- Bearish sentiment stays dominant throughout Bitcoin’s market

- A number of metrics and whale actions might be key to a value reversal

Bitcoin’s [BTC] value has as soon as once more fallen under $64k, sparking worry a few additional decline on the charts. Now, although there are a number of elements at play, a attainable purpose behind the aforementioned value correction might be whales’ newest actions.

Bitcoin whales take revenue

Market bears stepped up their sport within the final 24 hours as BTC’s value sank on the charts. In line with CoinMarketCap, BTC was down by over 2% at press time, with the crypto buying and selling at $63,042 with a market capitalization of over $1.24 trillion.

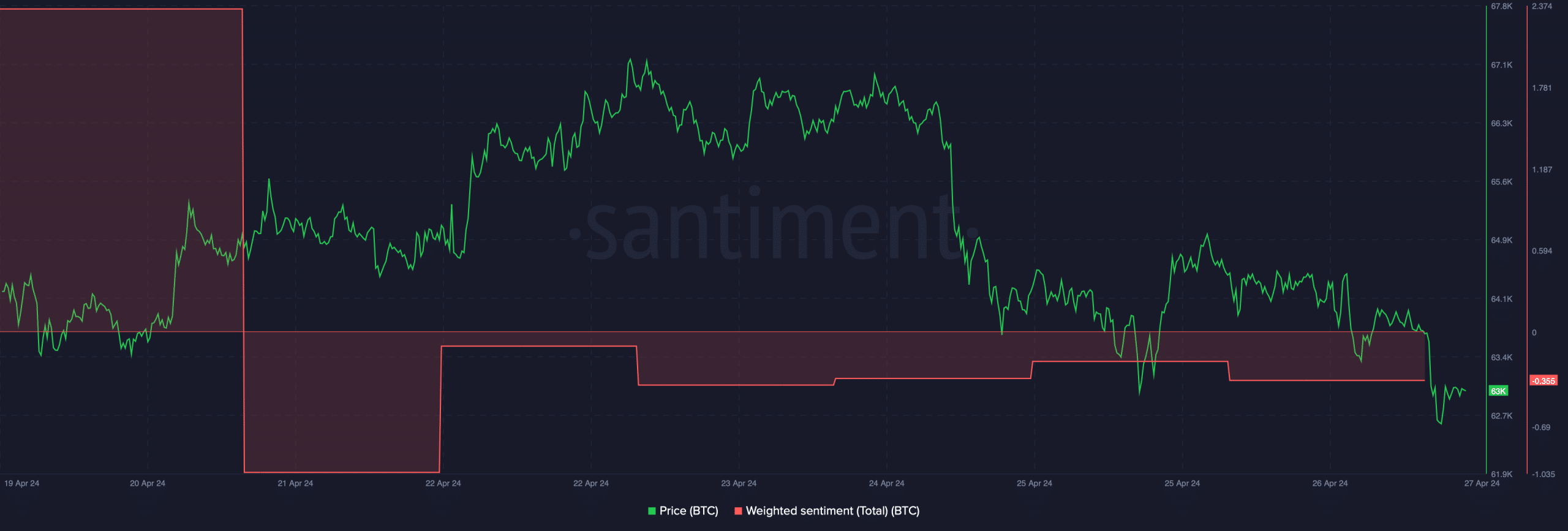

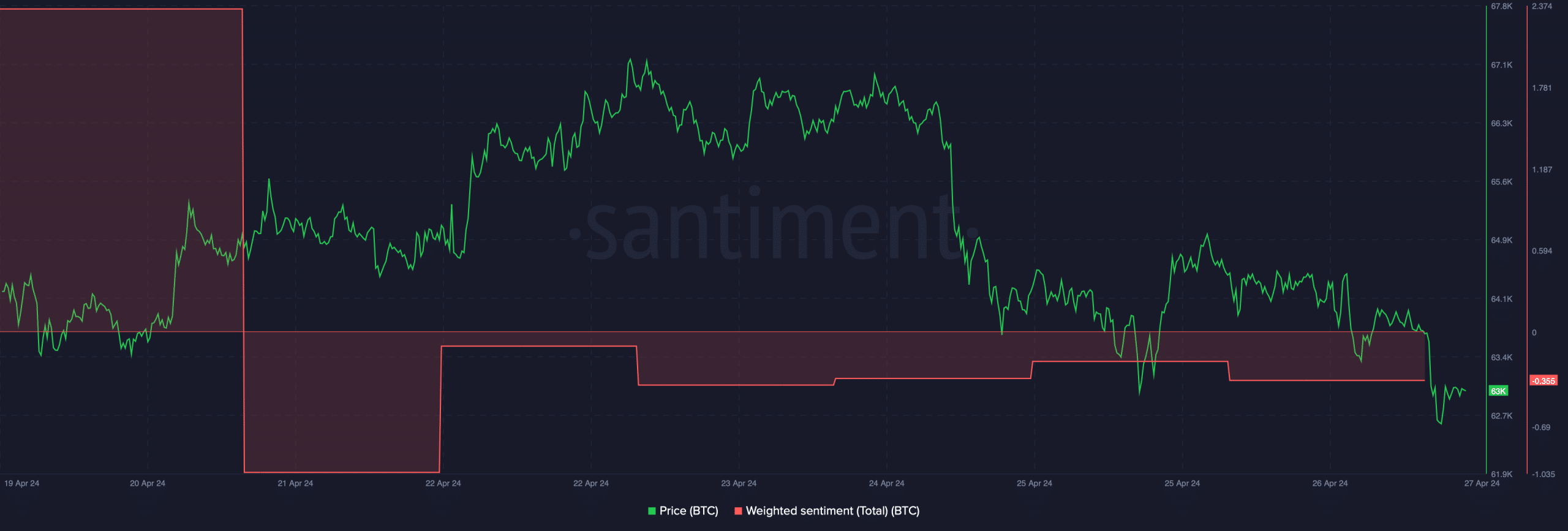

This decline additionally had an influence on the cryptocurrency’s social metrics. In reality, AMBCrypto’s evaluation of Santiment’s information revealed that BTC’s weighted sentiment went into the destructive zone – An indication that bearish sentiment retained dominance available in the market.

