- Bitcoin may wait until Q3 or This fall earlier than the bull run continues

- BTC’s value might hit $101,500 earlier than the top of 2024

Bitcoin’s [BTC] journey to the next worth on the charts may take longer than initially anticipated. This appeared to be the case after AMBCrypto analyzed a number of essential on-chain metrics.

Actually, at press time, it was noticed that the variety of BTC was falling. This decline may very well be an indication that almost all Bitcoin holders are inclined in the direction of accumulating extra of the coin, as a substitute of promoting.

Has the large cash chase taken a break?

Right here, it’s value declaring that the autumn in reserves proved that Bitcoin is in a bull market. Nevertheless, the metric additionally advised that Bitcoin could also be 50% away from its potential market prime this cycle.

On the time of writing, BTC was valued at $67,937, with the crypto having registered a notable decline from its ATH in March. The falling reserves and value mixture point out that Bitcoin could be looking for liquidity.

Supply: CryptoQuant

In buying and selling, liquidity looking occurs when market members search low liquidity as costs transfer inside a brief vary. AMBCrypto’s evaluation of the market confirmed that Bitcoin has been transferring between $64,000 and $68,000.

This value inefficiency is an indication that BTC may not make a major upward transfer until the top of the second quarter (Q2). As such, the bull run may pause and begin its subsequent leg in Q3, till the top of This fall this yr.

XBTManager, an analyst on CryptoQuant, additionally shared the same thought. In his evaluation, he explained,

“Bitcoin is gathering power for the subsequent rise. When it gathers sufficient power, a pointy rise appears to be ready for us. It appears probably that rises like these in Q3-This fall will proceed.”

This opinion additionally aligned with the crypto worry and greed index. This index exhibits if the cryptocurrency is pretty priced, overpriced, or undervalued utilizing market sentiment.

Bitcoin’s value can double

At press time, the metric had a studying of 60 – An indication that greed available in the market was not excessive. Due to this fact, Bitcoin appeared pretty priced on the charts. Nevertheless, this additionally signifies that one other vital hike could be attainable within the mid to long-term.

