- BTC demand from retail declined to a three-year low regardless of the current rally.

- Bearish sentiment on the spinoff market may derail the current restoration.

Bitcoin [BTC] has but to draw retail demand, regardless of doubling from final yr to a document excessive of $73K in March 2024.

The truth is, in keeping with CryptoQuant founder Ki Younger Ju, BTC demand from the retail class has hit a three-year low.

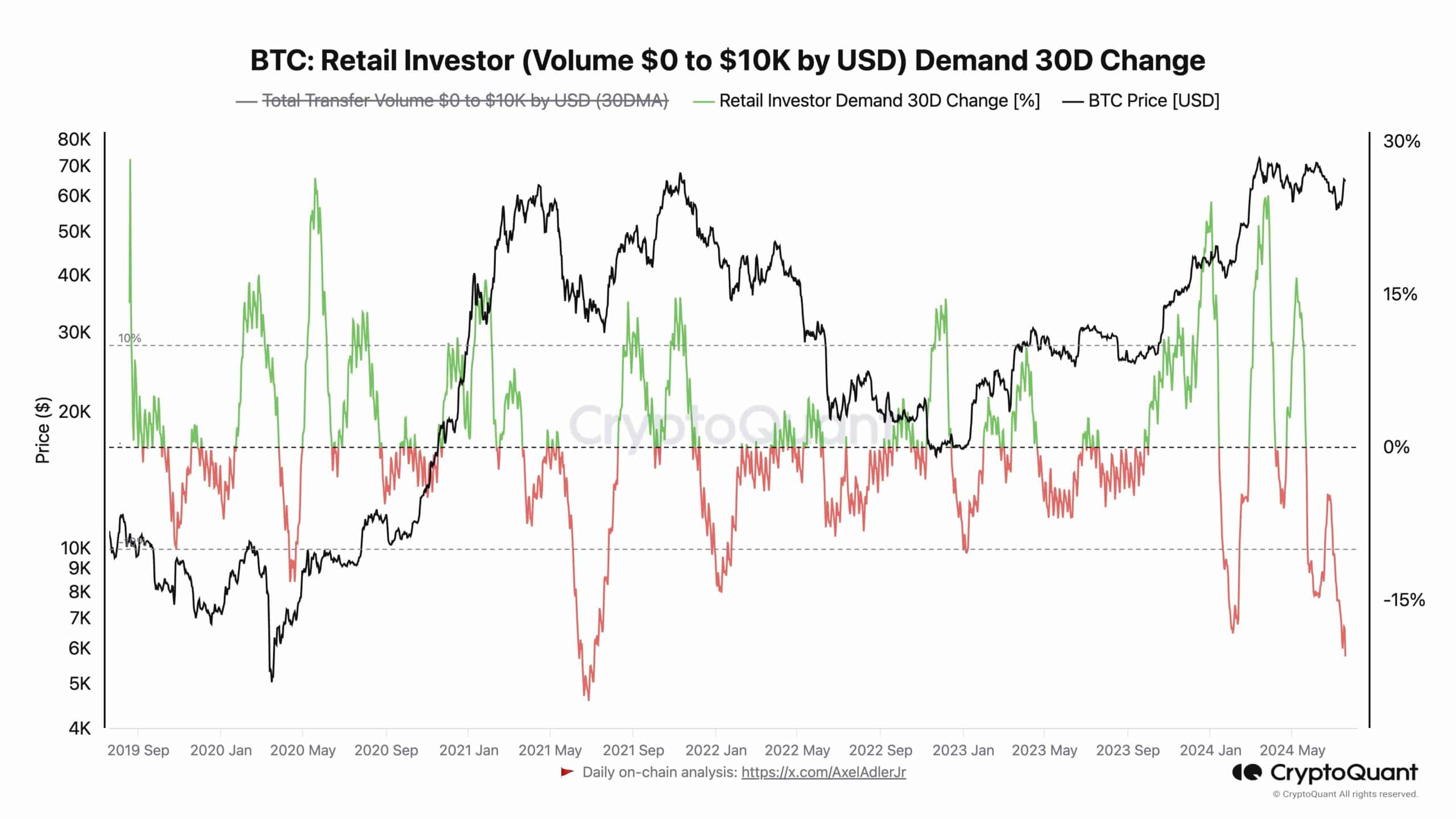

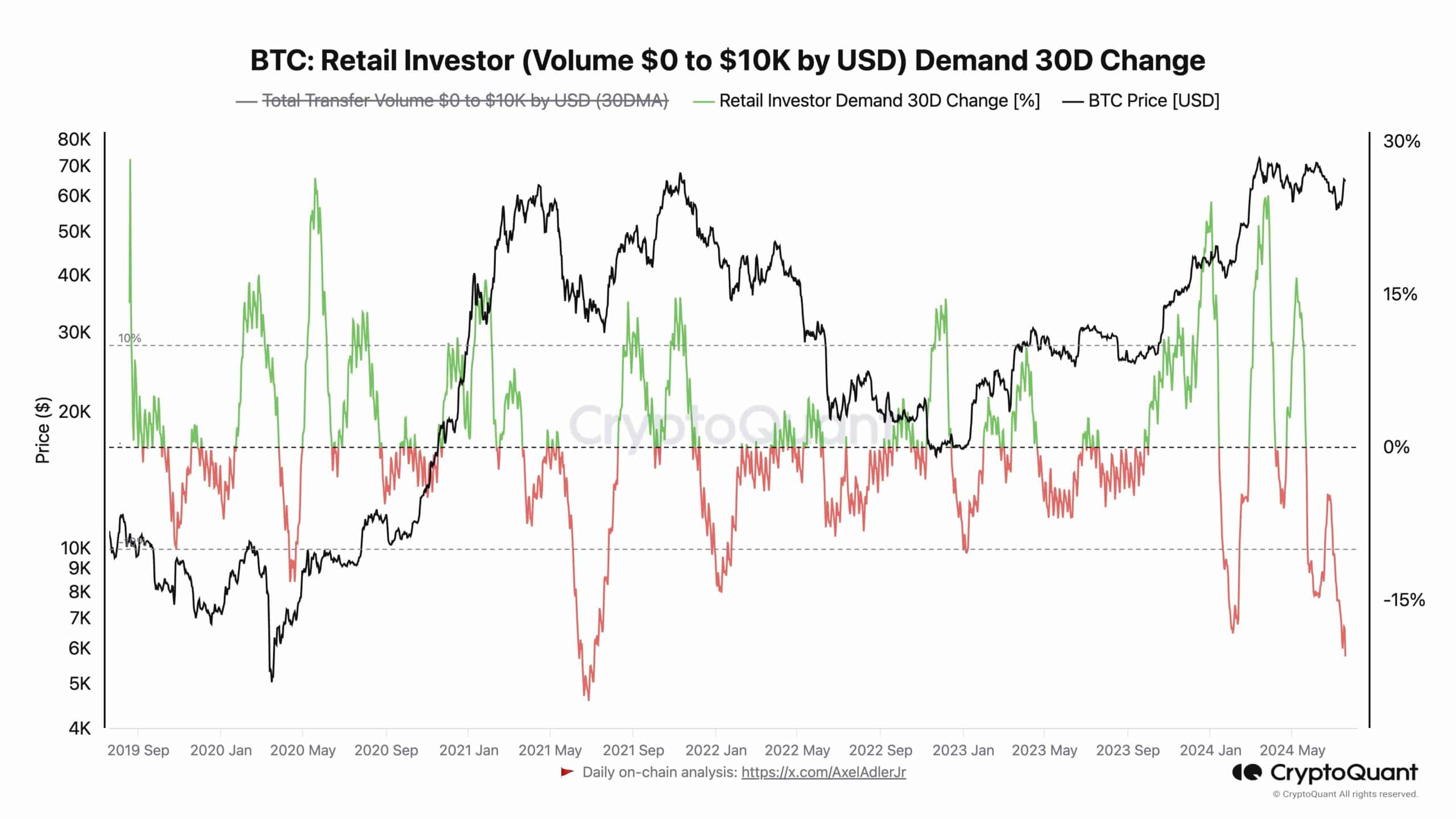

Supply: CryptoQuant

The metric tracks modifications in BTC’s switch quantity for lower than $10K over a 30-day interval. It hit a 2024 low of about -20%, final seen in 2021.

Some market observers imagine this meant that the retail class was sidelined and will delay the anticipated parabolic BTC run.

Based mostly on the chart, the 2021 cycle excessive of $69K coincided with an uptick in BTC Retail Investor above 15%.

An identical sample was printed throughout the early 2024 rally after BTC ETFs hit the market. Therefore, the dearth of retail curiosity was a painful concern for Bitcoin bulls anticipating an explosive rally.

May the anticipated late 2024 international easing and surge in liquidity drive again retail buyers?

Maybe, that may very well be a catalyst for retail, in keeping with one market analyst, Coin Dealer Nik.

Nik claimed that ETF drove the primary half of 2024, however the second half shall be induced by international liquidity.

