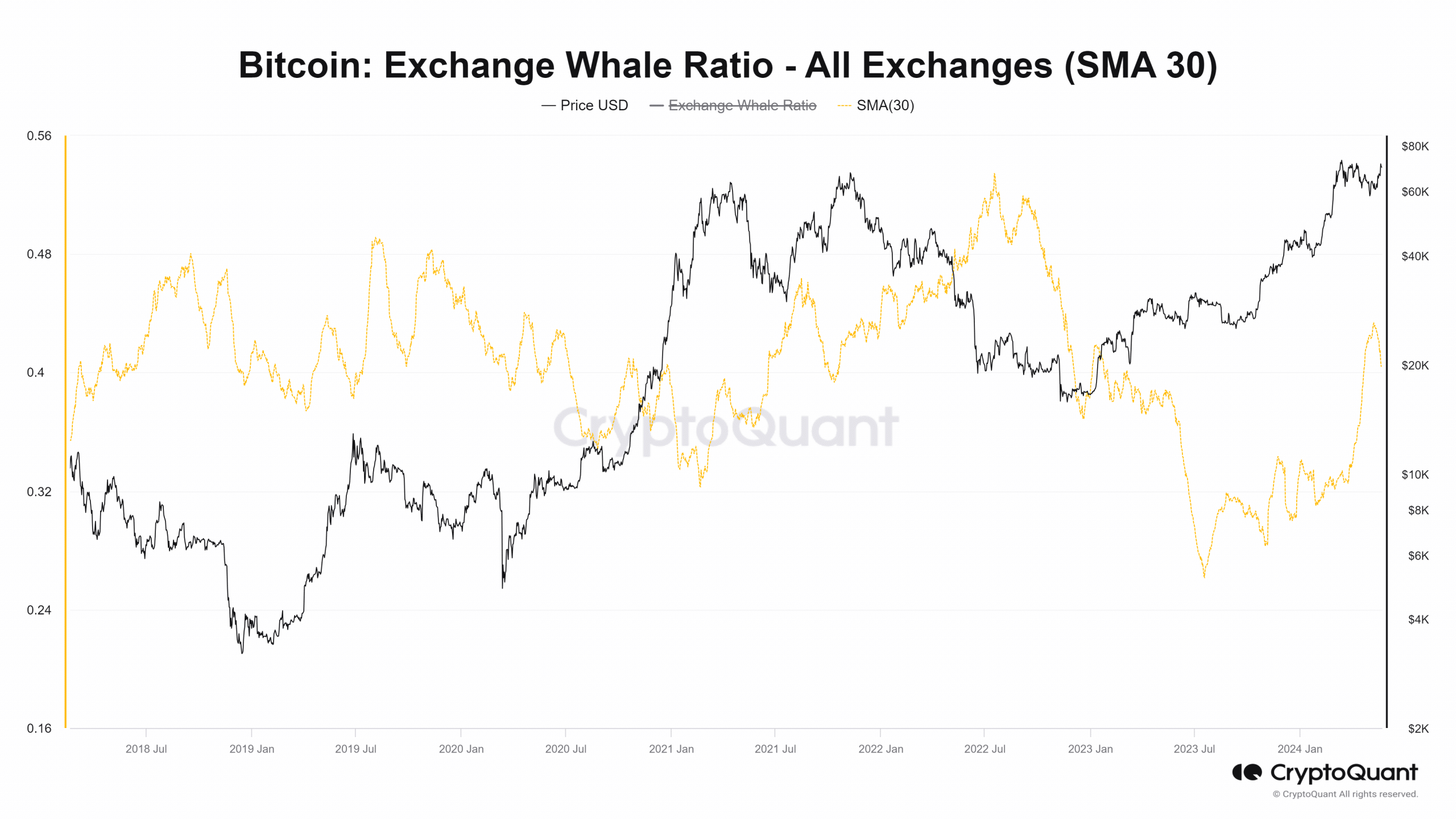

- Bitcoin whale exercise noticed an uptick, which often doesn’t happen throughout this a part of the cycle.

