- Regardless of basic variations, Bitcoin and Dogecoin share a robust correlation

- Brief-term trajectory pointed to a DOGE value enhance and a BTC decline

Not many cryptocurrencies have survived a decade of existence. And but, Bitcoin [BTC] and Dogecoin [DOGE] have been out there for greater than 10 years. Regardless of that, not many are conscious of the distinction between each.

On this article, AMBCrypto will dive into the similarities and variations between Bitcoin and Dogecoin. You’d additionally study their respective value motion and on-chain circumstances.

Bitcoin vs Dogecoin: Who takes the crown?

Bitcoin and Dogecoin have a number of issues in frequent. Probably the most notable one is that they each use the Proof-of-Work (PoW) consensus mechanism.

This similarity is why the blockchains are among the many high tasks who nonetheless stick with mining, as a substitute of adopting the usage of validators. Nevertheless, the foremost distinction between them is their provide.

Whereas Dogecoin’s provide is limitless, Bitcoin’s most provide is 21 million cash, making it a extra scarce asset than DOGE. At press time, DOGE was altering palms at $0.12.

This was a 38.19% hike on a Yr-To-Date (YTD) foundation. So far as Bitcoin was involved, it was valued at at $61,579 – A 39.42% enhance throughout the identical interval.

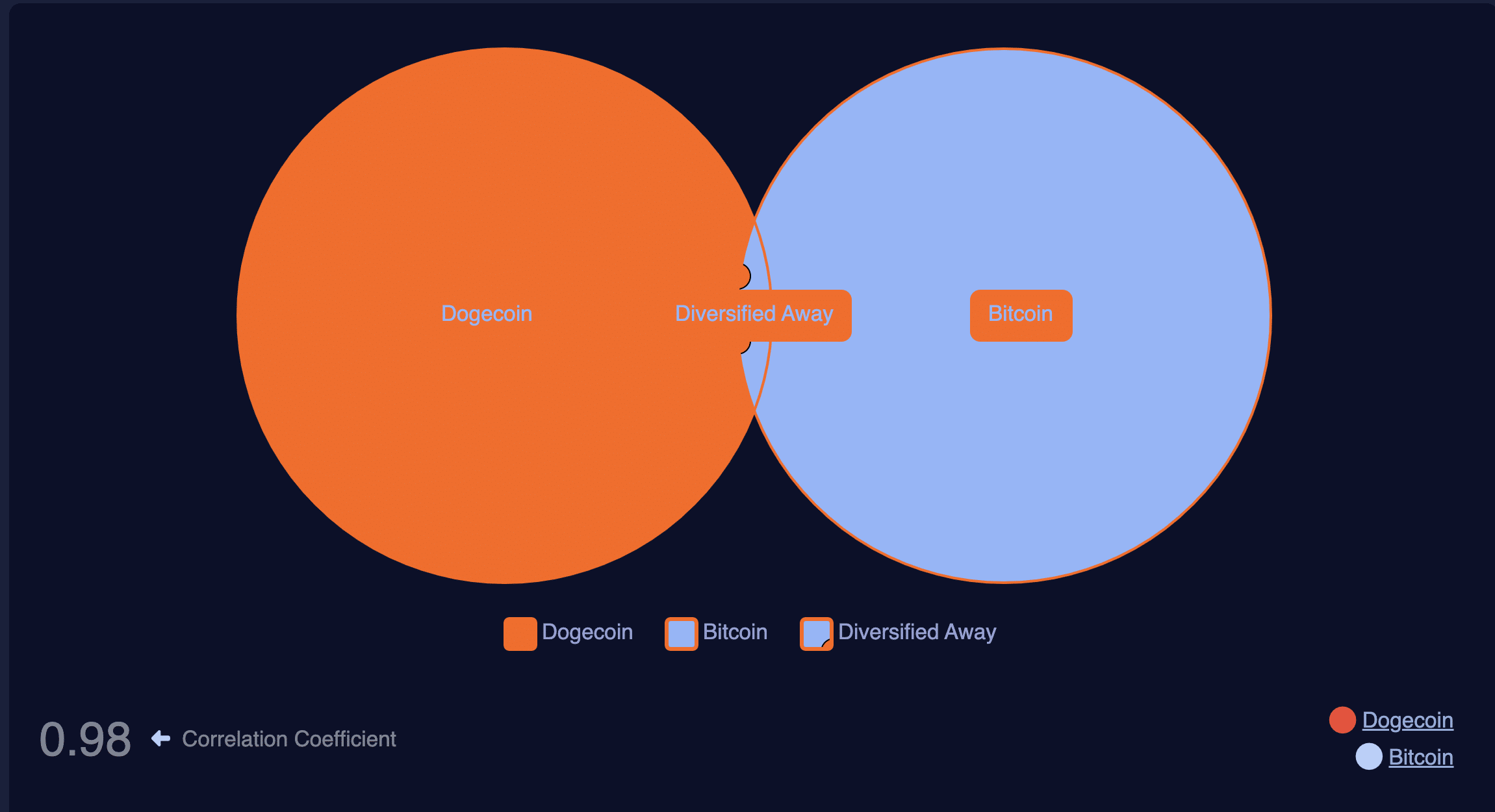

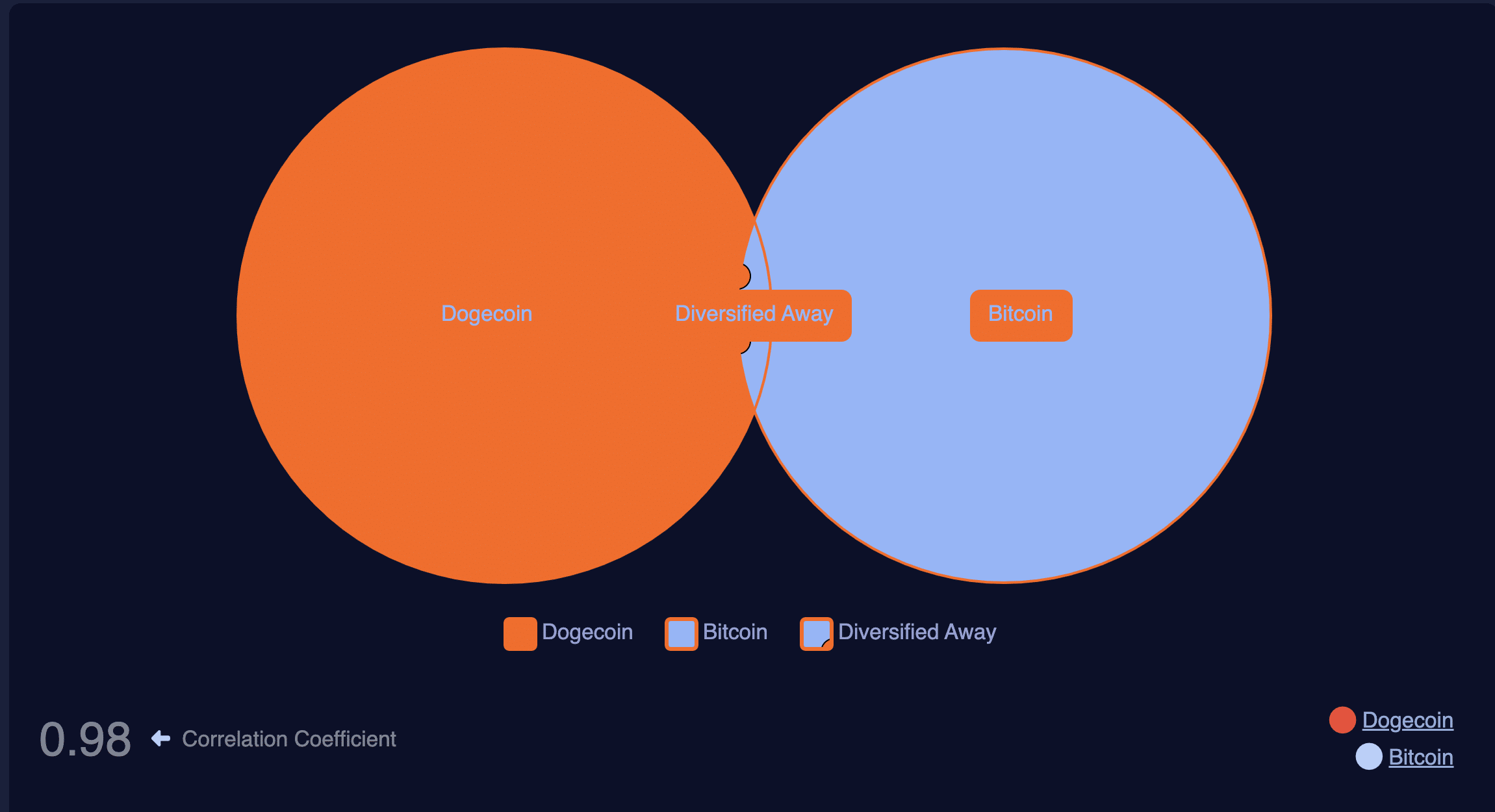

Once we assessed the costs of each cryptocurrencies, we seen that there was a robust correlation. For example,, in keeping with Macroaxis, the Bitcoin vs. Dogecoin correlation stood at 0.98.

Supply: Macroaxis

Values of the correlation coefficient vary from -1 to +1. When the studying is near -1, it signifies that the costs diverge, they usually not often transfer collectively.

