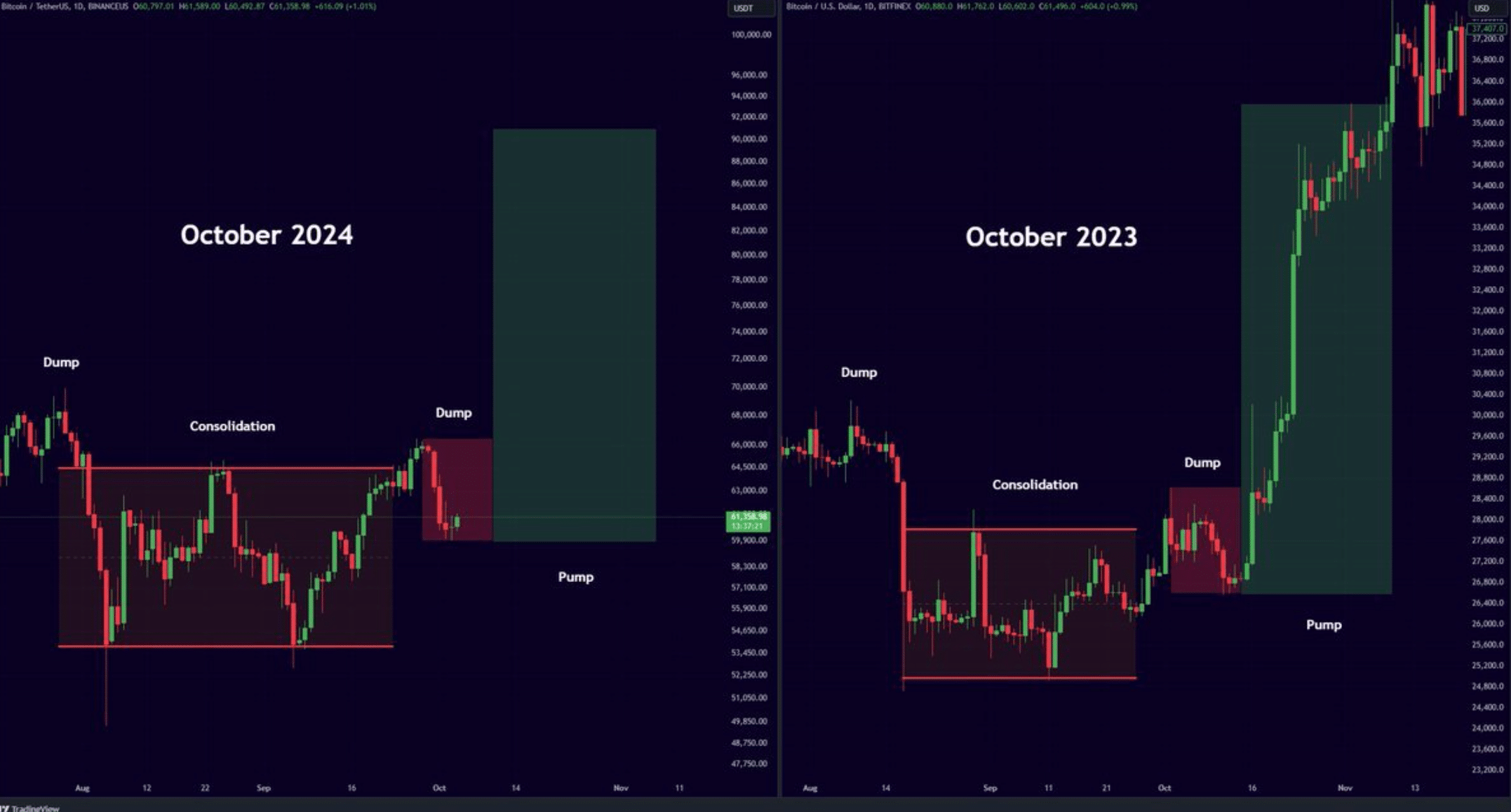

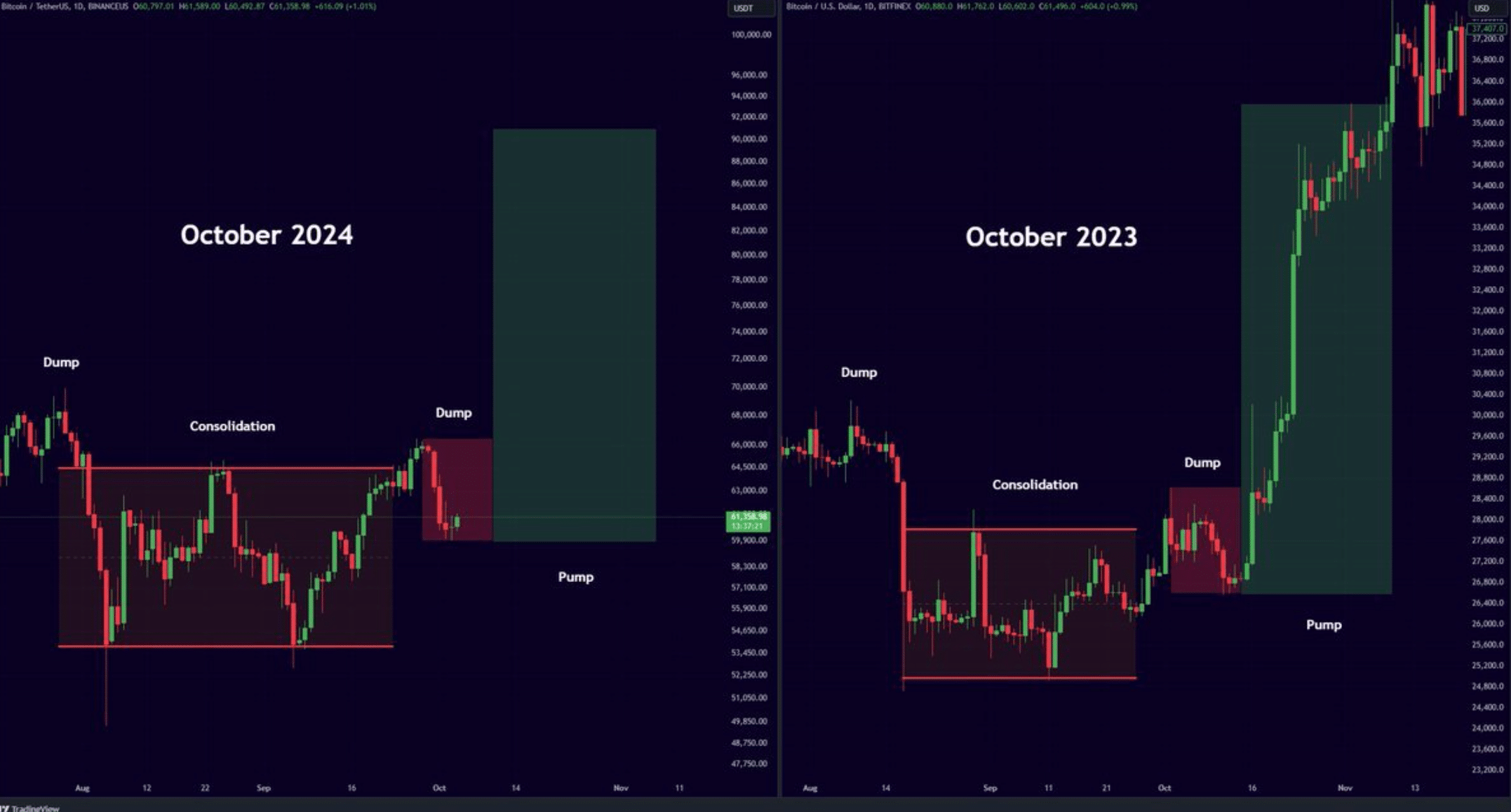

- Bitcoin has skilled an analogous dump that occurred in October 2023.

- A technical indicator turned bearish on the king coin.

Bitcoin [BTC] has been quietly approaching the $62k mark over the previous few days. Although this newest growth won’t appear large, this simply could be the start of a brand new bull rally.

Bitcoin to repeat historical past?

AMBCryptro reported earlier that Bitcoin was consolidating and was slowly approaching $62k. Additionally, shopping for stress on the coin was rising, which frequently resulted in value hikes.

At press time, the king coin was buying and selling at $61,865.46. Alongside this, newest evaluation revealed that BTC was following a previous development.

Mister Crypto, a well-liked crypto analyst, just lately posted a tweet highlighting an analogous development that was seen again in 2023. Final 12 months, BTC was in a consolidation section, after which it skilled a dump.

As per the tweet, an analogous state of affairs has now appeared. If historical past repeats itself, then it gained’t be stunning to see BTC starting a bull rally within the coming days.

Supply: X

Other than this, Titan Of Crypto, yet one more widespread crypto analyst, posted a tweet revealing an attention-grabbing growth. The tweet talked about that Bitcoin bounced from the Gaussian Channel.

For starters, the Gaussian Channel Indicator is a technical evaluation software that helps merchants establish value developments and potential buying and selling alternatives.

If we have a look again, each time such bouncebacks have occurred, BTC’s value has at all times rallied. Subsequently, there have been probabilities of that taking place on this event as effectively.

Supply: X

What to anticipate from Bitcoin

AMBCrypto then assessed the king coin’s on-chain information to raised perceive whether or not all of them trace at a value rise. As per our evaluation, BTC miners have been keen to carry their belongings.

This was clear from BTC’s inexperienced Miners’ Place Index.

