- Bitcoin surged previous $68,000 for the primary time since late July.

- Key metrics peaked at an ATH.

Bitcoin [BTC] bulls are having a subject day as their Uptober desires seem like turning into actuality. This week, the king coin made a exceptional comeback, breaching crucial resistance ranges.

On the sixteenth of October, the king coin climbed to $68,424, marking its highest value in practically three months. MicroStrategy Co-Founder and Chairman Michael Saylor chimed in on the thrill, declaring,

“To the moon.”

His phrases captured the optimism amongst crypto lovers, as Bitcoin’s surge fueled renewed confidence and pleasure.

On the time of writing, the coin had barely pulled again to $67,458 however remained up by 0.97% over the previous day and 10% over the previous week.

Is a Bitcoin provide shock coming?

Except for the constructive value motion, developments on the availability aspect have fueled merchants’ expectations for additional features.

Firstly, Bitcoin miners produce solely 450 BTC each day, which falls in need of assembly the rising demand pushed by ongoing accumulation from institutional traders.

For example, BlackRock not too long ago added $391.8 million price of Bitcoin to its holdings.

Value noting that spot Bitcoin ETFs maintain whole web property of $64.46 billion, representing 4.82% of Bitcoin’s market capitalization, in keeping with data from SoSo Worth.

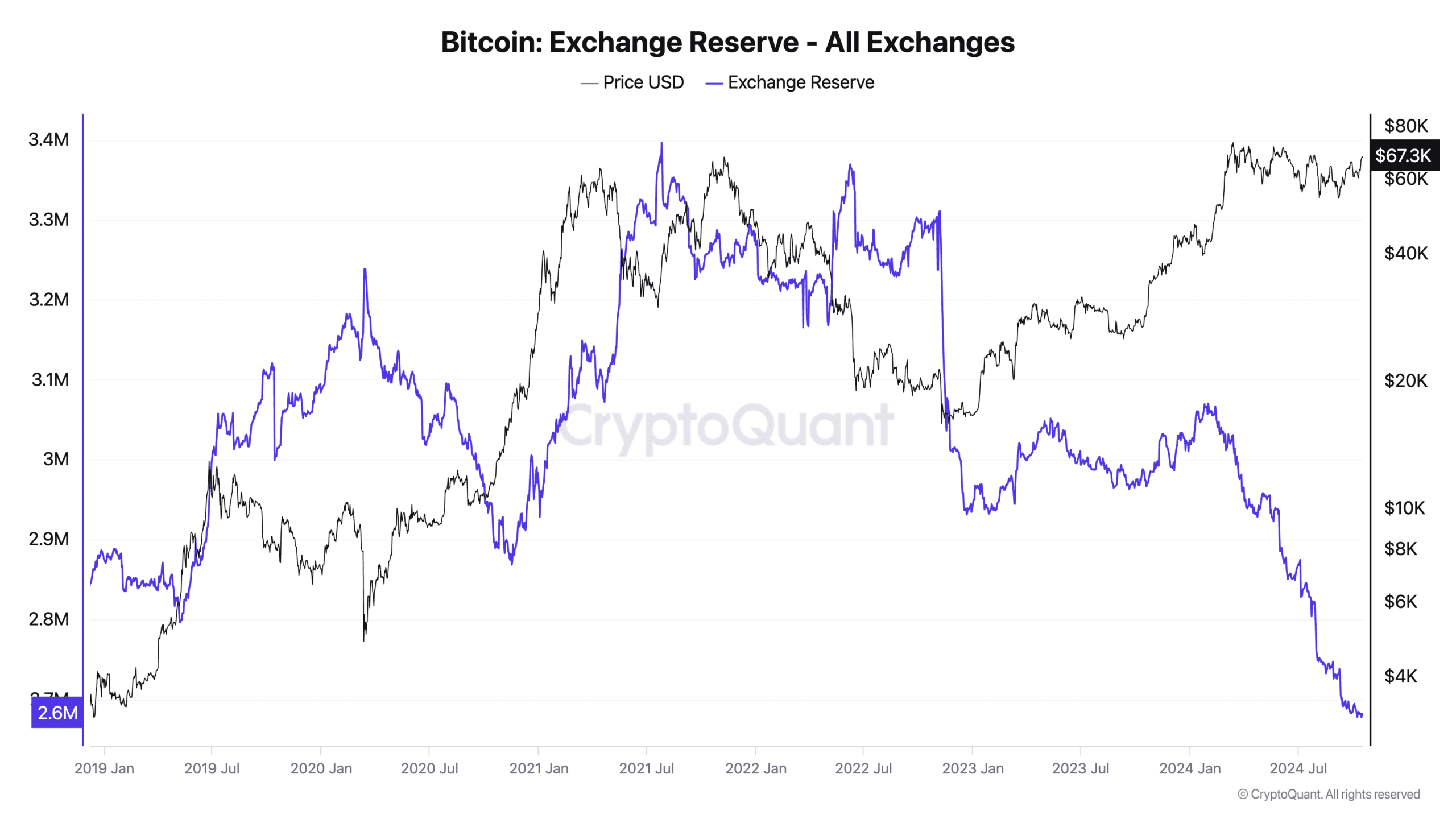

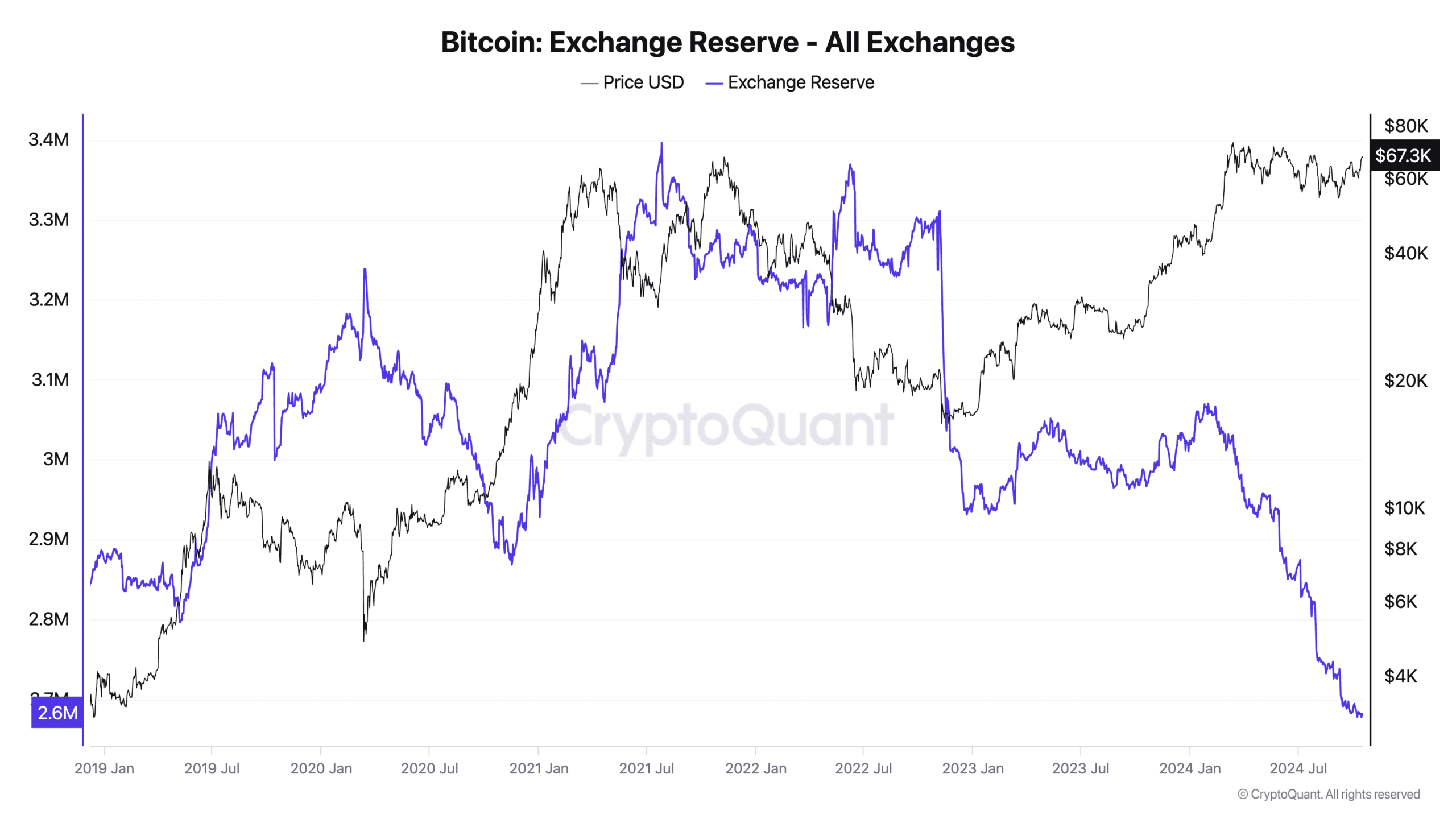

Moreover, the circulating provide of Bitcoin has reached 19.77 million, accounting for 94.14% of the full provide. Lastly, as per CryptoQuant, the Exchange Reserve has fallen to a five-year low of simply 2.6 million BTC.

