- Buyers train warning as Bitcoin ETF approval could trigger a sell-the-news occasion.

- Optimism surrounded Bitcoin mining and rising charges, however the worth mirrored uncertainty.

The prospect of Bitcoin[BTC] Trade-Traded Funds (ETFs) gaining approval has generated widespread anticipation, with many eagerly awaiting a call.

Nonetheless, latest information urged that the approval might set off a sell-the-news occasion, doubtlessly casting a shadow on the preliminary pleasure.

Hypothesis on the rise

In response to K33 Analysis, a call on Bitcoin spot ETFs is anticipated between the eighth and the tenth of January, with the potential for market-moving information rising earlier.

The analysis emphasised that the prevailing market dynamics level in the direction of a sell-the-news state of affairs.

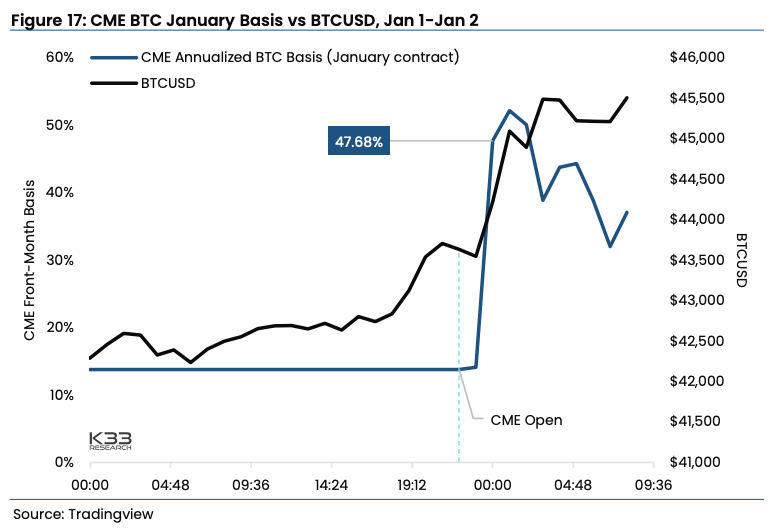

It was additionally famous that merchants are closely uncovered forward of the decision, with derivatives exhibiting important premiums after Bitcoin’s latest months of steady upside momentum.

This publicity makes the occasion a main goal for profit-taking, doubtlessly resulting in a self-fulfilling prophecy of a sell-off.

A 75% likelihood to the sell-the-news state of affairs was assigned, contrasting it with a 20% probability of approval, adopted by substantial inflows offsetting promoting stress and driving costs increased.

Regardless of latest conferences and up to date S-1 prospectuses suggesting imminent approval, there was a 5% probability of ETF denial in accordance with the information.

Supply: K33 Analysis

Doable impacts

The potential sell-off following the ETF approval might affect Bitcoin’s worth dynamics.

Quick-term merchants eyeing earnings could contribute to a short lived downturn, however the long-term implications stay unsure, hinging on the stability between profit-taking and sustained institutional curiosity.

Mine on you loopy diamond

Amidst this uncertainty, optimism surrounded Bitcoin mining. Notably, Canadian miner Bitfarms ($BITF) witnessed a doubling of its inventory worth final month regardless of unchanged income.

This growth urged a constructive market sentiment in the direction of Bitcoin-related shares, emphasizing the broader bullish narrative.

Canadian #Bitcoin miner Bitfarms ( $BITF ) doubled in inventory worth final month regardless of its income remaining unchanged.

We provide a paid service to trace the wallets of publicly traded firms. Let me know for those who’re .https://t.co/AGIl22AnUR https://t.co/XtaY099ZBi pic.twitter.com/pfPCdDbaEM

— Ki Younger Ju (@ki_young_ju) January 3, 2024

One other constructive indicator for Bitcoin lies within the surge in charges collected by miners. The king coin has claimed the highest spot amongst blockchains by charges during the last 30 days.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

With charges annualized at over $4 billion for miners, this uptrend indicators sturdy community exercise and reinforces Bitcoin’s attractiveness to miners.

Regardless of these constructive points, the instant market sentiment mirrored a decline in Bitcoin’s worth. On the time of reporting, Bitcoin was priced at $42,544.09, marking a decline of -1.13% within the final 24 hours.

Supply: Santiment