- Low UTXO Age Bands and dominant brief liquidations recommend that the value can hike

- Outdated arms have reverted to accumulating too

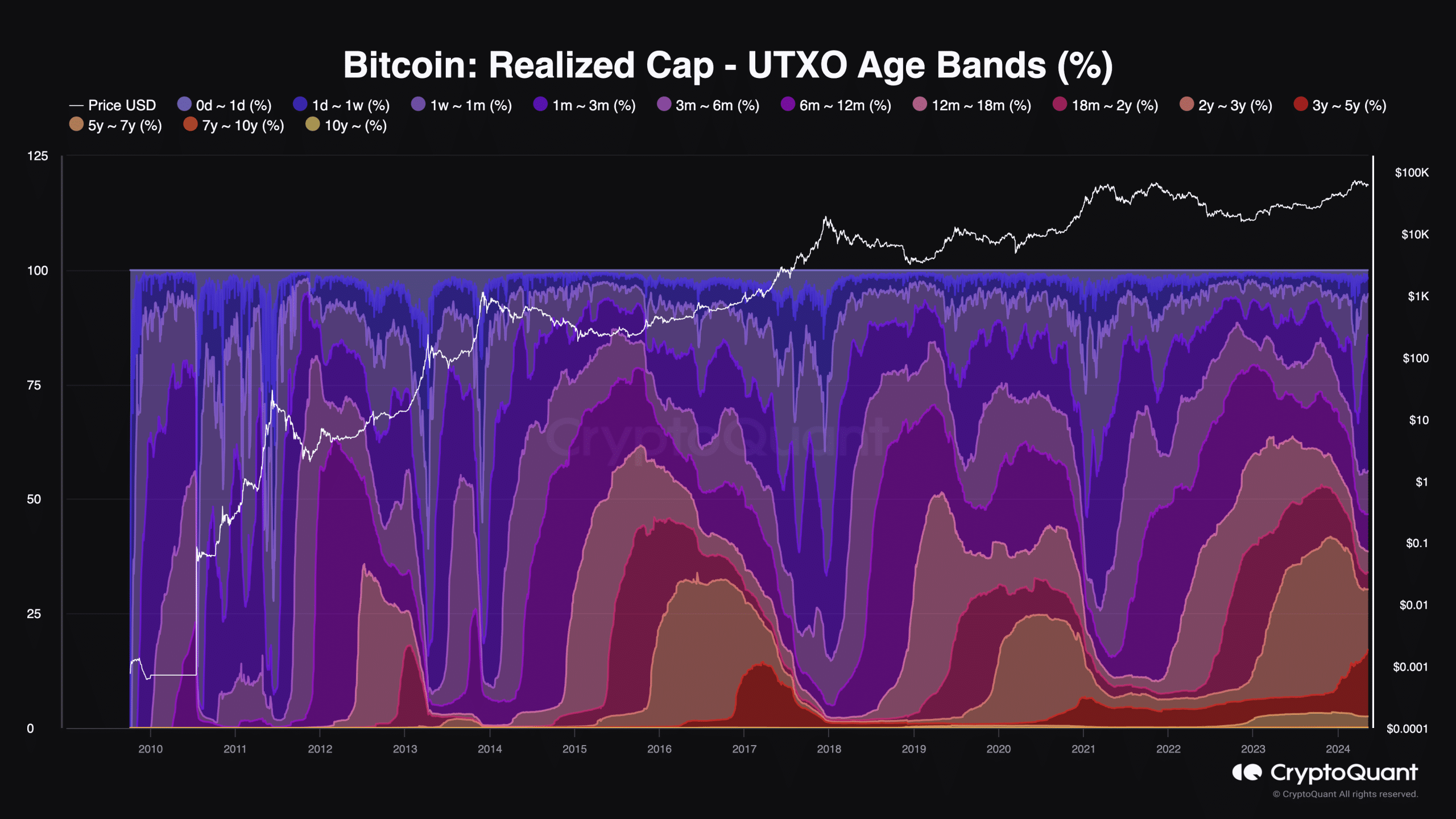

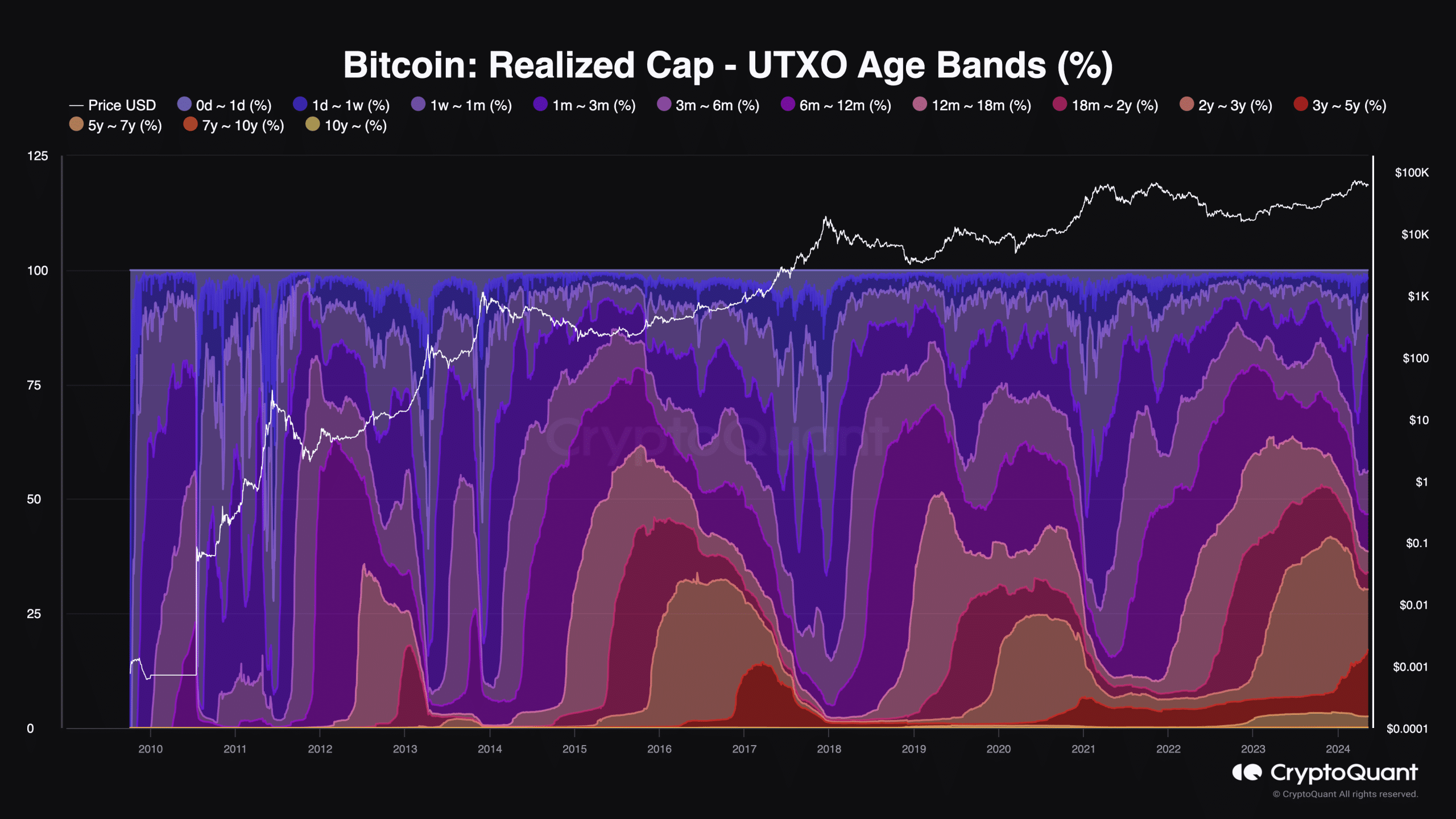

Bitcoin [BTC] has not hit the highest of this cycle, based on indicators from the Realized Cap. For context, the Realized Cap tracks the worth of every UTXO based mostly on the value at which it was final moved, in comparison with the present worth of the coin.

