- Bitcoin’s value appreciated by greater than 4% within the final 24 hours

- A number of metrics hinted that BTC was overbought on the charts

Bitcoin [BTC], because the market’s prime crypto, led the bull market final week as its value rallied significantly on the charts. Nonetheless, that’s not all, as knowledge revealed one other fascinating replace, one which may precipitate one other value hike.

Nonetheless, nothing might be stated with any certainty, particularly since one other indicator appeared to counsel in any other case at press time.

Bitcoin’s market dilemma

The king of crypto’s value comfortably rose by greater than 14% within the final seven days. So was the case within the final 24 hours too, with the coin’s worth surging by over 4%. On the time of writing, BTC was buying and selling at $66,616.52 with a market capitalization of over $1.3 trillion.

Ali, a well-liked crypto analyst, just lately shared a tweet highlighting a bullish improvement although. In line with the identical, the crypto has as soon as once more damaged above a resistance stage. This clearly indicated that BTC’s value would possibly advance additional within the coming days.

Nonetheless, not every part appeared to be working in BTC’s favor. As an example, the TD sequential indicator flashed a promote sign on BTC’s every day chart, as per one other tweet from Ali.

If that’s true, then BTC’s rally would possibly come to an finish quickly. Nonetheless, the tweet additionally talked about that if BTC manages to maintain the uptrend and climbs above $67.5k, then the promote sign shall be invalidated.

The place is BTC heading?

Because the aforementioned datasets regarded fairly ambiguous, AMBCrypto took a more in-depth take a look at the king of crypto’s metrics to raised perceive what to anticipate.

