- Bitcoin’s realized share of Quick-Time period Holders has dropped from 55% to 40% – An indication of a market shift

- Bitcoin broke above its 50-day transferring common to climb to $62,700

Bitcoin’s latest downtrend stalled considerably during the last 24 hours as its value started trending upwards. This sideways motion led to a drop within the realized share of Quick-Time period Holders (STH) – An indication that the market could also be gearing up for a major response.

Quick-term holders exit the market

In line with CryptoQuant, the realized share of Quick-Time period Holders (STH) in Bitcoin has fallen from 55% three months in the past to round 40%. The evaluation revealed that the important thing STH value degree is $62.7k, in line with latest months.

Realized costs throughout totally different age bands—1-week at $62,742, 1-month at $62,462, and 3-month at $64,029—could act as short-term resistance ranges for Bitcoin.

Supply: CryptoQuant

This decline in short-term UTXO (Unspent Transaction Output) age bands steered that many latest consumers have exited the market.

Quite the opposite, long-term holders (LTH) in greater age bands continued to carry. The market has been hovering round $62,000, and breaking above this important degree may sign a extra optimistic shift available in the market construction.

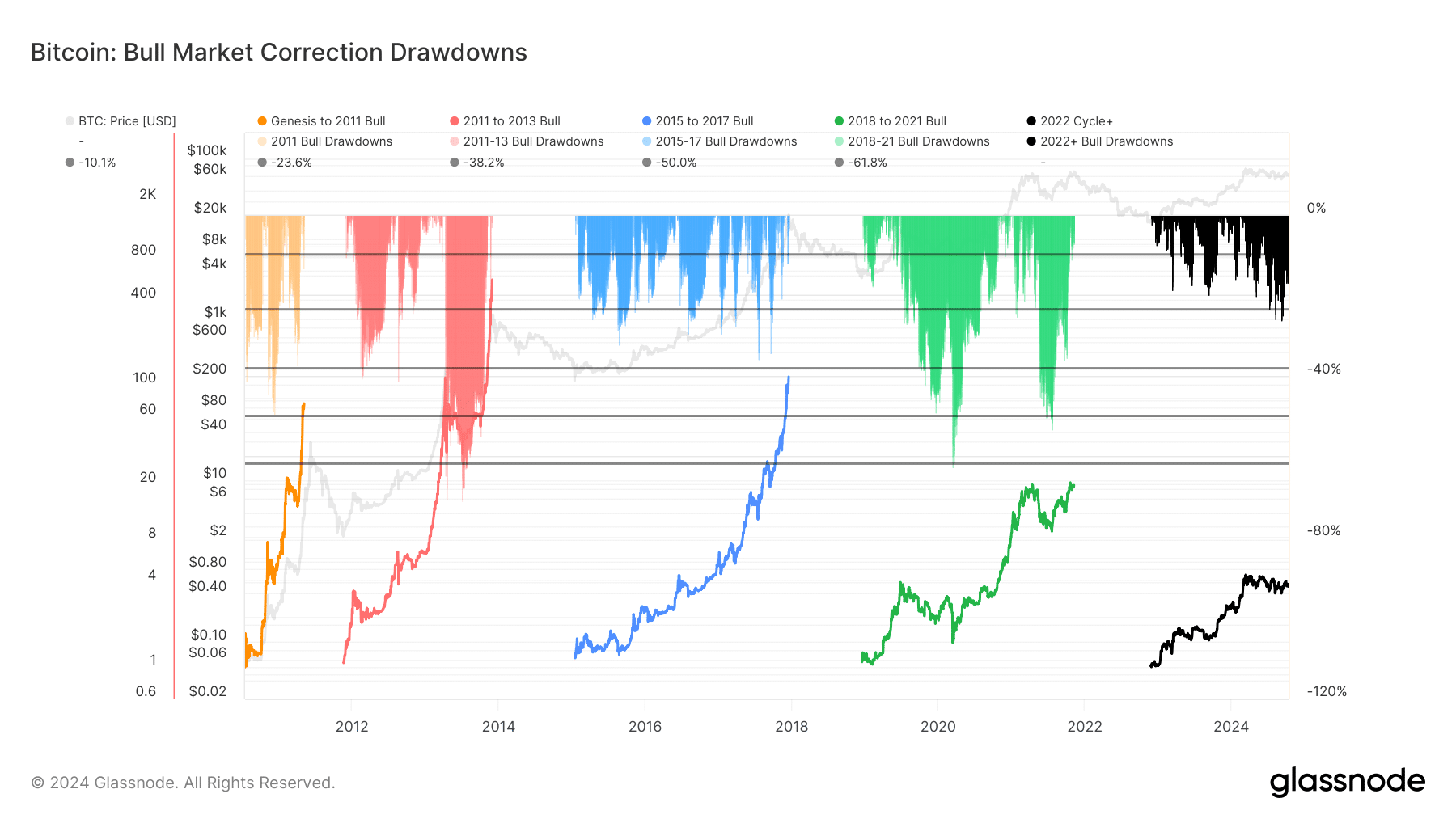

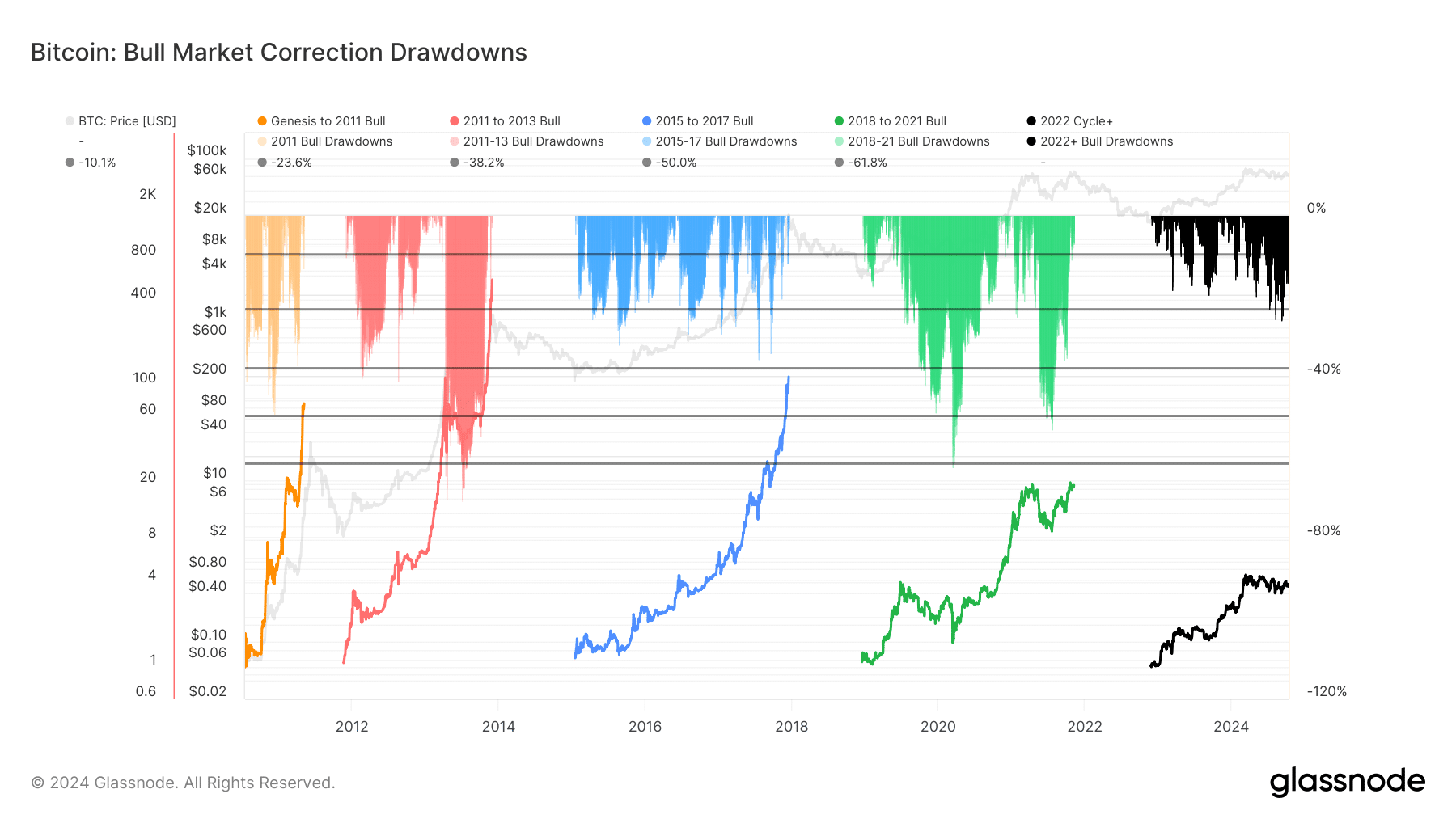

Bitcoin bull market drawdown and long-term holder positive factors

An evaluation of Bitcoin’s bull market drawdown additionally revealed patterns in historic corrections, providing perception into the place the present market development matches inside broader cycles.

Each bull market has seen vital corrections, earlier than hitting new highs. Earlier cycles noticed sharper drawdowns—as much as 94%—whereas latest cycles have been much less extreme.

