- BTC was buying and selling at round $57,000 with a slight achieve.

- Lengthy-term holders had been nonetheless capable of maintain at a revenue regardless of the preliminary scare.

Just lately, Bitcoin [BTC] skilled a major dip, reaching a degree that almost positioned long-time holders on the brink of non-profitability.

This example highlights the significance of the present Bitcoin’s Market Worth to Realized Worth (MVRV) ratio, which is a important assist line for Bitcoin’s worth. If this assist line is breached, the market may react in a number of methods.

Bitcoin ratio assessments assist

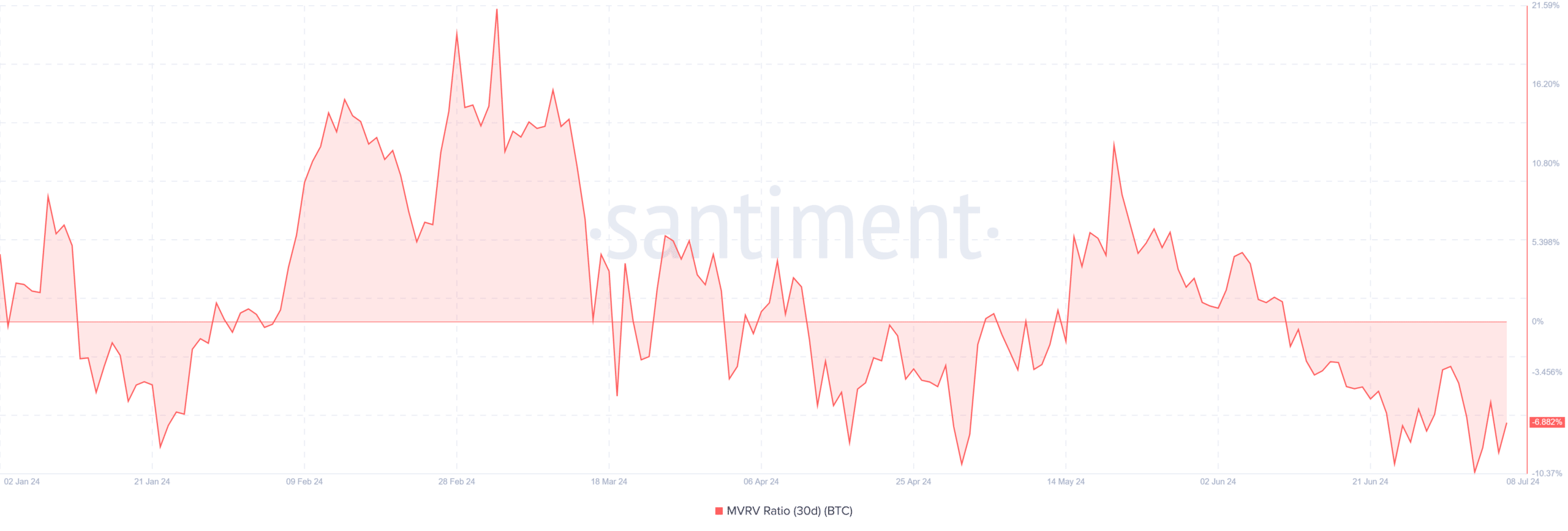

