- Bitcoin poised to retrace to $66K earlier than a bounce.

- International liquidity to doubtlessly proceed rising as much as 2026.

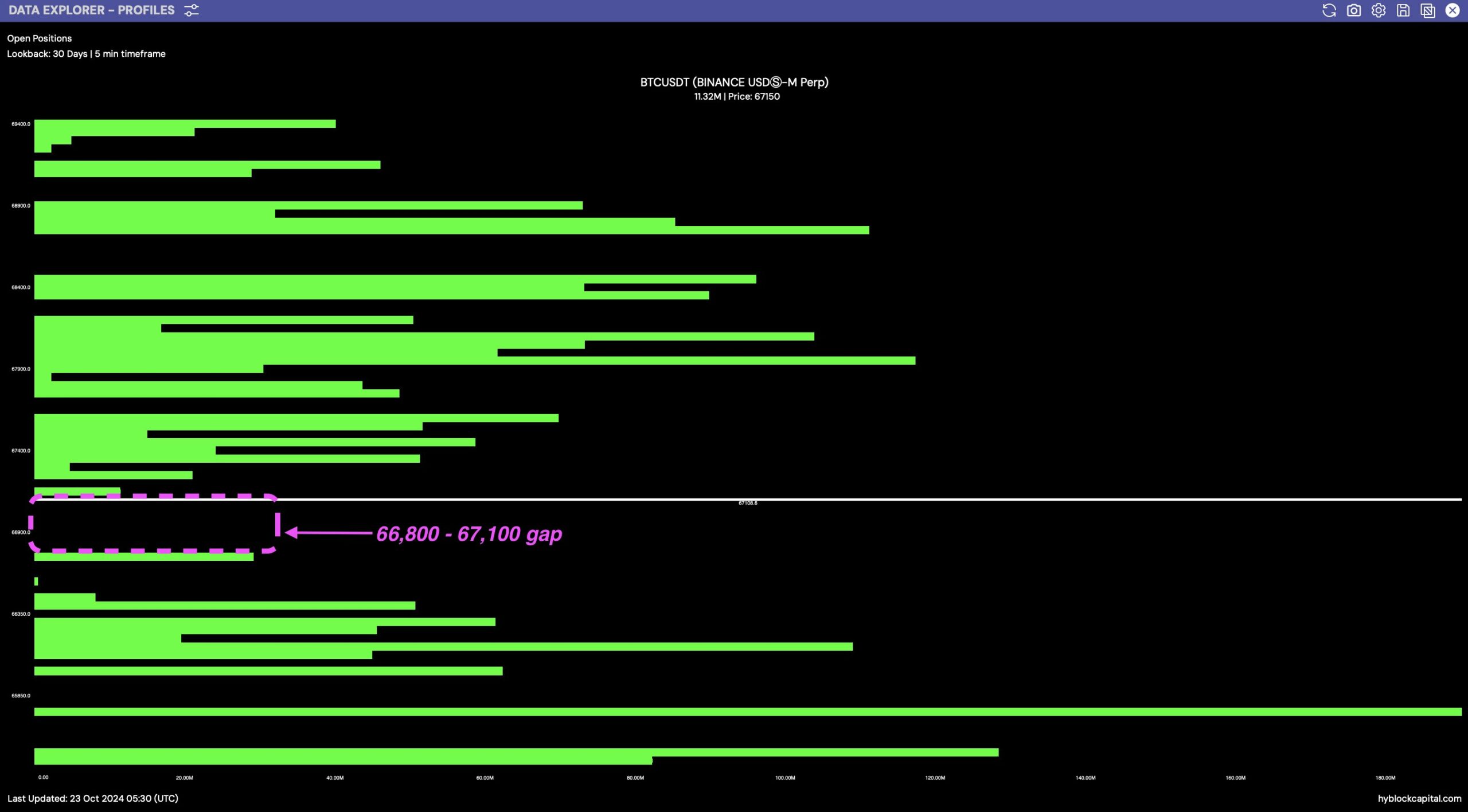

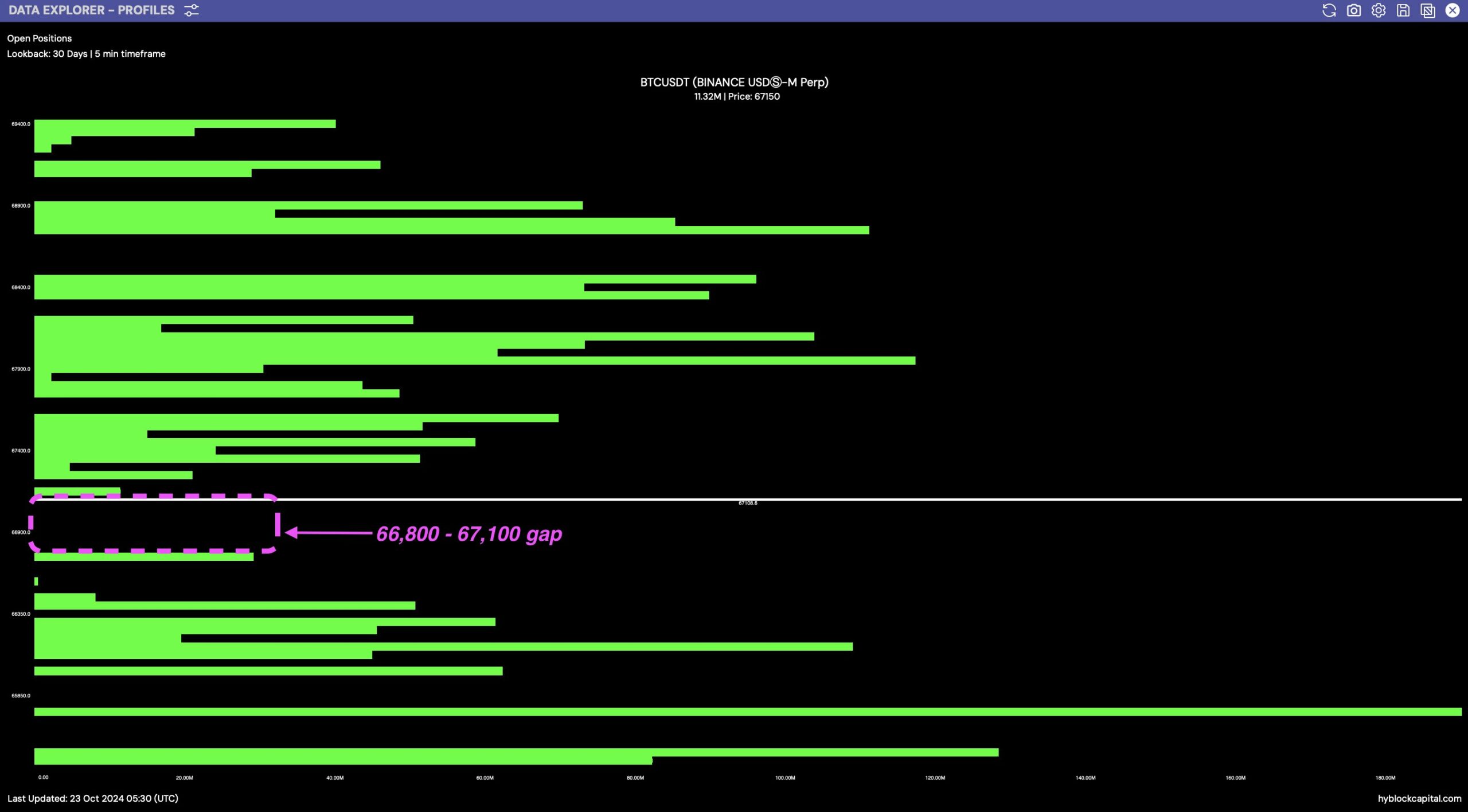

Bitcoin [BTC] was navigating a important value vary at press time, with market watchers anticipating its subsequent transfer. The $66.8K to $67.1K zone on Bitcoin’s profile chart exhibits fewer positions, indicating a value hole.

Traditionally, value tends to gravitate towards such gaps to fill them earlier than persevering with a pattern.

Bitcoin’s path ahead hinges on whether or not it fills this hole earlier than pushing larger or retraces additional to assemble liquidity.

