- There have been notable actions from a class of lengthy BTC holders.

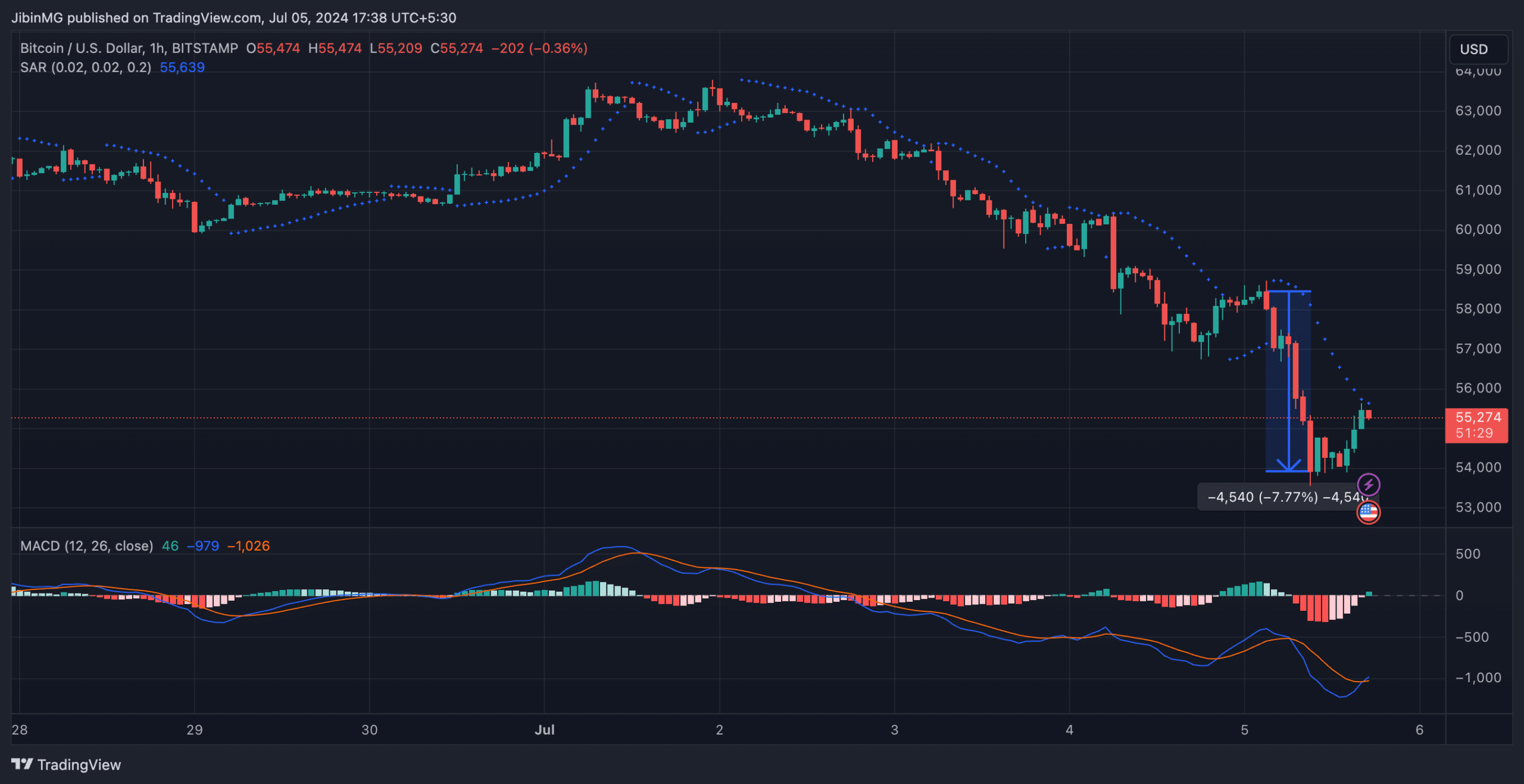

- BTC dropped beneath a vital help line within the final 24 hours.

It’s not been a cheerful week for Bitcoin, with the world’s largest cryptocurrency dropping 9% of its worth during the last 7 days. The truth is, such was the dimensions of depreciation that BTC briefly dropped beneath $54,000 too, earlier than recovering to commerce at $55,275 at press time.

The truth is, over the course of its value fall, Bitcoin [BTC] breached a vital threshold on the charts too, prompting long-term buyers to behave cautiously. This shift is perhaps linked to current exercise involving an change that collapsed greater than ten years in the past.

