- Specialists like Tom Lee consider Bitcoin will climb larger

- Metrics instructed the market hasn’t bottomed but in mild of the persistent sell-side strain

The previous couple of weeks have been very crucial for Bitcoin [BTC], with its worth dropping beneath the crucial $60,000-level too. Nonetheless, following vital corrections, the coin recovered on the charts to commerce at $63,167 on the time of writing.

BTC’s 6% hike over a interval of simply 24 hours factors to a possible reversal within the cryptocurrency’s market trajectory. Evidently, this has renewed a way of optimism amongst traders and observers alike.

Is there a shopping for alternative amidst volatility?

As risky as Bitcoin could also be proper now, nevertheless, many execs consider this is a chance too. Specifically, some see this as a very good shopping for alternative. Foremost amongst them is Tom Lee, with Fundstrat’s co-founder claiming throughout an interview,

“I feel that we’re sort of being fooled by the April turmoil and I feel that’s why it’s a shopping for alternative for each Bitcoin and shares now.”

He added,

“It doesn’t imply it’s going to show round immediately however, I don’t assume it is a high.”

In keeping with the exec, the latest decline was a wholesome correction, one probably pushed by profit-taking.

That’s not all, nevertheless, with one other analyst – @el_crypto_prof – taking to X (Previously Twitter) to attract a parallel with a historic market development.

“Historical past doesn’t repeat itself, but it surely usually rhymes. $BTC has touched a development line that has performed an necessary position because the starting of 2023.

Shedding mild on Bitcoin’s future outlook he added,

“The factor can be despatched larger. It’s solely a matter of time, imo.”

Supply: El_crypto_prof/Twitter

Crypto-analyst TechDev chipped in too, with the analyst stating,

“The impulsive construction of the final 1.5 years says 90-100K is subsequent. $BTC”

Supply: TechDev/Twitter

Merely put, the overall consensus amongst most analysts is that these market circumstances are usually not the top of the bullish cycle. Relatively, they’re merely a brief setback.

What are the metrics hinting at?