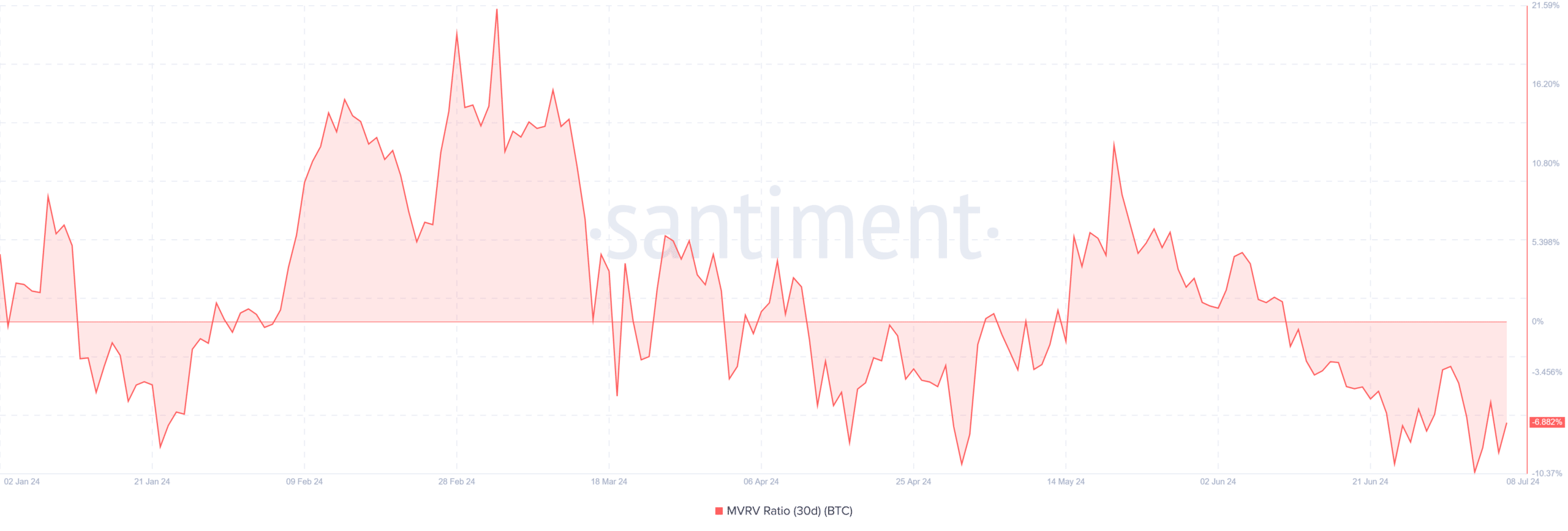

A latest submit by Santiment supplied insights into the present state of the Bitcoin ratio. The submit highlighted the MVRV ratio, specializing in 30-day and 365-day metrics. This evaluation is important in assessing the quick and longer-term monetary stance of Bitcoin holders.

The 30-day MVRV ratio, which assesses the revenue or loss standing of those that have purchased BTC within the final month, has just lately dipped under zero.

This decline started round eleventh June, and the ratio has worsened to roughly -6.8%. This means that holders who’ve acquired Bitcoin throughout this era are, on common, experiencing a loss exceeding 6%.