‘The second half shall be pushed by international liquidity growth. ‘Mass retail’ arrives when $BTC breaks $100k’

Supply: X

Following a disinflationary development up to now two months, over 90% of rate of interest merchants anticipated a September charge reduce.

If the Fed begins slicing rates of interest, this might gasoline danger belongings, together with Bitcoin. Already, some central banks have initiated charge cuts, setting the stage for a world liquidity injection.

Given the above macro outlook, the market foresees a possible BTC upswing to $80K —$100K. Latest data from the prediction market projected odds of above 20% that BTC will hit $100K by the tip of 2024.

The chances of crossing the $80K stage have been increased at 57%, additional reinforcing BTC’s bullish outlook.

The truth is, Quinn Thompson of crypto hedge fund Lekker Capital projected a daring $100K per BTC by November 2024.

All of the above bullish targets are pegged on Trump profitable the US presidential elections.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

In the meantime, BTC was up 11% on a weekly adjusted foundation however traded under $64K as of press time.

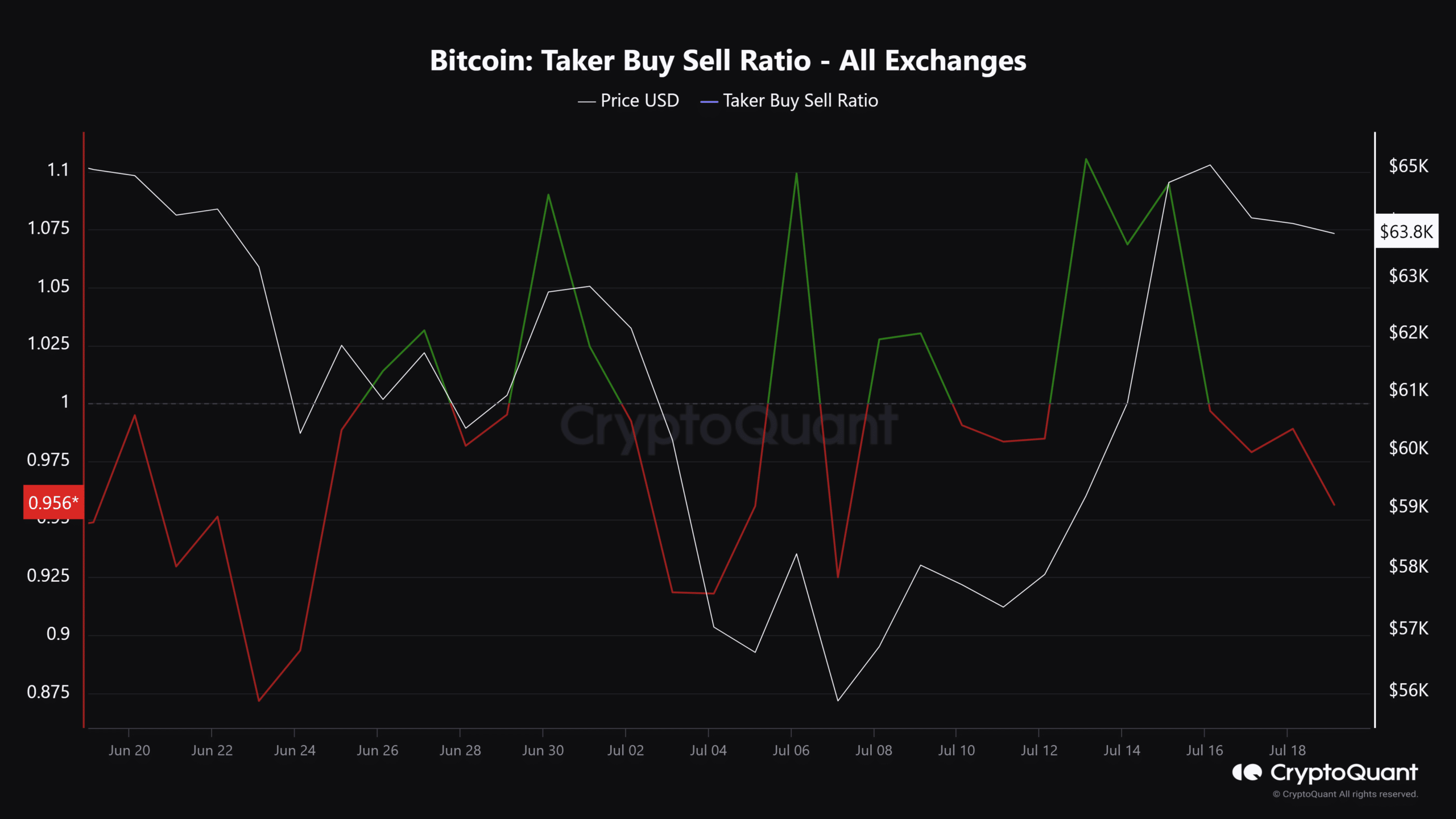

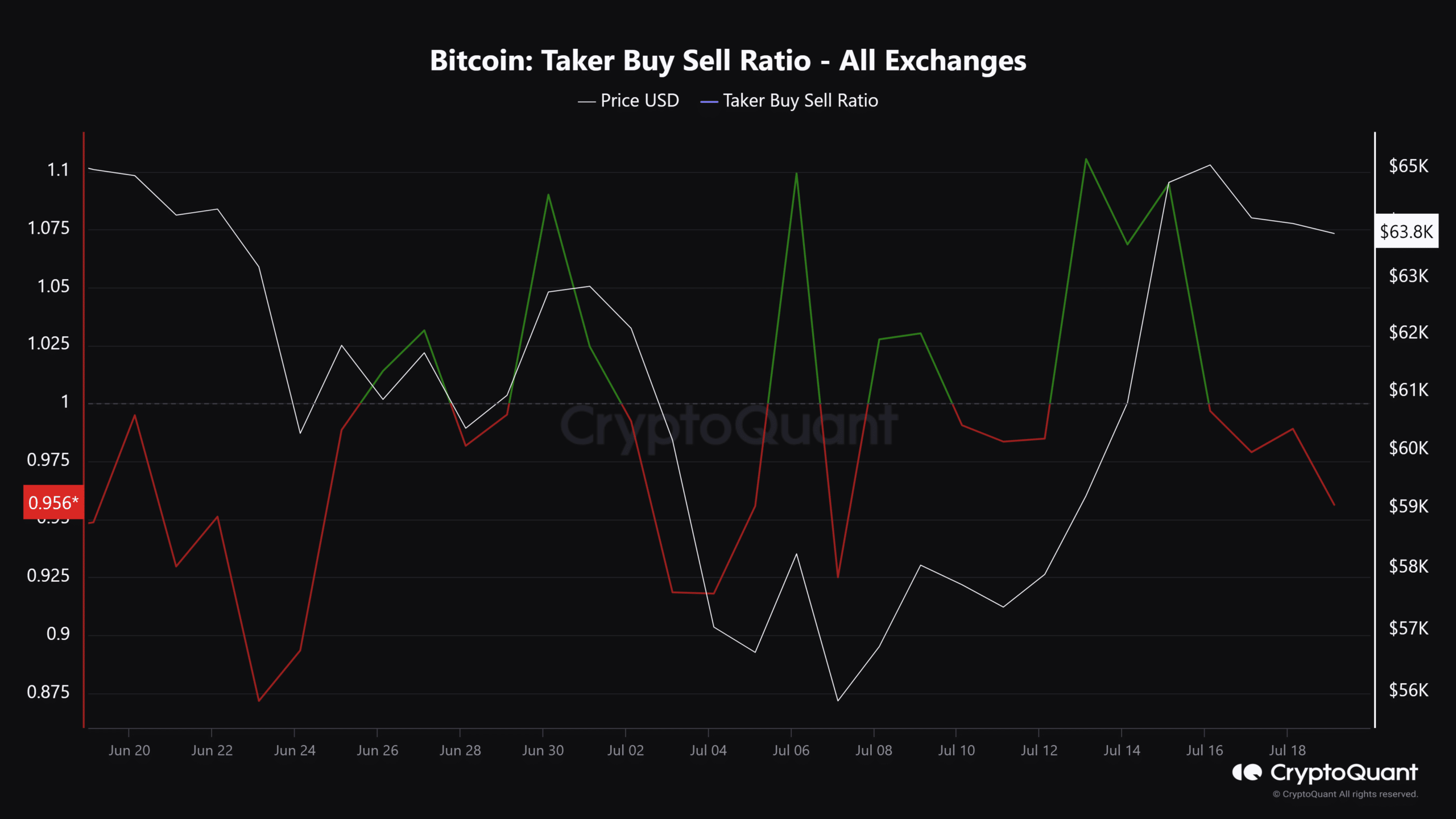

The bearish sentiment on the derivatives market, as proven by the unfavorable Taker Purchase Promote Ratio, indicated that the restoration above $60K may stall additional into the weekend.

Supply: CryptoQuant