- BTC’s 2024 post-halving rally is but to begin, says Capriole Investments govt.

- Market dynamics shifting in the direction of a potential upside later in 2024, per analysts.

Bitcoin [BTC] is in its fourth month of vary buying and selling, caught inside $60k – $71k. After Q1 2024’s unimaginable efficiency of 68% acquire, the cryptocurrency hasn’t seen vital beneficial properties.

In actual fact, it tanked 11% after the halving occasion in Q2 of 2024 and has solely recovered 6% in Q3 to date.

Submit-halving BTC beneficial properties nonetheless doubtless?

General, BTC was up 9% for the reason that April halving occasion. Nevertheless, the digital asset was but to see its parabolic rally, which is typical of post-halving occasions up to now.

This outlook was in accordance with Charles Edwards, founding father of crypto hedge fund Capriole Investments.

‘This Bitcoin cycle hasn’t even began but’

Supply: X/Charles Edwards

Not like the present single-digit acquire, past-halving noticed BTC report triple-digit rallies after the halving occasion.

In line with the hooked up chart from Capriole Investments, BTC rallied 630% after the 2020 halving occasion. In 2016 and 2012, the property jumped 1,400% and 5,500%, respectively.

An identical and earnest begin of 2024’s parabolic run might begin in September, per some analysts.

In actual fact, Coinbase and JPMorgan analysts have cautioned that the latest rally above $67K won’t be sustainable.

Briefly, the latest rally won’t be the beginning of the much-awaited post-halving parabolic run.

