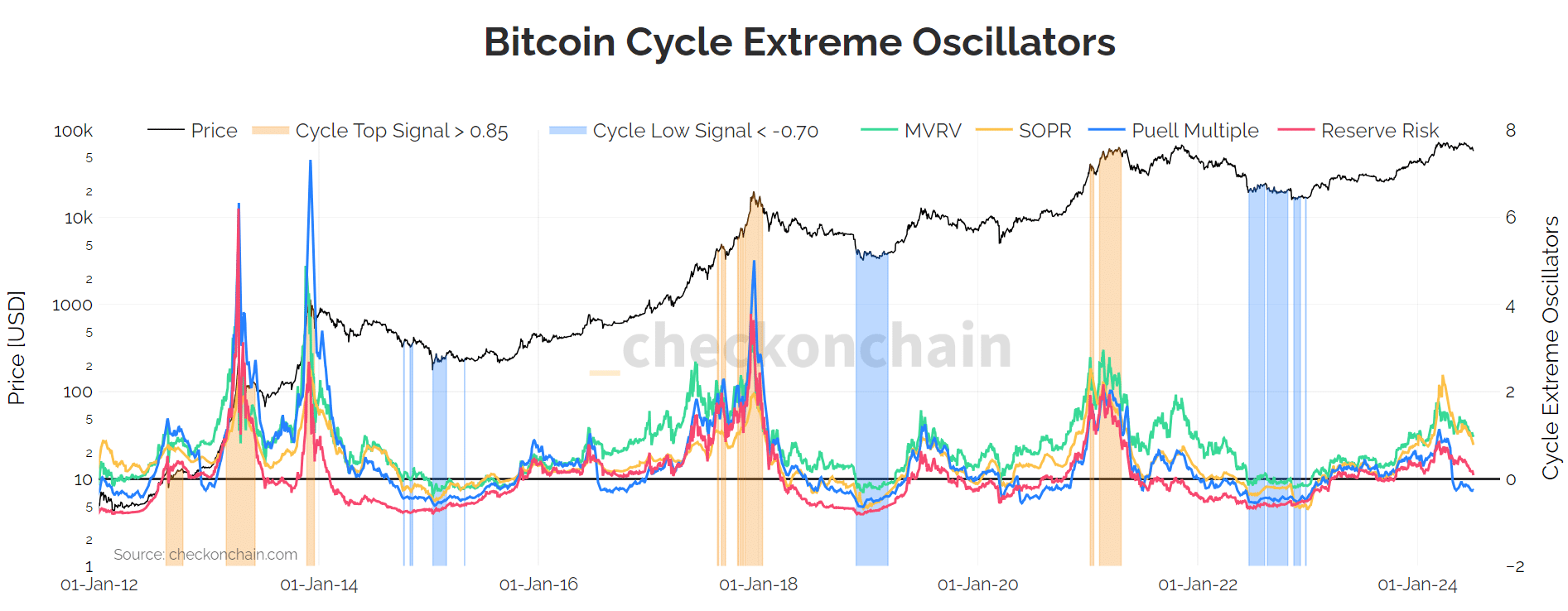

Within the meantime, regardless of the unfavorable sentiment, BTC nonetheless has some room to develop. Historic value chart knowledge indicated {that a} market prime may very well be seemingly in late 2025.

In addition to, a collective of key BTC cycle prime indicators hadn’t overheated but to sign that the highest was in.

Supply: checkonchain

Key metrics like MVRV (Market Worth to Realized Worth) and even Puell A number of, which gauges miners’ profitability, weren’t at excessive ranges. As such, it steered that BTC had a little bit extra room for upside.