- Information confirmed that Bitcoin would possibly fall under $66,000 regardless of rising bullish sentiment.

- A report defined how Bitcoin would possibly hit new peaks quicker than earlier halvings.

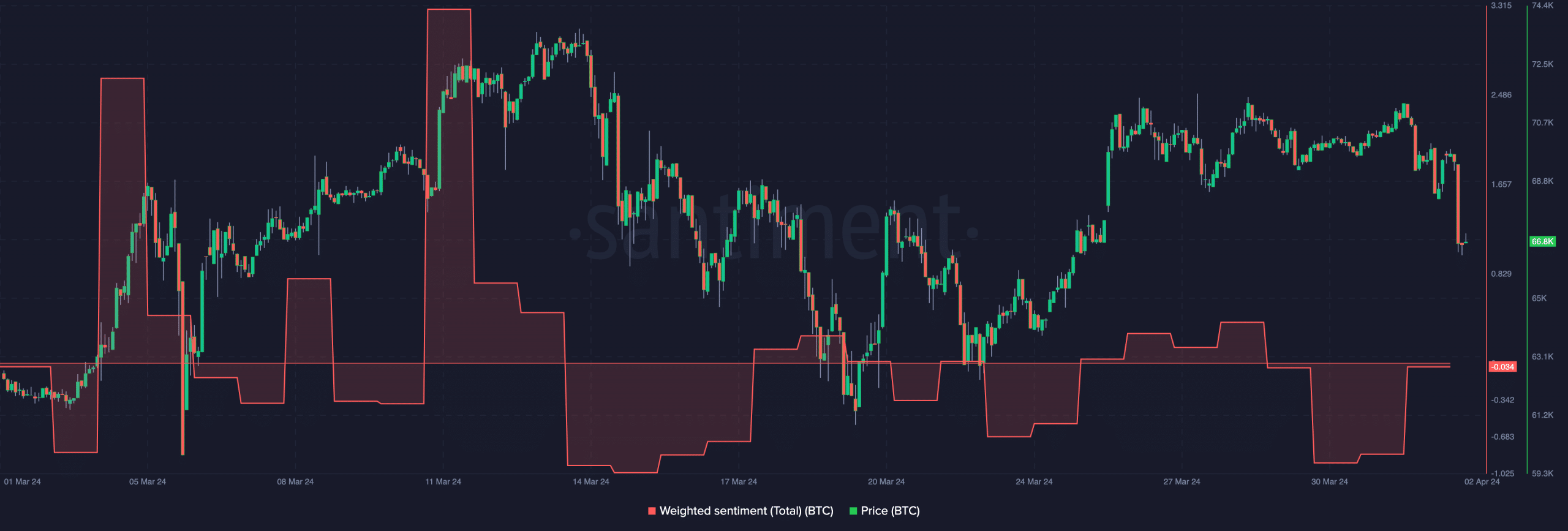

As a substitute of panicking after Bitcoin’s [BTC] value collapsed, market members are assured that the coin would possibly get better. AMBCrypto obtained this data after reviewing the social quantity utilizing Santiment.

In accordance with our evaluation, there was a surge in the usage of phrases like “bullish” and “shopping for.” Likewise, statements that embody “promoting” and “bearish” additionally elevated.

Scared cash to make extra?

Nevertheless, we observed that the bullish aspect was virtually double the scale of these in worry. Usually, you’ll count on this sentiment to gas a fast bounce for Bitcoin. However historical past says in any other case.

Sure, shopping for alternatives seem when costs crash, as they did within the final 24 hours. Nevertheless, an additional crash would possibly nonetheless occur if conviction is as excessive because it was at press time.

Supply: Santiment

Traditionally, if worry outweighs bullish conviction, and the retail cohort is panic promoting, that might be the very best time to purchase the dip. As of this writing, that has not occurred.

Therefore, it’s more likely to see BTC drop under $66,400 within the close to time period. Hours earlier than the piece, AMBCrypto reported how Bitcoin may expertise excessive volatility because the halving approaches.

“This cycle could also be quicker”

Apparently, crypto asset administration agency Grayscale additionally launched its thesis concerning the occasion and the potential influence on value.

The report, dated the first of April, targeted on Bitcoin’s efficiency in March and its potential restoration after the halving. Grayscale additionally talked about sure elements that would affect BTC later this 12 months.

In accordance with the report, Bitcoin outperformed many different property final month as a result of many central banks worldwide displayed indicators of lowering rates of interest.

Subsequently, demand for different shops of worth like Bitcoin jumped. In regards to the upcoming halving, the agency famous that it anticipated costs to drop.

