- U.S inflation was regular in July, elevating Fed fee lower odds

- Nonetheless, BTC’s value remained subdued and will keep range-bound

U.S inflation continues to be regular, reinforcing market expectations of a possible Fed fee lower in September. This fee lower is predicted to assist enhance Bitcoin [BTC] and different danger belongings. In line with the U.S Bureau of Financial Evaluation (BEA), the July Core PCE (Private Consumption Expenditure) Worth Index got here in at 2.5% on a yearly foundation.

The PCE Worth Index hiked by 0.2% final month, much like June’s studying, and matched analysts’ estimates. The information measures value modifications for items and providers, excluding meals and vitality, and is the Fed’s favourite variable for monitoring inflation and making financial coverage selections.

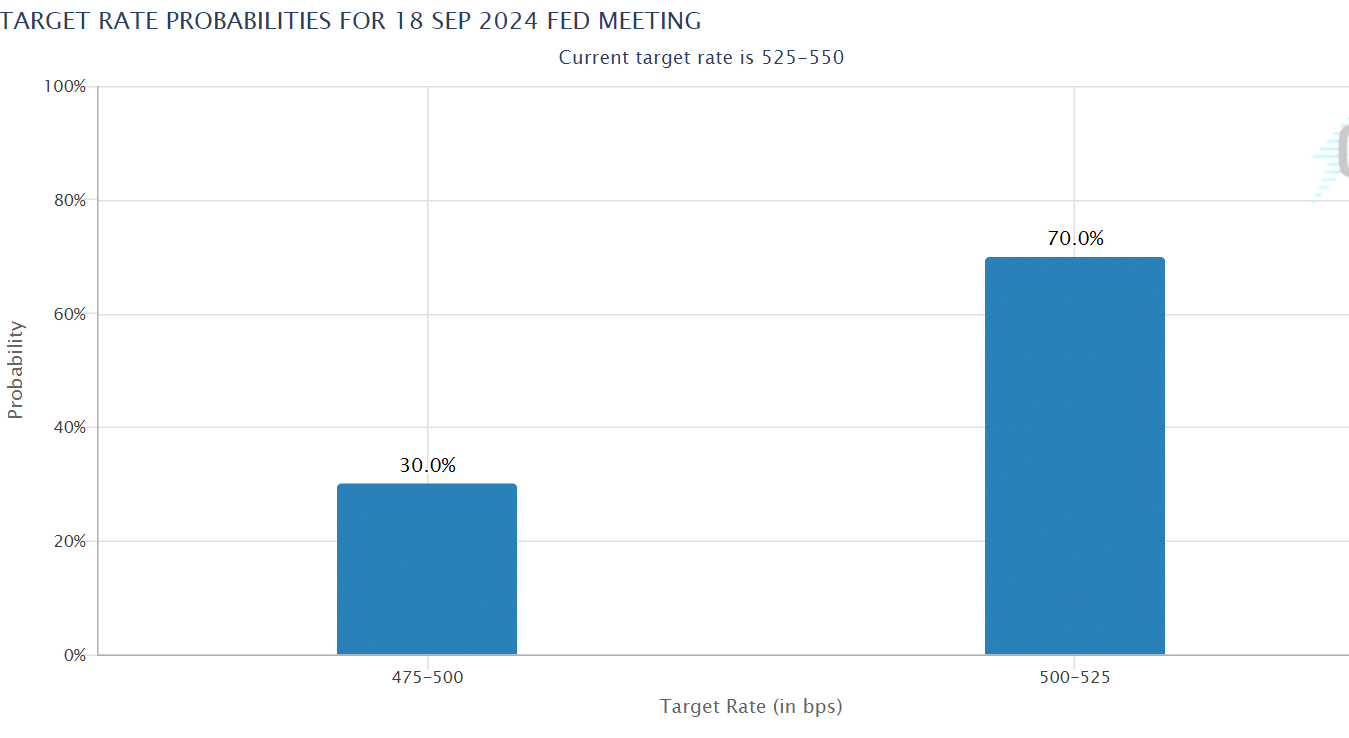

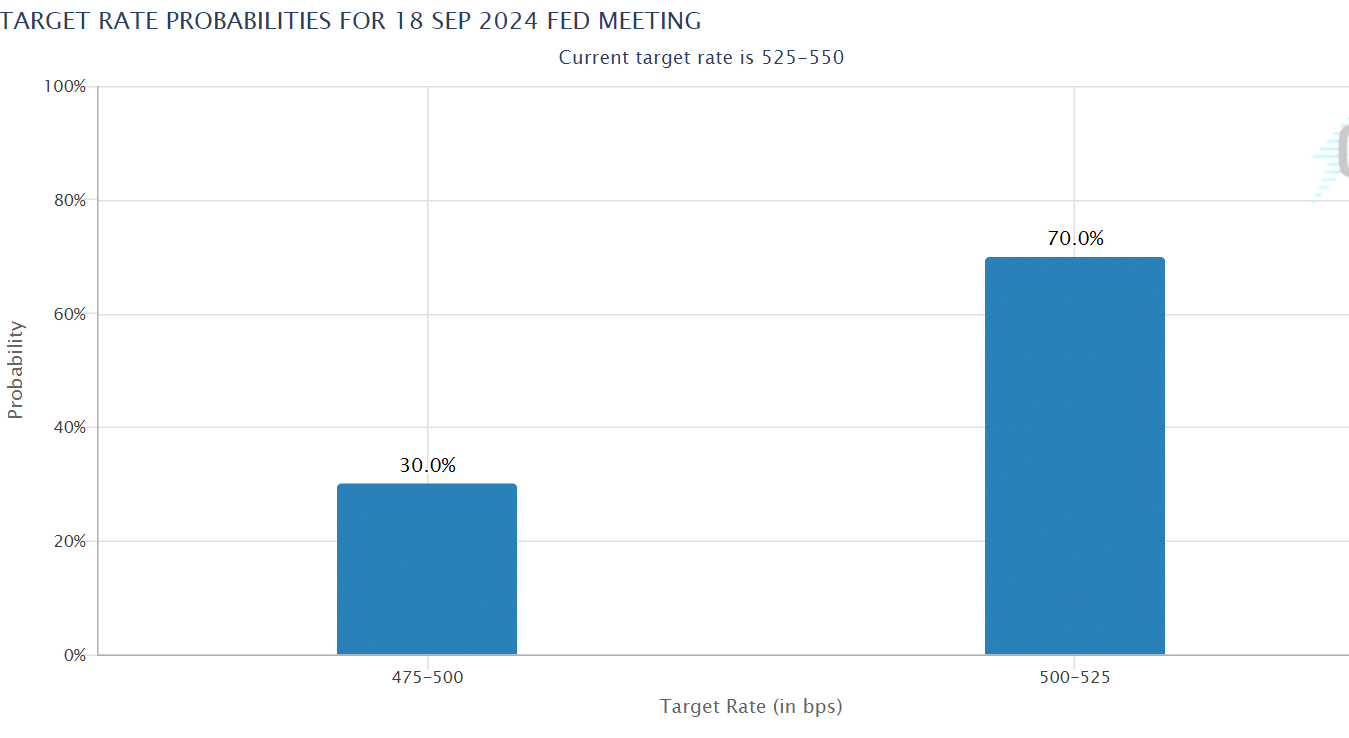

September Fed fee cuts bounce to 70%

That being stated, the regular July inflation knowledge strengthened the market’s conviction of a possible 25 foundation level (bps) Fed fee lower in September. In line with the CME FedWatch tool, curiosity merchants at the moment are pricing odds of 70% on a September fee lower.

Supply: CME FedWatch Software

That may translate to a 4% bounce from the 66% odds seen earlier than the July inflation knowledge was launched. In the meantime, some merchants have been pricing a 30% likelihood for a 50 bps fee lower throughout subsequent month’s Fed assembly.