Nevertheless, a coefficient near +1 implies in any other case. Subsequently, the correlation between BTC and DOGE confirmed that in the event you invested some cash into each cash for the reason that begin of the yr, you’d get nearly the identical returns.

Nevertheless, the returns on Bitcoin could be barely increased. Ergo, the query – Will the costs proceed to maneuver in the identical route? Let’s take a look at it.

DOGE takes the higher hand this time

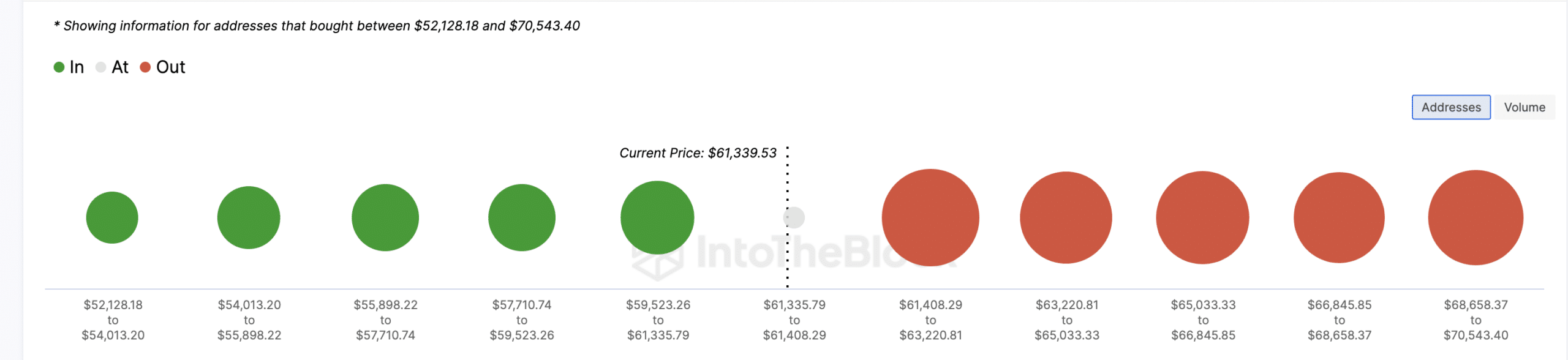

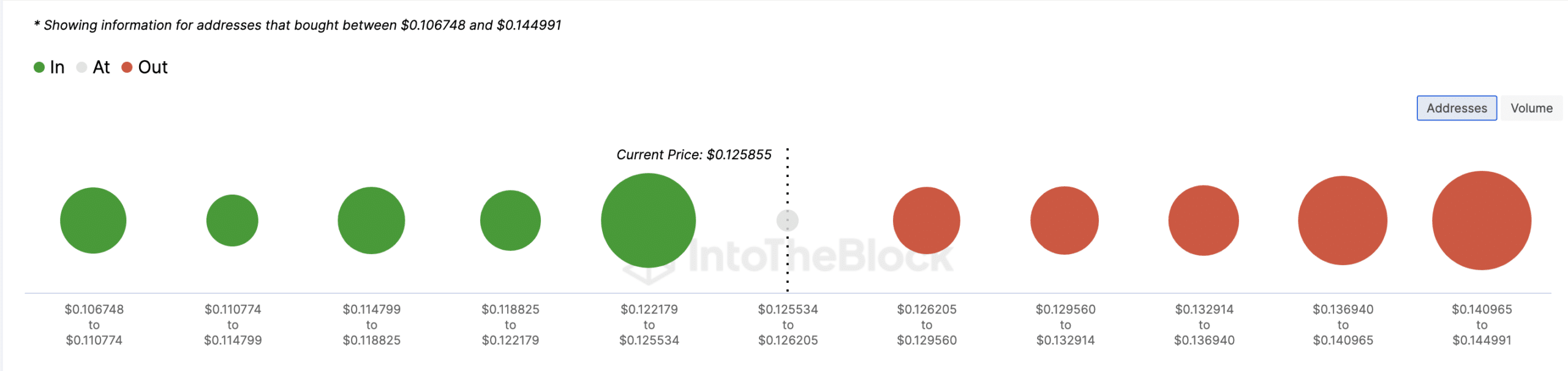

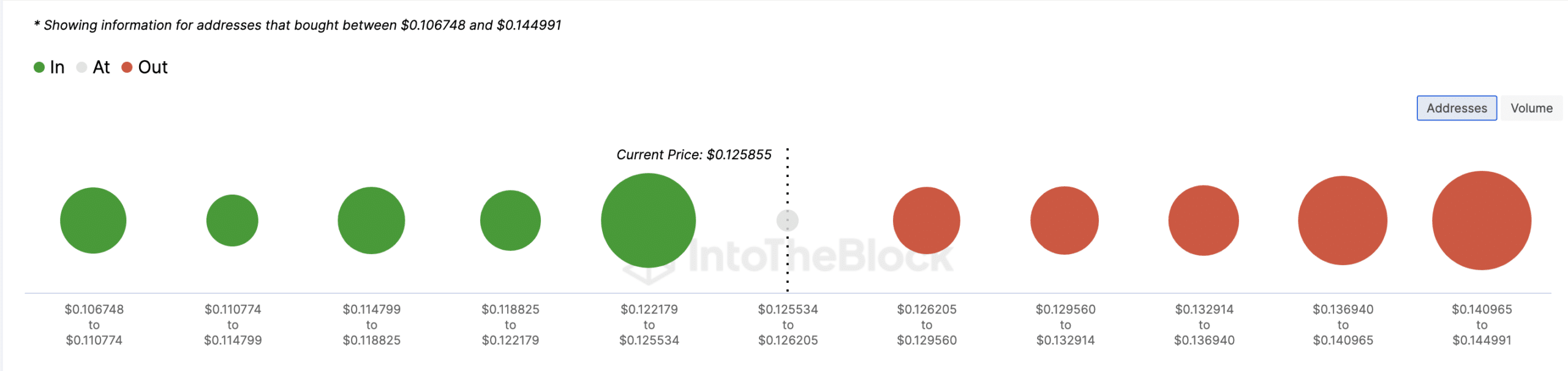

To establish this chance, AMBCrypto analyzed the In and Out of Cash Round Worth (IOMAP). This indicator, offered by IntoTheBlock, spots help and resistance ranges.

It does this by grouping addresses that purchased at a sure value vary. A few of which might be in revenue, and a few in loss. Usually, the bigger the cluster of addresses, the stable the help or resistance offered.

