- Bitcoin neared the essential $70,000 mark on the twenty ninth of July, the place the value beforehand noticed rejection.

- Sturdy technical indicators and renewed sentiment favored extra features forward of July’s month-to-month shut.

Bitcoin [BTC] is off to an excellent begin this week after a powerful efficiency on the twenty ninth of July, which pushed costs in the direction of $70K.

The flagship crypto rose previous $69,000 sharply, posting a seven-week excessive of $69,851, per CoinMarketCap data. At press time, Bitcoin was buying and selling solely -5.76% under its March all-time excessive of $73,750.

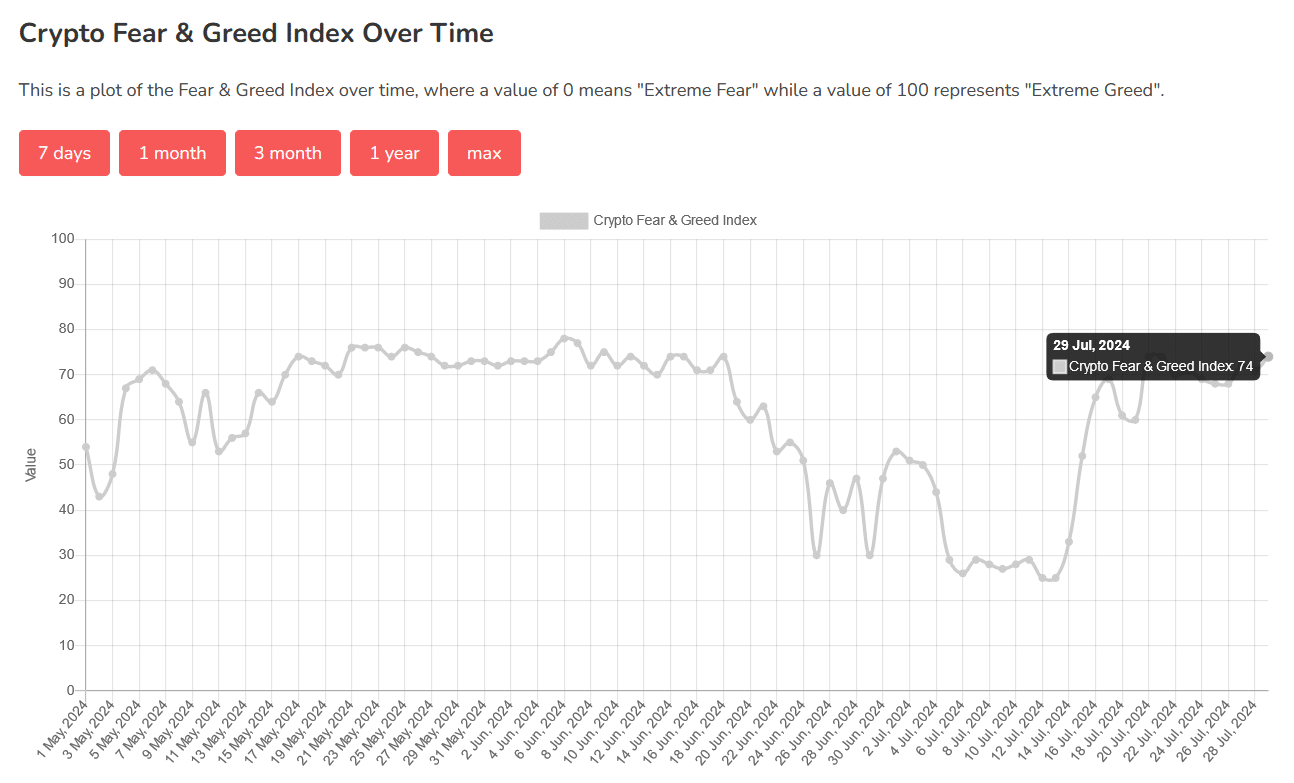

In the meantime, the Crypto Worry & Greed Index has continued hovering within the ‘Greed’ zone, reaching 74/100 at writing — 22 factors increased because the fifteenth of July.

Supply: Various.me

Following the spirited combat, which gave bulls last-minute reduction, Bitcoin managed optimistic, albeit meager, 0.22% returns within the concluded week.

Up to now this month, the main crypto has tracked 9.2% in month-to-month features per Coinglass information.

