- The STH-SOPR surpassed a worth of 1, suggesting attainable short-term profit-taking.

- An analyst famous that Bitcoin may hit $58,000, however the retracement is likely to be stunning.

Whether or not it’s good or unhealthy information for you, Bitcoin’s [BTC] correction has turn out to be more and more nearer than you assume. Nevertheless, there’s one main problem with the forecast that has put market gamers on reverse sides.

Will the drawdown occur earlier than the having or after?

Curiously, AMBCrypto got here throughout an opinion that BTC would appropriate pre-halving. Across the identical interval, we seen one other analyst saying that Bitcoin would surpass its yearly excessive earlier than the occasion.

One facet takes the preliminary

CryptoOnchain, a pseudonymous writer on CryptoQuant, posted that Bitcoin would possibly plummet to $48,000 within the coming days.

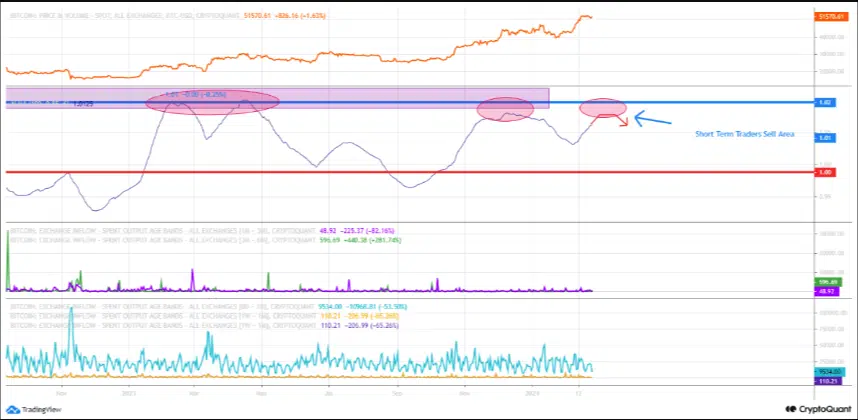

The writer made his conclusion primarily based on the Quick Time period Holder (STH) Spent Output Revenue Ratio (SOPR).

The STH-SOPR assesses the habits of short-term traders by contemplating the output youthful than 155 days. Values of the STH-SOPR over 1 counsel that traders are promoting at a revenue.

However when the worth is under 1, it means traders are cashing out at a loss.

Nevertheless, the chart above confirmed that the worth had risen above 1. It additionally revealed that the SOPR was at some extent the place Bitcoin’s value corrected over the previous few months.

Along with the on-chain evaluation, CryptoQuant additionally examined the technical angle. Regarding this half, the analyst wrote,

“Bitcoin is approaching the promoting space of short-term traders. Analyzing the technical chart additionally confirms this problem. Bitcoin is within the space under the resistance within the technical chart.”

The opposite sticks with historical past

Nevertheless, Michaël van de Poppe didn’t share the same view. In line with him, Bitcoin’s correction would occur, however not earlier than costs climb to $54,000 or $58,000.

In his level, the analyst additionally talked about that the decline might be more durable, noting that BTC may drop as little as 40,000 after the halving.

Traditionally, Bitcoin’s value has elevated earlier than the halving. After the occasion, the coin shreds a major a part of its worth earlier than heading for a brand new excessive.

AMBCrypto went forward to research the value motion earlier than the final two halvings.

The second halving occurred on the ninth of July 2016. From our remark, BTC climbed to $617 earlier than the occasion. Afterward, the value plunged.

An analogous prevalence occurred in the course of the third halving, when Bitcoin’s value jumped to $9,619. Weeks after the occasion, the value considerably decreased.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

AMBCrypto believes that Bitcoin would possibly go both means this time, relying on the place capital rotates. If market individuals determined to drive liquidity into BTC, then the value would possibly rise towards $54,000.

Nevertheless, rotation into altcoins may see BTC’s worth shrink. However on the identical time, the presence of institutional cash, which was not current within the final two halvings, may change issues.