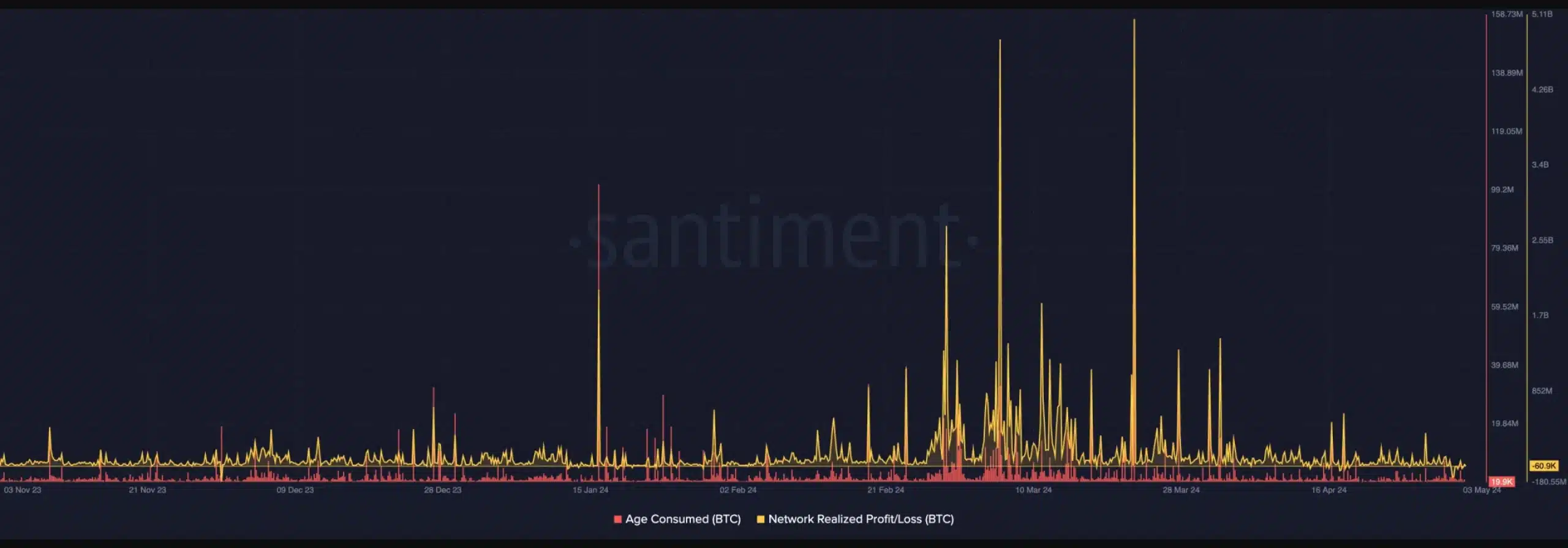

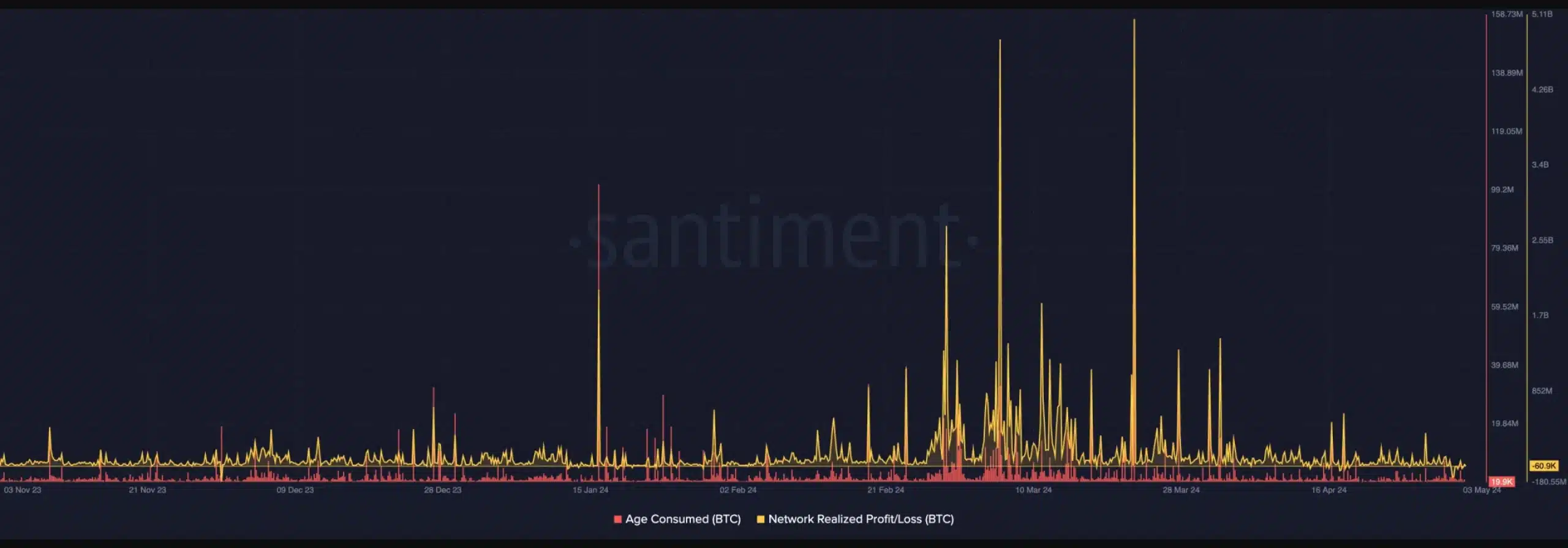

AMBCrypto’s evaluation of BTC’s Age Consumed information echoed its earlier findings. Since 3 April, there was minimal exercise, suggesting no indication of a worth backside.