Supply: Hyblock Capital

BTC heading in the direction of a spot

BTC’s value motion exhibits a slight correction after hitting the $70K degree, a significant milestone for the cryptocurrency.

The retracement means that Bitcoin is gathering momentum for its subsequent leg up, however first, it might must fill the hole within the $66.8K-$67.1K vary.

This zone lies beneath a key double backside sample on the 6-hour timeframe of the BTC/USDT pair, reinforcing the potential for upward motion as soon as the hole is crammed.

The weekly chart stays bullish, with the construction damaged to the upside, indicating sturdy market help.

Supply: TradingView

Merchants are carefully watching this value motion, with many anticipating Bitcoin to carry on the $70K-$71K degree, which might doubtless set off a transfer into value discovery and a brand new all-time excessive.

The filling of the hole on this value vary might additionally act as a liquidity seize, permitting Bitcoin to assemble energy earlier than making a decisive transfer larger.

A profitable breakout previous $70K would sign the beginning of a brand new bullish part, with Bitcoin doubtlessly getting into uncharted territory.

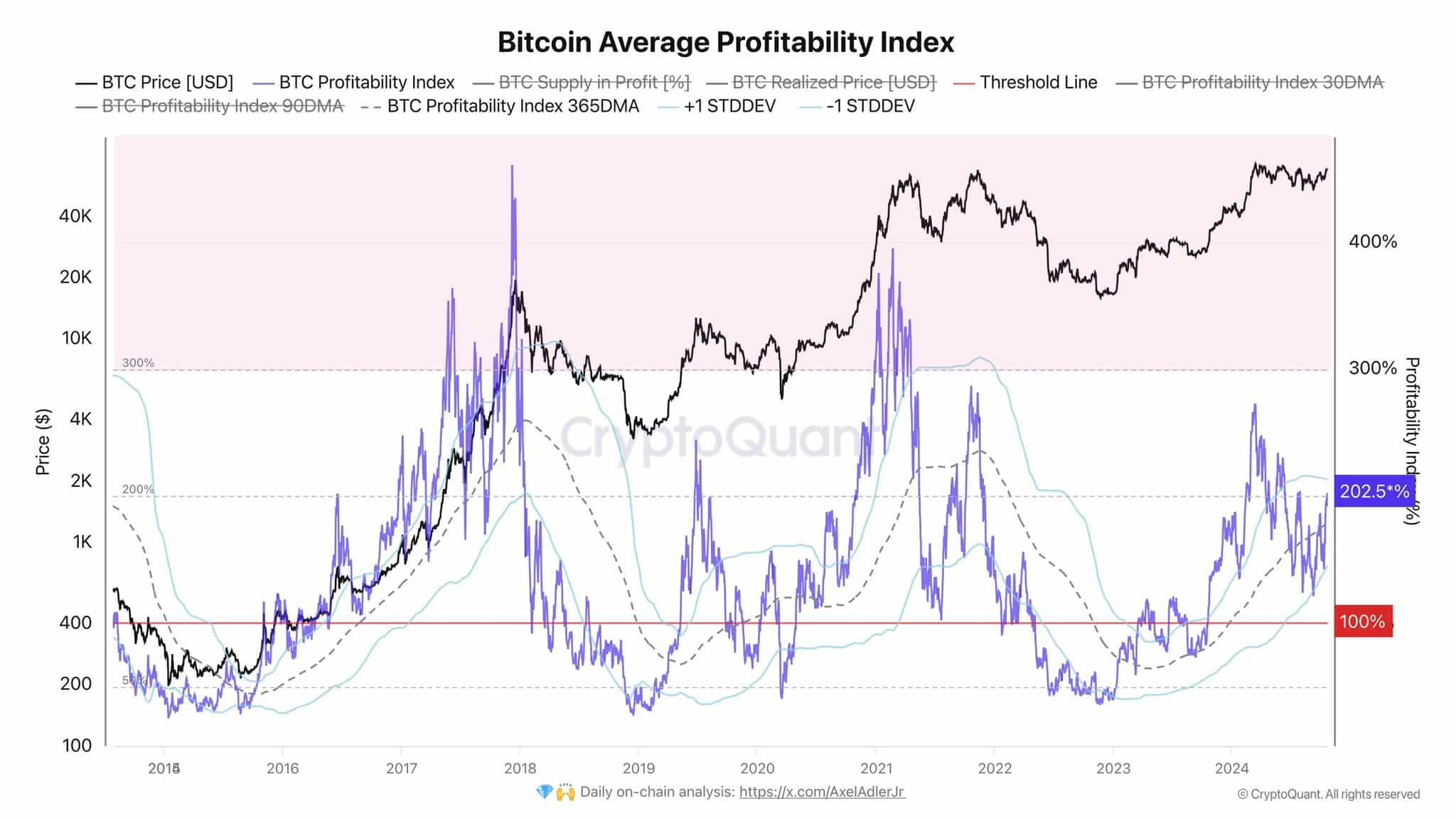

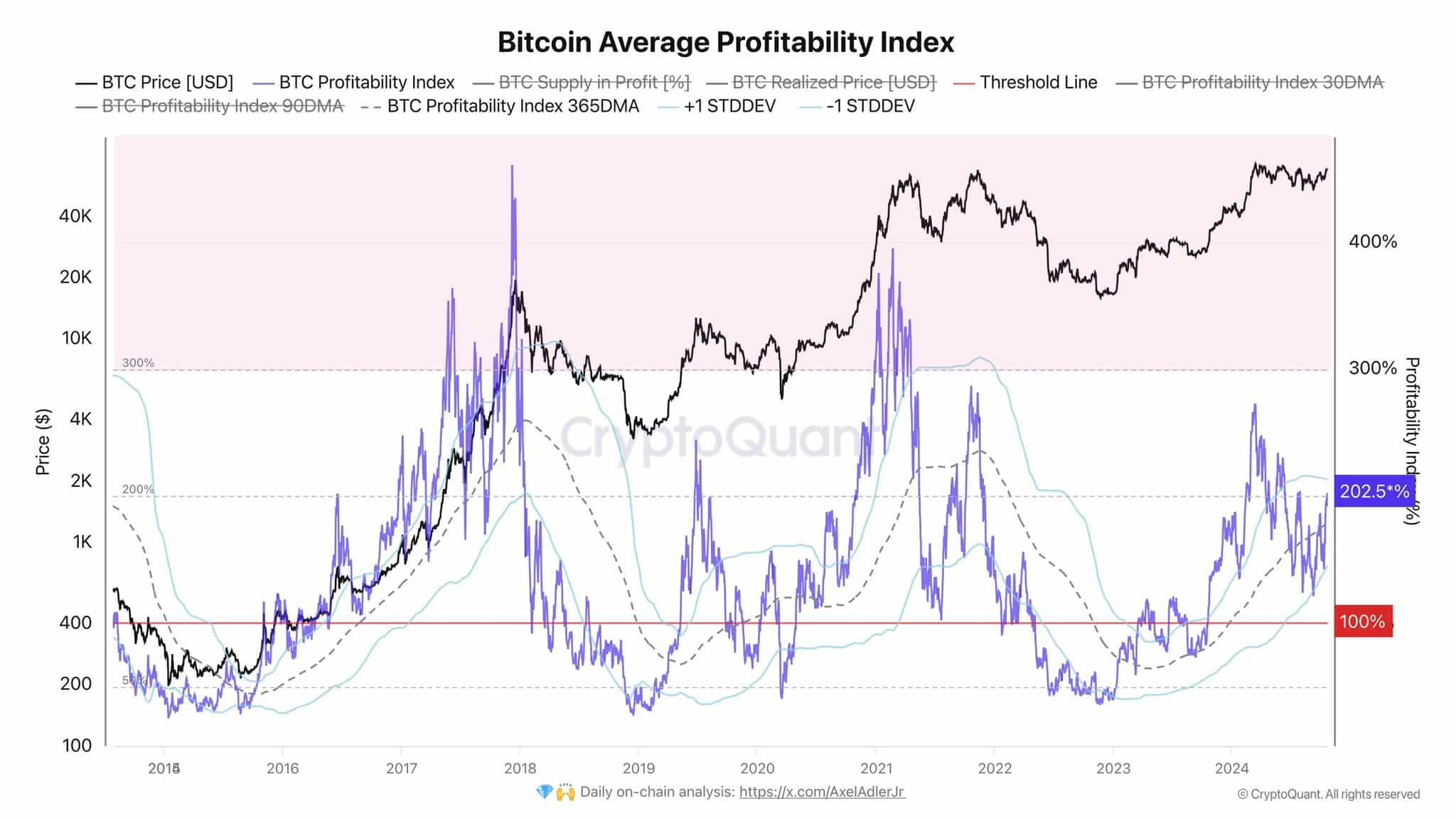

Profitability and international M2 provide

The Bitcoin Common Profitability Index additional helps this outlook. At present, the index stands at 202%, which means the worth is greater than double the realized value.

Traditionally, traders have a tendency to start out taking income when this index rises above 300%, however for now, it means that the market is just not but in heavy profit-taking mode.

This leaves room for BTC to proceed its upward trajectory after filling the worth hole, with long-term holders nonetheless optimistic about larger value ranges.

