- Analysts downplayed the optimistic affect of Fed price cuts on Bitcoin.

- Andrew Kang acknowledged that BTC may stay range-bound till a key crypto catalyst emerges.

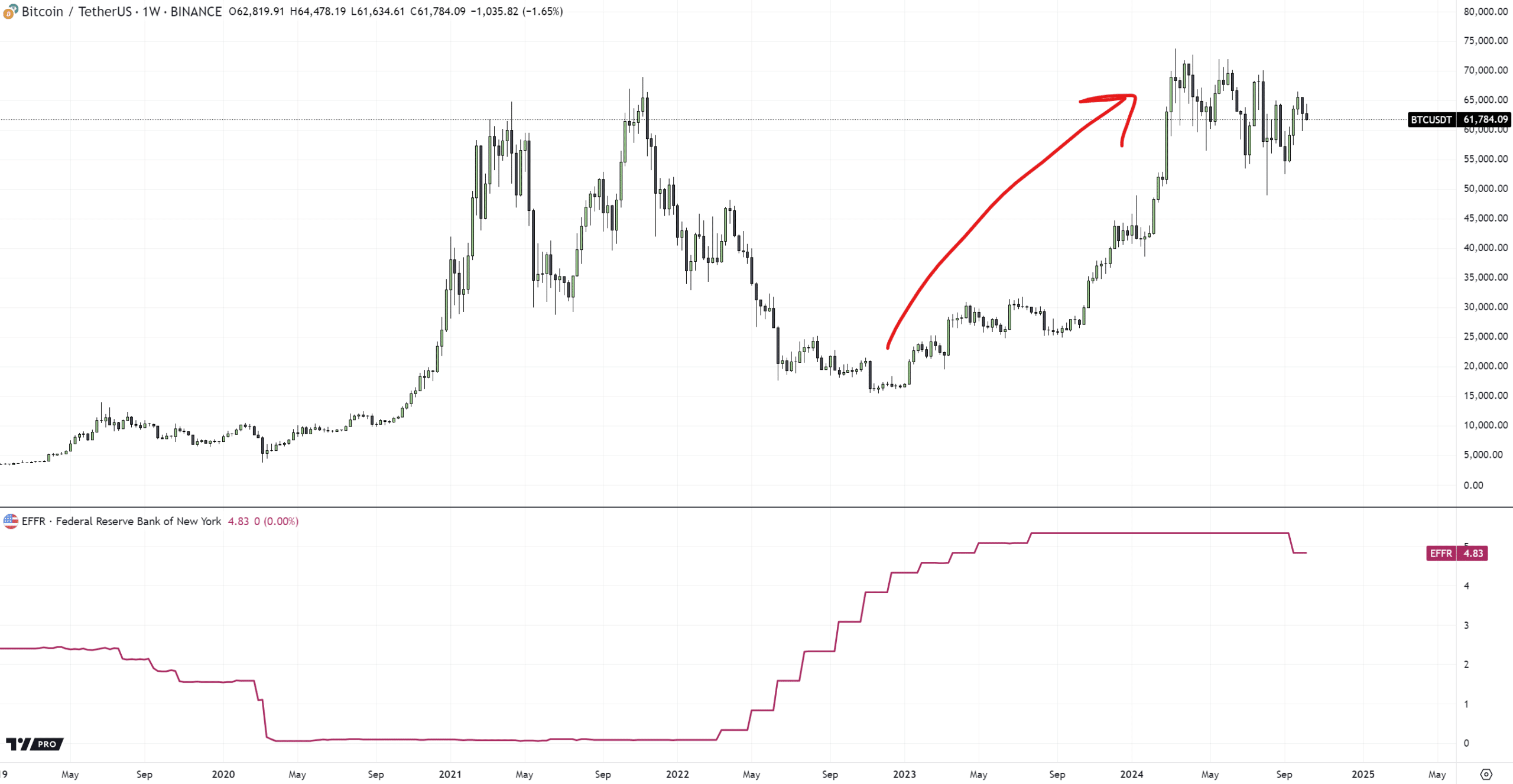

There’s an general market optimism that Bitcoin [BTC] may explode in This fall 2024, particularly given the continuing U.S. Fed price cuts and China stimulus bundle.

These components have been considered as internet optimistic for world liquidity and danger belongings, together with BTC. The aggressive 50 bps Fed price lower in September was deemed because the catalyst for BTC’s rally to $66K.

Contrarian view Fed price cuts

However Andrew Kang, co-founder of crypto funding agency Mechanism Capital, has taken a cautious and contrarian stance.

Based on Kang, the affect of the Fed price cuts and China’s coverage is likely to be overstated. He said,

“I consider crypto market contributors as an entire have overstated the affect of fed price cuts and China stimulus.”

Supply: BTC vs. Fed price cuts, TradingView

Kang argued that Fed charges are simply one of many many components influencing world liquidity. He added that even world liquidity is simply one of many many components influencing crypto costs.

To again his argument, Kang cited BTC’s wild rally since 2023, when Fed charges hiked to report highs.

“It appears nonsensical to see BTC rally 4.5x throughout a interval the place charges have been going to and at multi-decade highs – displaying little correlation between charges and BTC, after which anticipate a powerful inverse correlation to current itself as quickly as charges begin happening.”

Though he acknowledged Fed charges’ significance, he felt the market overemphasized it.