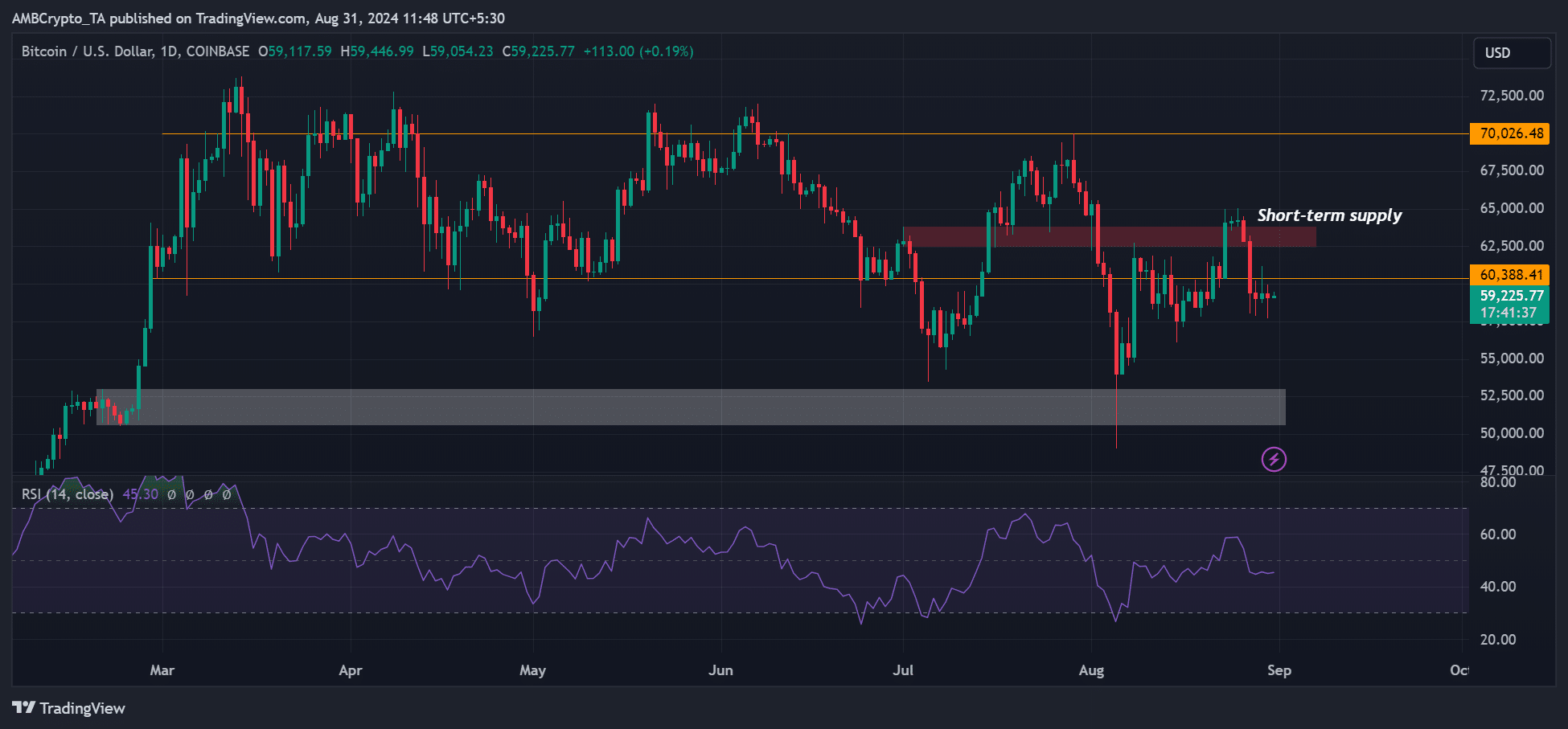

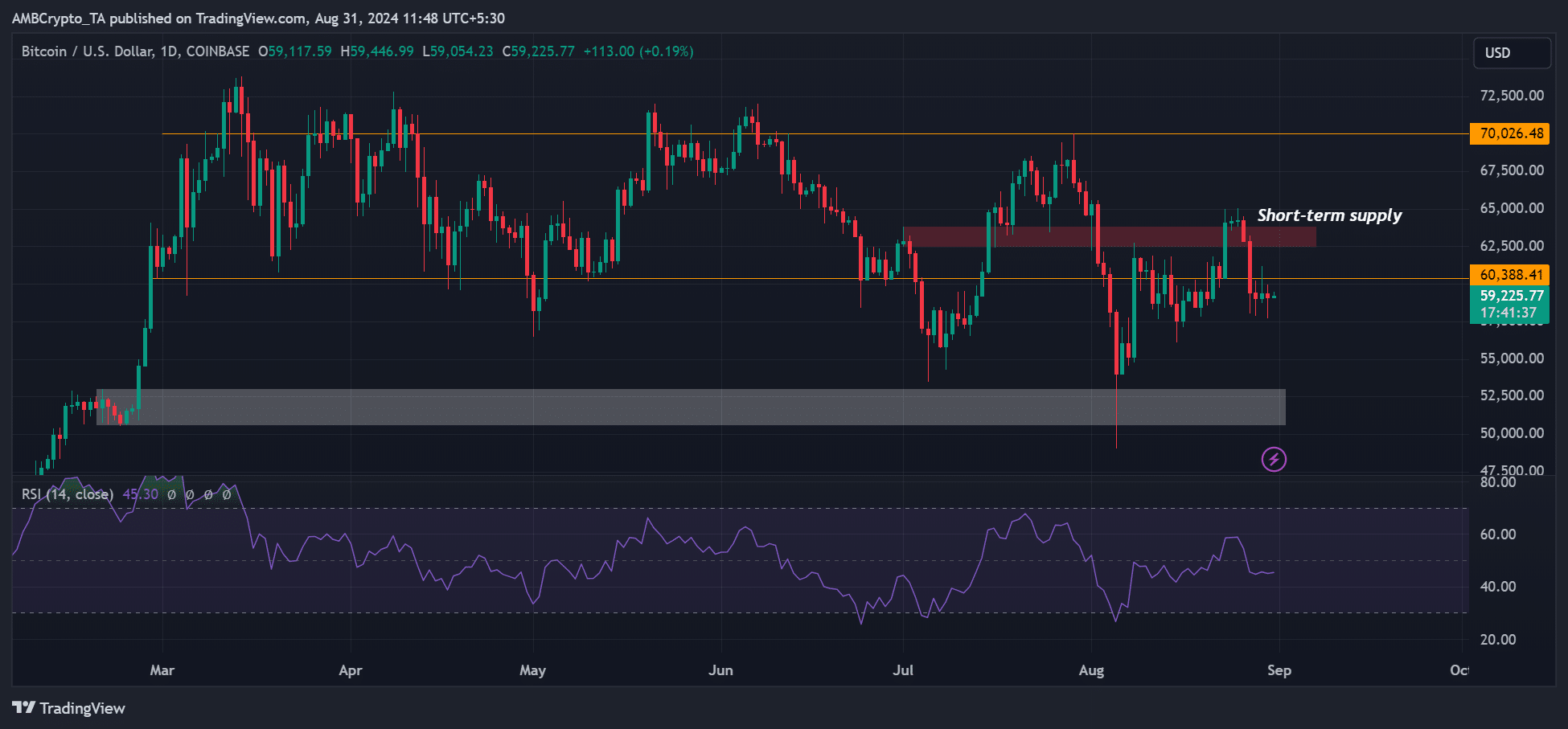

Bitcoin’s value stays muted

The information tipped U.S equities to edge increased whereas BTC and the crypto markets tanked and consolidated. BTC moved barely to $59.9k, earlier than dropping to $57k on Friday after the inflation knowledge was first launched.