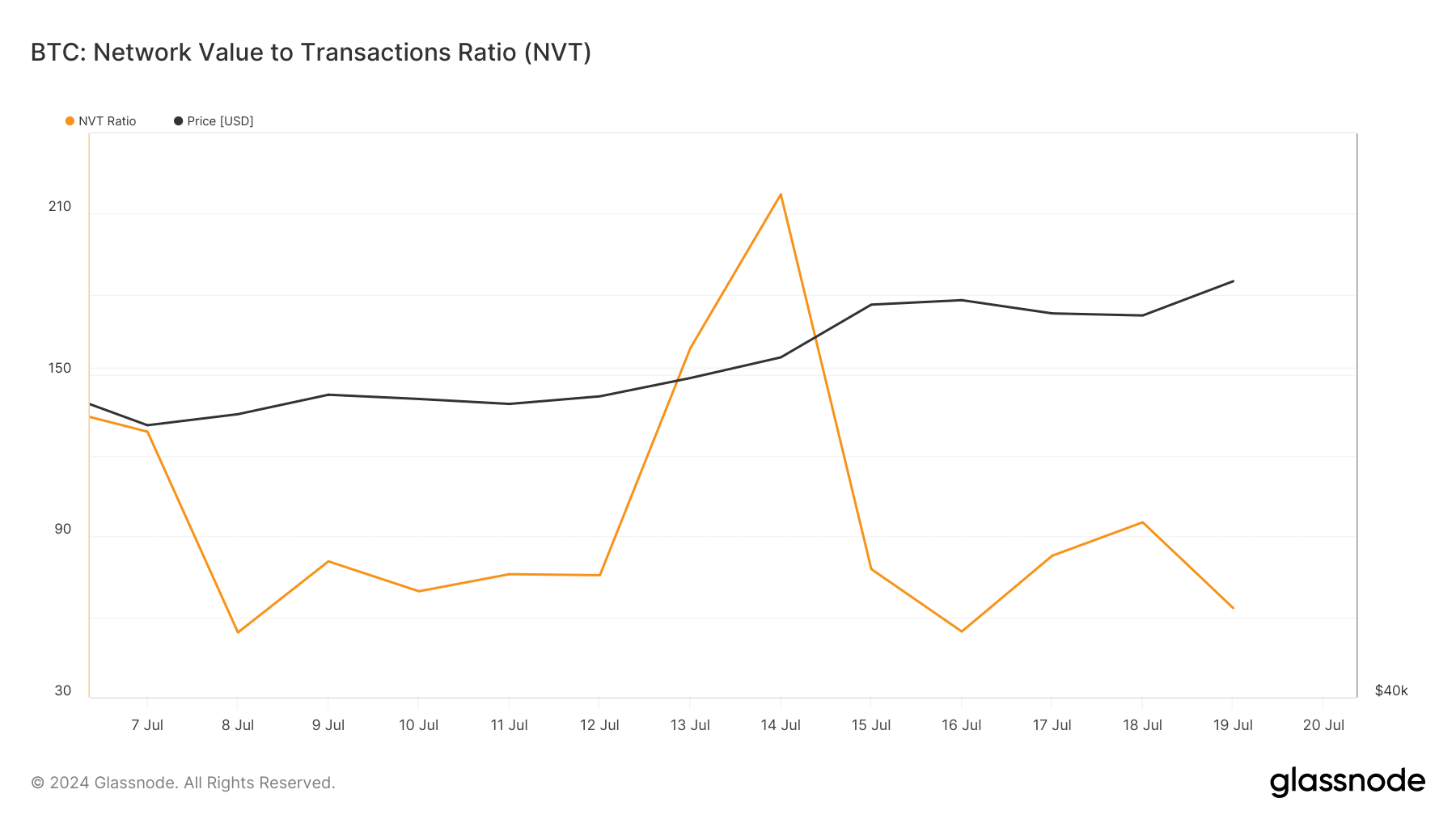

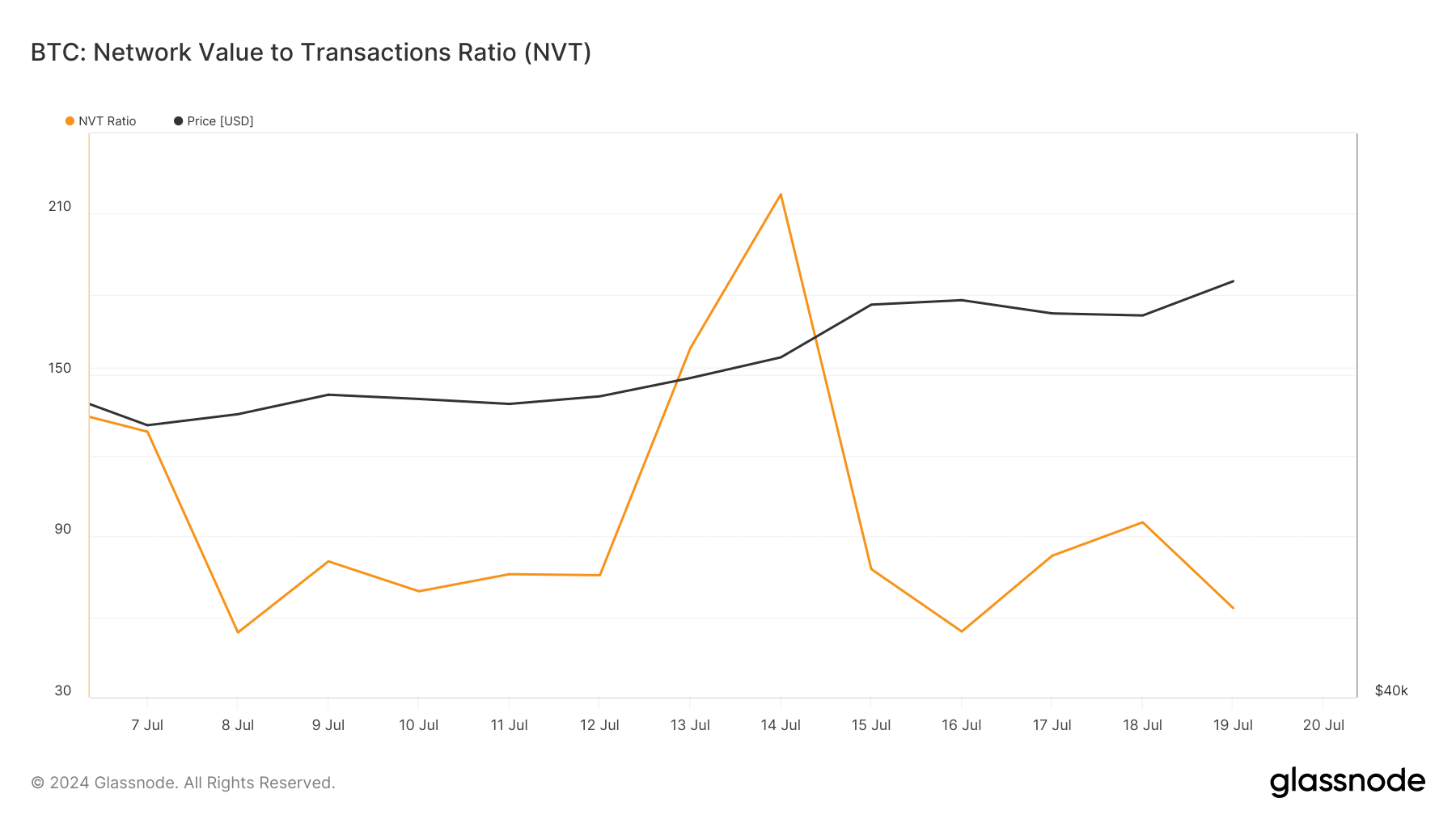

In line with Glassnode’s knowledge, BTC’s NVT ratio dropped on the charts. Normally, a drop within the metric signifies that an asset is undervalued, which regularly ends in value upticks in a while.

Supply: Glassnode

A further take a look at CryptoQuant’s data revealed just a few different bullish metrics too. As an example, BTC’s web deposit on exchanges was low, in comparison with the final seven days’s common – An indication that purchasing strain was excessive. Its binary CDD revealed that long-term holders’ actions within the final 7 days have been decrease than common. They’ve a motive to carry their cash.