Renewed optimistic sentiment

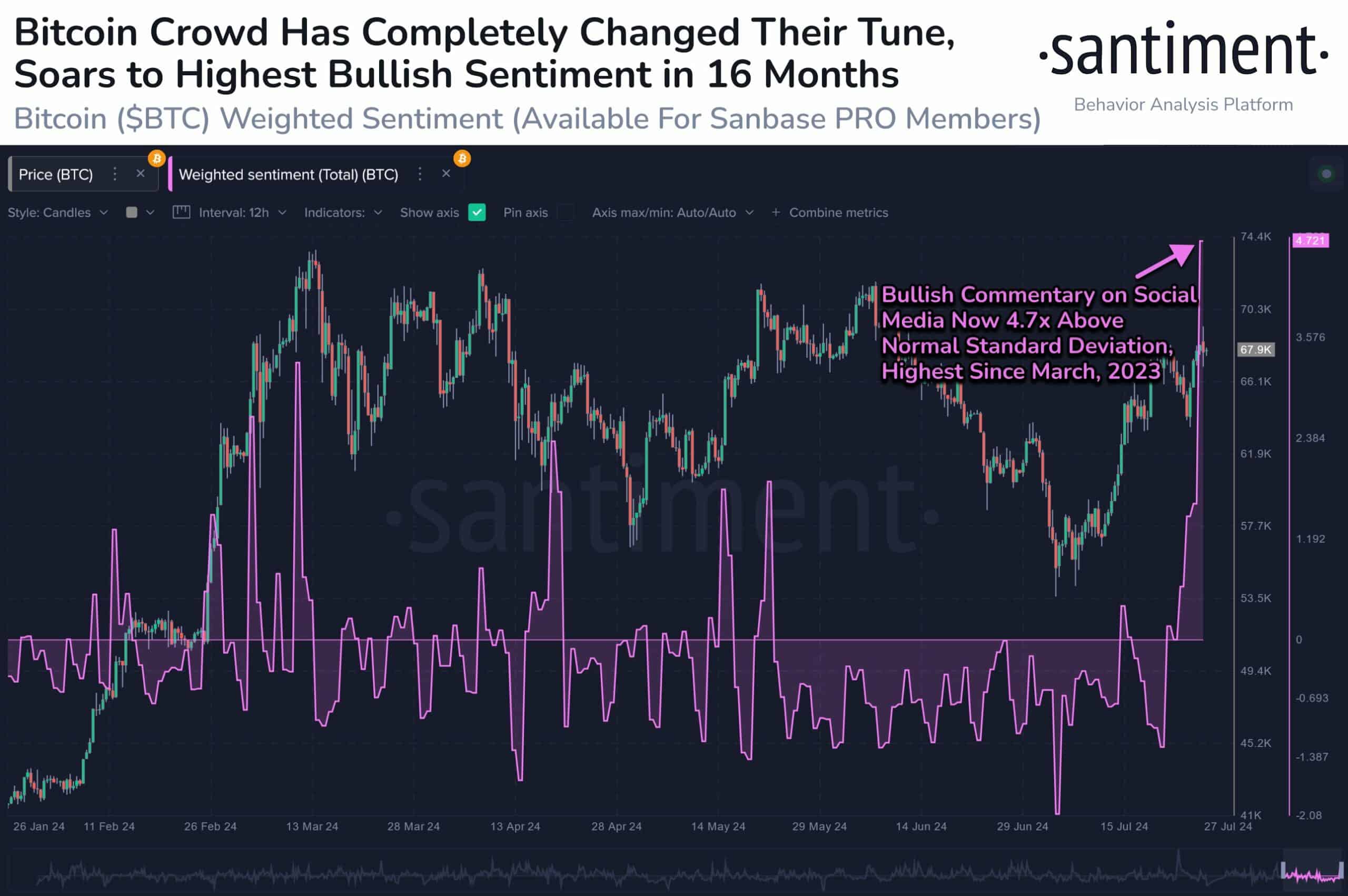

Market intelligence platform Santiment observed that Bitcoin’s value rebound within the final three weeks has made speculators much more optimistic than at first of the month.

Supply: Santiment

The most recent upside momentum comes on the again of the Bitcoin 2024 Convention, which concluded in Nashville on the twenty seventh of July.