SwissOne Capital, a crypto-focused asset supervisor, supported the projection.

The agency added that altcoins stand to profit greater than BTC through the Fed price lower cycle, as BTC dominance all the time declines throughout these intervals.

“In the course of the earlier rate-cutting cycle that started halfway via 2019, Bitcoin dominance then fell to 38%.”

Supply: TradingView

China stimulus

Kang additionally claimed China’s stimulus was extra bullish for shares than crypto. He cited current buying and selling reductions between USDT and the Chinese language Yuan (CNY).

“These in China have famous a migration from crypto to A shares. The info backs this up – since Chinese language stimulus was introduced, USDT has traded at a reduction to CNY. Nonetheless at 3% as of current.”

Though the Chinese language inventory rally stalled quickly, market pundits projected an additional stimulus bundle from the Chinese language authorities may reignite the uptrend.

In that case, crypto buyers may reallocate capital to shares, as Kang famous.

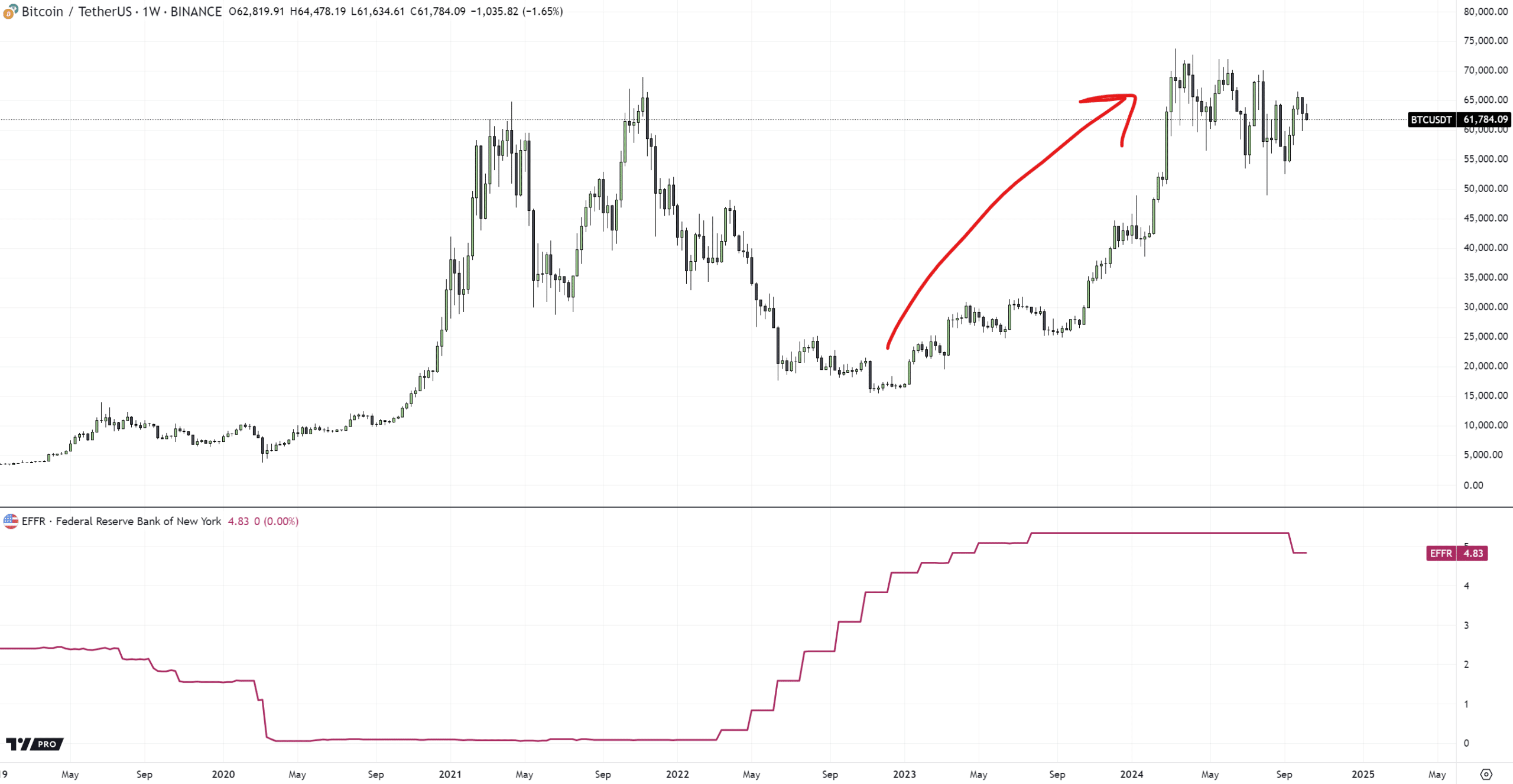

Ergo, he predicted that BTC may stay range-bound between $50K and $72K till a powerful crypto catalyst triggers the market.

“This isn’t to say I’m bearish; I simply suppose that some folks have gotten over their skis slightly. I nonetheless consider we’re in a $50k-$72k vary till there’s a significant catalyst for crypto.”

Within the meantime, BTC was nonetheless beneath the 200-day MA (Shifting Common), reinforcing that it was but to entrance a convincing market construction shift to bullish.

Supply: BTC/USDT, TradingView