- The newest market fall was not on account of Mt. Gox, however due to the market sentiment following ETF approval.

- Merchants are utilizing extreme leverage to purchase the dip, with a $30 million liquidation pool if BTC falls beneath the $63,800 stage.

Throughout Asian buying and selling hours on twenty fifth July the general cryptocurrency market skilled a big decline, with the highest asset Bitcoin [BTC] slipping beneath the $64,000 mark.

Crypto merchants appear to be shopping for the BTC dip

Amid this promoting stress throughout the market, a crypto analyst made a post on X (beforehand Twitter) stating that degens are utilizing heavy leverage to purchase Bitcoin dip.

Based on the put up on X, these merchants have created a large $30 million liquidation pool close to the $63,800 mark. Which means that if the BTC value tanks beneath the $63,800 stage, this $30 million pool can be liquidated.

Apart from these merchants, BTC whales additionally appear all in favour of shopping for the dip. Not too long ago, an on-chain analytic agency Lookonchain made a put up on X {that a} good whale had purchased 244 BTC price $16 million.

Moreover, this whale has added a complete of 921 BTC price $60.6 million at a mean value of $65,821.

These posts by the analyst and on-chain analytic agency sign that buyers and merchants are displaying confidence in BTC regardless of its decline of greater than 3.4% within the final 24 hours.

Analysts on latest market decline

this ongoing promoting stress, Ki Young Ju the CEO and Founding father of CryptoQuant made a put up on X stating that following Mt. Gox collectors’ repayments in all international time zones have handed, the crypto change Krakens’ spot Bitcoin buying and selling quantity and change flows are regular.

Moreover, Younger Ju added that any value drop out there would occur due to market sentiment, not on account of Mt. Gox.

This put up by the CEO highlights that the latest market fall is probably going as a result of market sentiment and the continual BTC and Ethereum (ETH) sell-off by whales and establishments after spot Ethereum ETF approval.

Bitcoin technical evaluation and upcoming ranges

Then again, one other crypto analyst made a put up sharing an perception that there’s potential for BTC to rebound because the technical indicator is flashing a purchase sign on the BTC hourly chart.

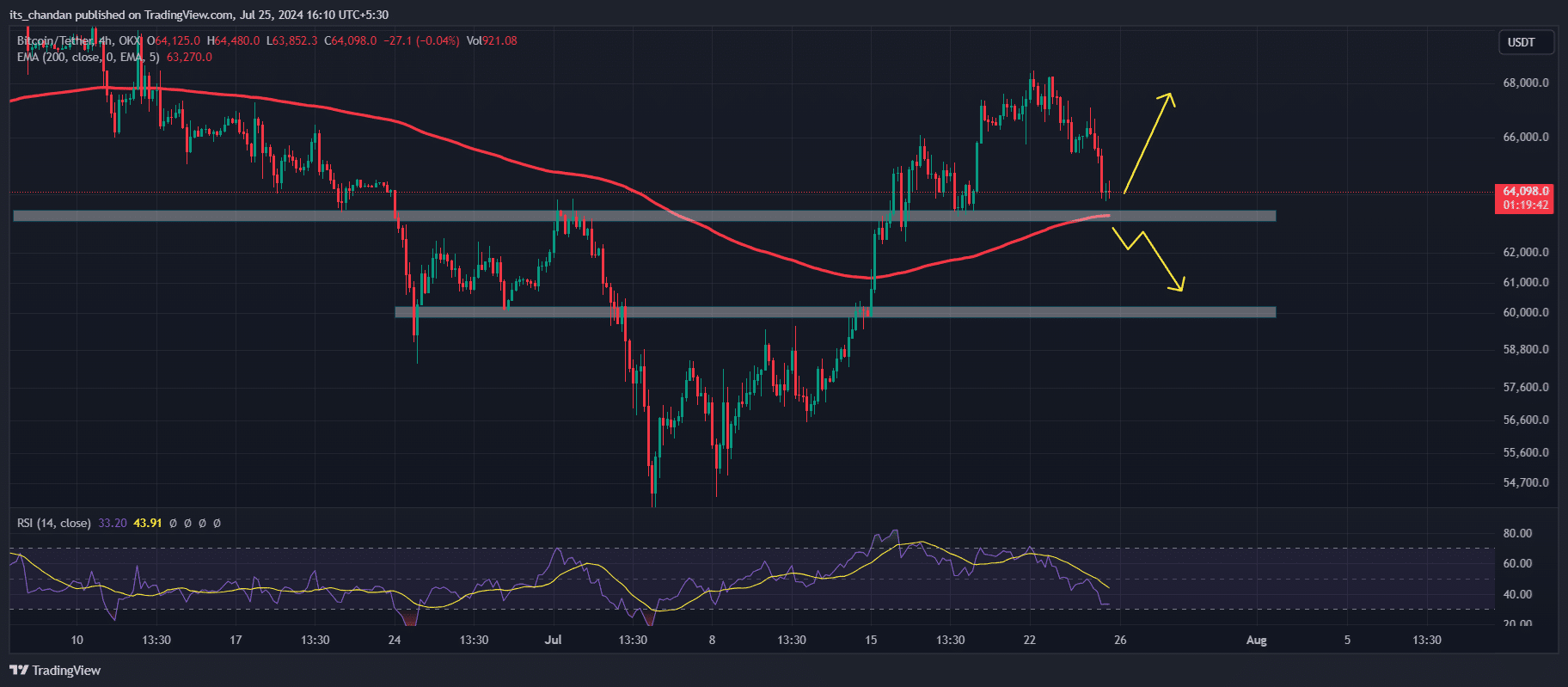

Based on professional technical evaluation, BTC nonetheless appears bullish, holding a help stage of $63,350, and continues to maneuver above the 200 Exponential Shifting Common (EMA) within the 4-hour timeframe.

The BTC value above the 200 EMA indicators bullishness on the chart.

Supply: TradingView

Moreover, one other technical indicator the Relative Energy Index (RSI) is in oversold offered purpose which additionally indicators potential value restoration.

As per value motion, if market sentiment stays the identical and BTC fails to maintain above 200 EMA and $63,350 stage, then we may even see a large sell-off, with BTC value falling to the $60,300 stage.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

After the $63,350 stage, the $60,300 stage is the subsequent help BTC might encounter if it fails to carry this time.

As of writing, BTC is buying and selling close to the $64,200 stage and skilled a 3.4% value drop within the final 24 hours. It additionally reached an intraday low of $63,770 stage. Moreover, buying and selling quantity has jumped by 10%, signaling elevated participation from buyers and merchants.