Presidential candidates Donald Trump and Robert F. Kennedy Jr. spoke extremely of cryptocurrencies and each dedicated to ascertain a strategic Bitcoin reserve for the U.S.

Macro influences

The larger macro image favors danger belongings, together with cryptocurrencies, however merchants have to control macro occasions this week, which may spark flash volatility.

Federal policymakers are set to speak an interest-rate resolution after the anticipated Federal Open Market Committee (FOMC) assembly on the thirty first of July, with expectations leaning in the direction of the rates of interest remaining unchanged.

The FOMC resolution will likely be key in shaping the month-to-month shut for Bitcoin, which has traditionally delivered optimistic returns in July.

10X Analysis wrote in a analysis publish dated the twenty eighth of July,

“Whereas we count on an eventual breakout, Bitcoin will seemingly want ‘macro’ assist in the type of projected Fed charge cuts or one other dose of decrease inflation […] The FOMC assembly on July 31 and the US CPI report on August 14 will likely be vital.”

This week additionally marks the top of 100 days after the fourth Bitcoin halving occasion, which noticed block mining rewards reduce to three.125 BTC from 6.25 BTC on the twentieth of April.

Halvings are thought of bullish, and information from previous cycles exhibits that costs begin accelerating after round 100 days.

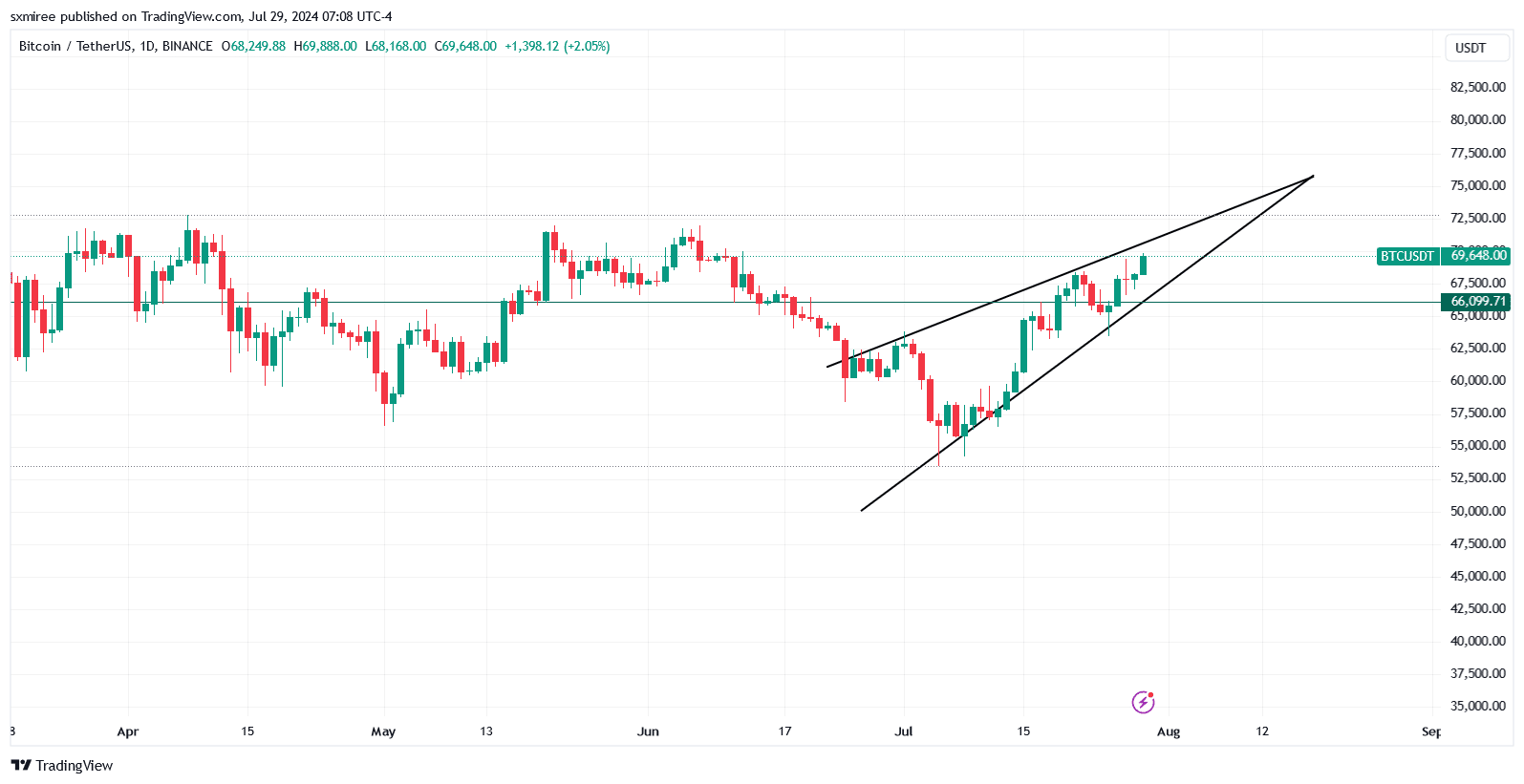

BTC/USDT technical evaluation

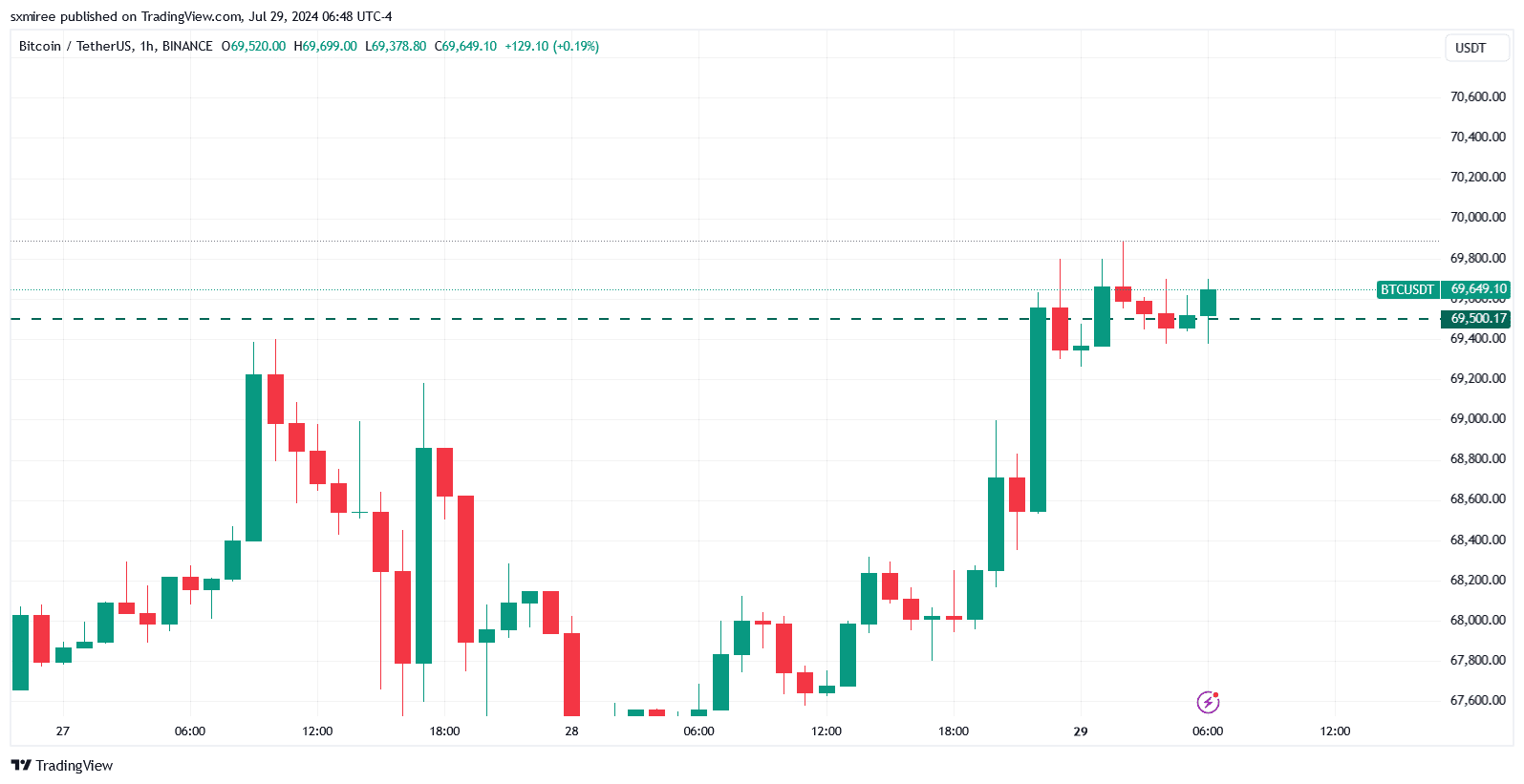

Bitcoin noticed promoting close to its intraday excessive of $69,850 as indicated by the lengthy candle wicks on the hourly chart.

