Bitcoin is stepping past its position as a retailer of worth and into DeFi. BTCFi is bringing lending, staking, and yield alternatives on to the Bitcoin community with out middlemen. This shift not solely unlocks new monetary use circumstances for Bitcoin holders but additionally helps safe the community by holding miners incentivized.

To grasp the place BTCFi stands at the moment and the place it’s headed, BeInCrypto spoke with trade leaders from 1inch, exSat, Babylon and GOAT Community. They shared insights on the present panorama, key challenges, and what’s wanted for BTCFi to achieve its full potential.

Key developments and explosive development in 2024

The 12 months 2024 marked a pivotal interval for BTCfi, characterised by outstanding development metrics. In accordance toDefiLlama, the Whole Worth Locked (TVL) in Bitcoin-based DeFi protocols skilled an unprecedented surge, escalating from $307 million in January to over $6.5 billion by December 31, 2024, a staggering enhance of greater than 2,000%. This surge displays a burgeoning curiosity and confidence in Bitcoin’s DeFi capabilities.

Supply: DefiLlama

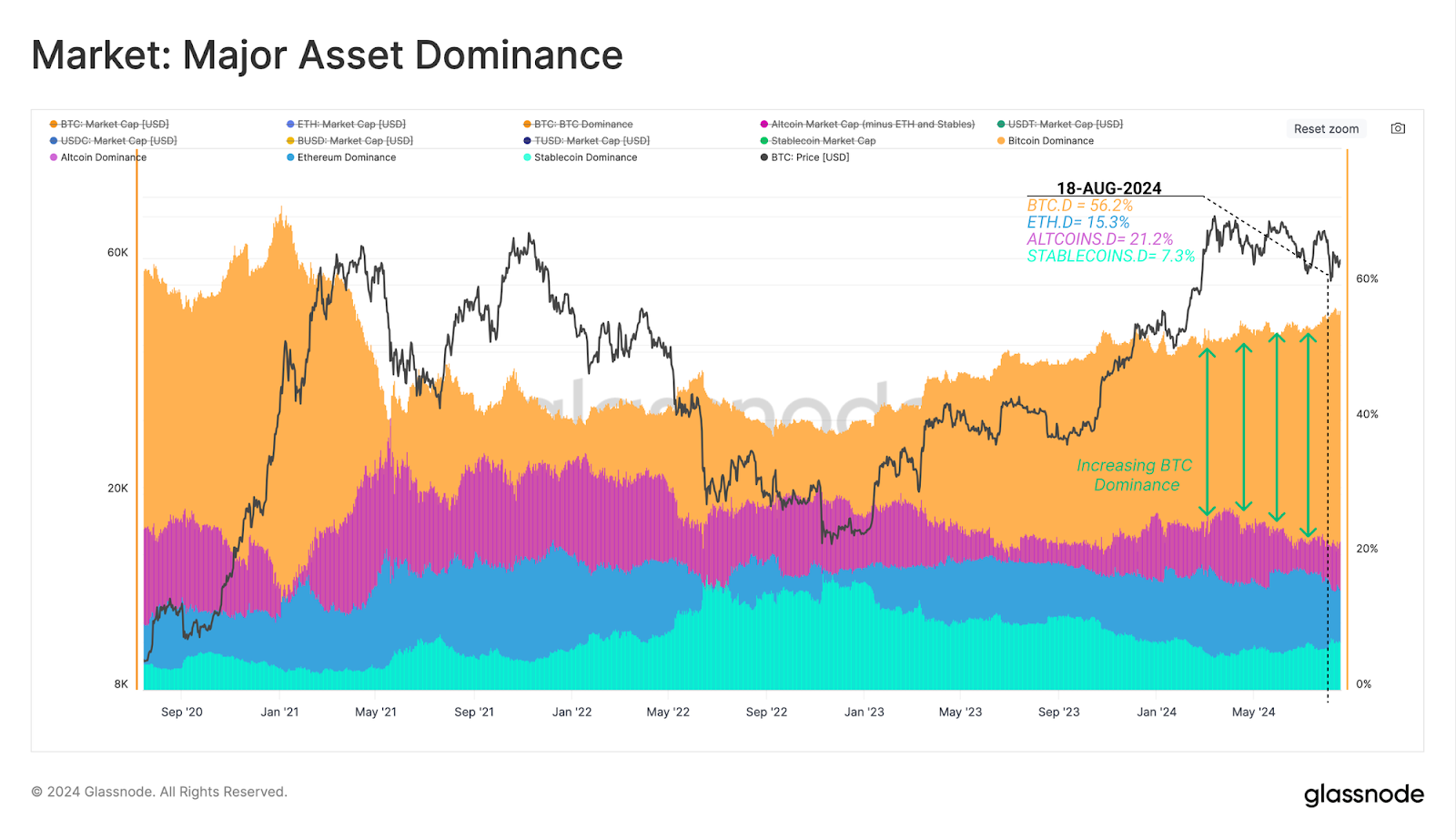

BTCFi’s development is pushed by a mixture of institutional adoption, market efficiency, and technological developments. The approval of Bitcoin ETFs has fueled institutional curiosity, pushing BTCFi’s complete worth locked (TVL) increased. Main exchanges like Binance and OKX are integrating BTCFi providers, bettering accessibility and liquidity. Bitcoin’s robust market efficiency, hitting an all-time excessive of $108,268 in December 2024 earlier than closing at $93,429, has additional boosted confidence.

Supply: Glassnode

On the identical time, improvements like Bitcoin-native property, wrapped BTC, and staking options are increasing Bitcoin’s position in DeFi. Tasks similar to exSat, GOAT Community, Babylon and 1inch are main the way in which with new protocols that improve Bitcoin’s DeFi potential.