Because of these components, the chance of a provide shock seems more and more imminent.

Supply: CryptoQuant

What does the spinoff knowledge say?

To achieve deeper insights into market sentiment surrounding Bitcoin, AMBCrypto analyzed the spinoff’s knowledge.

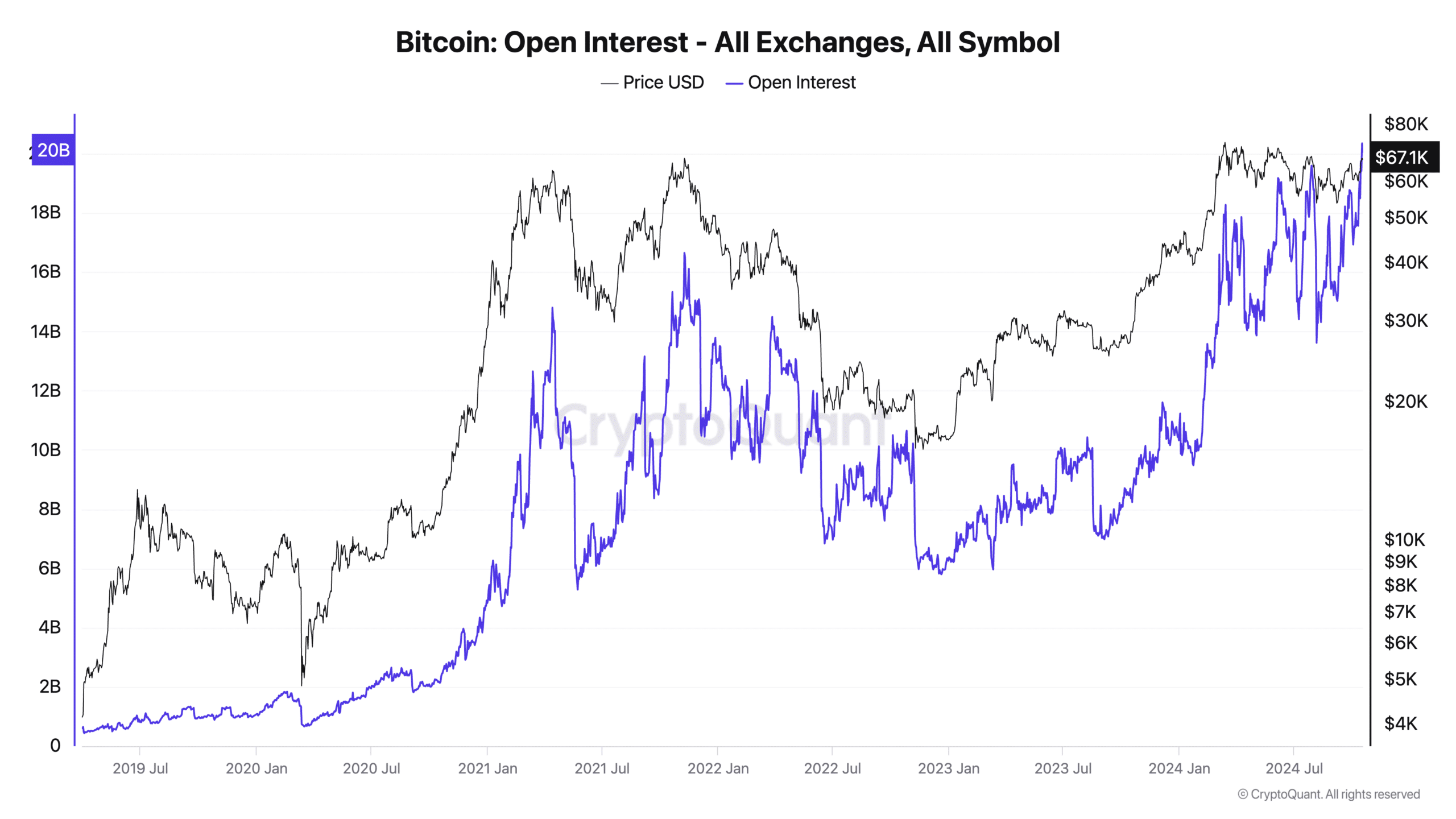

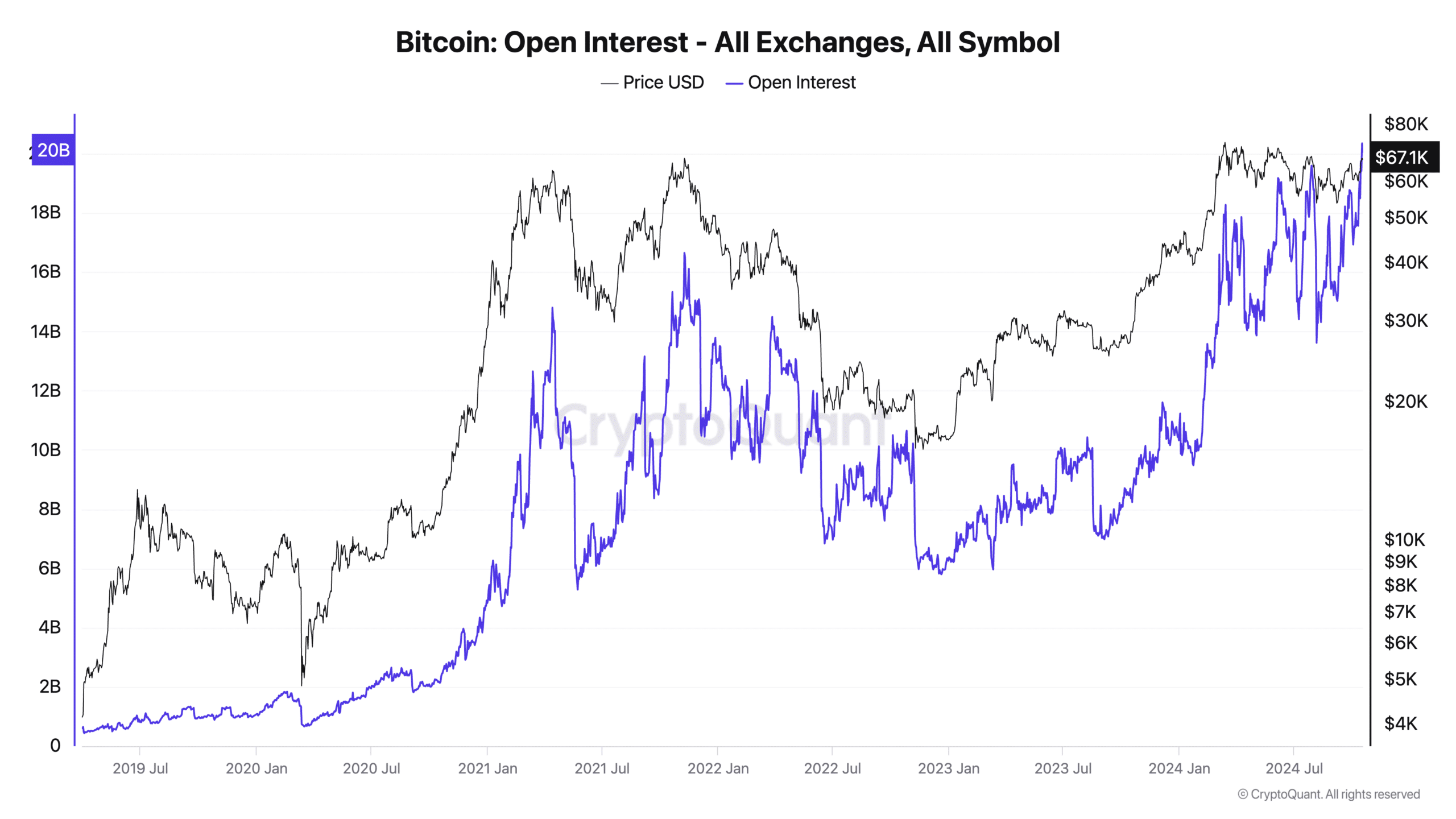

In line with CryptoQuant, Bitcoin’s Open Interest (OI) not too long ago reached an all-time excessive of $20 billion, signaling elevated participation and curiosity.