Supply: Santiment

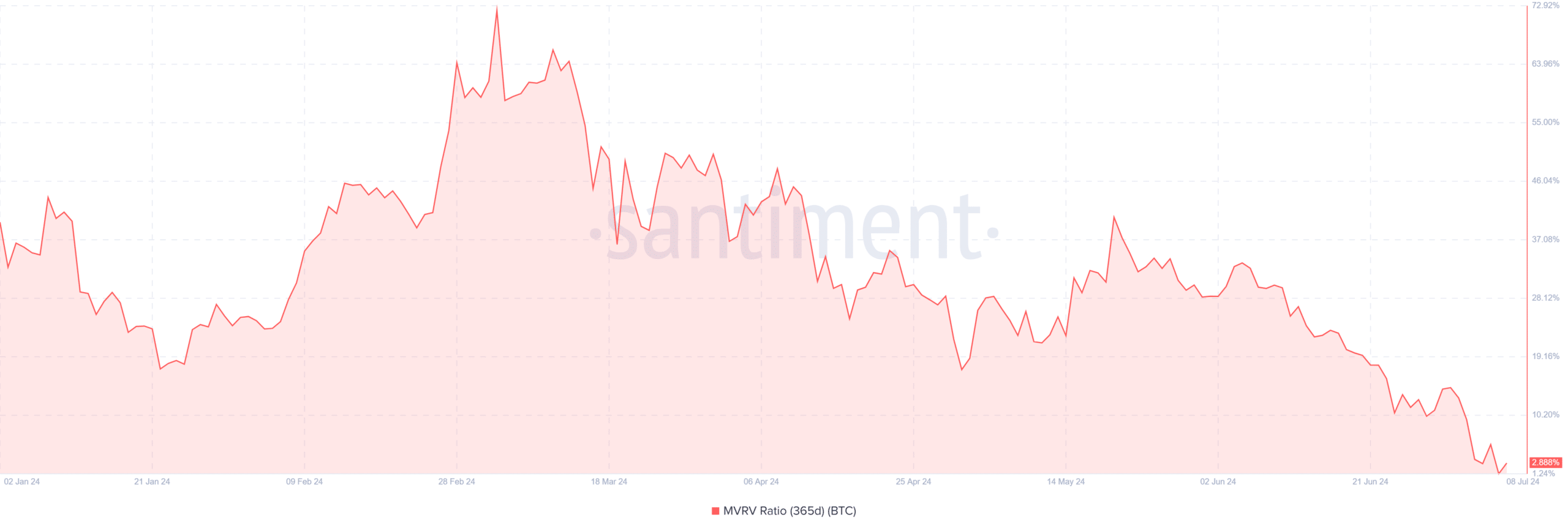

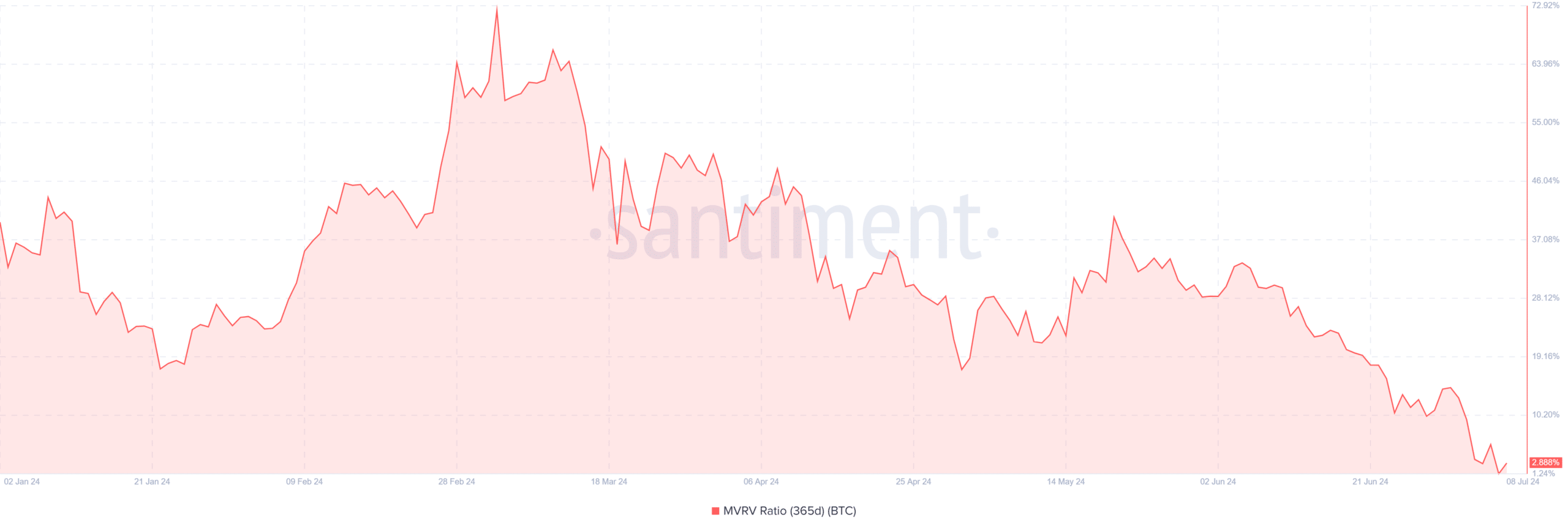

Moreover, on a broader scale, the 365-day MVRV ratio, which displays the market conduct of long-term holders, confirmed these traders had been nearing an important threshold.

Over time, this ratio has remained above zero, suggesting that long-term holders have maintained a worthwhile place.

Supply: Santiment

Nonetheless, latest information reveals a regarding development: only a few days in the past, the ratio fell to about 1.25%, marking its lowest level in months, and as of the final report on eighth July, it hovered round 2.8%.

How the market may react

This proximity of the long-term MVRV ratio to the breakeven level is critical as a result of it acts as a assist degree.

If this Bitcoin ratio fell under zero, it may sign a shift in sentiment amongst long-term holders. It may enhance promoting strain as these traders search to chop losses or capitalize on remaining beneficial properties.