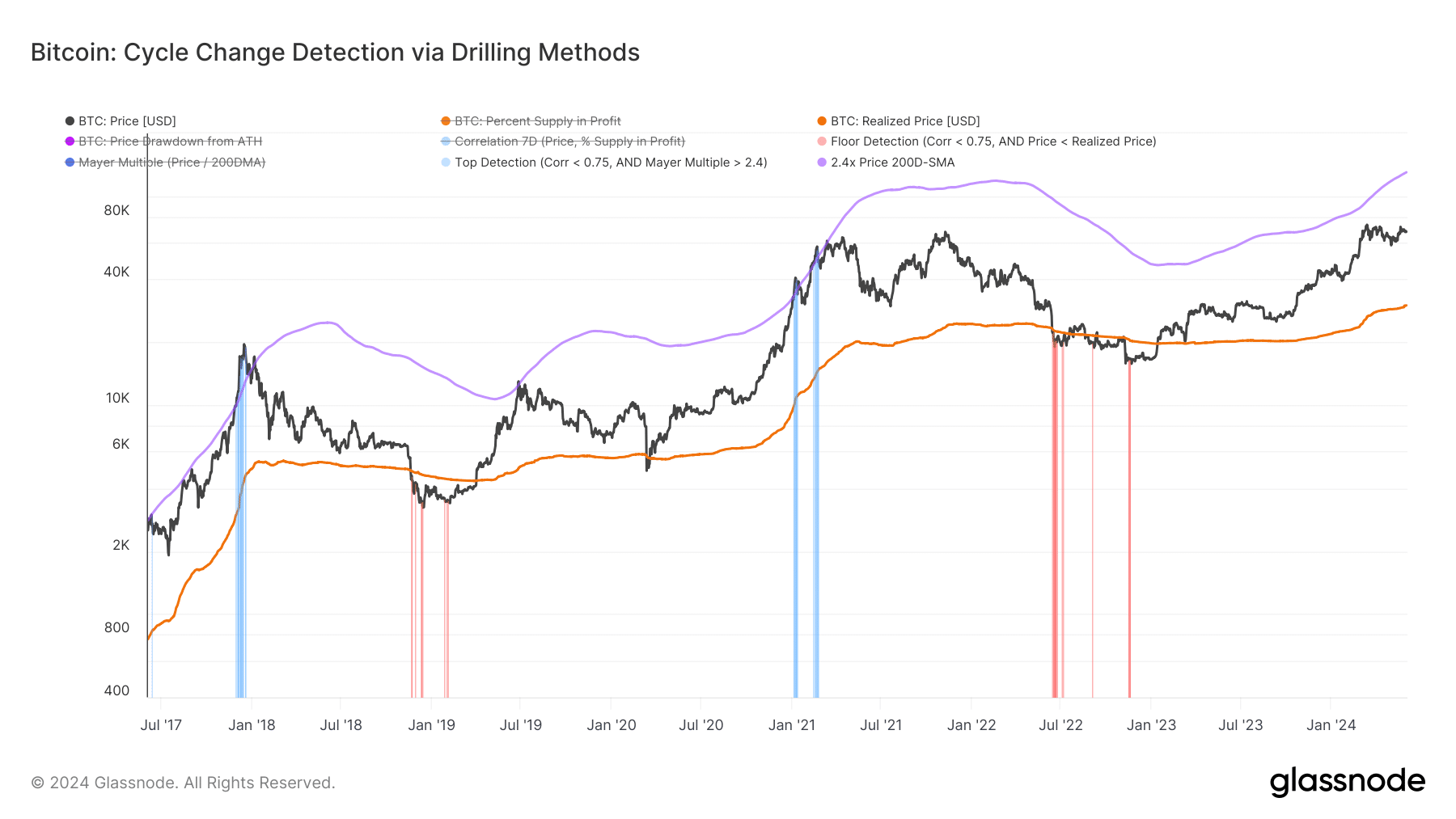

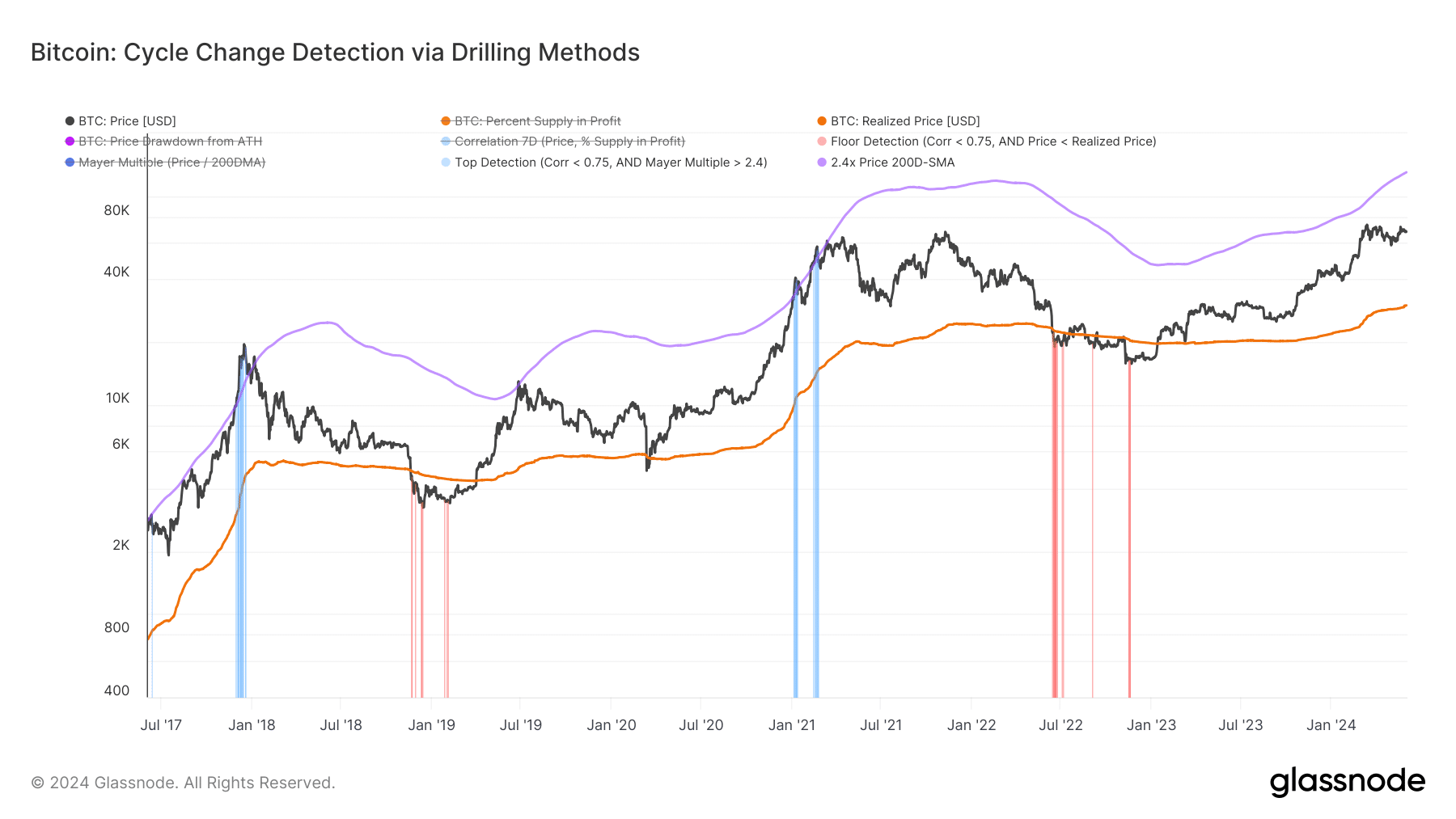

To buttress this bullish value prediction, AMBCrypto checked the Cycle Change Detector. This metric exhibits if Bitcoin has transitioned right into a bull or bear part.

This metric additionally makes use of the correlation between the value and provide in revenue. Trying on the chart beneath, a lightweight blue line would seem if Bitcoin reaches its peak value.

Supply: Glaassnode

Nevertheless, if the road is gentle purple, it implies that the value is near the underside. At press time, Bitcoin had moved previous the underside.

Is your portfolio inexperienced? Test the Bitcoin Revenue Calculator

Nevertheless, there was no blue gentle (prime detector) in sight but. Going by the indicators addressed above, the value of BTC may hit $101,500 between Q3 and This fall 2024.