Supply: Santiment

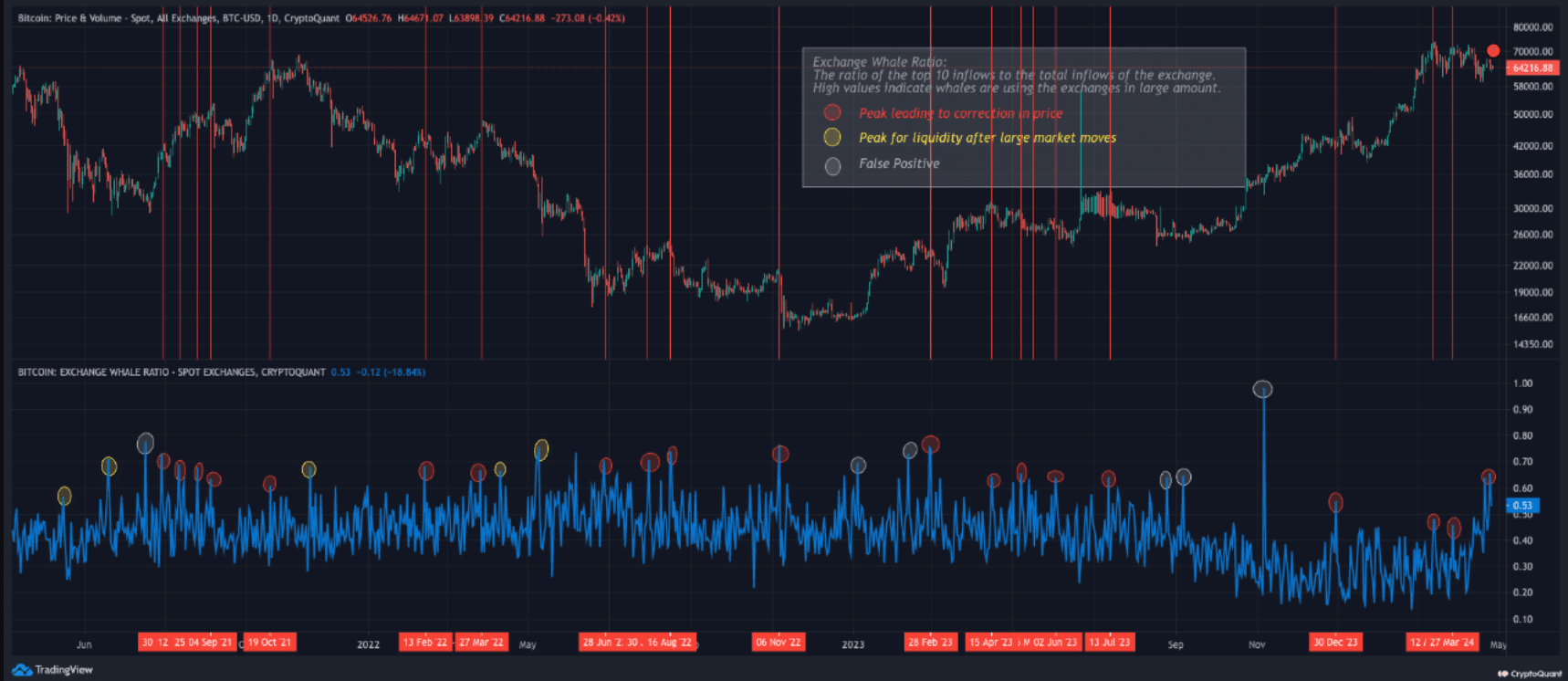

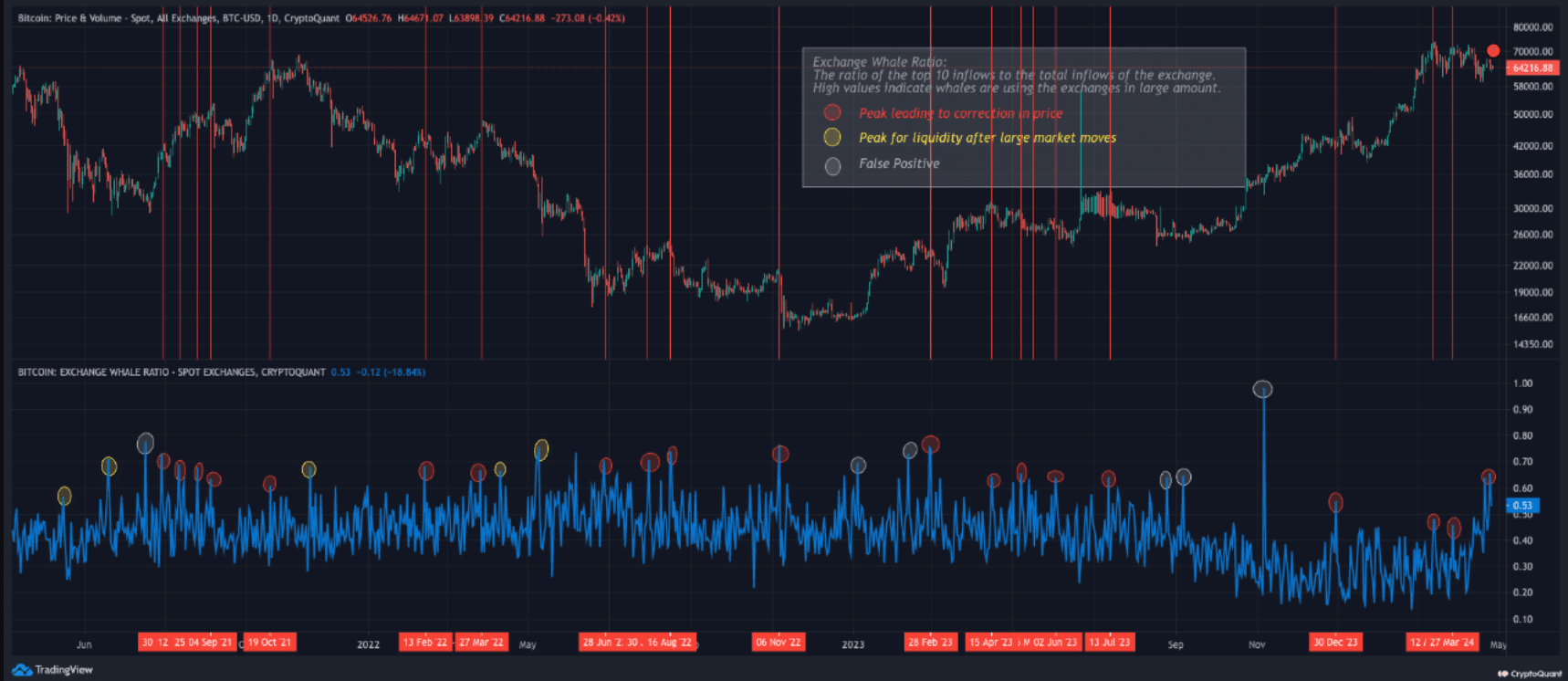

Moreover, Phi Deltalytics, an creator and analyst at CryptoQuant, lately shared an analysis highlighting an attention-grabbing growth, one which might have been the explanation behind BTC’s newest value drop.

As per the evaluation, whale Bitcoin trade inflows recorded a notable surge.

The hike accounted for a considerable portion of total trade inflows, indicating vital profit-taking by whales amidst the 2024 Bitcoin bull run. If historic information is to be thought-about, each time this metric has risen previously, it has been adopted by value corrections on a number of events.

Supply: CryptoQuant

Will Bitcoin fall even additional?

Since BTC’s value has already turned bearish, AMBCrypto checked its metrics to see whether or not an extra downtrend is certain to occur. As per CryptoQuant’s data, shopping for sentiment has been weak amongst U.S and Korean traders, with Bitcoin’s Coinbase and Korea Premiums pink too.