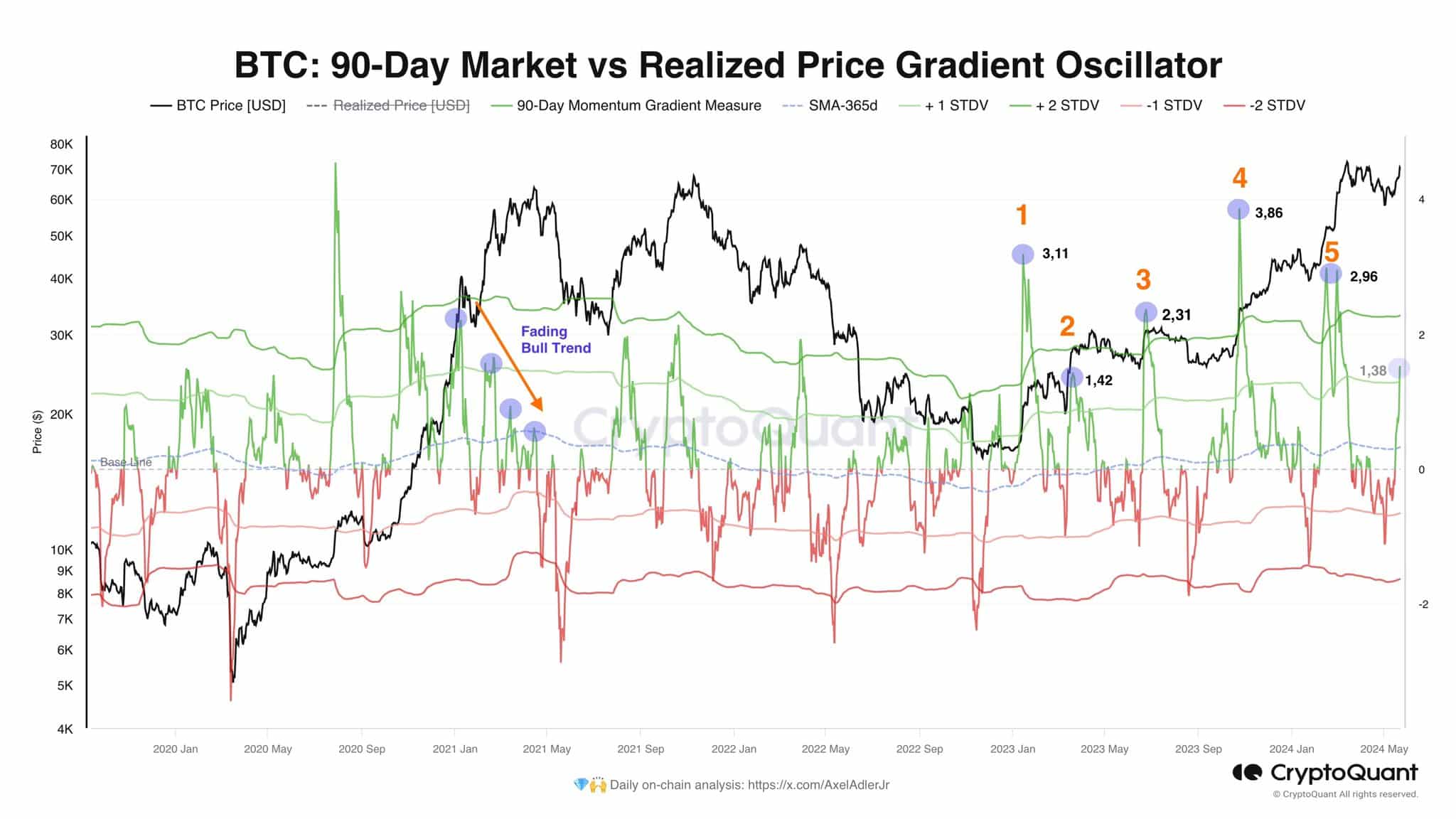

- The realized value gradient oscillator confirmed bulls want to take care of their momentum.

Bitcoin [BTC] was gaining bullish momentum as costs approached the all-time excessive. It noticed a 4% pullback prior to now two days that retested the $69k help zone. The technical indicators remained bullish.

Accumulation continued apace, whereas costs stagnated in April and the primary half of Could.

In a latest AMBCrypto report, the information highlighted that Bitcoin could be readying to embark on a 300-day bull run. The proof at hand additional strengthened the bullish bias.

This momentum indicator exhibits bulls have to take care of the stress or threat a stoop

Crypto analyst Axel Adler posted on X (previously Twitter) a chunk of on-chain evaluation that highlighted the present momentum of Bitcoin and the values the gradient reached prior to now 18 months.

The value gradient oscillator above measures how rapidly the market cap grows in comparison with the realized cap.

In the course of the 2021 rally, as BTC neared its eventual prime, the oscillator fashioned decrease highs which indicated a fading bull development.

In 2024, the oscillator has fashioned a decrease excessive at 2.96. Therefore, a transfer previous 3 could be fascinating for bulls to keep away from repeating the 2021 sample, which might sign fading bullishness.

On the time of writing, the oscillator studying was at 1.38.