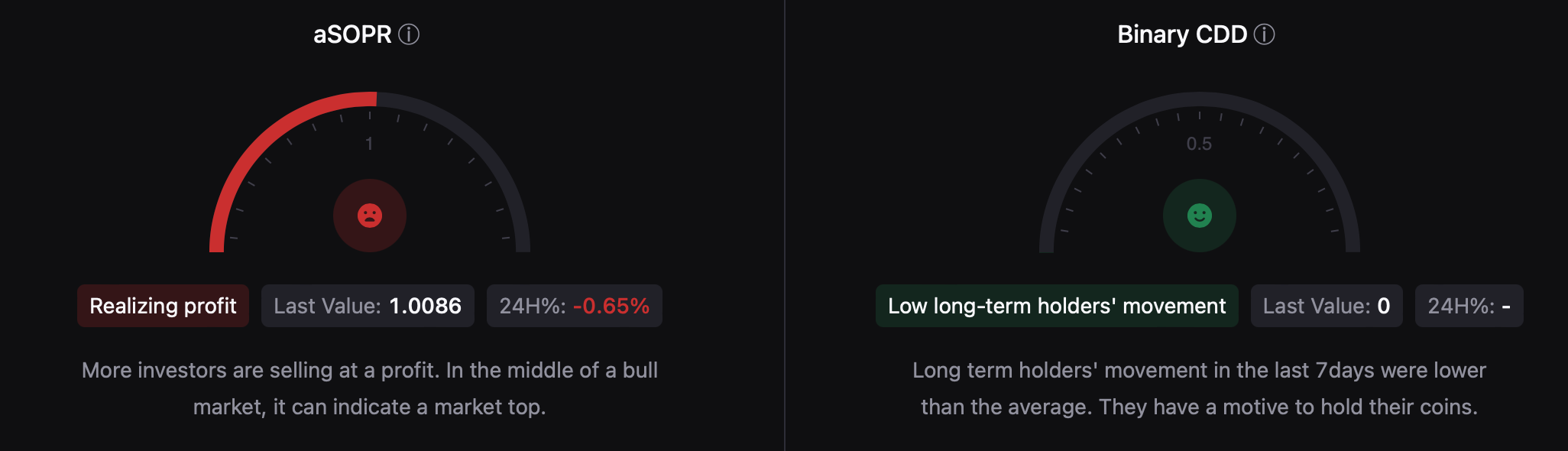

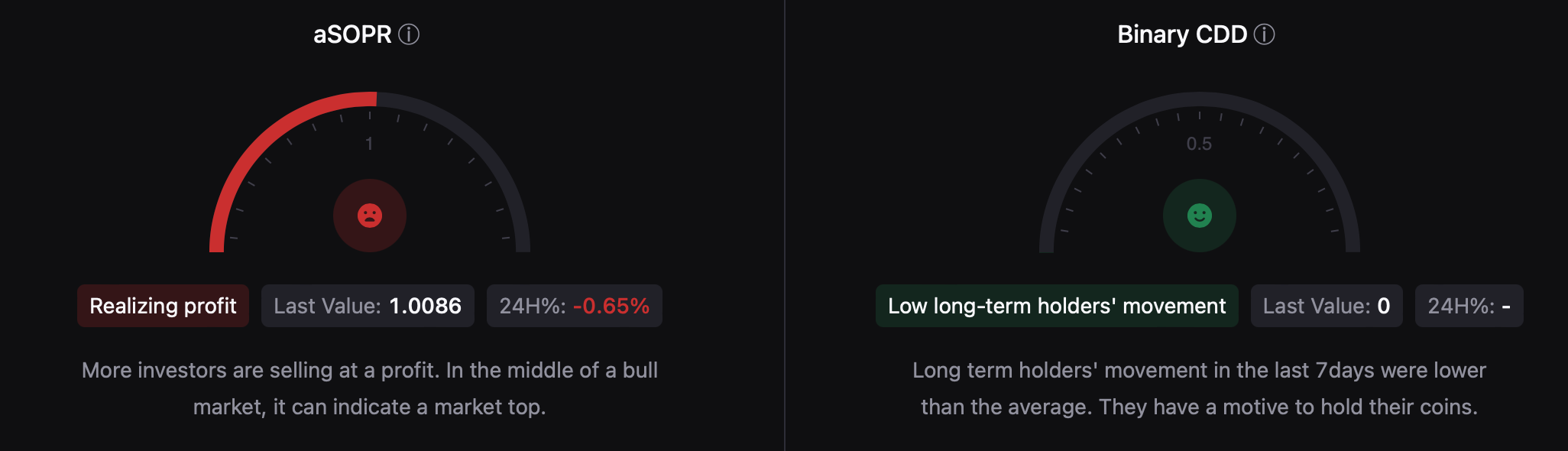

Its Binary CDD was additionally inexperienced, which means that long-term holders’ actions within the final seven days have been decrease than common. They’ve a motive to carry their cash.

Nonetheless, the coin’s aSORP appeared bearish. The metric revealed that extra traders have been promoting at a revenue. In the midst of a bull market, it will possibly point out a market prime.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

Lastly, we took a take a look at Bitcoin’s day by day chart. Regardless of the optimistic metrics talked about above, BTC’s technical indicator MACD displayed a bearish crossover. This recommended that traders would possibly witness a value drop.

If that occurs, then BTC would possibly once more plummet to its help at $54k quickly.

Supply: TradingView