- Into The Cryptoverse CEO forecasts Bitcoin’s future worth actions.

- Rising greed warrants warning.

Because the a lot anticipated month of ‘Uptober’ involves a detailed, everyone solely has one query on their thoughts: What’s subsequent for Bitcoin [BTC]?

Properly, Benjamin Cowen, CEO and founding father of Into The Cryptoverse, appears to have the reply. In his newest video, the exec emphasised the significance of the month’s final week, stating,

“This week that we’re going into, I consider, would be the resolution week for the trail of Bitcoin for the remainder of the fourth quarter.”

Down or up: The place will Bitcoin go?

Cowen elaborated that the king coin is at a crossroads between the cyclical view and the financial coverage view.

Traditionally, BTC has carried out strongly within the fourth quarter of its halving years.

Barring unfavorable macroeconomic components, the previous development would possibly push costs upward in This fall 2024. Due to this fact, if the coin can break by the $70,000 mark with sustained momentum, the cyclical outlook strengthens.

Conversely, if Bitcoin falters close to the $70,000 mark, dropping again to $64,000, the financial coverage outlook might prevail.

This angle aligns with earlier patterns the place BTC declined after reaching peaks in April and August. Thus, this state of affairs suggests a brief pullback, with the subsequent vital rally probably delayed till early 2025.

Upcoming labor market report: A decisive issue?

However what’s going to resolve the king coin’s destiny? The reply is kind of easy. The CEO underlined that the labor market knowledge can probably dictate the short-term path.

Apparently, AMBCrypto famous that previously, weaker job studies—signaling fewer jobs added—have typically led to Bitcoin rallies.

For instance, after the April jobs report in early Might, it noticed a 6% enhance because the labor market softened. Conversely, stronger job studies in June and July correlated with BTC worth declines. So, if the sample holds true the upcoming report would show pivotal for BTC’s prospects.

Past worth motion, Cowen highlighted that Bitcoin’s market dominance was nearing a essential 60% threshold. This dominance milestone signaled its rising affect and will result in market-wide changes.

BTC’s greed rises

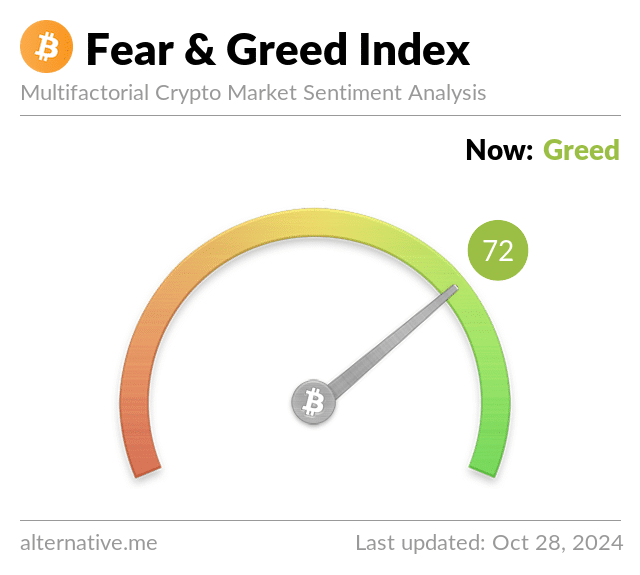

Including to the heightened anticipation, Bitcoin’s Fear and Greed Index was recorded at 72, at press time.

Supply: Different.me

Value noting that elevated greed ranges typically point out that many buyers count on continued worth positive factors, reinforcing a bullish sentiment.

But, this additionally raises issues about potential market overheating, particularly if exterior components, akin to regulatory developments or financial knowledge, set off a shift in sentiment and spark sell-offs.

What does the liquidation heatmap say?