Supply: TradingView

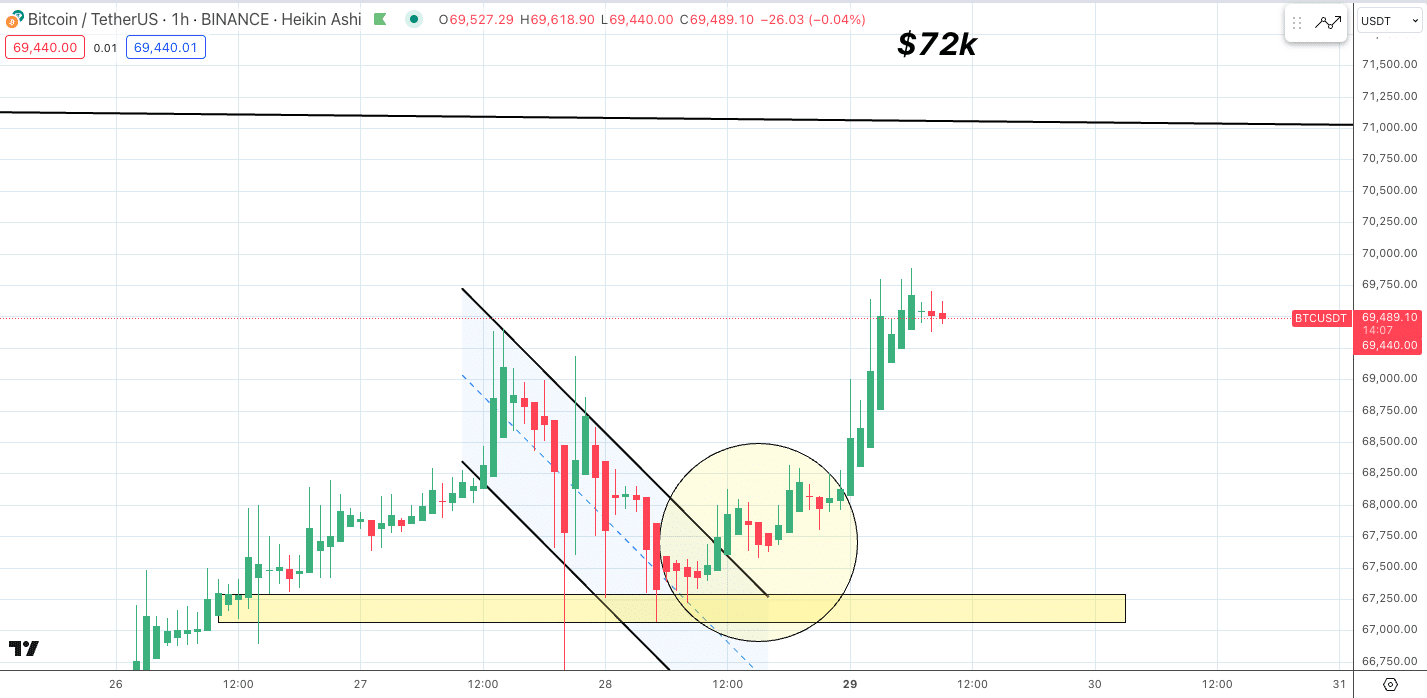

Clearing the hurdle at $70,000 would usher in sight the $72,000 degree, which pseudonymous futures dealer Satoshi Flipper mentioned is “programmed,” in an X (previously Twitter) publish on the twenty ninth of July.

The analyst was referencing a bullish descending channel on the each day chart.

Supply: X

A rising wedge on the each day chart additionally alerts a possible rally towards $74,000, the place the extrapolated sample’s pattern traces converge.