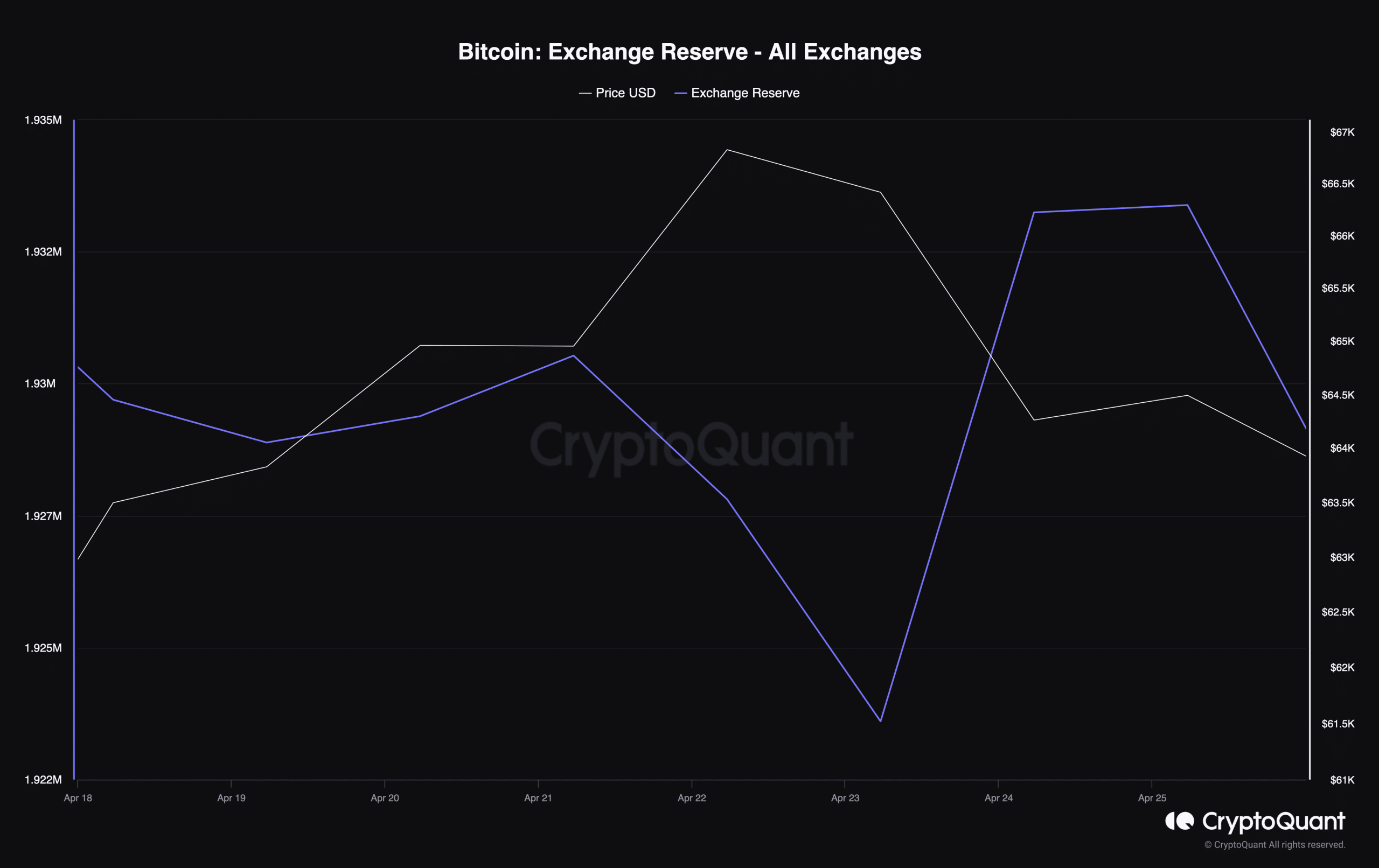

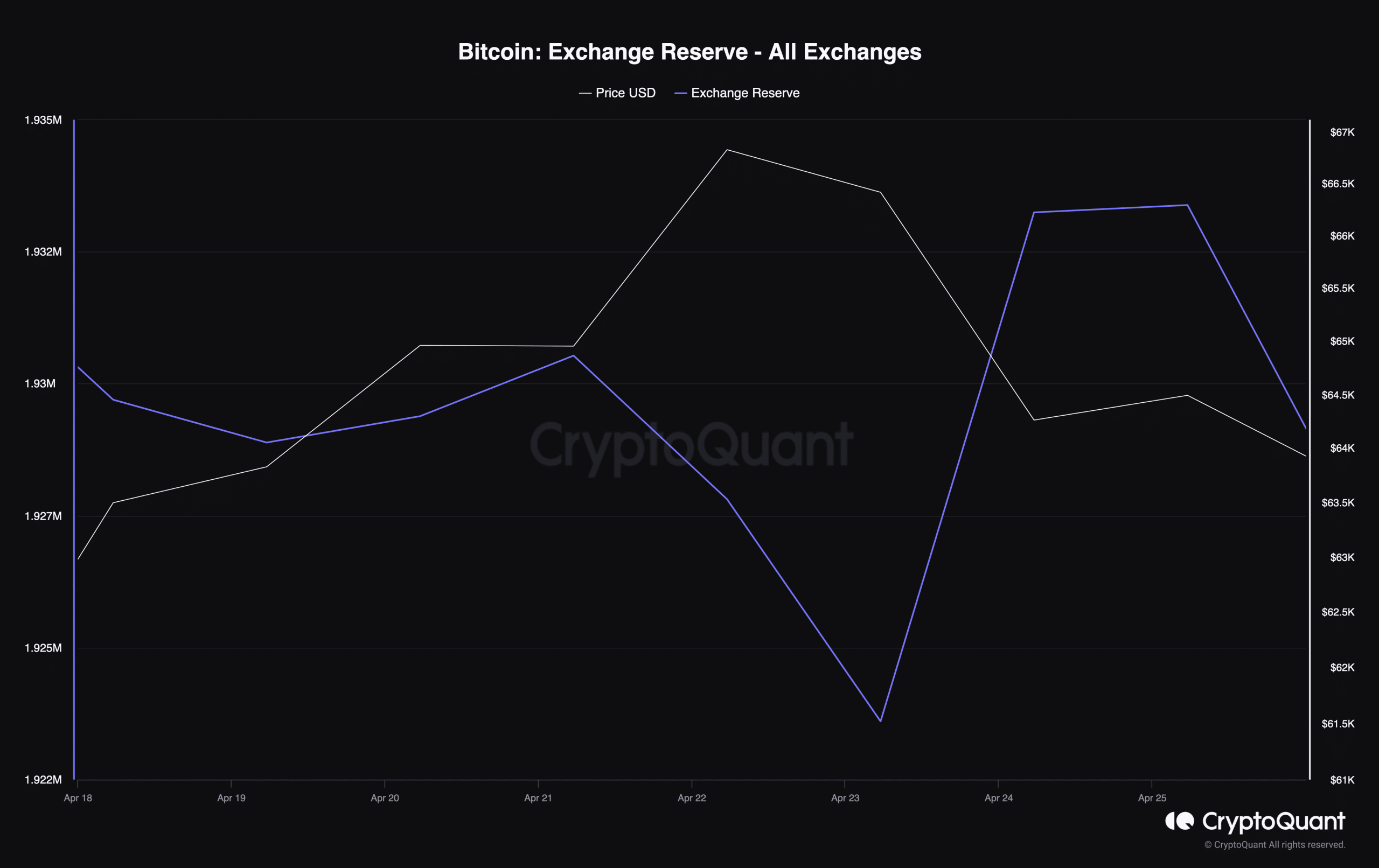

Right here, the excellent news is that after a spike on 24 April, BTC’s trade reserves began to say no – An indication that promoting strain on the king of cryptos was declining.