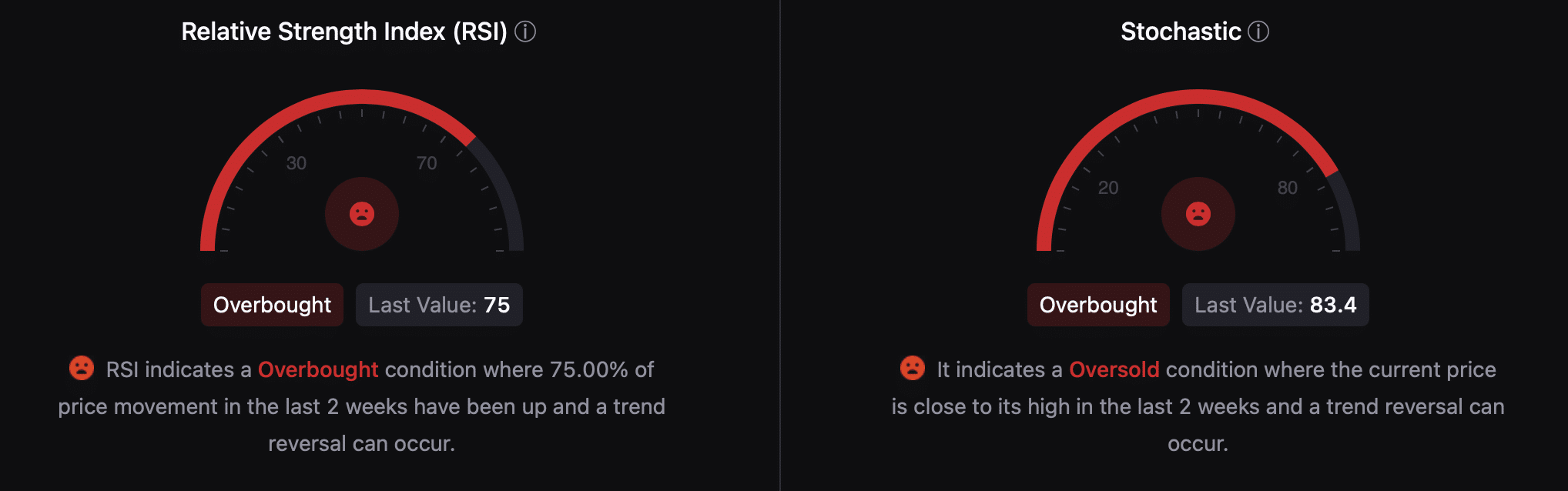

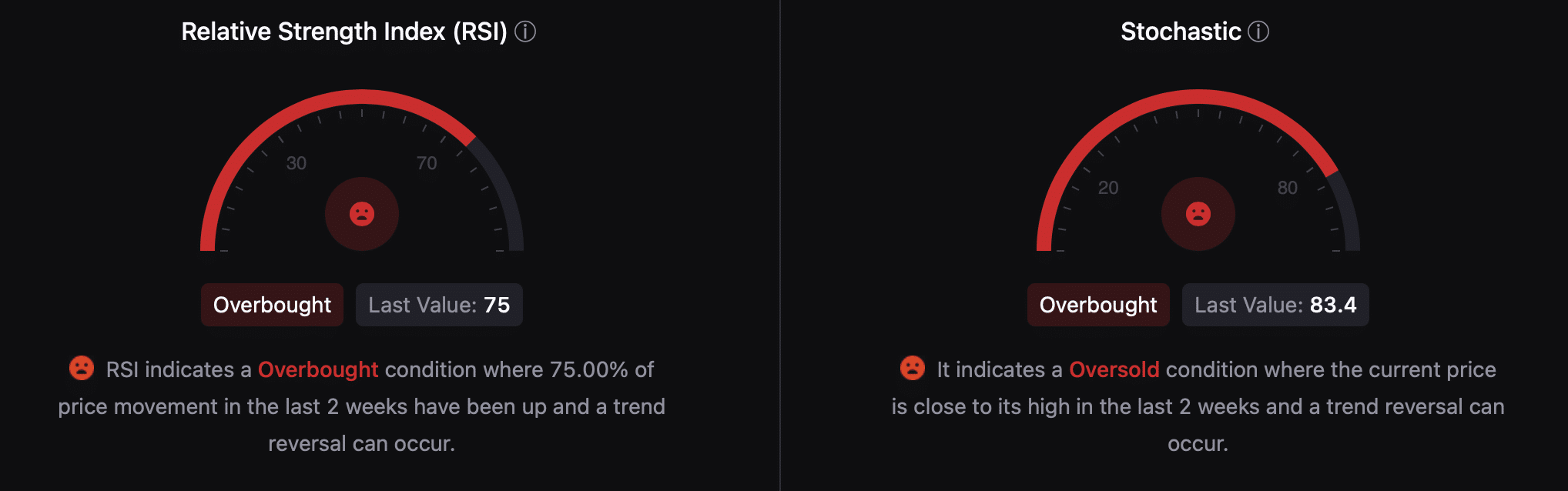

Different metrics and indicators, nevertheless, have been regarding. For instance, each Bitcoin’s Relative Power Index (RSI) and Stochastic have been in overbought zones.

This indicated that promoting strain would possibly rise quickly, in flip placing an finish to BTC’s rally on the charts.