As BTCFi continues to evolve, one elementary fact stays unchanged – demand for Bitcoin itself. Kevin Liu, co-founder of GOAT Community, encapsulates this sentiment: “All of us need extra BTC, as a result of it’s the king of all tokens. Whichever initiatives achieve delivering actual BTC yield will flourish, as a result of they’re giving individuals precisely what they need. That is true now, and will probably be true 3-5 years from now.”

The Affect of U.S. Political Choices on BTCFi

Though Donald Trump’s announcement of a US Crypto Reserve that includes XRP, Cardano, and Solana triggered a large surge of their costs, Bitcoin stays the world’s largest and most wanted cryptocurrency. Nevertheless, the passive holding of this “digital gold” is step by step falling out of favor as market dynamics evolve.

Shalini Wooden, CMO of Babylon, captures this shift, stating: “We’re seeing a shift the place Bitcoin is now not simply one thing you HODL. Improvements in Bitcoin staking, lending, and trustless interoperability will outline the following wave of BTCFi. BTCFi will evolve past conventional DeFi fashions, leveraging Bitcoin’s safety to help sovereign functions, cross-chain liquidity, and extra scalable, trust-minimized monetary merchandise. The purpose is to carve out a definite, Bitcoin-native method that enhances safety and decentralization throughout all the crypto ecosystem.”

Tristan Dickinson, CMO exSat Community: “Enabling Bitcoin yield and DeFi-based methods with out sacrificing management of native Bitcoin is essential. Bitcoin has fulfilled its unique function as a retailer of worth, evolving it right into a device for worth creation requires assembly some very particular standards: preserving native Bitcoin safety, making certain interoperability between ecosystems, and supporting complicated sensible contracts.

On the identical time, regulatory developments within the U.S. are reshaping the BTCFi panorama. The prospect of a government-backed Bitcoin reserve lends legitimacy to BTC as a monetary asset, doubtlessly attracting institutional buyers. Nevertheless, as Sergej Kunz, co-founder of 1inch, factors out, regulation stays a double-edged sword: “Some insurance policies help innovation, whereas others might tighten controls on BTCFi. Clear rules on current DeFi and sensible contracts will likely be essential for its development.”

