- Lengthy positions constituted about 83% of the whole liquidations.

- An analyst reaffirmed that the market typically turns into “considerably risky” within the lead as much as Bitcoin’s halving.

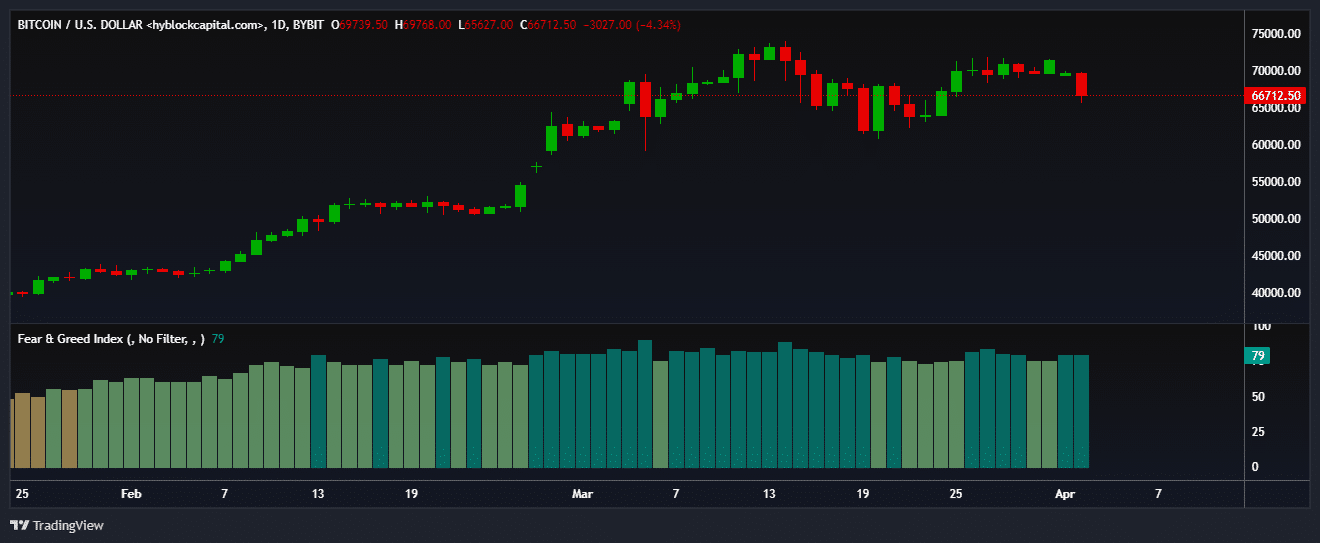

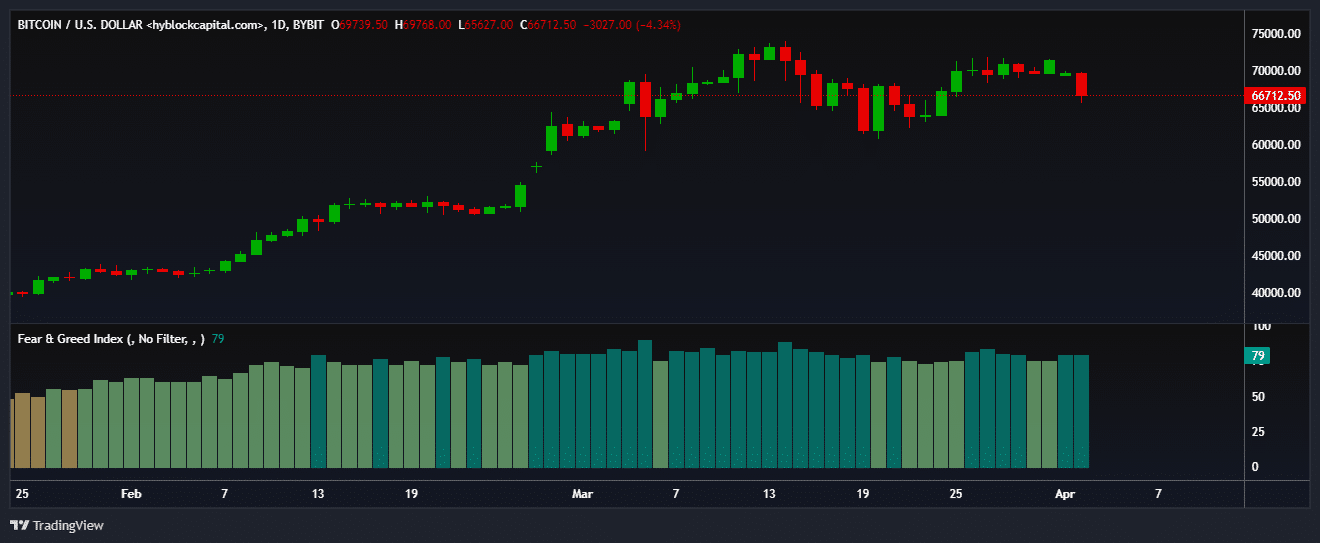

Bitcoin [BTC] sharply corrected throughout early Asia hours on Tuesday, plunging 5.7% to as little as $66,000.

The sudden retracement triggered liquidations value $200 million from your complete crypto market within the final 4 hours, as per AMBCrypto’s evaluation of Coinglass’ information.

Lengthy positions constituted about 83% of the whole liquidations.

Supply: Coinglass

The dip additionally brought about the vast majority of BTC derivatives merchants to show bearish on the asset.

Additionally, the Long/Shorts Ratio fell sharply under 1 in the previous couple of hours till press time, indicating a pointy enhance in bearish leveraged positions.

This stoop adopted a weak begin to the week for Bitcoin spot exchange-traded funds (ETFs).

Ten new funding avenues, monitoring spot costs of the world’s largest digital asset, witnessed web outflows of $85 million on the first of April, AMBCrypto seen utilizing SoSo Worth’s information.

Supply: Coinglass

The downward strain was additionally a response to stronger-than-expected U.S. manufacturing sector information, Shivam Thakral, CEO of Indian cryptocurrency BuyUcoin, stated to AMBCrypto.

Sometimes, risk-based markets resembling cryptocurrencies and equities interpret such occasions as a decrease chance of the U.S. Federal Reserve slicing rates of interest.

Wall Road’s primary indices like S&P 500 and Nasdaq Composite additionally slipped decrease on this improvement.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

Thakral, nevertheless, reaffirmed that the crypto market typically turns into “considerably risky” within the lead as much as Bitcoin’s halving. Therefore, members may brace for extra ebbs and flows over the subsequent two weeks.

The market sentiment was certainly one of “excessive greed” at press time, in keeping with Hyblock Capital’s information. This might speed up shopping for strain within the days to come back, serving to Bitcoin push additional north.

Supply: Hyblock Capital