Lengthy-term BTC holders make strikes

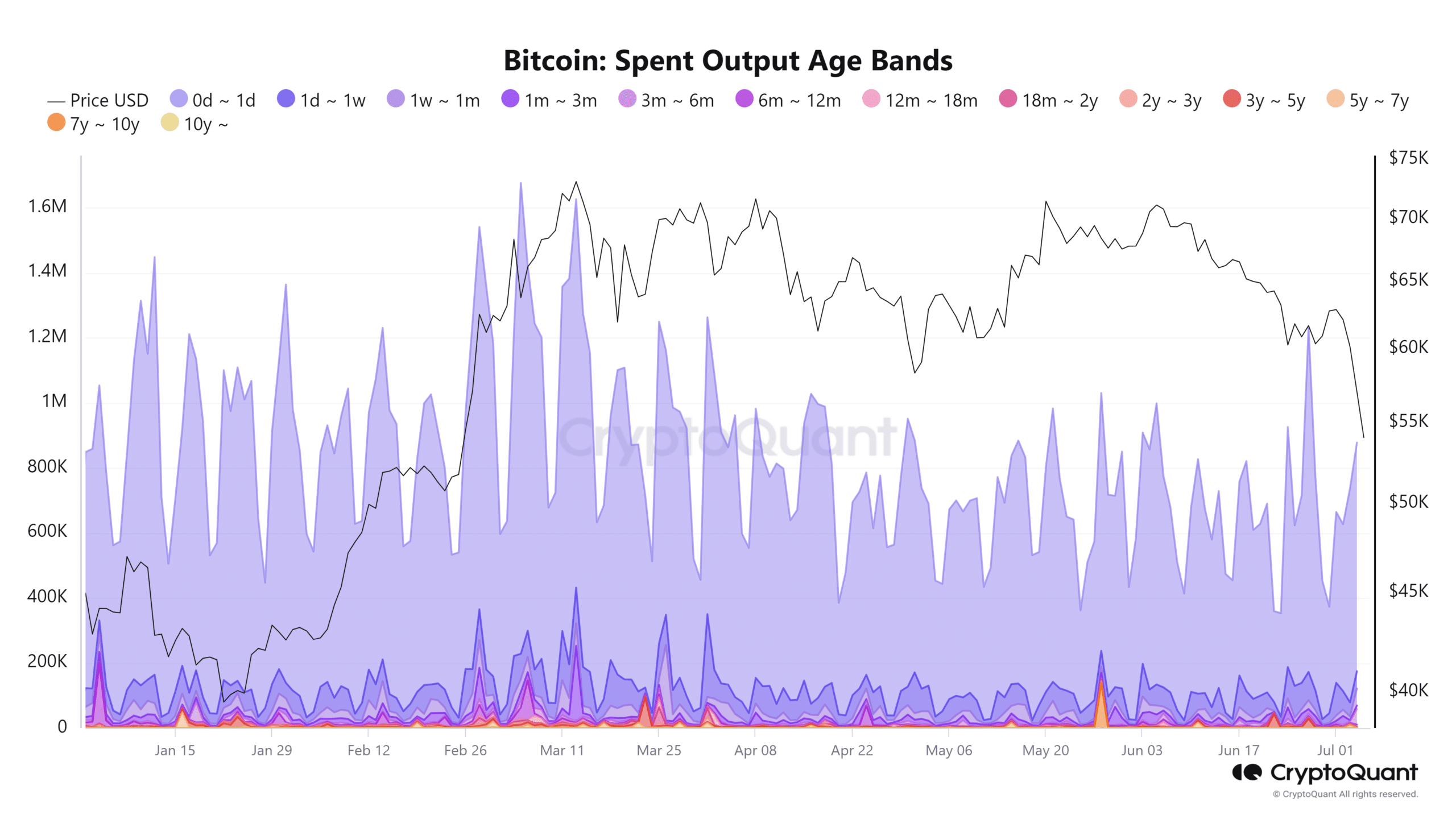

AMBCrypto’s current analysis of Bitcoin’s Spent Output Revenue Ratio (SOPR) for long-term holders and Spent Output Age Bands has revealed notable tendencies. The SOPR for long-term holders exceeded 10.

This indicated that regardless of declining BTC costs, these holders made important income when shifting their BTC to exchanges. The SOPR worth above one, as noticed within the present chart, underscored this development.

Moreover, AMBCrypto’s have a look at the Spent Output Age Bands supplied insights into particular teams of long-term holders actively transferring Bitcoin.

The info indicated that holders inside the 5-7 yr class have been essentially the most energetic, having moved over 10,000 BTCs on the third of July. This marked the very best transaction quantity in months for this group.

Supply: CryptoQuant

The Mt.Gox angle

Along with the affect of Bitcoin’s value decline, current developments surrounding the defunct change Mt. Gox may additionally impression long-term holders’ actions.

Studies point out that Mt. Gox has just lately moved a considerable quantity of Bitcoin to a different pockets, together with some transfers to a scorching pockets.

These actions are a part of the change’s preparations to repay its collectors greater than a decade after its collapse.