Supply: TradingView

A breakdown under the wedge’s decrease trendline, alternatively, would set off a correction towards the $66,000 vary.

Learn Bitcoin’s [BTC] Worth Prediction 2024-25

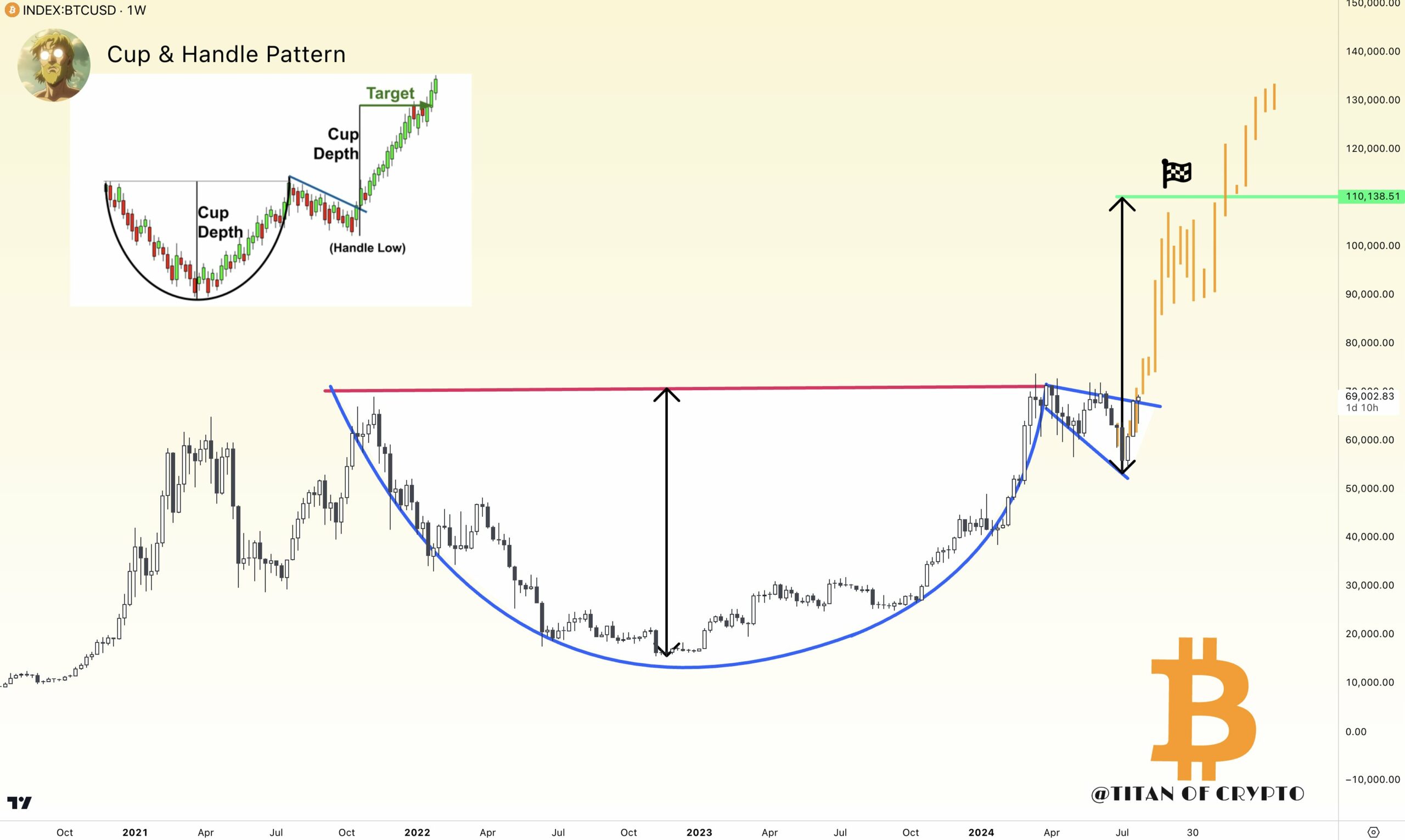

Within the bigger timeframe, BTC/USDT seems to be charting a brand new pattern exterior a cup and deal with chart sample.

Supply: X

A profitable “breaking out from the deal with” would arrange Bitcoin on the trail to $100,000.