UTXO stands for Unspent Transaction Output and represents the quantity of Bitcoin left after a transaction. AMBCrypto’s evaluation of CryptoQuant’s information revealed that the UTXO Age Bands, at press time, weren’t near the zenith that was hit through the 2021 bull market.

This metric measures energetic particular person purchases available in the market. When this metric is extraordinarily excessive, it implies that some huge cash is flowing into Bitcoin. It additionally signifies that the top of the bull cycle may very well be shut.

Supply: CryptoQuant

Is one other 80% hike potential?

Nevertheless, that has not been the case as the share stays a lot decrease than its earlier peak. Owing to this information, one can assume that BTC’s value will climb previous its $73,750-high from March.

Crypto Dan, an analyst and writer on CryptoQuant, additionally shared a similar view. In line with him, Bitcoin has solely achieved 20% of this bull cycle. He famous,

“The present short-term cash influx scenario is considerably smaller than the height of the previous bull cycle.”

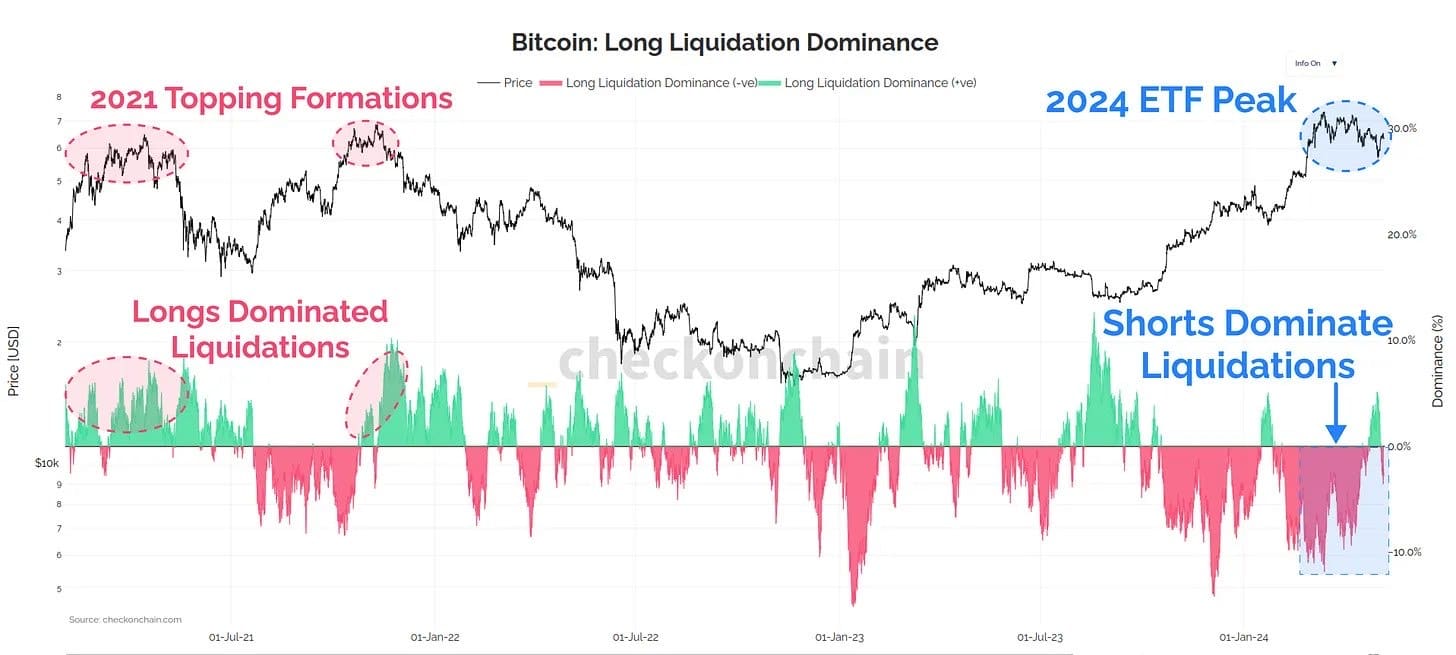

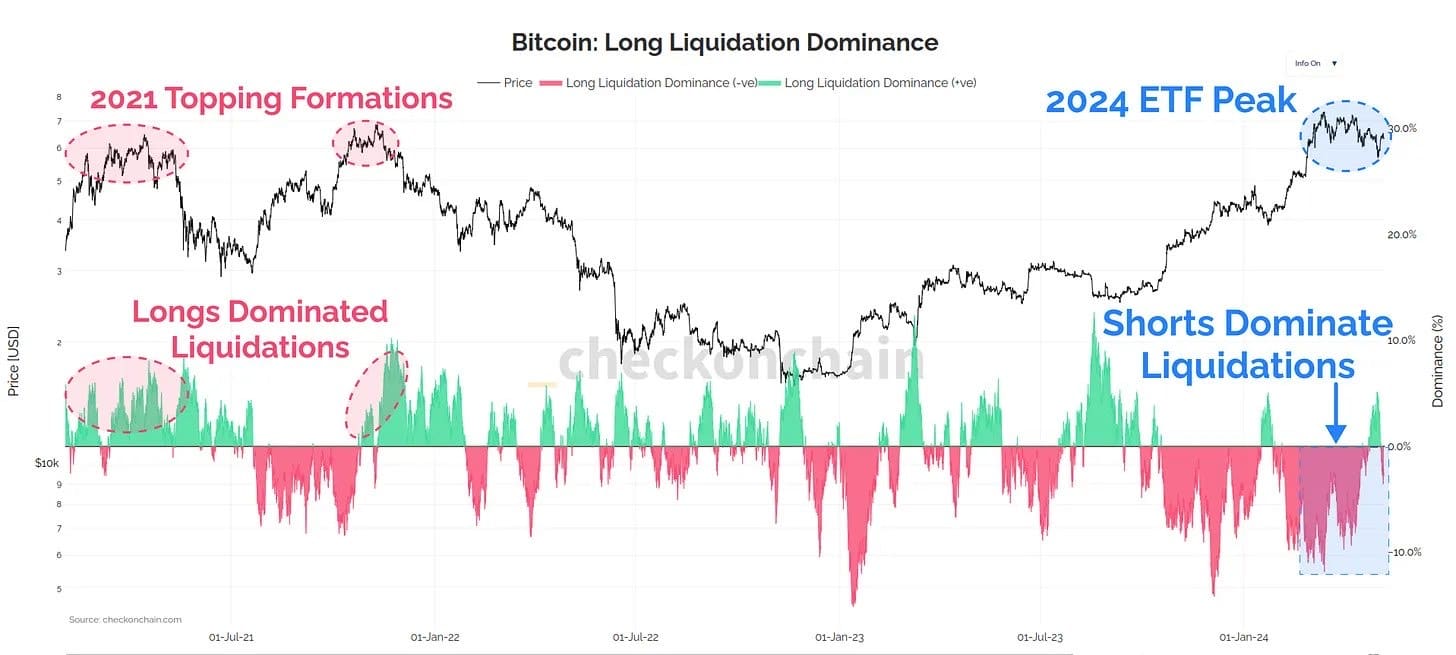

Nevertheless, that was not the one signal that BTC may rise greater this cycle. Checkmate, a pseudonymous on-chain analyst, additionally weighed in on the matter.

Nevertheless, this time, the analyst centered on what’s occurring within the derivatives market. From the info the analyst shared, the 2021 peak was marred by a surge in lengthy liquidations. In his publication, he mentioned,

“Final time, this was truly a sign the market had topped out.”

For the uninitiated, liquidations happen when a dealer’s place is closed attributable to an inadequate margin steadiness to maintain it open. It additionally occurs if a dealer makes use of excessive leverage and the goal hits cease loss.

Supply: Coinglass

HODLing is the way in which to go

Excessive lengthy liquidations indicate that almost all positions worn out are these betting on a value hike. Nevertheless, this 12 months, most liquidations have been brief, reinforcing Bitcoin’s potential to hit a brand new all-time excessive.