Additionally, this might exacerbate the downward strain on BTC’s worth. Conversely, if the assist holds, it may bolster confidence amongst traders. It may stabilize the value and even drive restoration.

The market’s response to this pivotal level will likely be essential in figuring out BTC’s quick to medium-term worth trajectory.

The present development of BTC

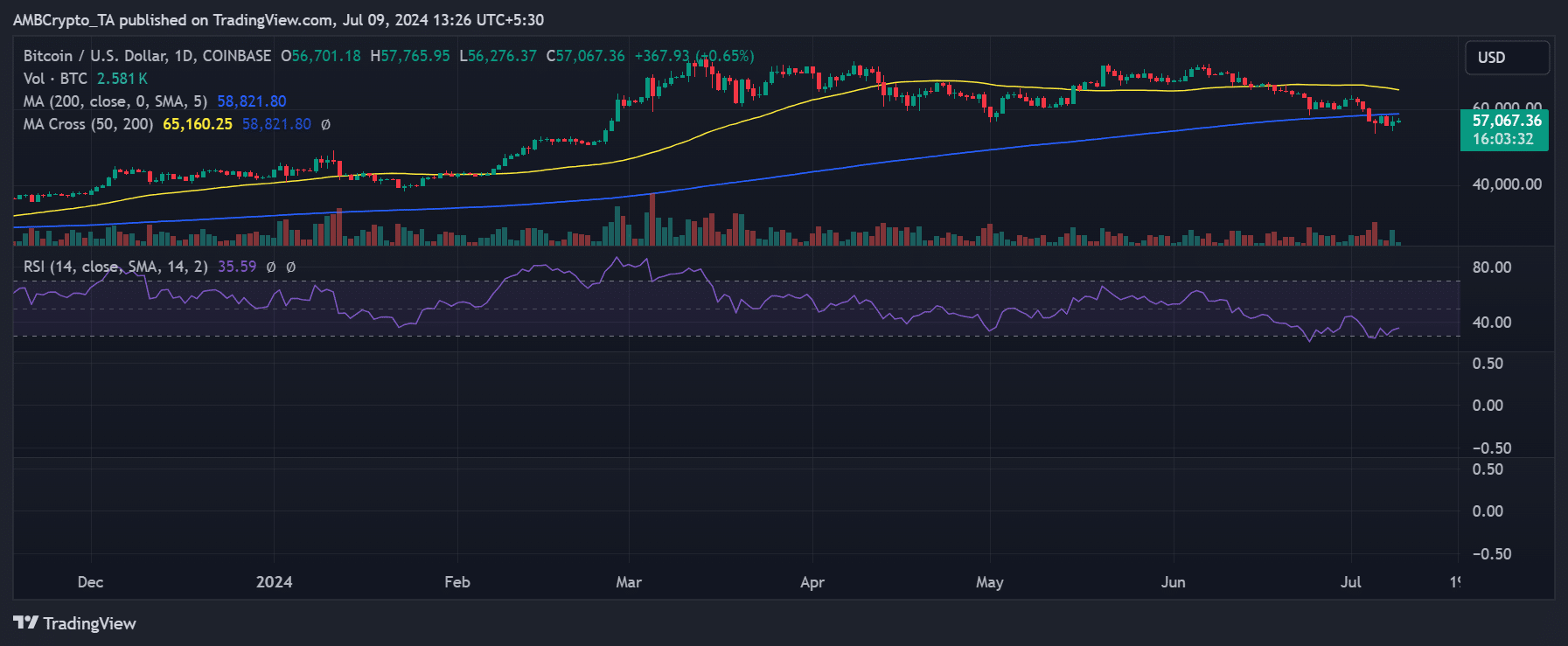

The evaluation of Bitcoin on a every day time-frame chart offers a nuanced view of its latest market actions. BTC initially skilled a notable decline within the earlier buying and selling session, hitting a low of roughly $54,278.

This downturn briefly heightened issues concerning the potential for breaking key assist ranges inside the Bitcoin MVRV ratio—a metric intently watched for indicators of market stability or stress.

Supply: TradingView

Learn Bitcoin (BTC) Value Prediction 2024-25

Regardless of the decline in early classes, the session ended with a rise of over 1%. Additionally, as of this writing, it was buying and selling at over $57,000, growing round 0.6%.