- Buy sparked renewed curiosity in Bitcoin, with a transparent help round $57,493

- BTC may battle to hit $60,000 on account of decreased community exercise

After Bitcoin’s [BTC] worth dropped to $54,000 on 9 July, a market participant bought 10,000 cash valued at $540 million. Ali Martinez, an analyst on X, revealed this.

Shortly after, the value of Bitcoin jumped to $58,000. The motion talked about above is a typical ‘purchase the dip‘ conduct. This underlines the idea {that a} worth lower is an indication to buy at low cost costs, earlier than one other soar occurs.

Nonetheless, the customer was not the one one concerned in shopping for Bitcoin. Across the similar interval, spot Bitcoin ETFs’ inflows, which have been seeing a dry spell, recorded a surge of three,760 BTC gathered in three days.

This, in keeping with data from Farside Investors. Direct shopping for of BTC and elevated publicity on the ETF entrance, collectively, suggest rising confidence within the cryptocurrency.

Huge buys, big backing

At press time, Bitcoin was valued at $57,384, representing a light 0.60% fall within the final 24 hours. Regardless of the decline, nonetheless, AMBCrypto’s evaluation confirmed that the coin’s worth may get near $60,000.

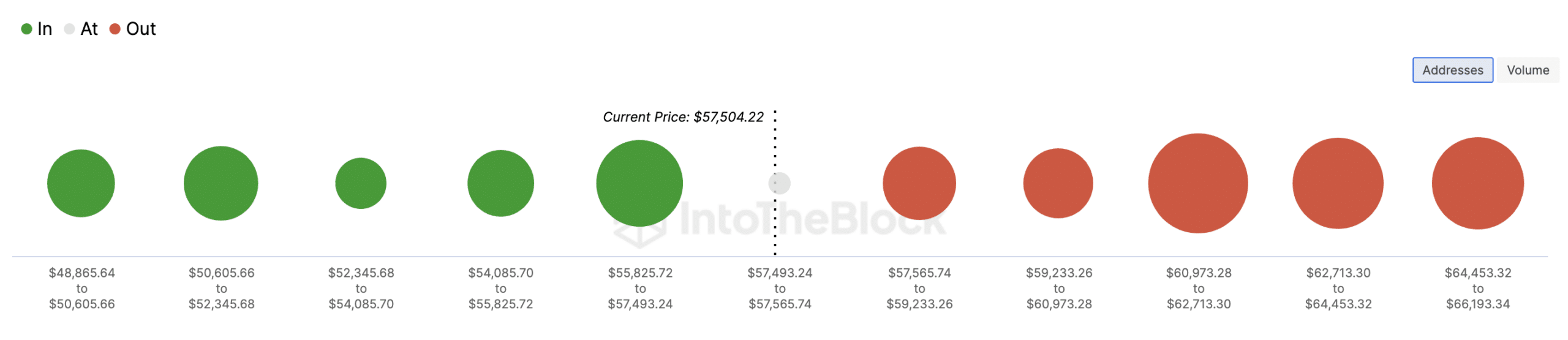

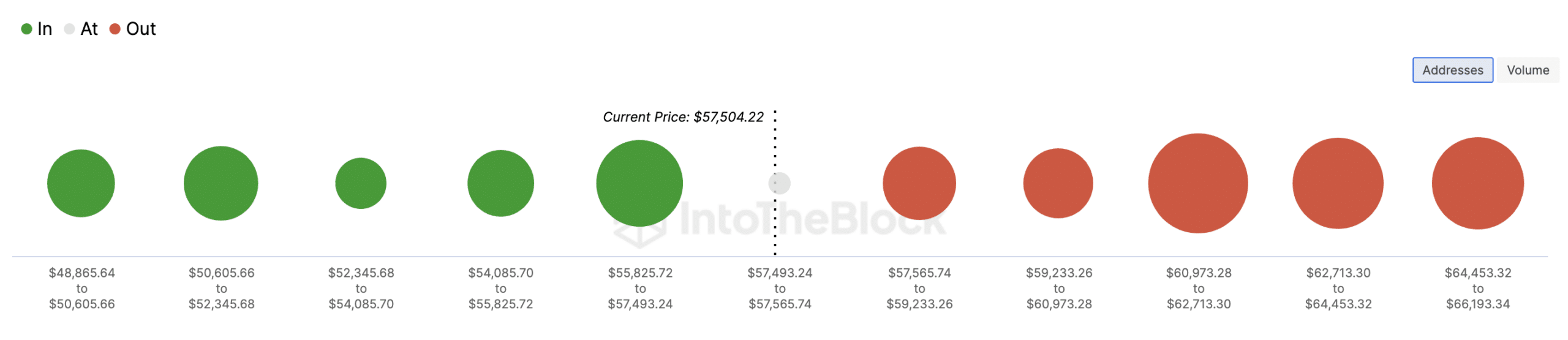

This was the conclusion after we examined the In/Out of Cash Round Value (IOMAP) indicator. Right here, the IOMAP classifies addresses based mostly on these creating wealth and people of out.

With this metric, one can inform if a coin has strong support or resistance at any given worth. Usually, the bigger the cluster of addresses at a worth vary, the stronger the help or resistance.

In response to IntoTheBlock, 1.11 million addresses bought a complete of 623,720 BTC between $55,825 and 57,493. These addresses are in income.

However, 701,630 addresses purchased 279,210 BTC between $57,565 and $59,233. Since there was the next variety of addresses on the decrease ranges, they will present help for Bitcoin.

Supply: IntoTheBlock

Will shopping for now yield returns?

If so, Bitcoin’s worth may be capable of break by way of the $59,233-resistance. Ought to this be the case, the worth of the coin may surge previous $60,000 within the brief time period.