At press time, AMBCrypto discovered {that a} sell-wall appeared at $62,134. At this level, 1.64 million addresses purchased 759,670 BTC. On the opposite finish, 755, 240 addresses purchased 445,280 BTC at round $60,793.

Supply: IntoTheBlock

Contemplating the distinction, it’s possible that Bitcoin would possibly face one other decline. If that is so, the coin dangers falling under $60,000. As such, it won’t be the most effective time to purchase BTC.

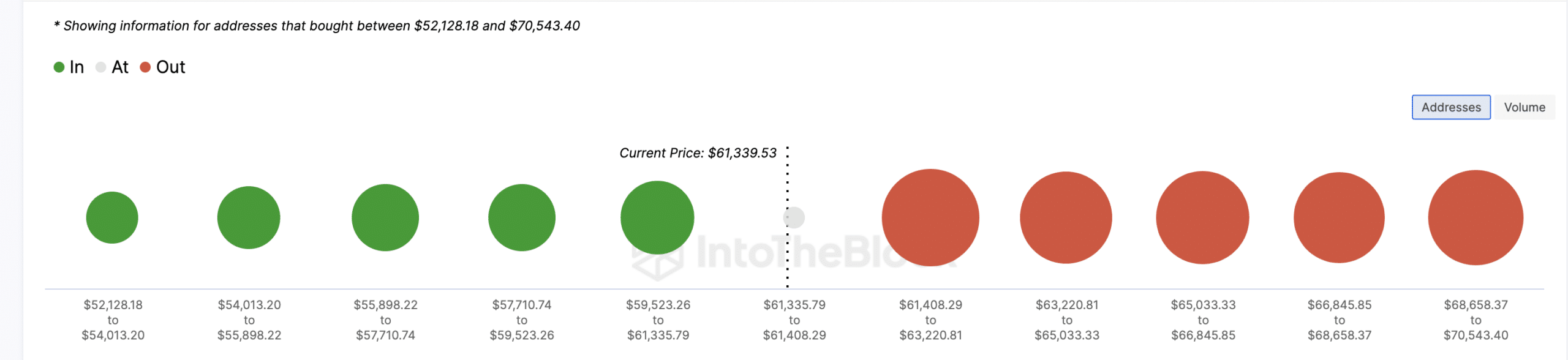

For Dogecoin, it was a completely different scenario. In contrast to Bitcoin, DOGE had its help at $0.12. This, as a result of 86,480 addresses bought 6.87 billion DOGE on the stated value.

This was greater than 33,520 addresses that purchased 717.77 million cash at a better worth. Due to this situation, DOGE would possibly simply commerce at a better worth within the brief time period.

Supply: IntoTheBlock

Sensible or not, right here’s DOGE’s market cap in BTC phrases

As well as, the doable goal for Dogecoin is between $0.13 and $0.15. Merely put, the memecoin would possibly supply a greater return than Bitcoin within the brief time period.