The following section of BTCFi will likely be outlined by the stability between innovation and regulation. Whereas Bitcoin’s decentralized nature makes it proof against authorities interference, regulatory readability might present the steadiness wanted for mainstream adoption. The query stays — will policymakers embrace BTCFi as a transformative monetary power, or will they try and include its potential?

How A lot Beginning Capital Do You Actually Want?

The world of Bitcoin Finance (BTCFi) is evolving quickly, providing alternatives for each institutional buyers and on a regular basis customers. However how a lot capital do you truly must get began?

Shalini Wooden, emphasizes that “BTCFi is not only about particular person participation—it’s about unlocking capital effectivity for Bitcoin at scale. BTCFi is designed to maximise safety and reward alternatives whereas holding Bitcoin’s core rules intact.” Platforms like Babylon, which holds “$4.4 billion in Whole Worth Locked (TVL),” are driving liquidity and accessibility.

One of the crucial important benefits of BTCFi is its accessibility. Conventional finance typically has excessive entry limitations, requiring buyers to place down substantial capital to take part in significant methods. In distinction, BTCFi permits customers to begin with a lot smaller quantities, due to the effectivity of Bitcoin sidechains and second-layer options.

Sergej Kunz, highlights this shift, stating that “BTCFi platforms have low entry limitations, with some permitting participation with as little as $100 due to Bitcoin sidechains like Rootstock and Lightning-based protocols.” Because of this retail buyers, who could have beforehand been excluded from monetary alternatives, can now leverage Bitcoin’s rising DeFi ecosystem without having deep pockets.

This low entry threshold is especially necessary in areas the place conventional banking infrastructure is weak or inaccessible. BTCFi can present individuals in rising markets with new methods to avoid wasting, earn yield, and entry monetary providers with out counting on intermediaries.

Kevin Liu, explains this philosophy: “The very best BTCFi options received’t require customers to be whales; reasonably, they’ll give each whales and guppies the chance to earn actual BTC yield. A well-designed BTCFi-focused ecosystem will allot the very same annual returns (by share) to a person who stakes $1 million, vs. one other who stakes $100.”

This precept is essential as a result of it aligns with Bitcoin’s unique ethos of monetary equity and open participation. In a world the place conventional monetary merchandise typically favor the rich with higher rates of interest and decrease charges, BTCFi is aiming to degree the enjoying area.

Finally, whether or not you’re a small investor or a deep-pocketed establishment, BTCFi platforms are more and more designed to accommodate all ranges of participation, making certain that Bitcoin’s monetary ecosystem stays open and rewarding for everybody.

BTCFi: A Gateway to Incomes With out Leaving Bitcoin

With the rise of Bitcoin Finance (BTCFi), crypto customers now have extra methods to earn from their BTC with out counting on centralized platforms. “BTCFi is changing into extra accessible, enabling customers to lend, stake, and commerce BTC with out counting on centralized platforms,” explains Sergej Kunz. Whereas APR packages and staking choices on Ethereum or Solana could supply increased yields, he notes that “BTCFi permits customers to earn on BTC with out leaving the Bitcoin ecosystem, making it a powerful various for long-term holders.”

Tristan Dickinson, highlights the speedy growth of Bitcoin’s Layer 2 ecosystem: “Right now, there are over 70+ Bitcoin L2 initiatives working to increase entry to and from the Bitcoin ecosystem, however the ecosystem is immature. Fundamental DeFi devices like staking are rising, but only some gamers, perhaps three to 5, supply true staking with token and APY packages.”

He emphasizes that Bitcoin DeFi is on an inevitable development trajectory: “First comes staking, then re-staking, adopted by diversified yield, collateralized lending and borrowing, and finally an explosion in structured monetary merchandise. Some initiatives are main, others are following.”

exSat’s method goals to speed up this evolution by mirroring Bitcoin’s information whereas integrating it with DeFi improvements. “Making a mirrored model of Bitcoin with an identical (UTXO) information and comparable companions is the primary true scaling answer for the ecosystem. Combining the perfect elements of Bitcoin with probably the most highly effective components of DeFi is the one path to significant BTCFi development,” Dickinson concludes.