Supply: CryptoQuant

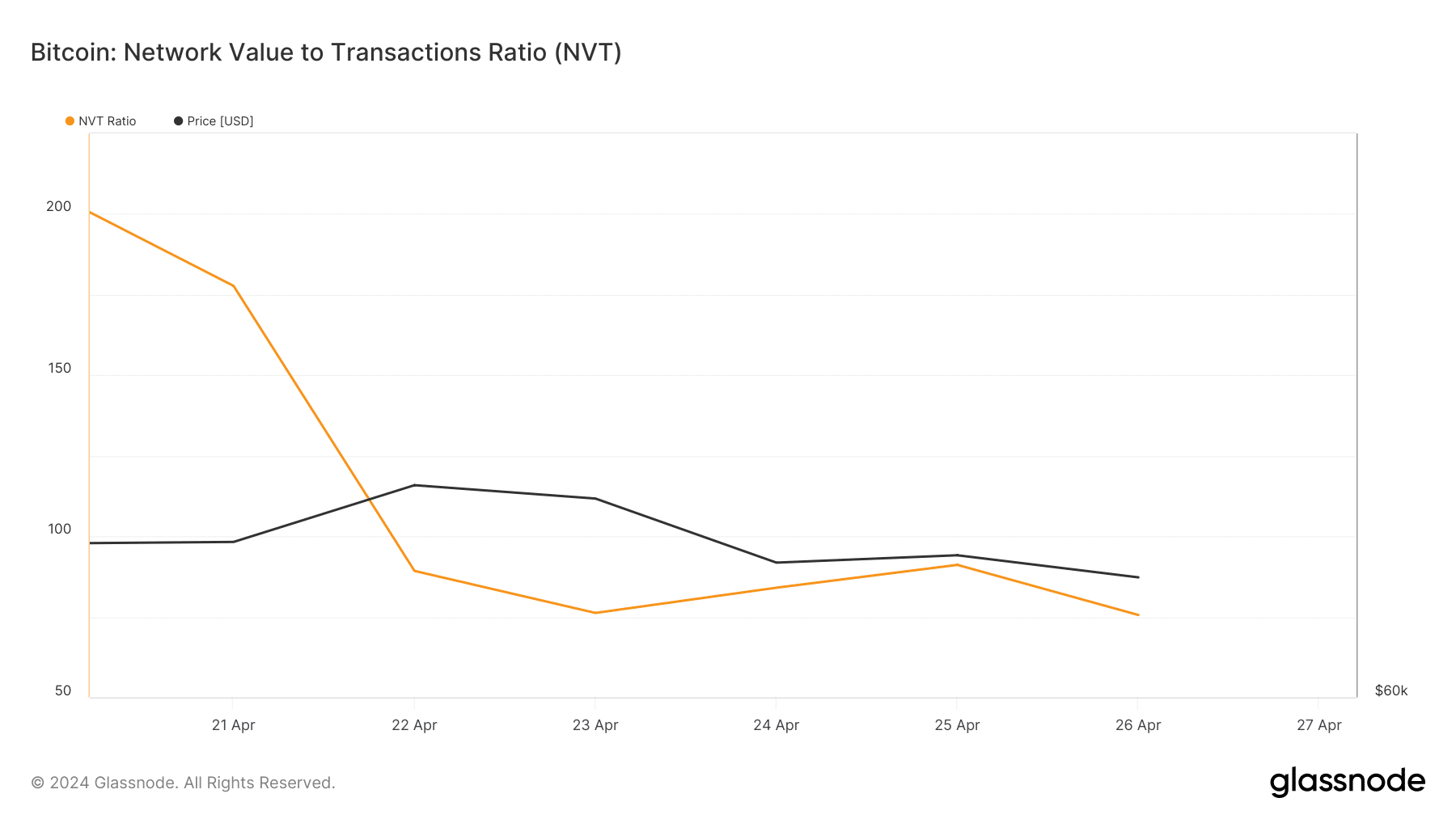

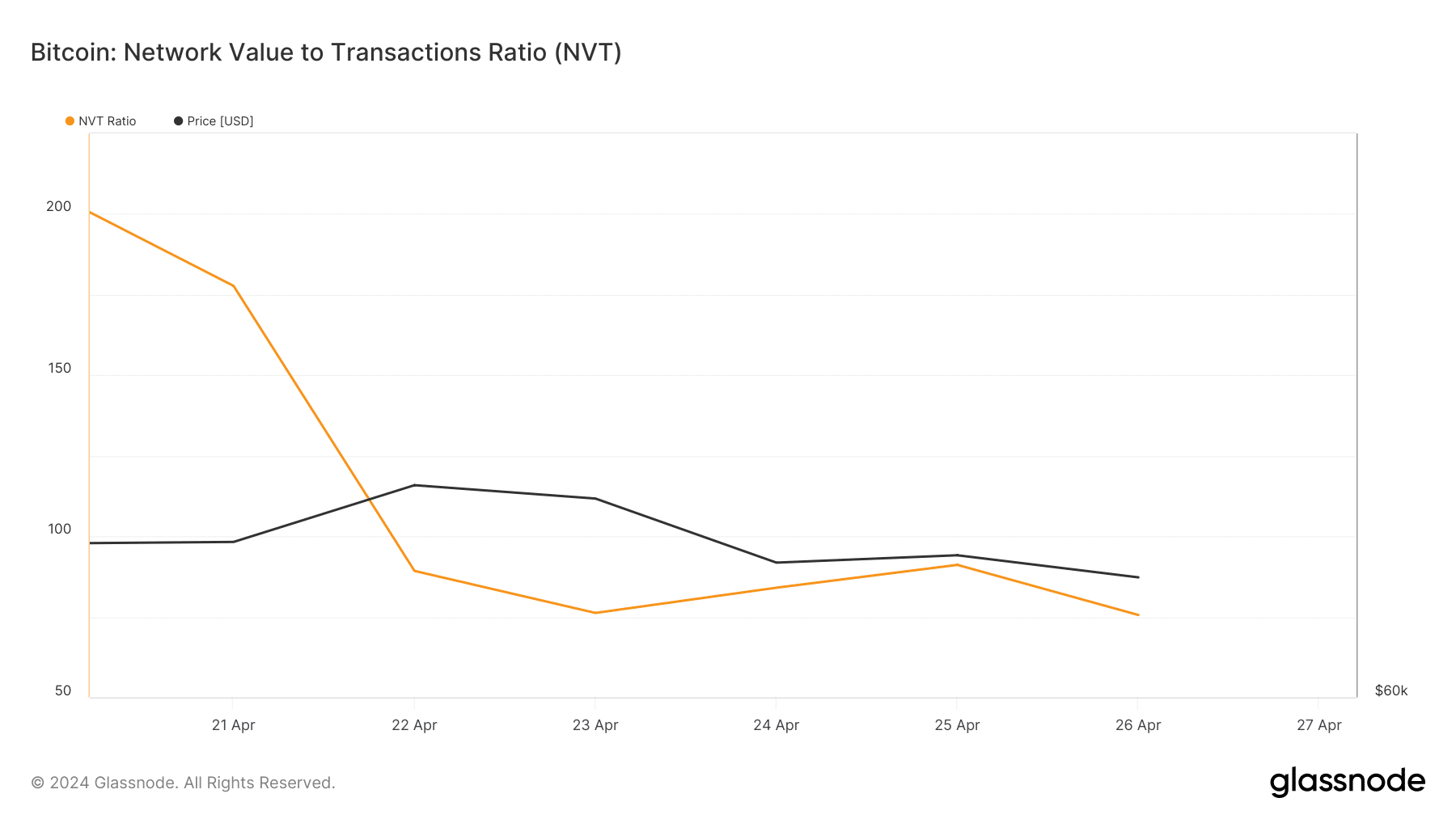

AMBCrypto’s statement of Glassnode’s information identified one more bullish sign.

BTC’s Community To Worth (NVT) ratio registered a pointy downtick. For starters, the NVT ratio is computed by dividing the market cap by the transferred on-chain quantity measured in USD.

Supply: Glassnode

Every time the metric drops, it means that an asset is undervalued. On this event, it indicated that the probabilities of BTC’s value going up have been excessive.

In reality, AMBCrypto lately reported {that a} well-trained AI mannequin predicted BTC’s value to the touch $77K inside the subsequent 30 days.