Supply: CryptoQuant

At press time, the crypto’s fear and greed index had a studying of 69%, that means that the market was in a “greed” part. At any time when the metric hits that stage, it signifies that the possibilities of a value correction are excessive.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

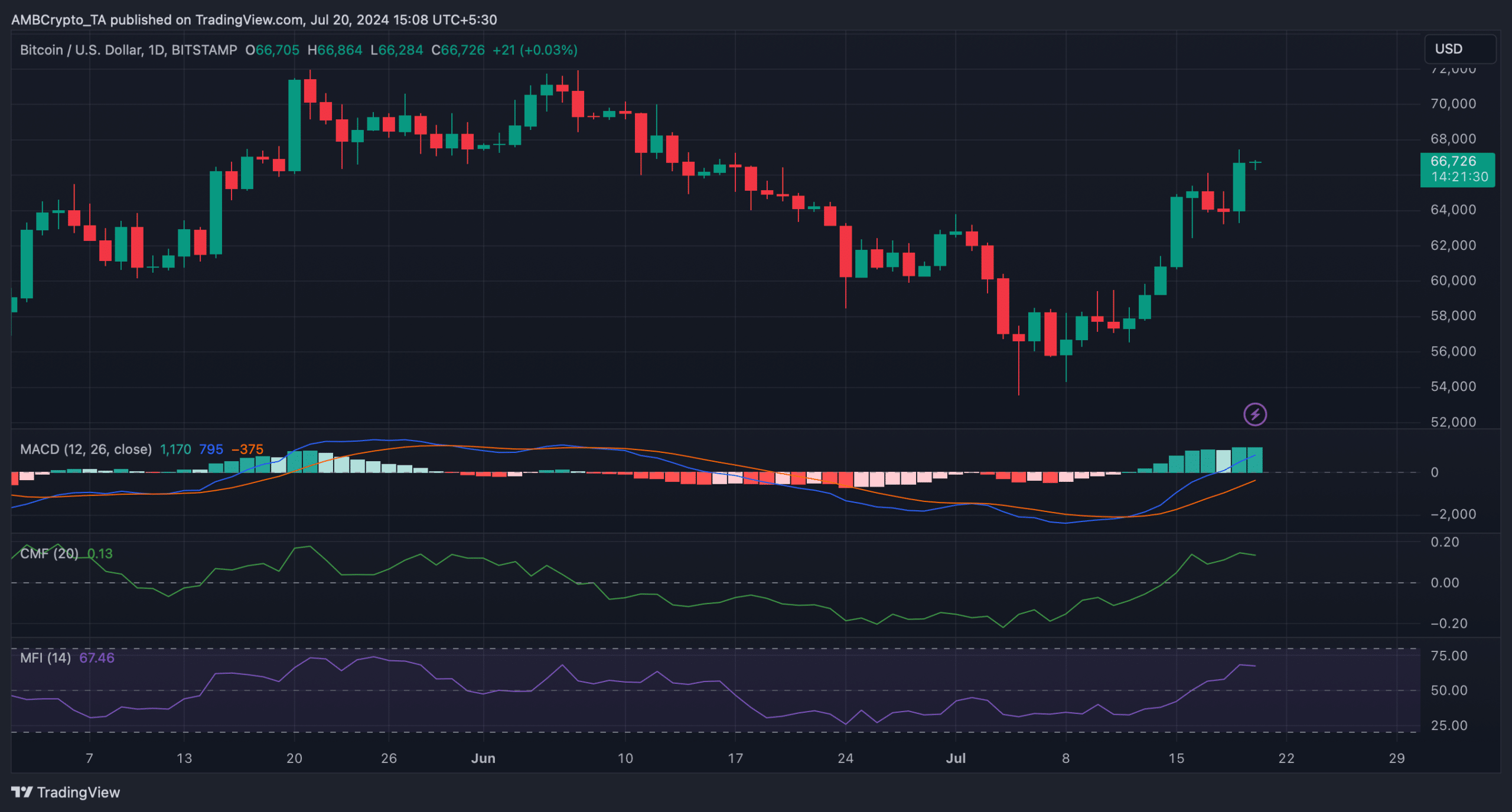