As BTCFi continues to mature, its capability to supply decentralized yield alternatives with out compromising Bitcoin’s core rules is positioning it as a compelling various for long-term BTC holders.

Kevin Liu, highlights the rising divide in person habits: “We’ll doubtless see development in each teams – individuals who merely purchase BTC on centralized exchanges and both go away it alone or perhaps ape into limited-time APR promotions on these CEXes, and individuals who watch centralized exchanges get hacked and/or admire the facility of ‘not your keys, not your cash’ and thus search out decentralized choices.” As Bitcoin adoption will increase, Liu predicts that extra customers will discover BTCFi options to generate yield with out handing management of their property to centralized exchanges.

With Bitcoin remaining “the only strongest asset because it got here into existence 16 years in the past,” BTCFi is poised to draw each informal holders and people looking for decentralized incomes alternatives, serving to drive mass adoption within the course of.

BTCFi vs. DeFi on Ethereum and Solana: Key Variations and Similarities

As Bitcoin Finance (BTCFi) continues to evolve, it’s more and more in comparison with the established DeFi ecosystems on Ethereum and Solana. Whereas all three intention to offer monetary alternatives past conventional banking, they differ in design, safety, and person expertise.

Ethereum has lengthy been the dominant power in decentralized finance, identified for its strong sensible contract capabilities and in depth vary of DeFi functions. “Ethereum has inspired sensible contract improvement and as many DeFi use circumstances as you possibly can probably think about,” explains Kevin Liu. The ecosystem has fostered improvements in lending, automated market-making, and derivatives, making it the go-to platform for builders experimenting with new monetary fashions. Nevertheless, Ethereum’s strengths additionally include challenges, excessive fuel charges and community congestion can restrict accessibility for smaller buyers.

Solana, however, was designed with velocity and effectivity in thoughts. Its excessive throughput and low charges make it a lovely selection for retail customers and merchants on the lookout for quick execution instances. “Solana stands out for its velocity and low charges,” notes Sergej Kunz. This effectivity has allowed Solana’s DeFi ecosystem to flourish, with platforms like Raydium, Jupiter, and Kamino offering seamless buying and selling and yield farming experiences. Nevertheless, the trade-off comes within the type of increased {hardware} necessities for validators and periodic community outages, which have raised considerations about decentralization and stability.

Bitcoin, in distinction, follows a essentially completely different philosophy. It prioritizes safety and decentralization above all else, which traditionally restricted its capability to help complicated sensible contracts. “BTCFi is constructed on Bitcoin’s battle-tested PoW safety, making certain minimal belief assumptions and censorship resistance,” says Shalini Wooden. Quite than making an attempt to duplicate Ethereum’s DeFi mannequin, BTCFi is creating its personal distinct method, leveraging Bitcoin’s unparalleled safety whereas introducing monetary functions tailor-made for BTC holders.

“THORChain, Sovryn, and Stackswap are among the many initiatives providing native BTC DeFi options, bridging the hole between Bitcoin’s safety and Ethereum’s programmability,” provides Sergej Kunz. These platforms permit customers to interact in decentralized buying and selling and lending whereas holding custody of their Bitcoin, avoiding the dangers related to wrapped BTC on different chains. As BTCFi infrastructure matures, it’s anticipated to carve out its personal area of interest, the one that continues to be true to Bitcoin’s rules whereas increasing its monetary utility.

Ultimately, whereas Ethereum, Solana, and Bitcoin every supply distinctive strengths, BTCFi is proving that Bitcoin is now not only a passive retailer of worth. It’s evolving into a completely useful monetary ecosystem, leveraging its unmatched safety to create decentralized functions that don’t compromise on decentralization or belief minimization.