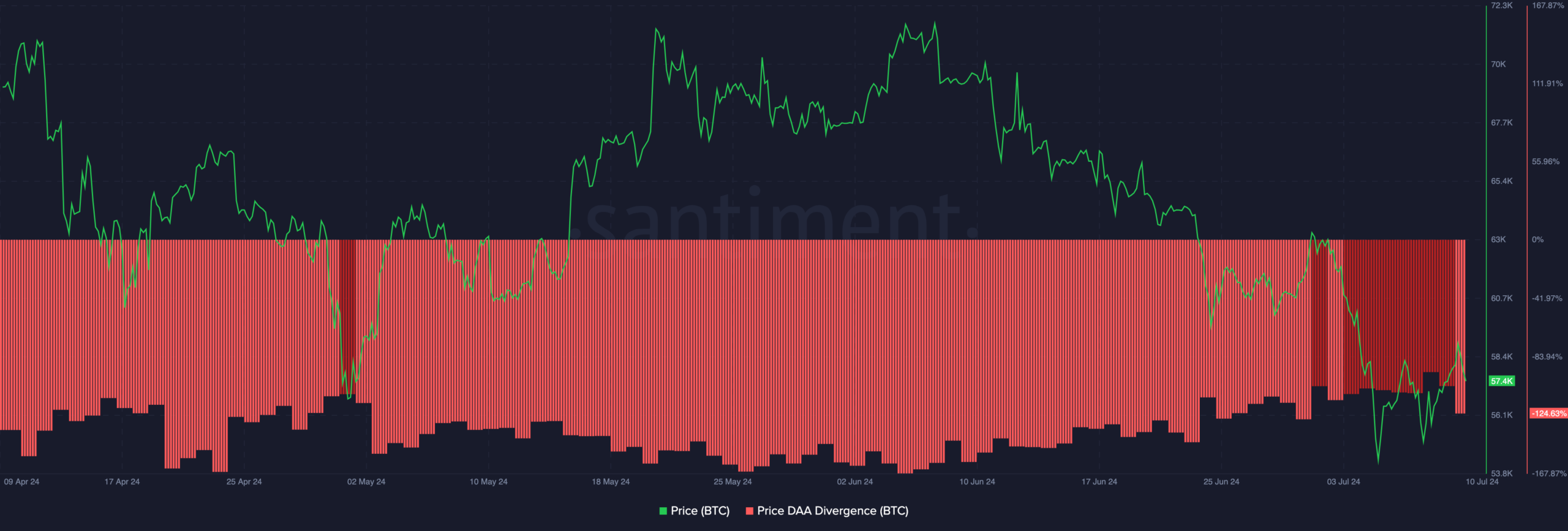

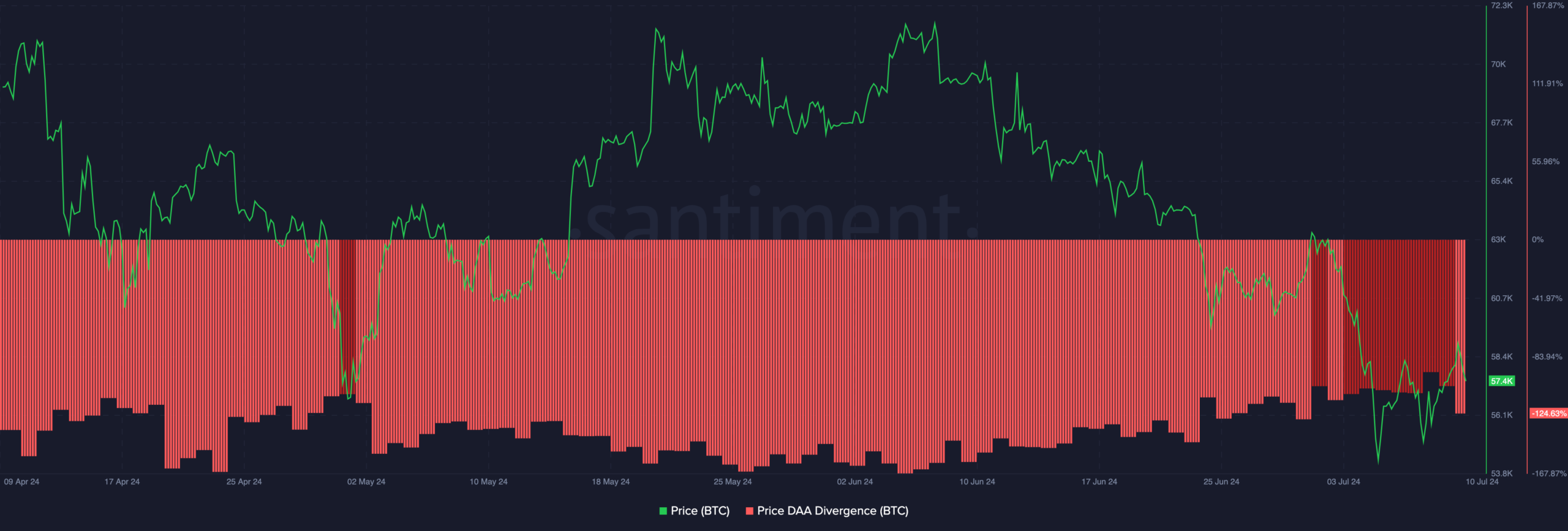

AMBCrypto additionally analyzed the price-DAA divergence. DAA is an acronym for Day by day Energetic Addresses. Subsequently, the indicator measures worth adjustments and the speed of participation to generate purchase and promote alerts.

If the value is growing in addition to the DAA, it implies that Bitcoin’s worth has risen, and may proceed. At press time, the divergence was in damaging territory, indicating that the value decline was accompanied by a fall in community exercise.

Supply: Santiment

If this stays the identical, it might be difficult for BTC to maintain a worth hike. Nonetheless, if exercise on the community begins to extend, BTC may register a gradual stand up the charts, surpassing $60,000 whereas doing so.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Quite the opposite, this forecast is likely to be invalidated if promoting stress continues. For instance, Germany, which has been on the forefront of distributing Bitcoin these days, nonetheless has round $1 billion in its holdings. If it decides to distribute these cash, the crypto may drop beneath $58,000 once more.