Learn Bitcoin [BTC] Value Prediction 2024 -2025

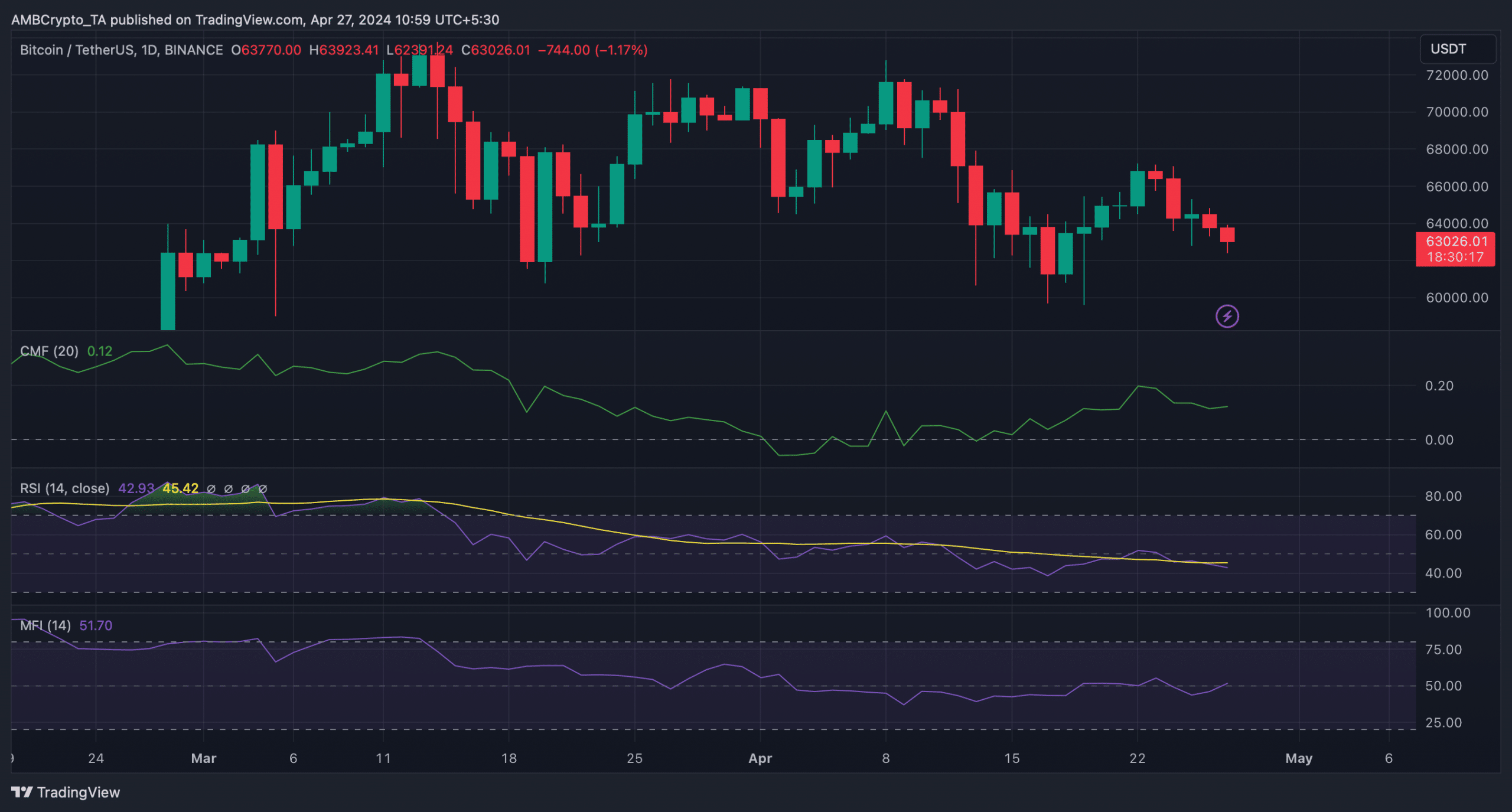

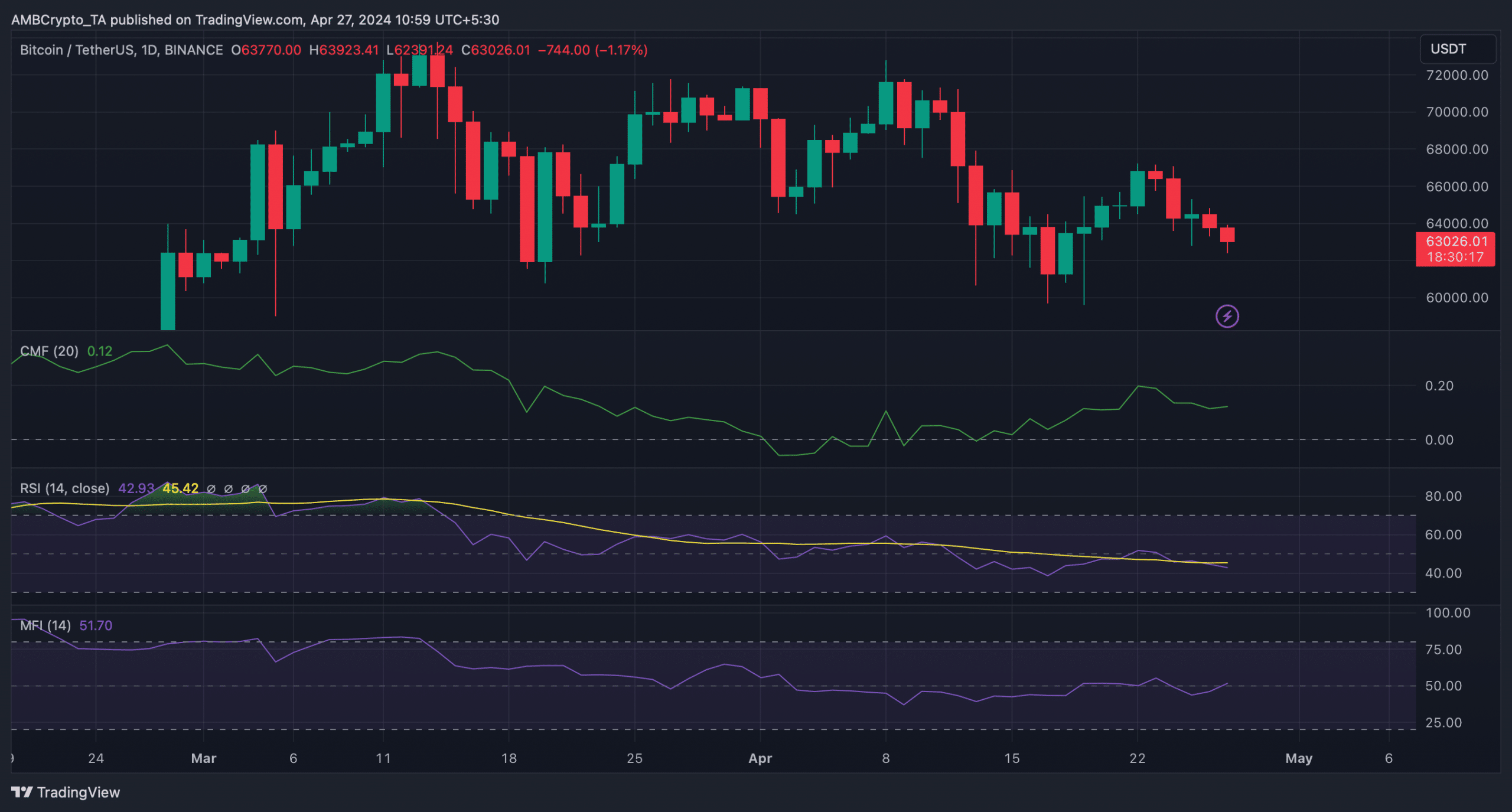

AMBCrypto then analyzed Bitcoin’s every day chart to higher perceive whether or not an uptrend is more likely to occur. BTC’s Cash Movement Index (MFI) registered an uptick and was headed additional above the impartial mark. Its Chaikin Cash Movement (CMF) was additionally resting effectively above the impartial mark of 0.

These indicators advised that BTC’s value chart would possibly quickly flip inexperienced once more. Nevertheless, the Relative Energy Index (RSI) regarded bearish because it went south.

Supply: TradingView