Whale demand for Bitcoin surge

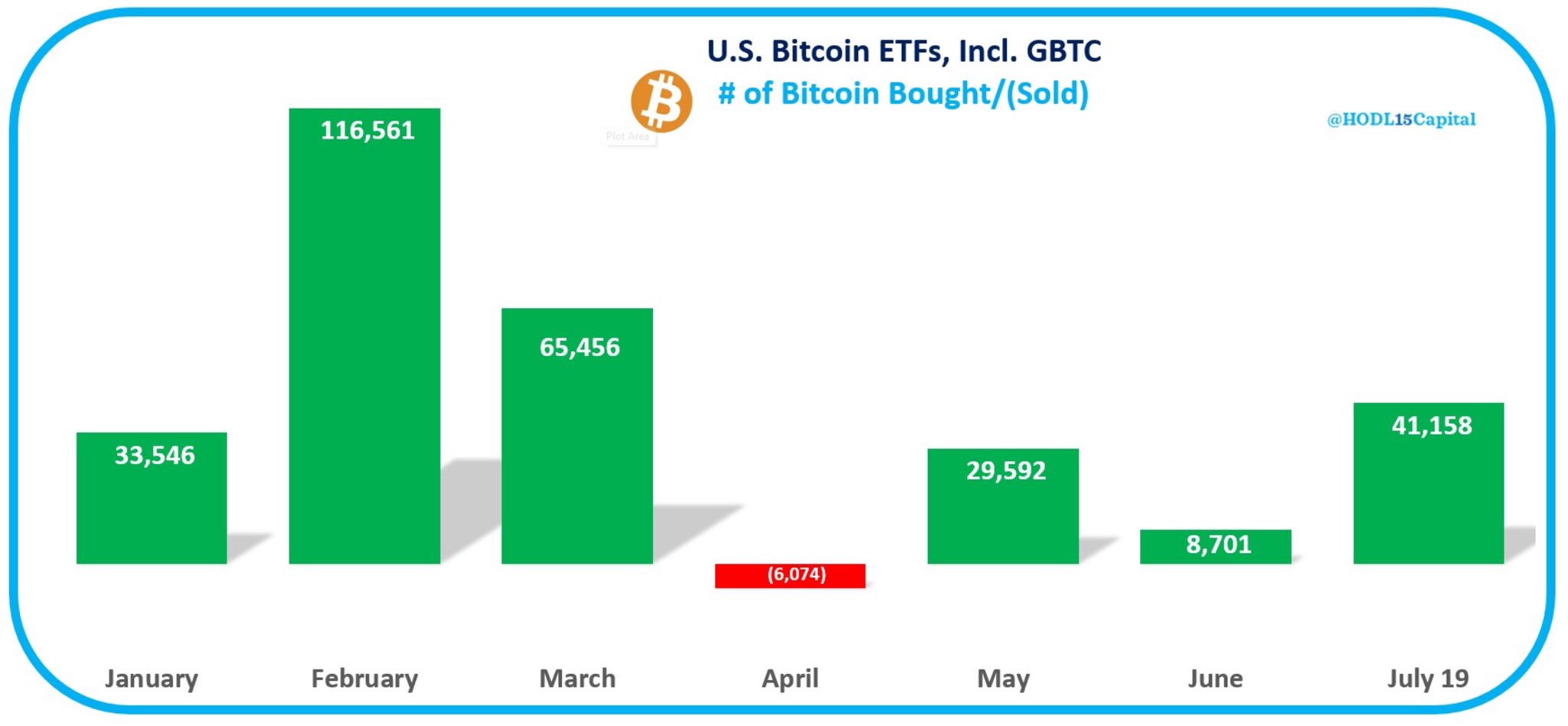

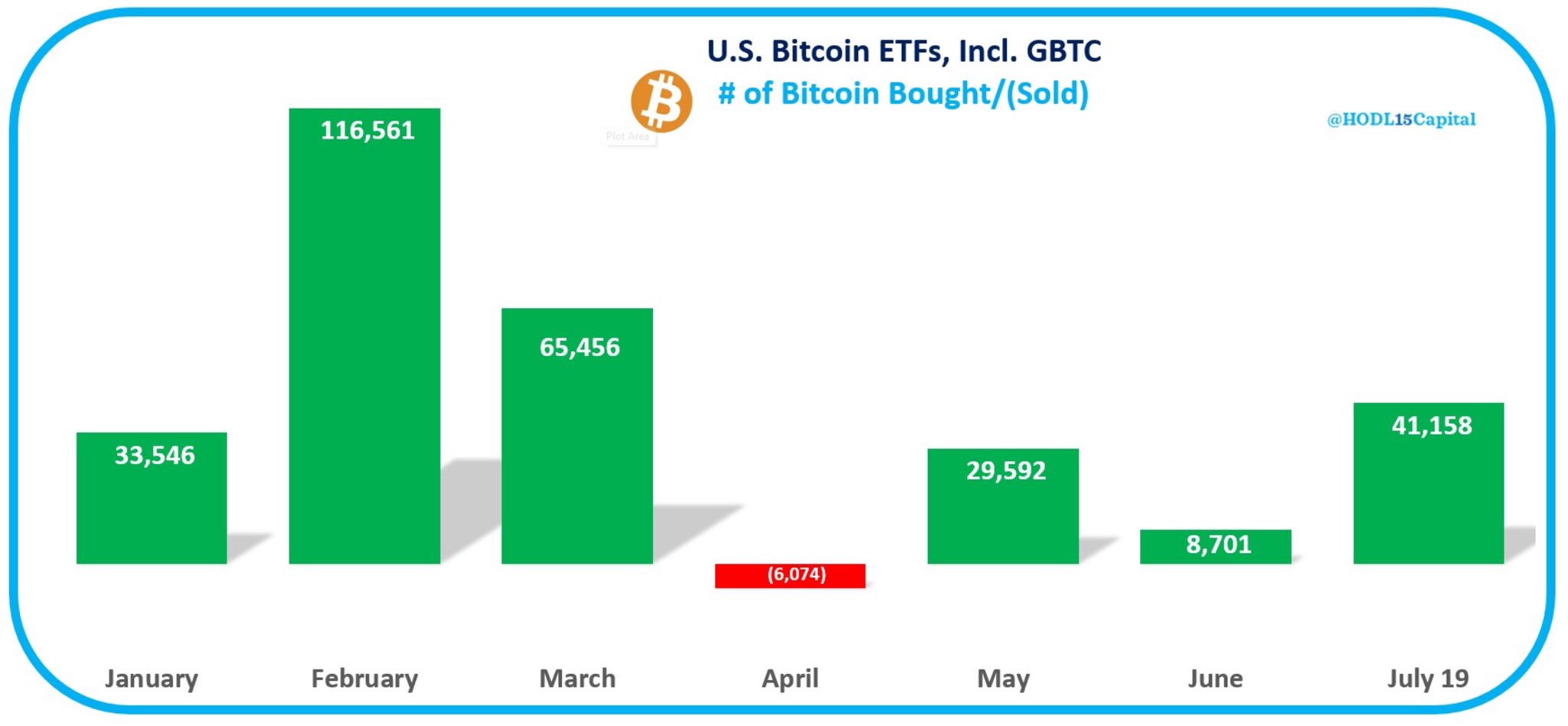

In the meantime, demand from US spot BTC ETFs has picked up tempo. The merchandise gathered +41K BTC within the first three weeks of July. This accumulation spree, led by BlackRock, has since tipped YTD (year-to-date) net flows of BTC ETFs to cross $17 billion.

Supply: X/HOLD15 Capital

This has additionally pushed Bitcoin whales to a two-year excessive. Moreover, the general BTC short-positions within the Chicago Mercantile Change (CME) have decreased considerably.

Reacting to the decline in total CME futures brief positions, CryptoQuant founder Ki Younger Ju said,

‘Open curiosity for each lengthy and brief positions has elevated, nevertheless it’s web unfavorable. We’re much less unfavorable now, much like the degrees 10 months in the past when BTC value was $27K.’

This may very well be one other set-up for an explosive run for BTC, particularly if Mt. Gox provide stress is cleared.