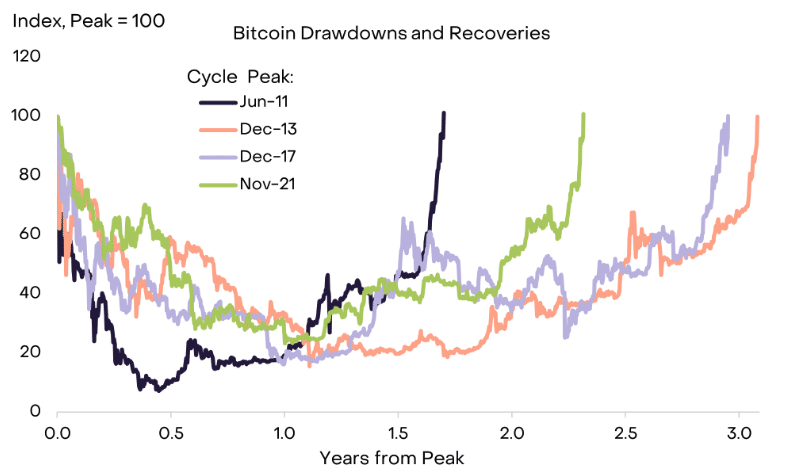

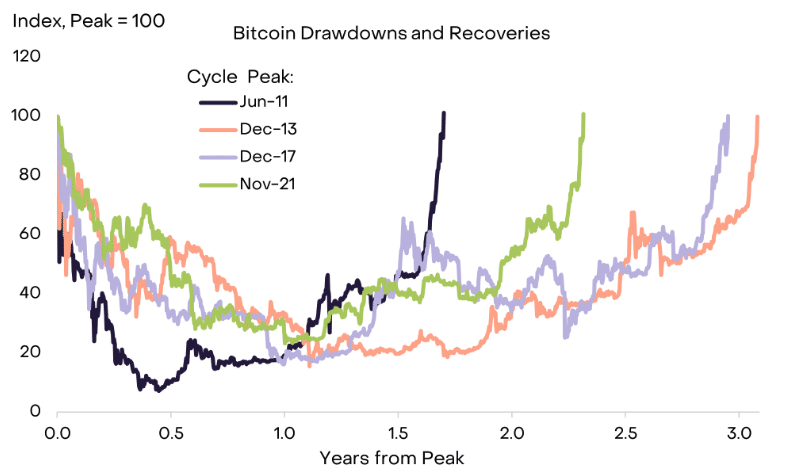

Supply: Grayscale Funding

Nevertheless, restoration might be quicker than it was through the earlier halvings. The thesis learn,

“By comparability, the restoration from the prior two drawdowns took roughly three years, whereas the restoration from the primary main drawdown took about one and a half years. In Grayscale Analysis’s view, we are actually within the “center innings” of one other Bitcoin bull market.”

Bitcoin has others to look as much as

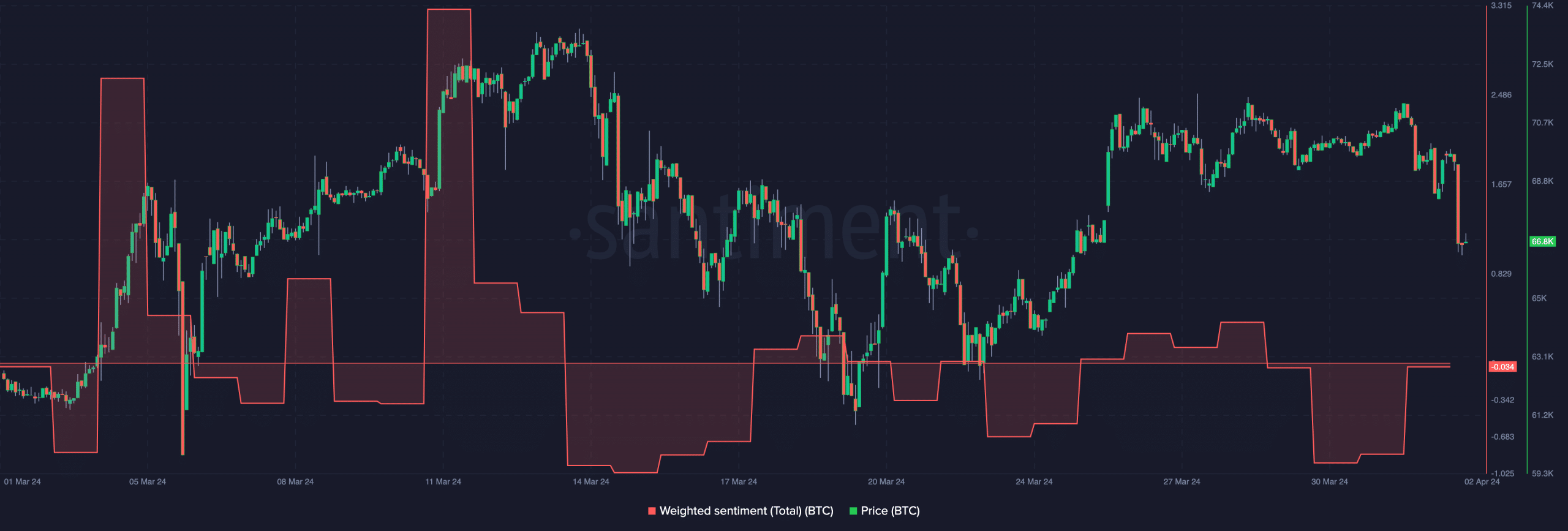

In the meantime, AMBCrypto checked the general notion of the coin out there. On the first of April, the Weighted Sentiment dropped to -0.937, suggesting that the majority members have been bearish.

However at press time, the metric gave the impression to be heading back to constructive territory. If the studying turns into constructive, it could reinforce members’ confidence initially talked about.

Supply: Santiment

Transferring on, Grayscale talked about that Bitcoin ETFs are more likely to stay a driver of the value. Subsequently, if inflows enhance, BTC would possibly climb.

Nevertheless, a rise in outflows, as we mentioned in current instances, may trigger Bitcoin to stall or decline additional.

Past that, the agency famous that the Federal Reserve’s resolution to cut back rates of interest would possibly assist BTC respect.

For the long-term horizon, it additionally famous that the November 2024 U.S. elections may affect the coin’s route.

Learn Bitcoin’s [BTC] Value Prediction 2024-2025

Over the last elections in 2020, Bitcoin went from lower than $13,000 and obtained near hitting $20,000 inside a month.

Will the situation be related this time? Time will inform. However for now, the coin’s decline would possibly lengthen somewhat longer.