A broadly adopted crypto analyst is issuing a warning to merchants saying that Bitcoin’s (BTC) downtrend isn’t over after displaying a bearish sign.

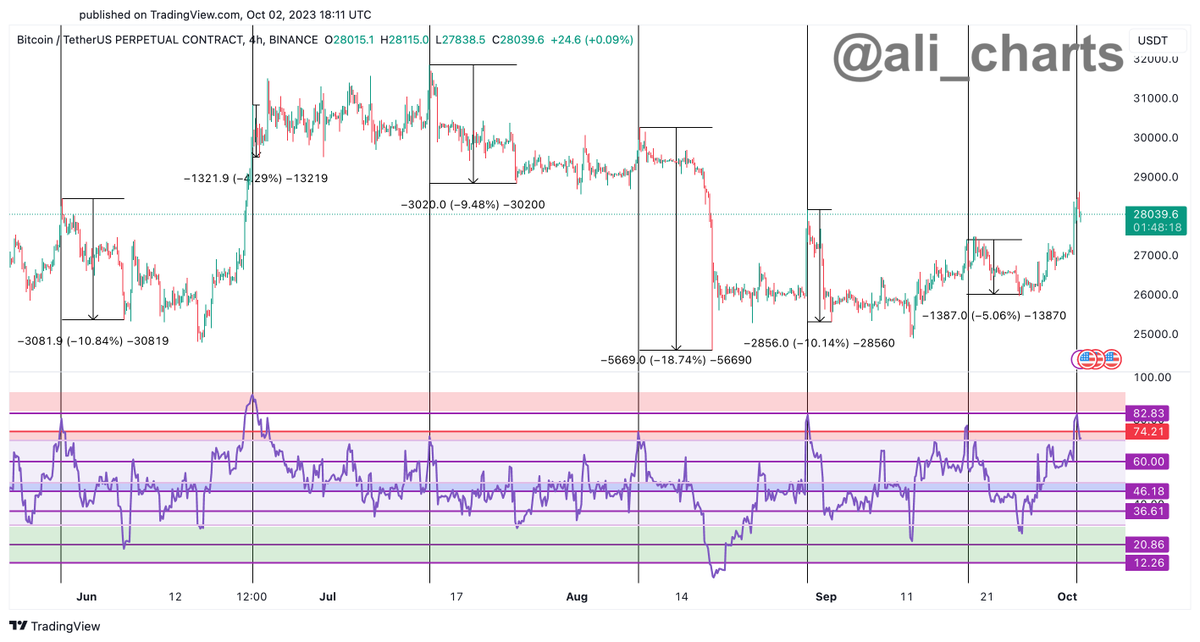

Crypto dealer Ali Martinez tells his 30,900 followers on the social media platform X that the king crypto seems to be forming a basic bearish flag sample.

Bearish flag patterns are utilized in technical evaluation to forecast abrupt strikes to the draw back. They’re shaped when value consolidates upwards after a powerful downtrend, however fails to interrupt a key help degree.

“Bitcoin appears to be shaping a bear flag – a basic chart sample that usually indicators a continuation of the BTC downtrend.

The silver lining? A good cease lack of solely 0.86% with a possible take revenue close to 5%.”

The dealer’s chart signifies that the flag sample will materialize if Bitcoin fails to flip help across the $28,034 degree, inflicting it to dip right down to $26,751.

The dealer additionally says {that a} Bitcoin dip is additional supported by the highest crypto asset by market cap’s Relative Energy Index (RSI), a broadly used momentum indicator that goals to find out if an asset is overbought or oversold.

“Discover that every time the RSI on BTC four-hour chart hits or surpasses 74.21, BTC tends to retrace. The RSI on the four-hour chart lately hit 82.83!”

The RSI indicator scales from 0 to 100. A studying of beneath 30 is usually thought-about bullish whereas a studying of over 70 is usually thought-about to be a bearish signal.

Bitcoin is buying and selling for $27,568 at time of writing, up 0.6% within the final 24 hours.

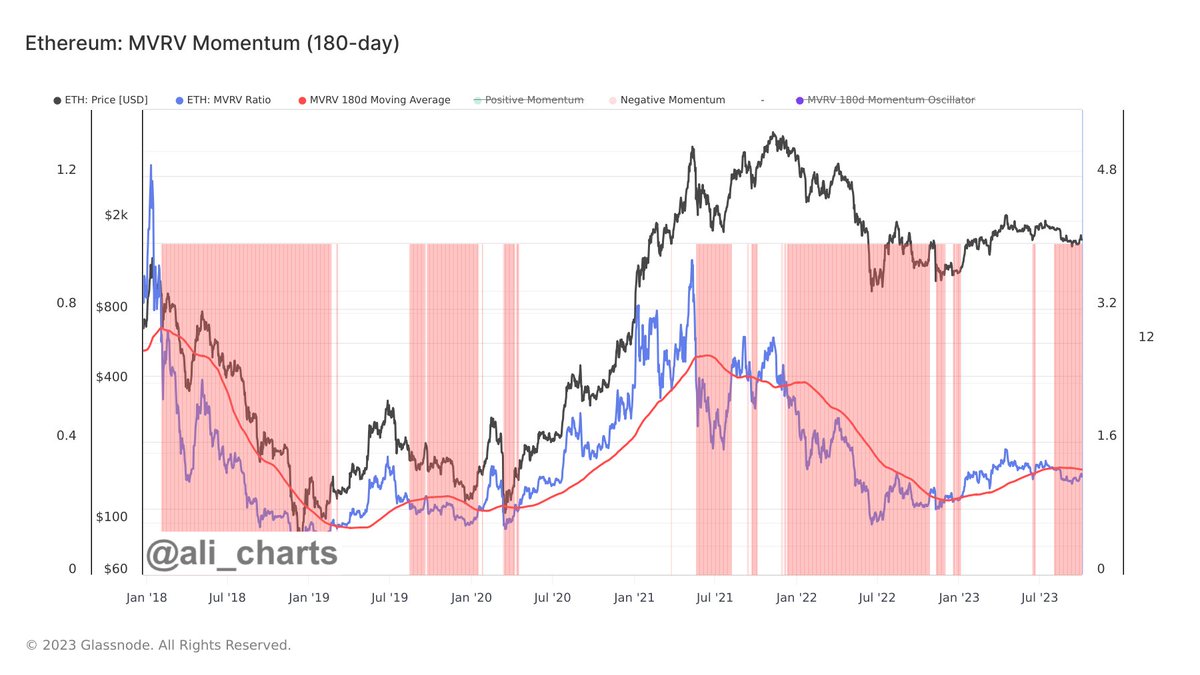

The dealer additionally weighs in on Ethereum (ETH) and says that the second largest crypto asset by market cap is setting the stage for a bullish reversal primarily based available on the market worth to realized worth (MVRV) indicator.

“Ethereum market cycles transition from bearish to bullish when the MVRV (blue line) breaks strongly above the MVRV 180-day SMA (crimson line). At present, ETH stays in a distribution part, awaiting heavy accumulation!”

The MVRV compares an asset’s complete market cap to its realized worth and can be utilized to time market tops and bottoms.

ETH is buying and selling for $1,618 at time of writing.

Do not Miss a Beat – Subscribe to get e mail alerts delivered on to your inbox

Examine Value Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Featured Picture: Shutterstock/NextMarsMedia