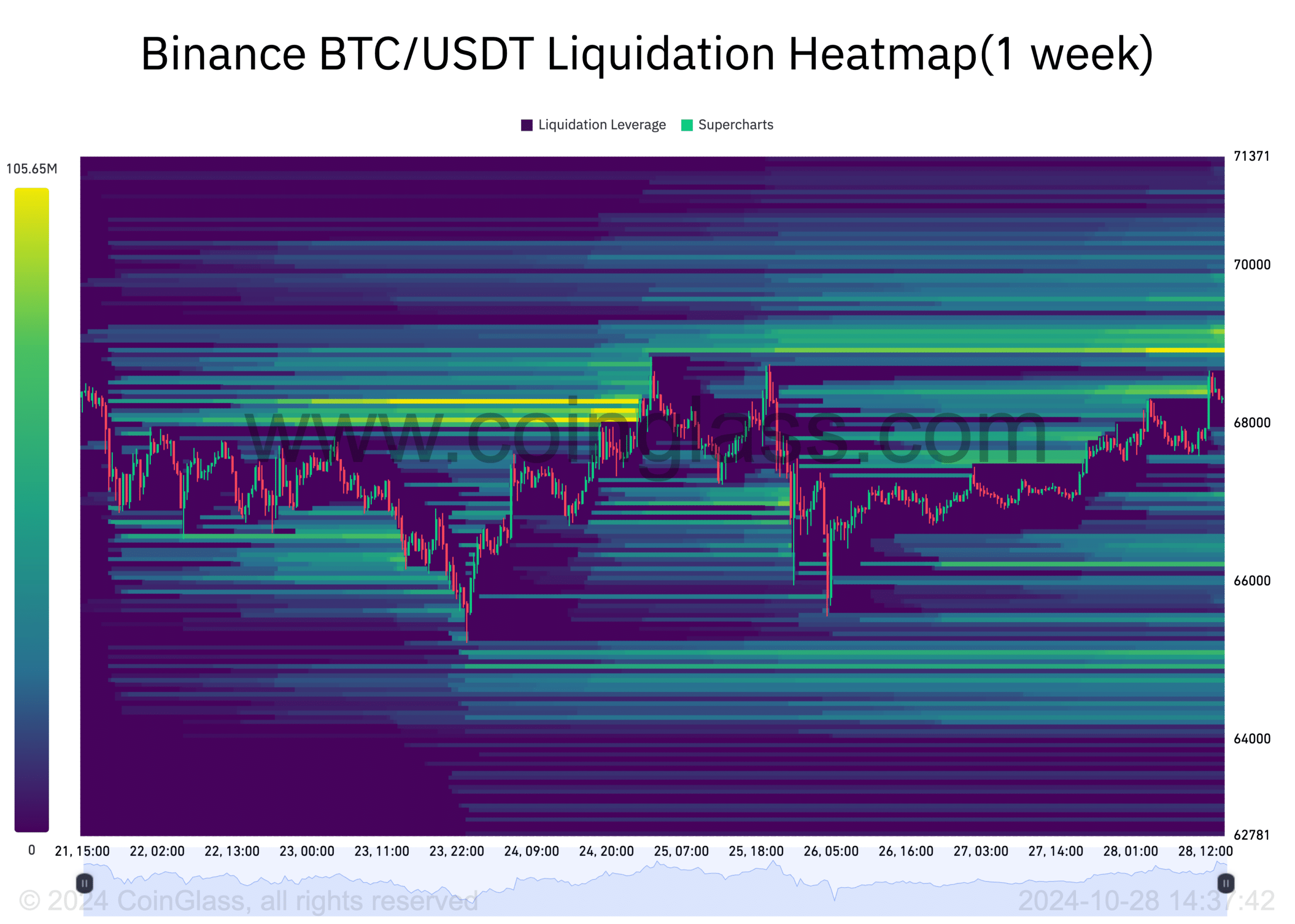

To discover BTC’s potential short-term path additional, AMBCrypto analyzed the one-week liquidation heatmap from Coinglass.

The heatmap revealed a robust liquidity cluster at round $68,900. So, within the brief time period, a transfer towards this magnetic zone can probably materialize.

Supply: Coinglass

At this degree, the coin faces the potential for both a rejection or a breakthrough, every carrying implications for the broader market.

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

As well as, AMBCrypto’s observations indicated an impending provide shock. This might set the stage for vital upward worth motion, thereby favoring the latter chance.