- Arthur Hayes believes BTC might slip beneath $50k into the weekend

- Bitget’s Gracy Chen maintains a long-term bullish outlook although

Bitcoin’s [BTC] weak point hiked in September because the world’s largest digital asset struggled beneath $60k on the charts. In actual fact, in response to Arthur Hayes, Co-Founding father of BitMEX and CIO at VC fund Maelstrom, BTC might drop additional down and slip beneath $50k over the weekend.

“$BTC is heavy, I’m gunning for sub $50k this weekend. I took a cheeky brief.”

Extra BTC losses within the brief time period?

Earlier within the week, Hayes made a bearish name for BTC within the brief time period, arguing that the anticipated Fed fee cuts wouldn’t rally crypto markets. This, earlier than rate of interest merchants elevated bets on a 0.25% and 0.50% Fed fee lower forward of the U.S jobs report on Friday.

In keeping with the exec’s argument. U.S liquidity is squeezed as monetary establishments have opted for the Fed’s RRP (reverse repurchase settlement) for larger yields, moderately than betting on dangerous property like Bitcoin. This may imply web destructive liquidity, which might decrease BTC costs regardless of the probably Fed fee cuts, he added.

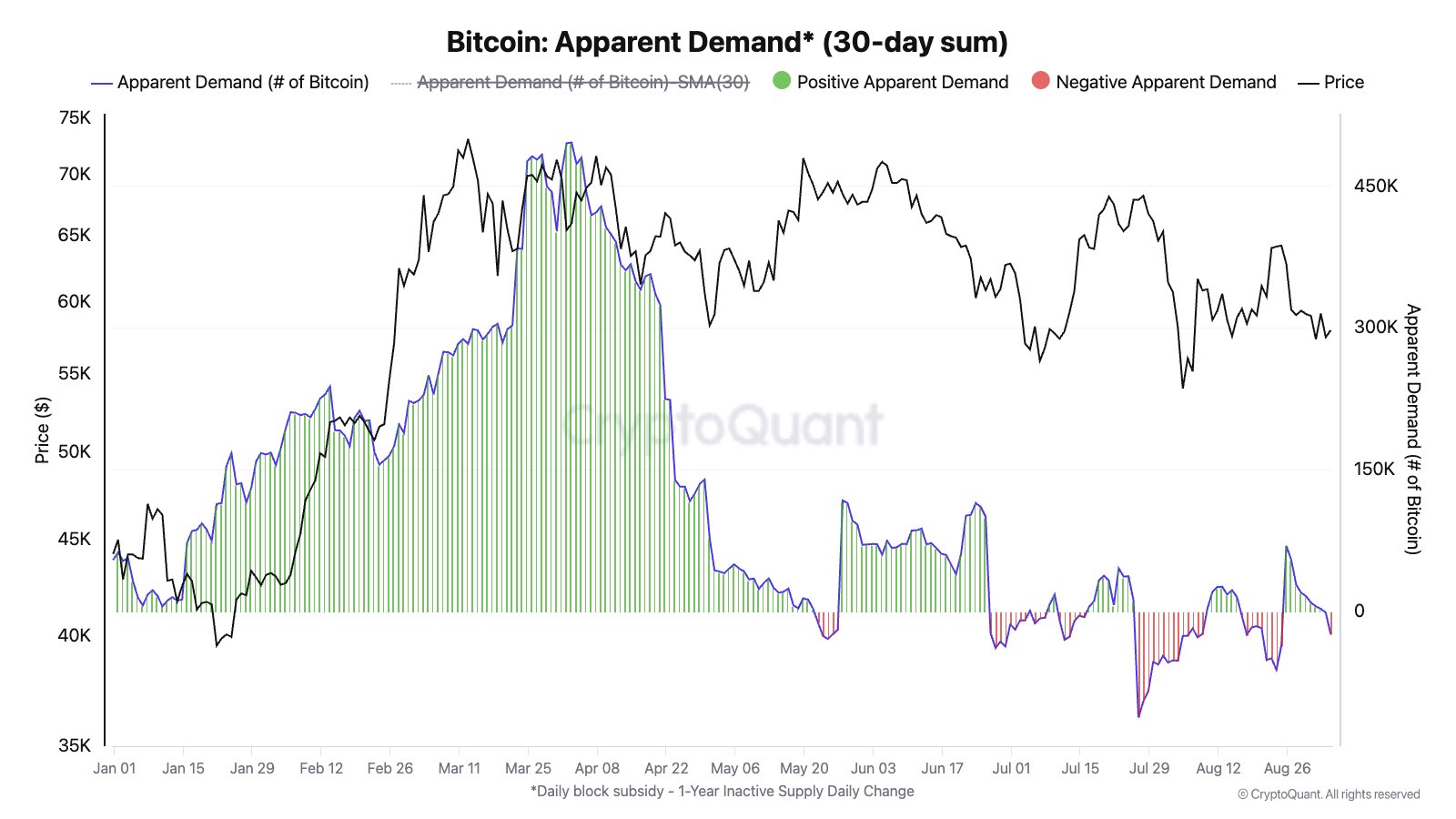

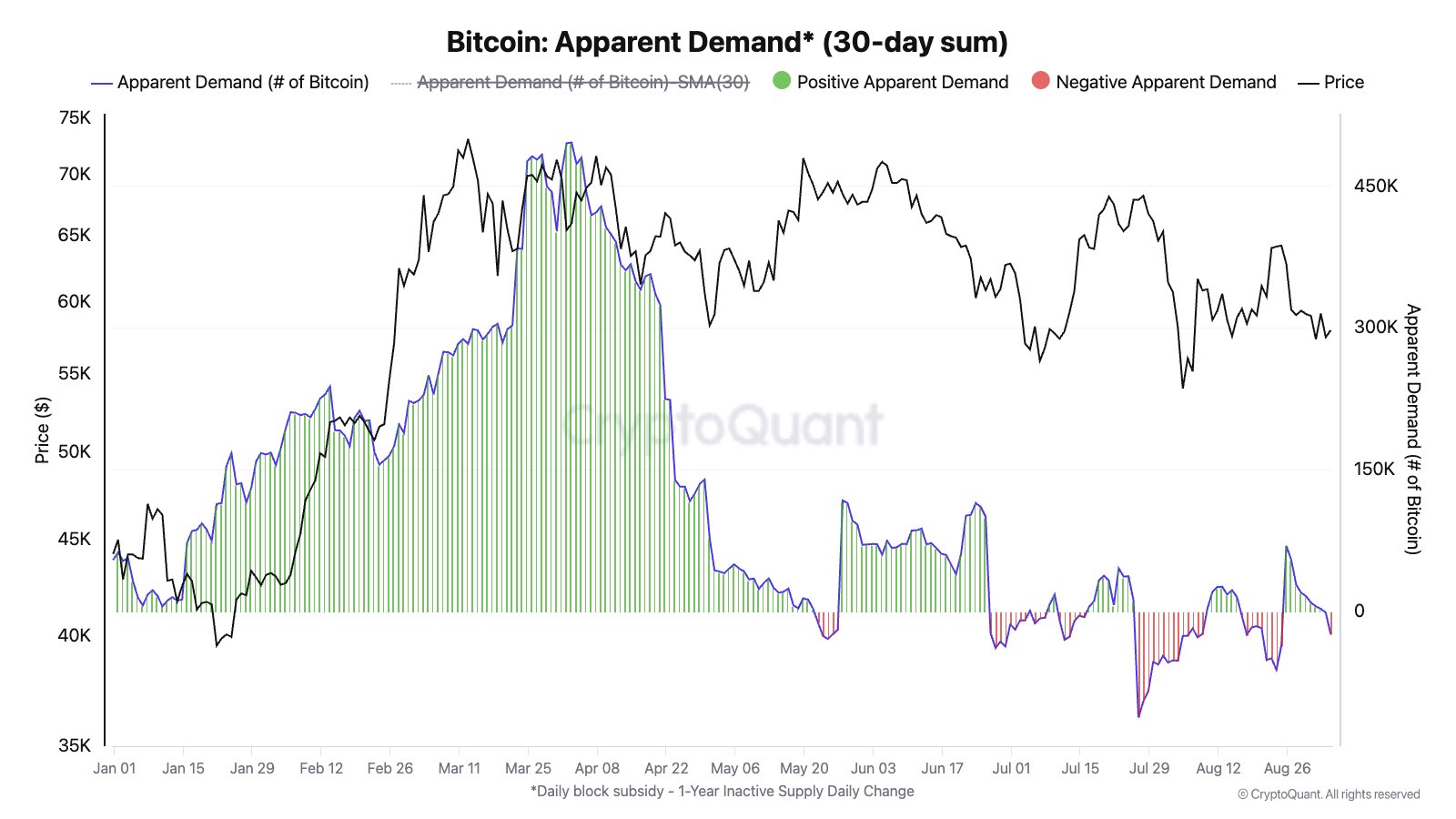

Right here, it’s value stating that demand for the crypto has additionally tapered considerably since Q1. In keeping with CryptoQuant data, investor demand hit file lows at press time, which might additional put downward strain on the crypto’s value.

Supply: CryptoQuant

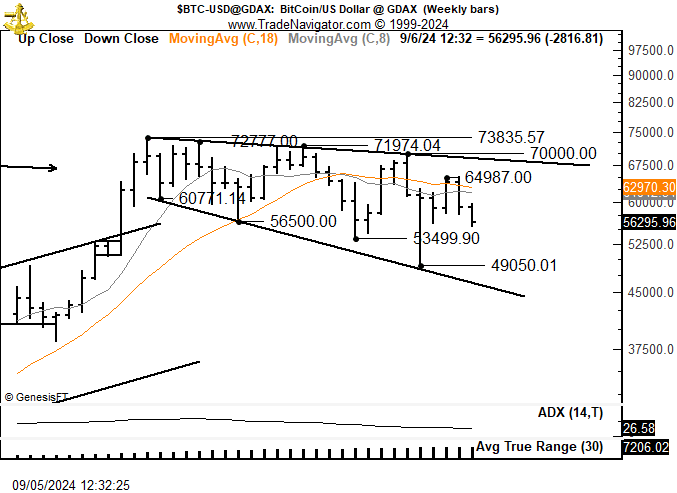

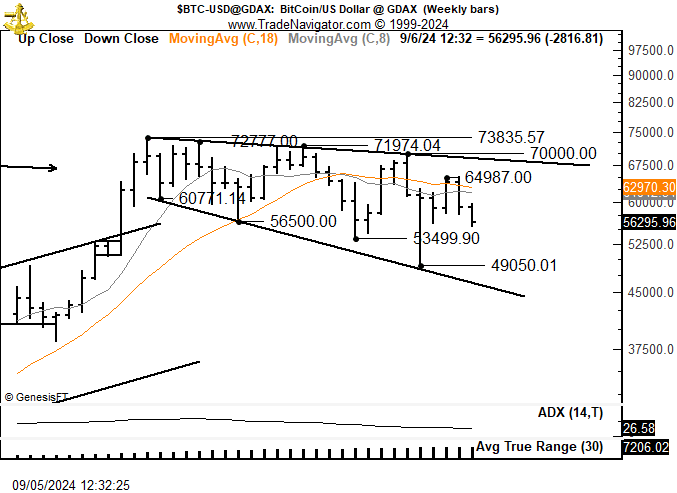

For his half, Peter Brandt suggested that BTC would see extra promoting than shopping for, given its present megaphone value chart sample. In a worst-case state of affairs, Brandt projected that BTC might drop to as little as $46k.

Supply: X/Peter Brandt

Quite the opposite, some market insiders stay bullish in the long term. Gracy Chen, CEO of crypto change Bitget, advised AMBCrypto that September losses can be the ‘”ast drop” earlier than a possible BTC rally in This fall and 2025.

“The current market decline at first of September is sometimes called the ‘final drop,’ with costs anticipated to hit new highs by the tip of the 12 months. Many analysts stay fairly optimistic about Bitcoin’s value outlook for This fall 2024.”

Given the long-term bullish outlook, Chen projected that BTC might climb above $100k by November.

“In a state of affairs with none black swan occasions, Bitcoin might probably break via the $100,000 threshold by November, expertise a correction, after which start its climb towards the $200,000 vary.”

BTC was valued at $56.4k at press time as merchants and traders waited for the U.S Jobs report.