Supply: Glassnode

The continued correction, represented by the black drawdown within the 2022+ cycle, highlighted that Bitcoin should still be in a correction part after hitting its final all-time excessive (ATH). Nonetheless, this drawdown appeared to be comparatively gentle in comparison with earlier cycles – An indication that there could also be room for additional corrections earlier than Bitcoin can resume its upside.

Whereas there may very well be extra draw back danger, the milder nature of the present drawdown additionally implies that Bitcoin could also be approaching a possible restoration zone.

Traditionally, long-term holders who face up to these corrections have a tendency to learn significantly when the market rebounds within the later levels of the bull cycle.

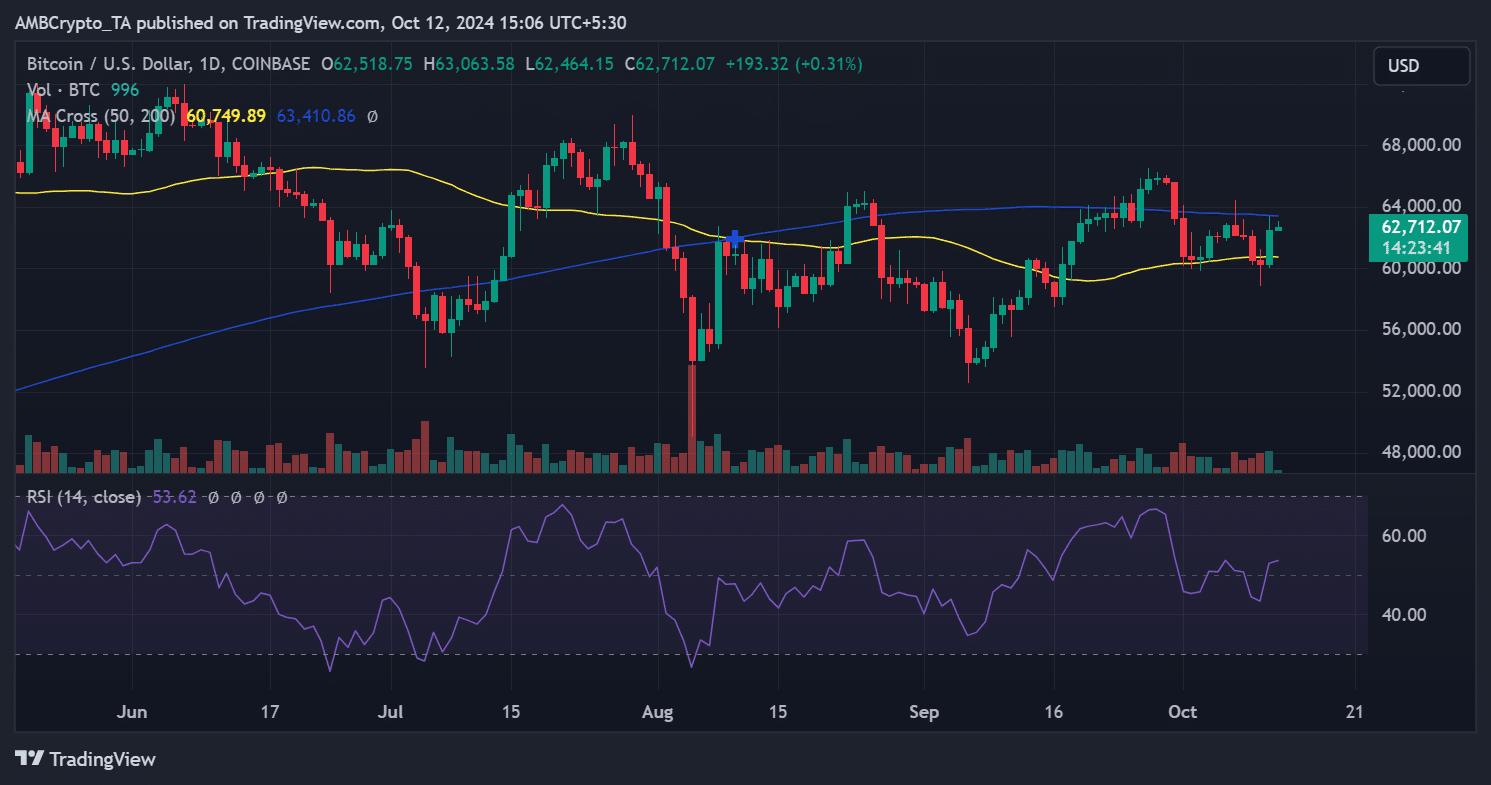

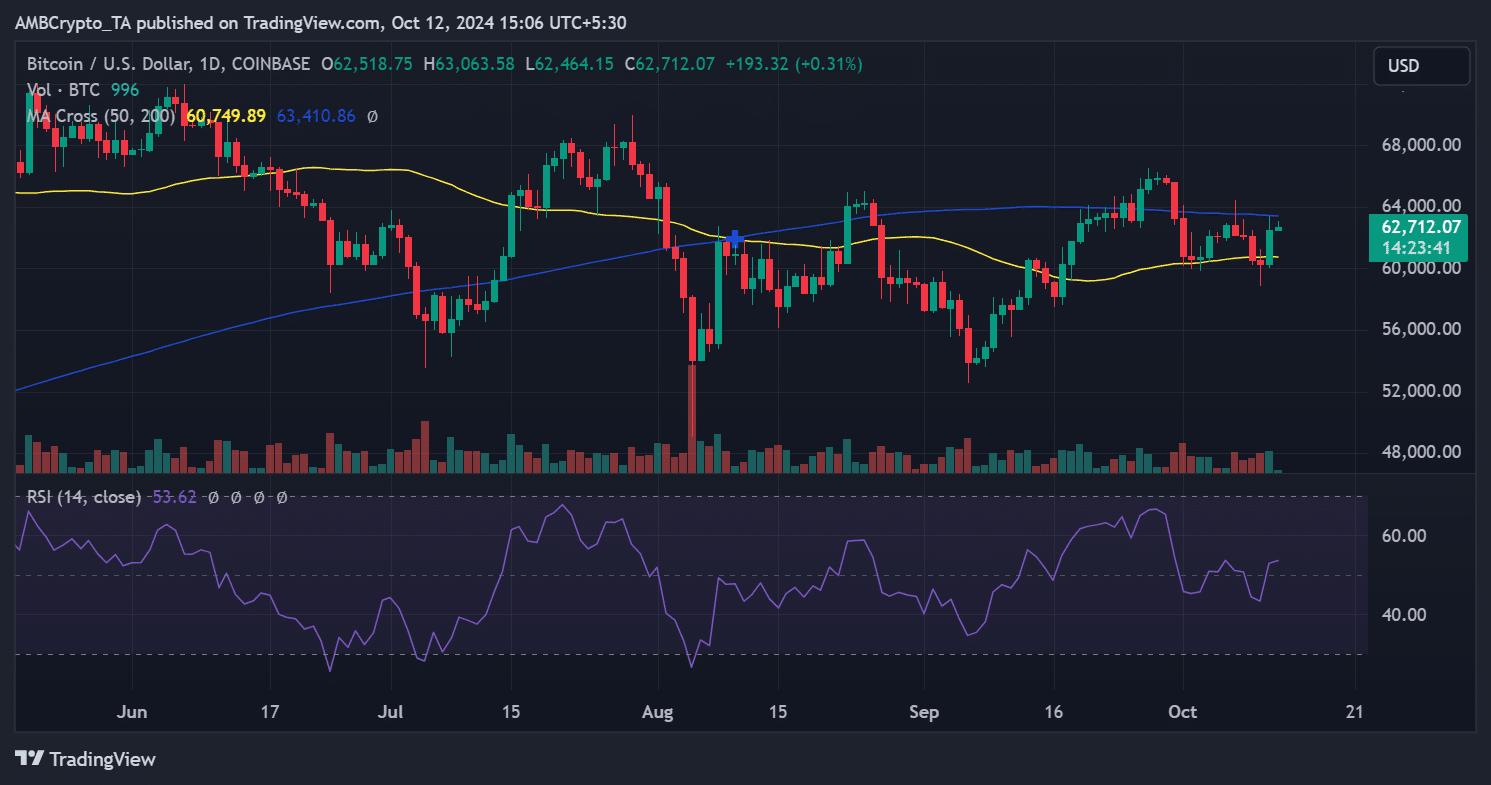

What do the charts say?

Bitcoin’s value charts indicated that whereas short-term holders have been exiting the market, the correction on this bull cycle stays gentle in comparison with earlier ones.

Because of this Bitcoin may both see additional draw back or be close to a market backside.

Supply: TradingView

Over the past buying and selling session, Bitcoin broke above its 50-day transferring common (yellow line), with its value mountaineering by over 3%, rising from $60,279 to $62,518.

This may very well be an indication that the cryptocurrency is on the brink of construct on its optimistic momentum and climb greater on the value charts.

– Learn Bitcoin (BTC) Value Prediction 2024-25

Bitcoin’s market is shifting, with short-term holders exiting whereas long-term holders remaining affected person. With the value now stabilizing round key ranges, the potential for a restoration is rising.

If Bitcoin can break above its important resistance ranges, it may sign the beginning of the following bullish part.