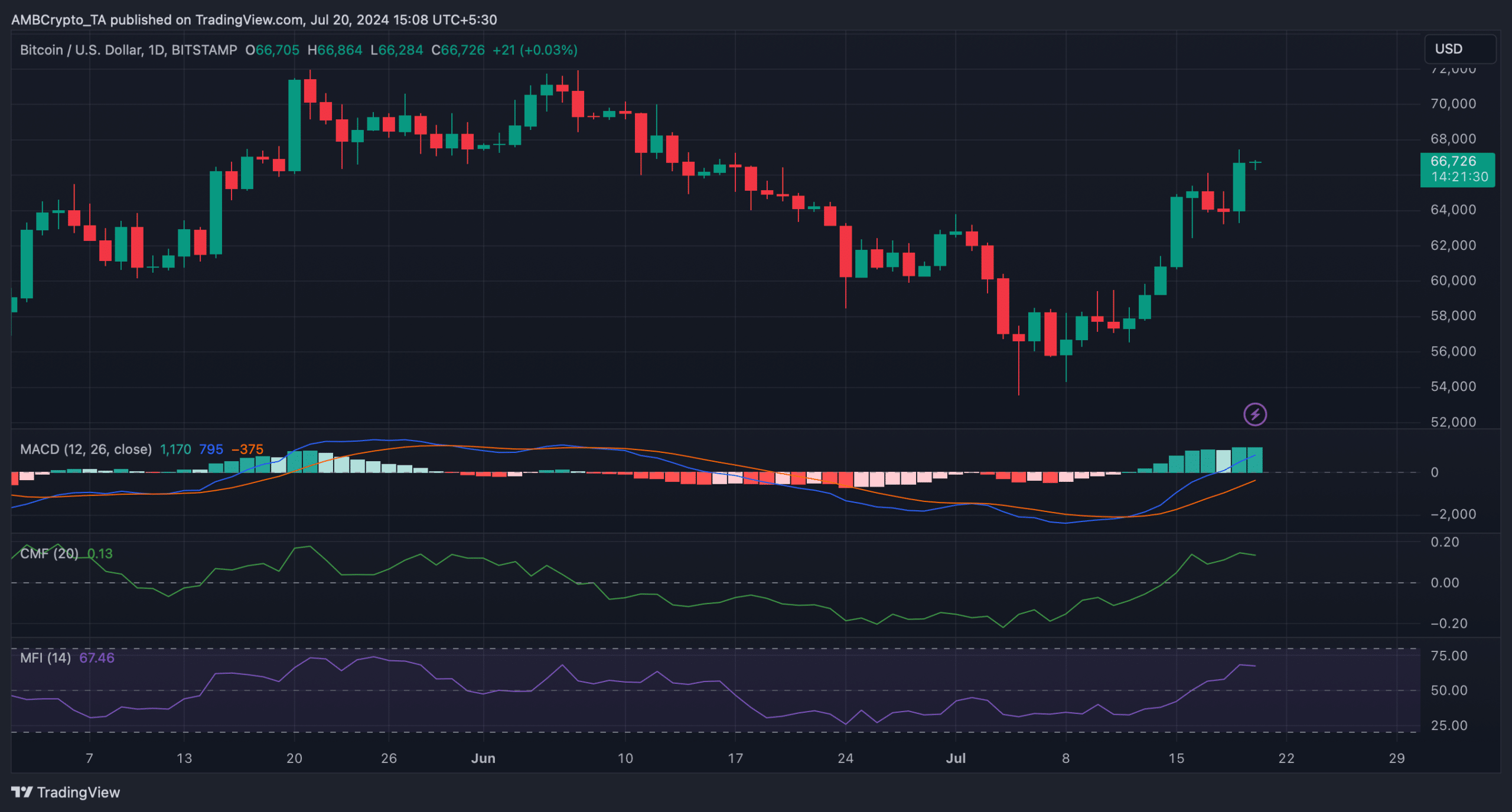

Therefore, we then checked BTC’s every day chart. We discovered that each its Cash Circulation Index (MFI) and Chaikin Cash Circulation (CMF) registered downticks, hinting at a value correction quickly.

Quite the opposite, the MACD supported the patrons because it displayed a bullish higher hand.

Supply: TradingView