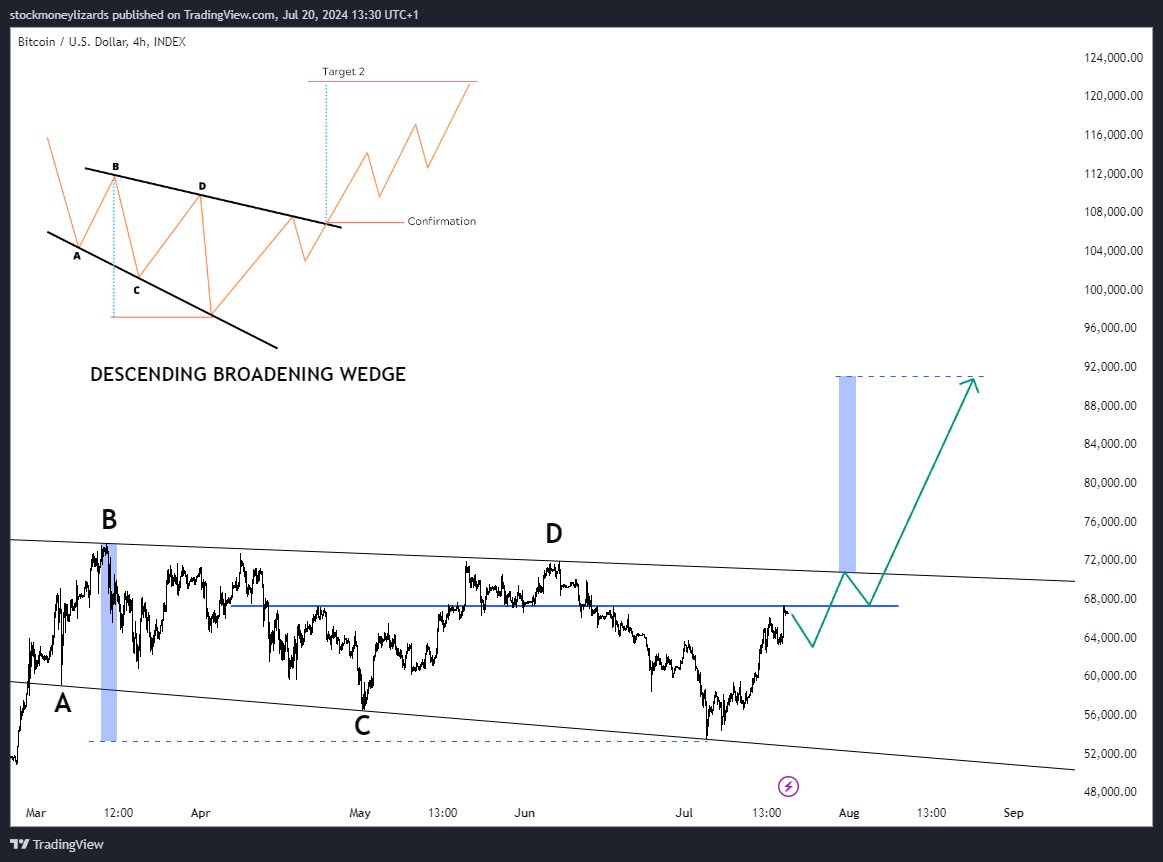

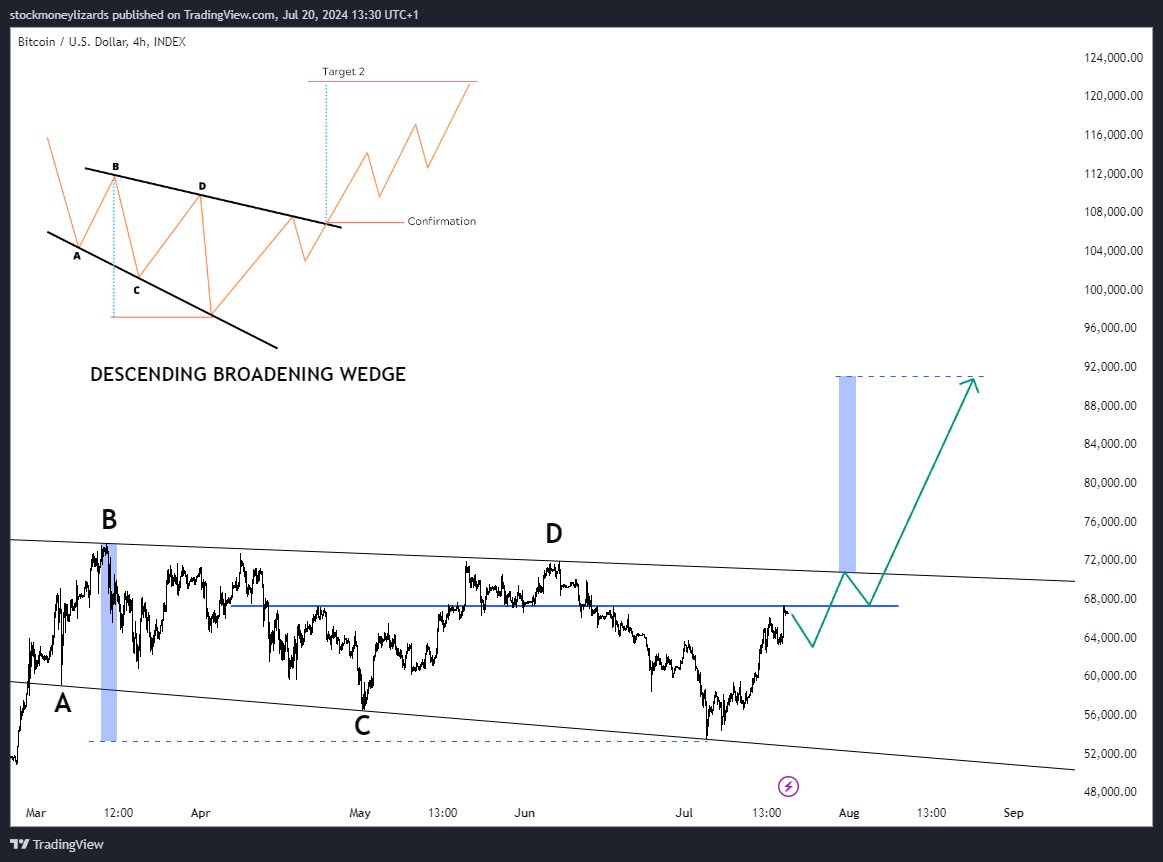

In such a possible bullish state of affairs, market analyst Stockmoney Lizards suggested that BTC might hit $90K by Fall 2024.

Supply: X/Stockmoney Lizards