This motion of BTC by Mt. Gox, which Arkham reported as involving 47,229 Bitcoins valued at roughly $2.71 billion, is important.

With Mt. Gox set to repay round $8.5 billion value of Bitcoin to its collectors, anticipating these transactions may immediate long-term holders to maneuver their holdings.

The transfer may very well be because of worry of an additional drop within the BTC value because of these large-scale repayments.

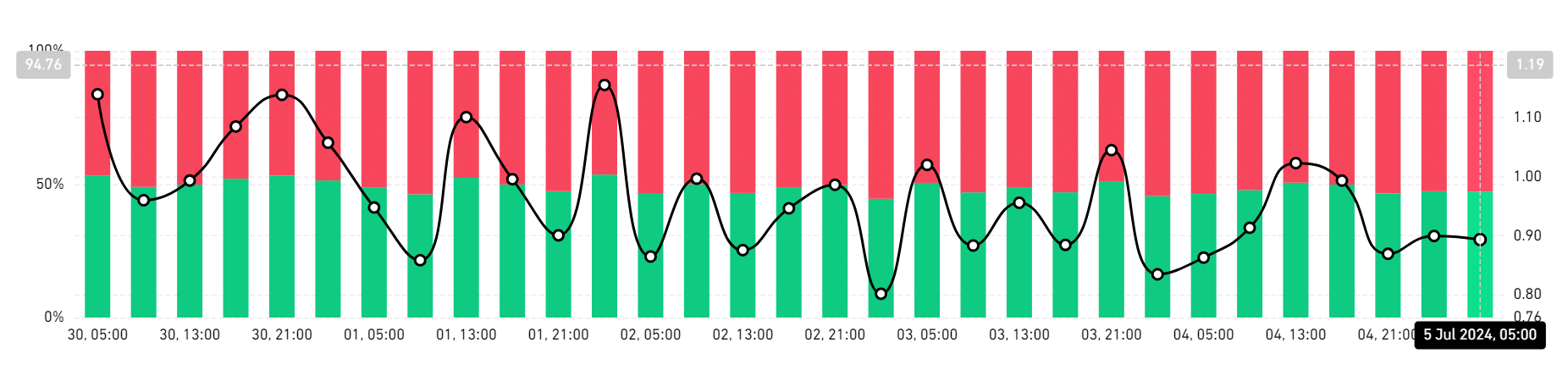

Extra shorts dominate the Bitcoin commerce

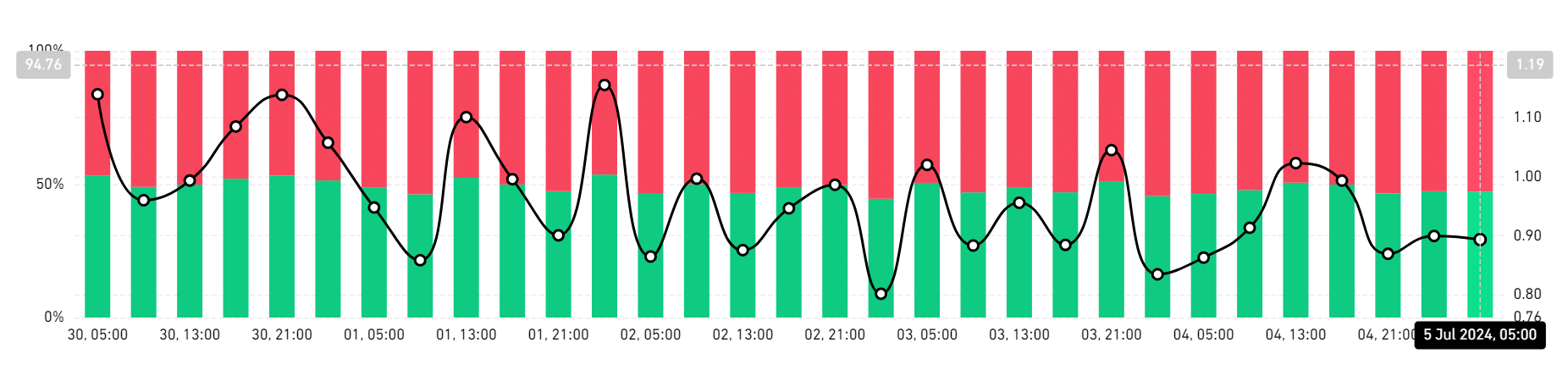

At press time, Bitcoin was buying and selling at roughly $55,300, based mostly on its every day time-frame value development. Additionally, current evaluation appeared to point that quick sellers have dominated the market over the previous 48 hours.

Supply: Coinglass

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In accordance with the BTC Lengthy/Brief Ratio chart from Coinglass, the proportion of quick positions was 52.64%, in comparison with 47.36% for lengthy positions on the 4th of July.

The quick ratio has barely elevated to 52.81%, whereas the lengthy ratio has decreased to 47.19%.