Supply: CryptoQuant

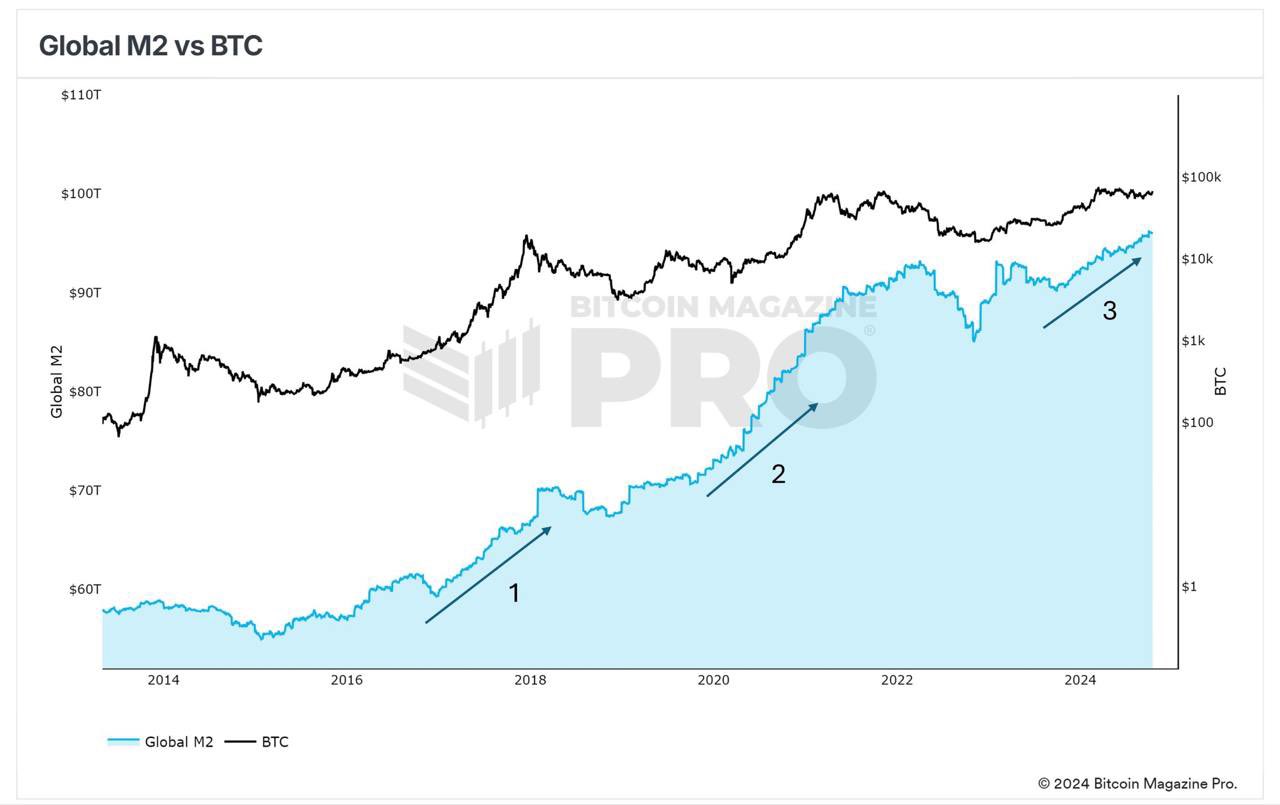

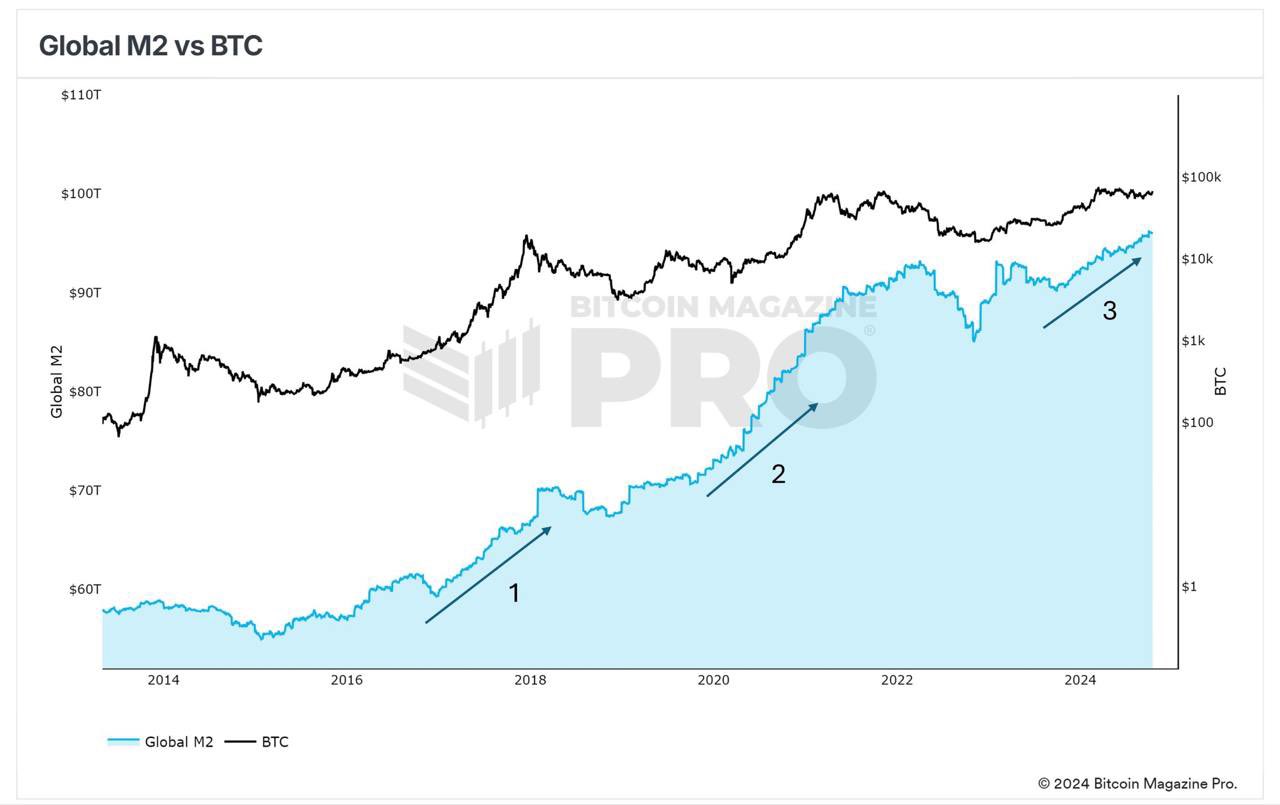

Along with these indicators, the International M2 cash provide information presents insights into Bitcoin’s broader potential.

Throughout earlier bull cycles, equivalent to in 2016-2017, the enlargement of the M2 provide coincided with vital Bitcoin value development.

In 2021, an identical enlargement occurred, however exterior components just like the collapse of FTX and rising rates of interest dampened Bitcoin’s momentum.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

If the M2 provide continues to develop via mid-2026, as some analysts predict, this might present further liquidity to the market and lengthen Bitcoin’s present cycle.Bitcoin’s path stays bullish, with the worth hole performing as a short-term help that should be tapped earlier than rally continuation.