Moreover, Bitcoin’s Community Realized Revenue/Loss (NPL) information, which measures the distinction between the final moved worth and the present market worth, additionally failed to point out indicators of a worth backside.

Supply: Santiment

Ergo, each metrics contradict the emotions shared by Lee and others, suggesting that the market could not have reached its backside but.

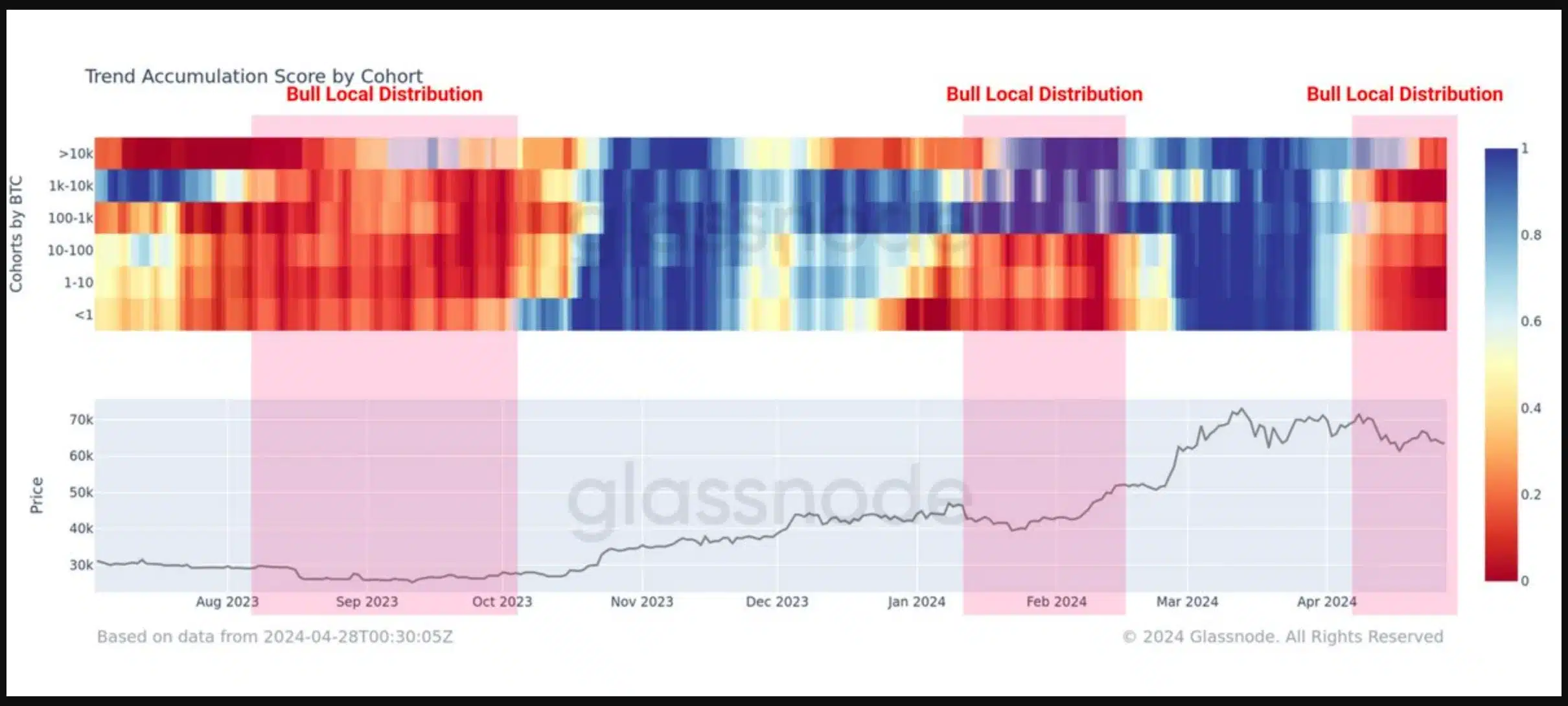

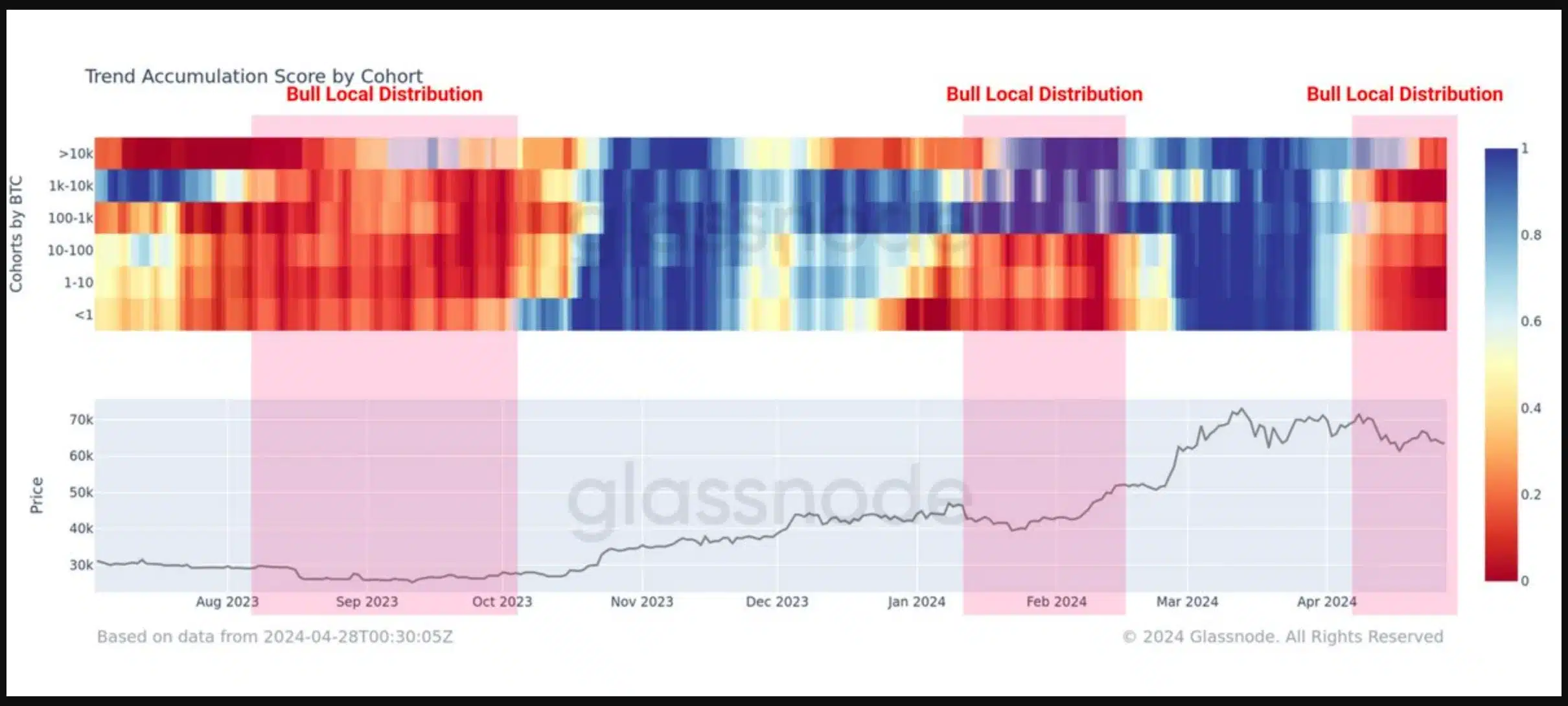

Echoing the identical, an evaluation by Glassnode highlighted an uptick in Bitcoin outflows in April – An indication of promoting strain available in the market.

Supply: Glassnode