Supply: CryptoQuant

CME Bitcoin Futures OI additionally hit a report excessive, reflecting rising institutional involvement. Furthermore, the funding rate was constructive at press time.

Knowledge from Coinglass confirmed a Long/Short Ratio of 1.02, indicating a slight desire for lengthy positions. These metrics recommended total optimism available in the market.

BTC closing in on $70K

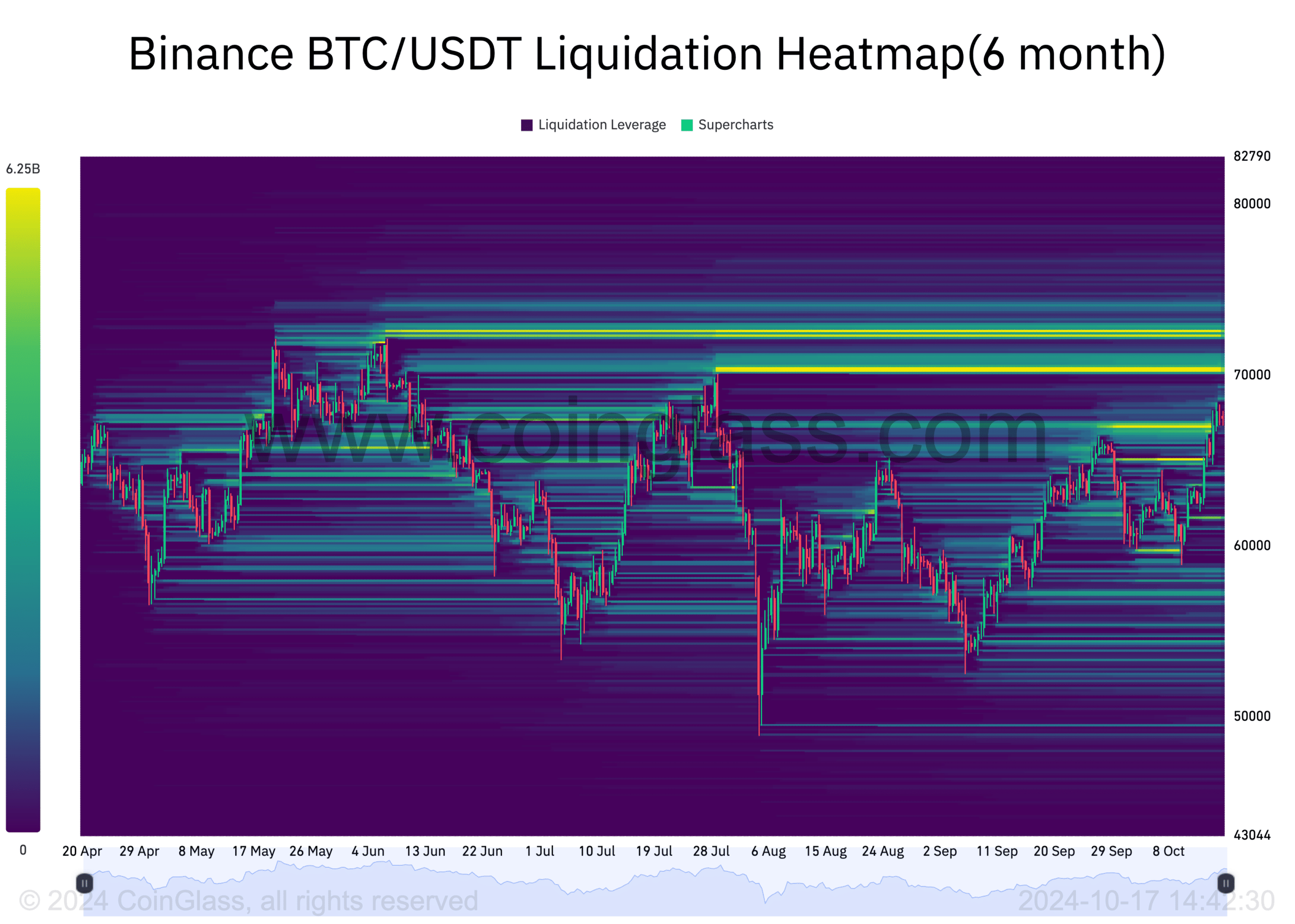

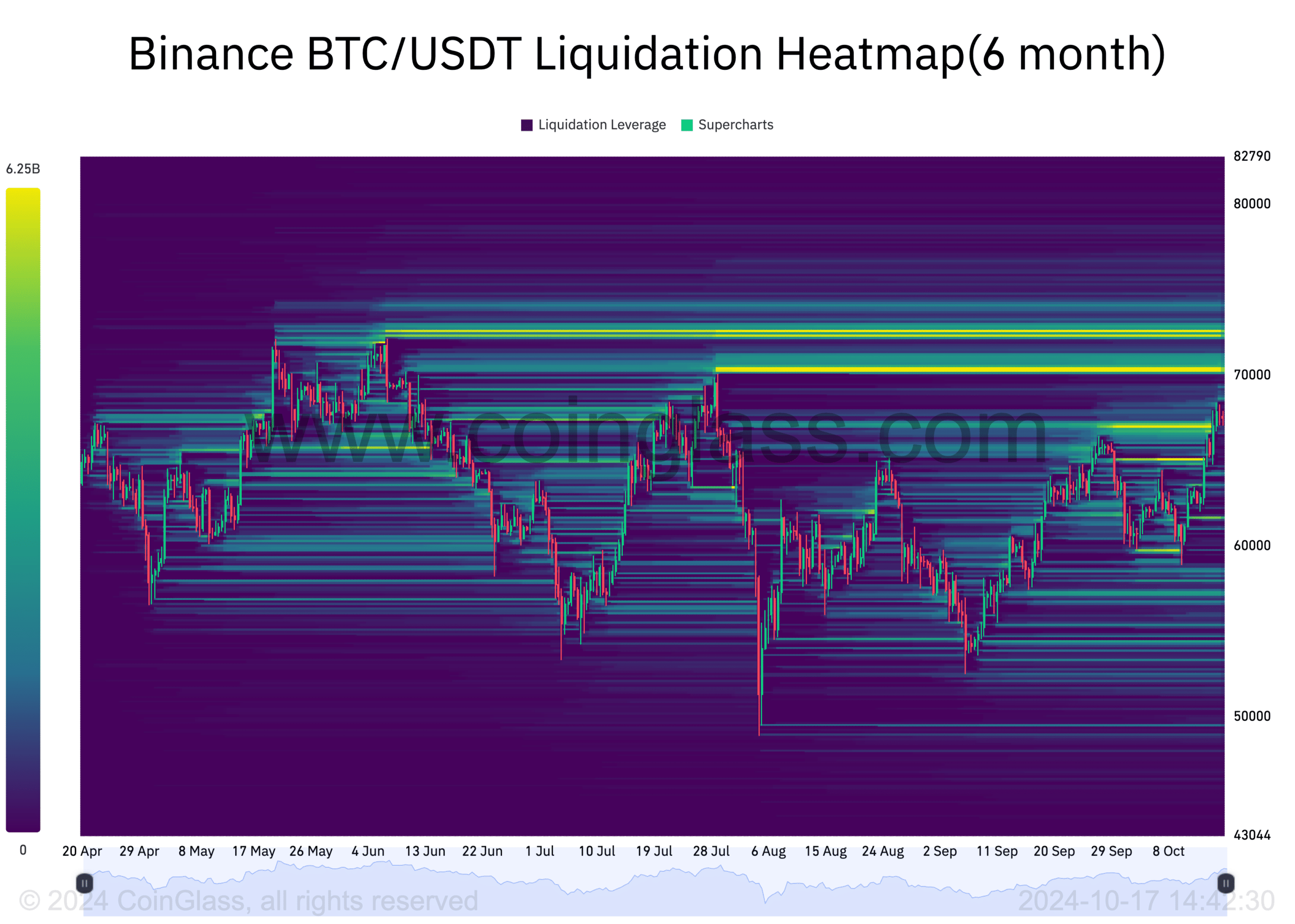

Amid the favorable market atmosphere, with Saylor eyeing the moon, it appears that evidently the moon is likely to be round $70,000.

The 6-month liquidation heatmap from Coinglass revealed a considerable liquidity cluster at this degree, with $72,300 and $72,600 rising as the following magnetic zones more likely to appeal to the value.

On the draw back, vital liquidity was concentrated round $67,000 and $65,000. If BTC drops to brush these ranges, a rebound might comply with.

Supply: Coinglass

Thus, given Bitcoin’s trajectory, bulls stay hopeful of reclaiming the report highs set in March.