Supply: BTC/USD, TradingView

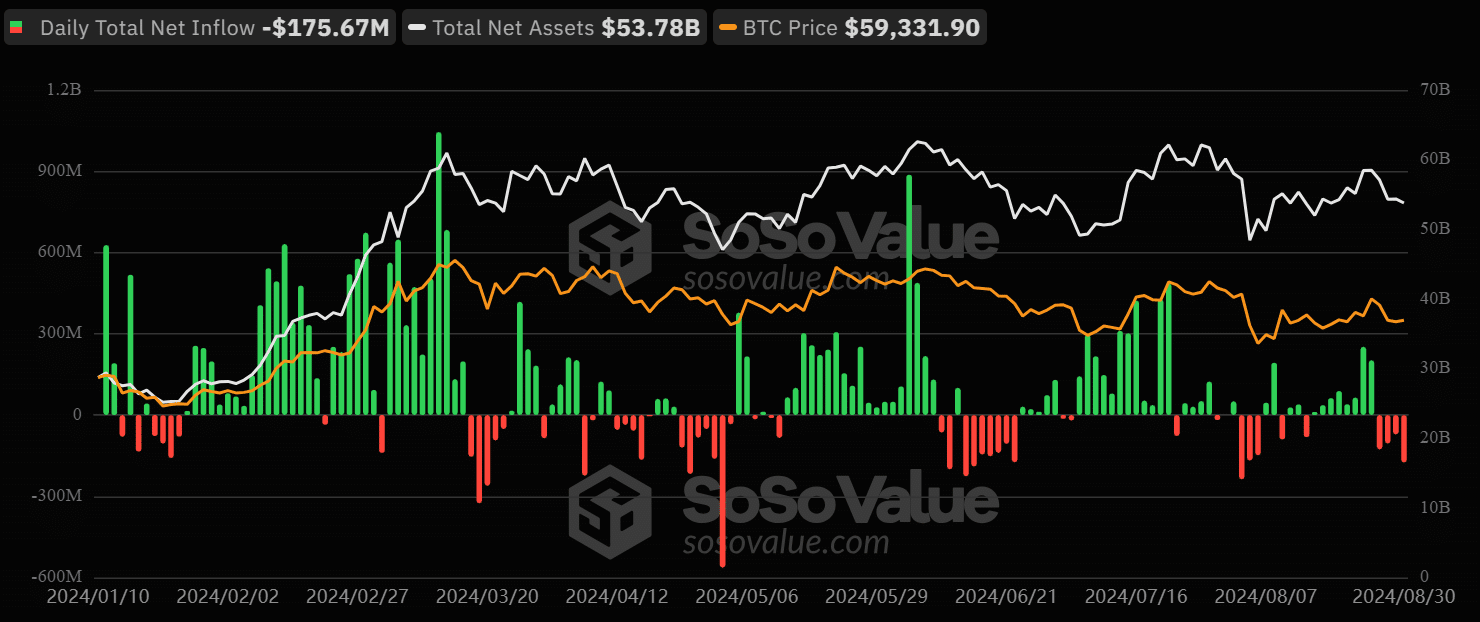

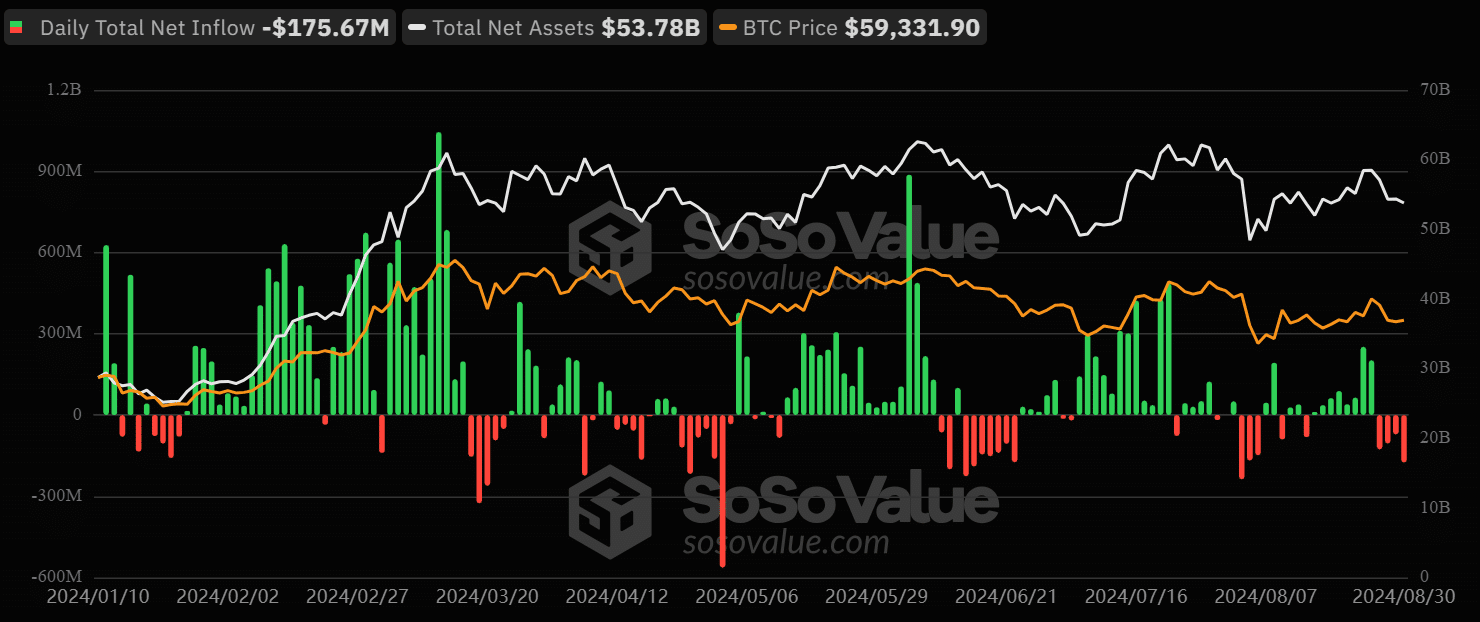

On the time of writing, the cryptocurrency was buying and selling at $59.2k, marking the fourth day it has remained under $60k. The weak sentiment and risk-off buyers’ strategy was additionally evident throughout U.S spot BTC ETFs.

Since Tuesday, the merchandise have recorded web outflows of $277 million, illustrating that the regular July inflation wasn’t sufficient to interrupt the weak development.

Supply: Soso Worth

Nonetheless, crypto buying and selling agency QCP Capital famous {that a} probably weaker U.S jobs report subsequent week may verify a ‘sturdy case’ for a Fed fee lower in September. Within the meantime, the buying and selling agency projected that BTC may stay range-bound.

“With the current macro information proving to have little impact on the crypto market, we imagine BTC is prone to stay range-bound inside 58k-65k within the brief time period because the market awaits constructive catalysts to interrupt out of this vary.”