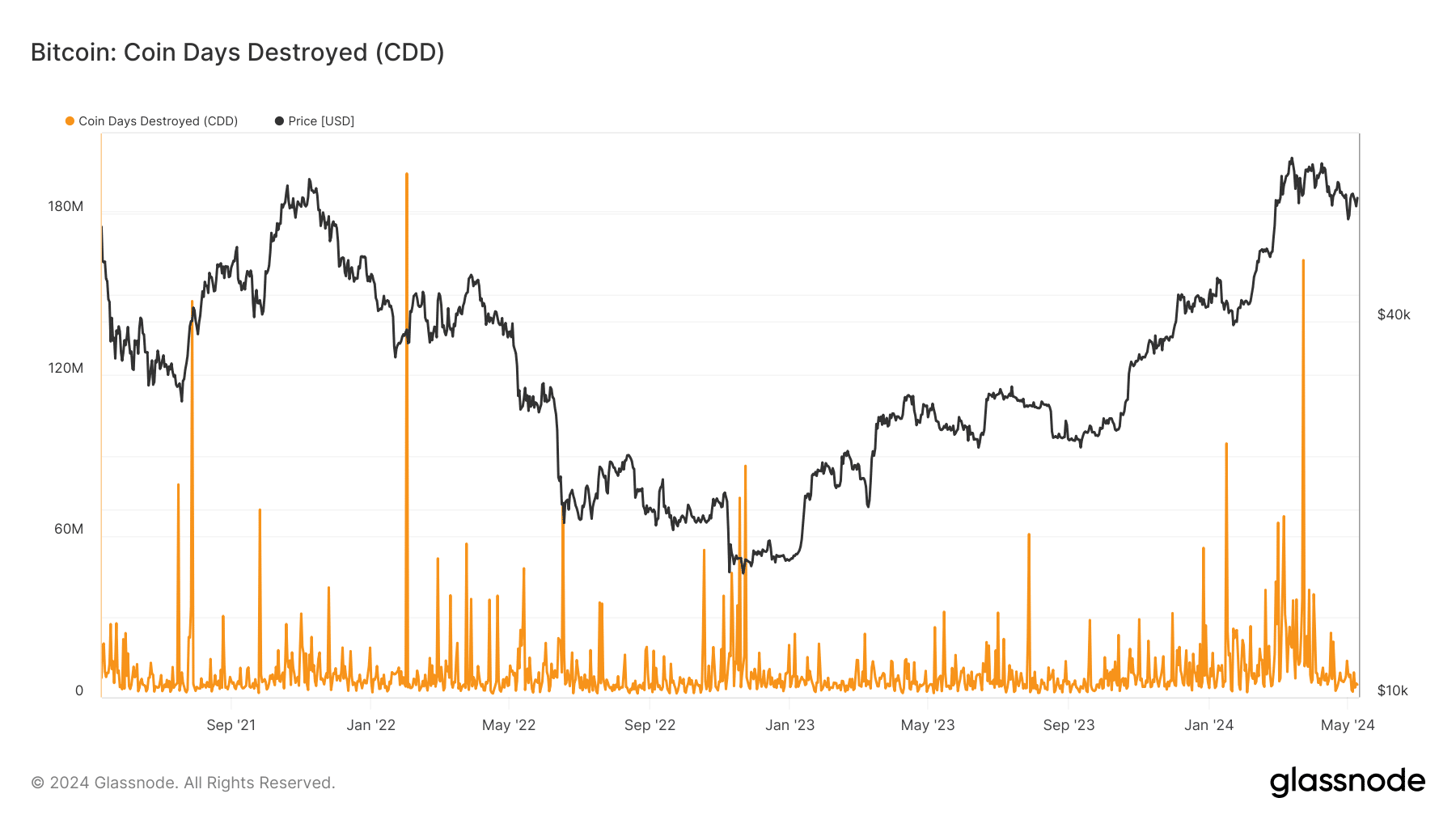

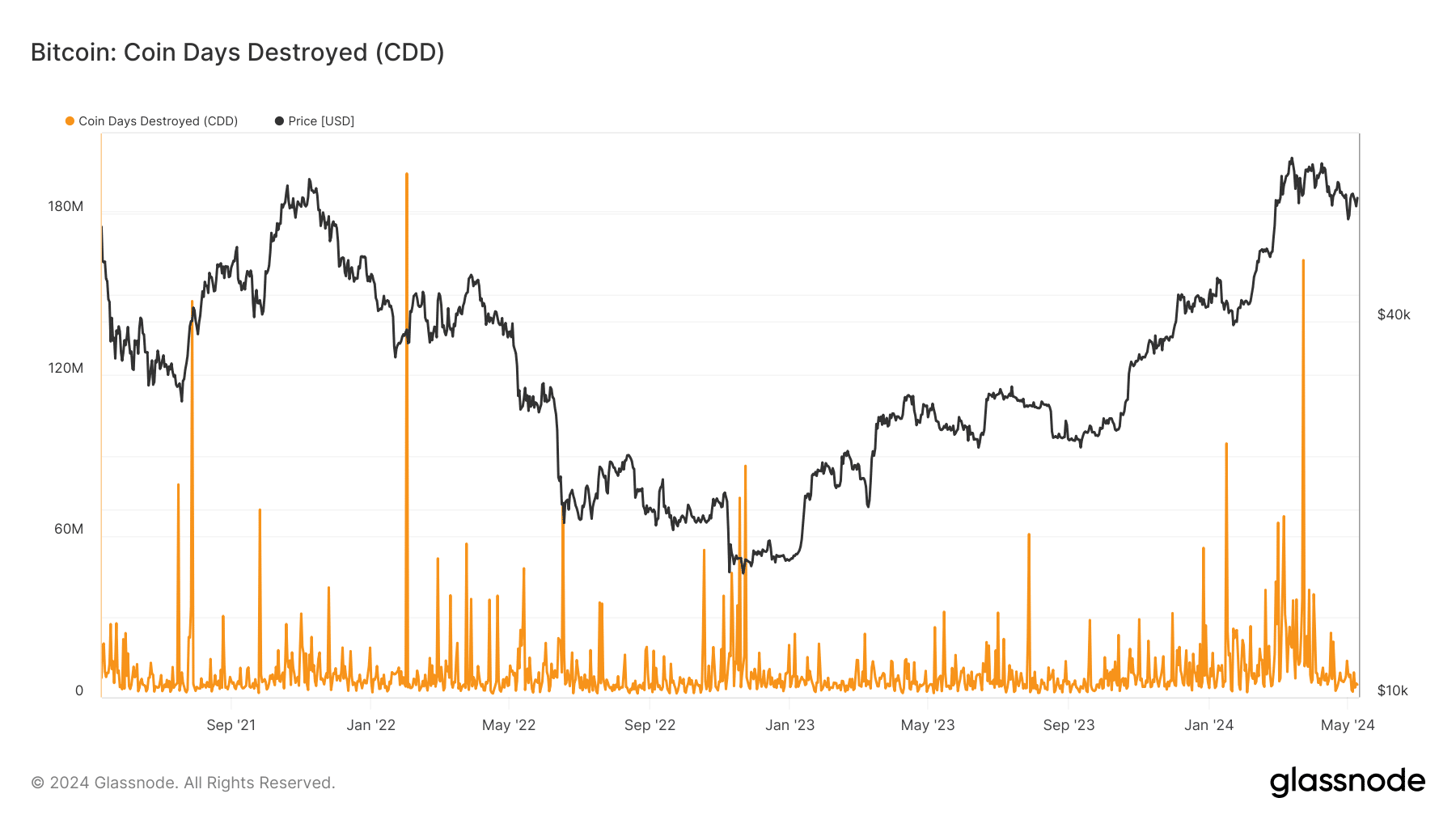

Moreover, AMBCrypto seemed on the Coin Days Destroyed (CDD). This metric exhibits if HODLers are actively spending their cash or accumulating extra.

A excessive CDD signifies a surge in spent cash and will result in a value lower. Based mostly on our evaluation, we discovered {that a} hike within the metric occurred on 24 March, following which Bitcoin’s value tumbled.

Supply: Glassnode

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

On the time of writing, the CDD had returned to the baseline it occupied in 202o, earlier than the explosive run of 2021. Since HODLing continues to be the popular choice of buyers, Bitcoin may nonetheless produce a monster rally earlier than this cycle hits its peak.