“It’s solely a matter of time” for Bitcoin to hit all-time highs

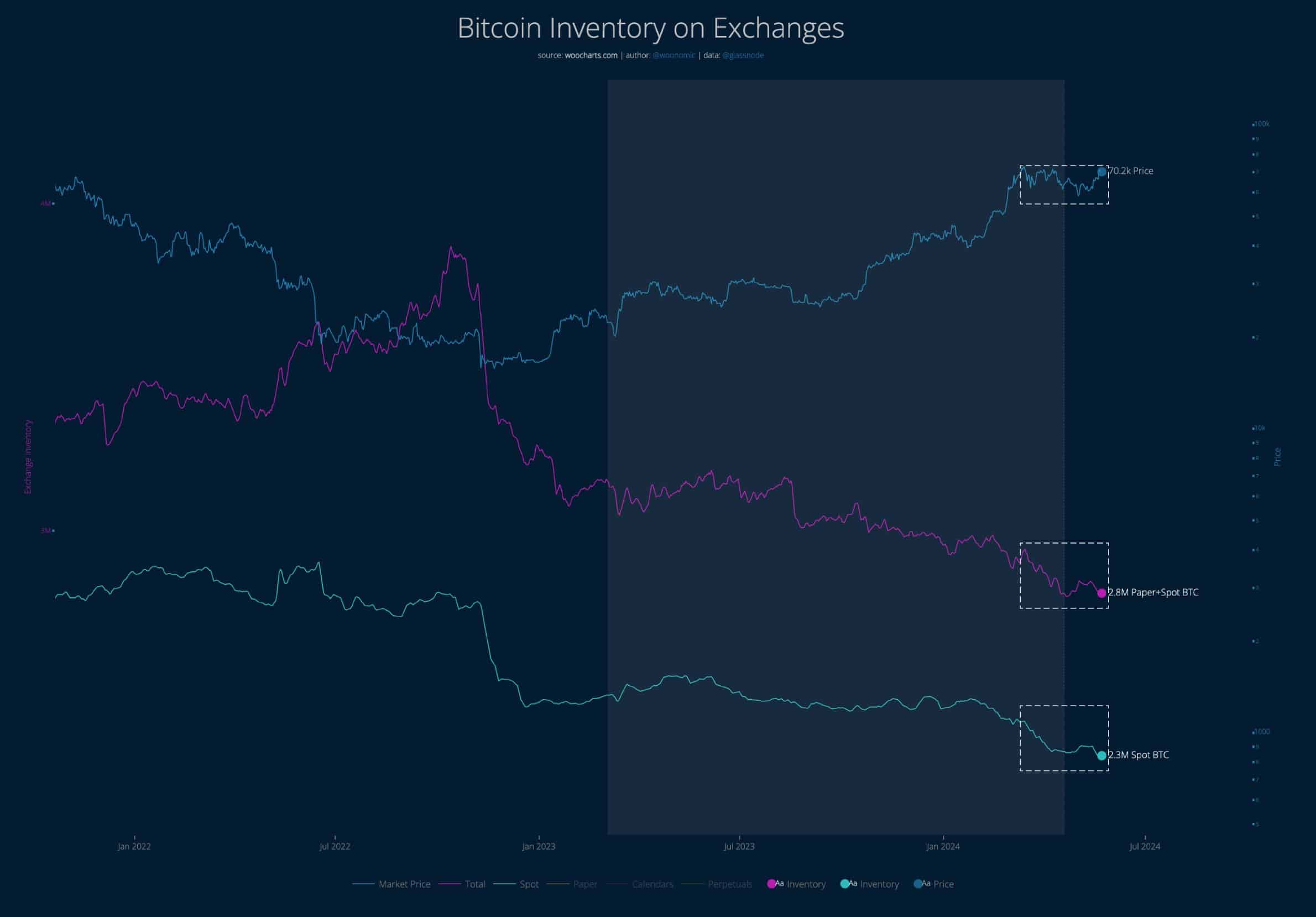

Analyst Willy Woo famous that the obtainable Bitcoin was being scooped up through the previous two months when the value lacked a real increased timeframe development.

This led to panic amongst retail holders, however the spot BTC demand was sizeable.

The analyst believed that it’s solely a matter of time earlier than the costs climb previous their all-time excessive towards the US Greenback.

The change whale ratio noticed a rising development in April and Could. This indicated elevated whale exercise, which is irregular throughout a bull run. Normally, through the bullish long-term development, whale exercise quietens down.

It picked up as soon as the highest was in and costs began sliding decrease.

Learn Bitcoin’s [BTC] Value Prediction 2024-25

The outflow from exchanges that Willy Woo highlighted earlier was a very good argument towards the highest being in, however the rising whale exercise may give buyers pause.

Nonetheless, the change whale ratio will not be definitive, and the proof at hand exhibits this bull run has additional to go.