- QCP Capital foresaw a constructive outlook for BTC as Choices market elevated.

- Anticipated Fed price cuts could possibly be one other constructive catalyst, per crypto exec.

After latest carnage and large sell-offs, markets appear prepared to increase restoration. Primarily based on choices market information, crypto buying and selling agency QCP Capital initiatives a constructive outlook for Bitcoin [BTC].

In its periodic replace on Thursday, the agency stated it was bullish on the biggest digital asset, as main funds have been exhibiting large curiosity.

‘We stay bullish on #BTC as we see vital name shopping for within the Dec and March expiries. Main funds additionally proceed to roll their Sep lengthy name positions.’

For the unfamiliar, a surge in “lengthy name” positions meant that the shopping for speculators anticipated the underlying asset, BTC, to rise by the expiration dates (September and December).

Briefly, it paints a bullish sentiment and sure BTC appreciation in Q3 and This fall.

BTC: No extra macro danger?

After the huge BTC plunge to $49K on the fifth of August, the market stagnated on the sixth and seventh of August after a lightweight rebound above $50K.

In keeping with Quinn Thompson, founding father of crypto hedge fund Lekker Capital, BTC surged to $60k on the eighth of August, as there have been no sellers just like the market anticipated.

“Whereas many in search of a retesting of the lows, no sellers confirmed up eager to do it, and sufficient time glided by the place the broader market simply realized there have been no sellers at these ranges.”

The manager downplayed the recession fears and claimed that the upcoming Fed price cuts have been the following constructive market catalyst.

“The recession was a Q2 occasion, and now the market is trying ahead to its first price cuts in 4 years subsequent month whereas world central banks are again to coordinating simpler coverage once more.”

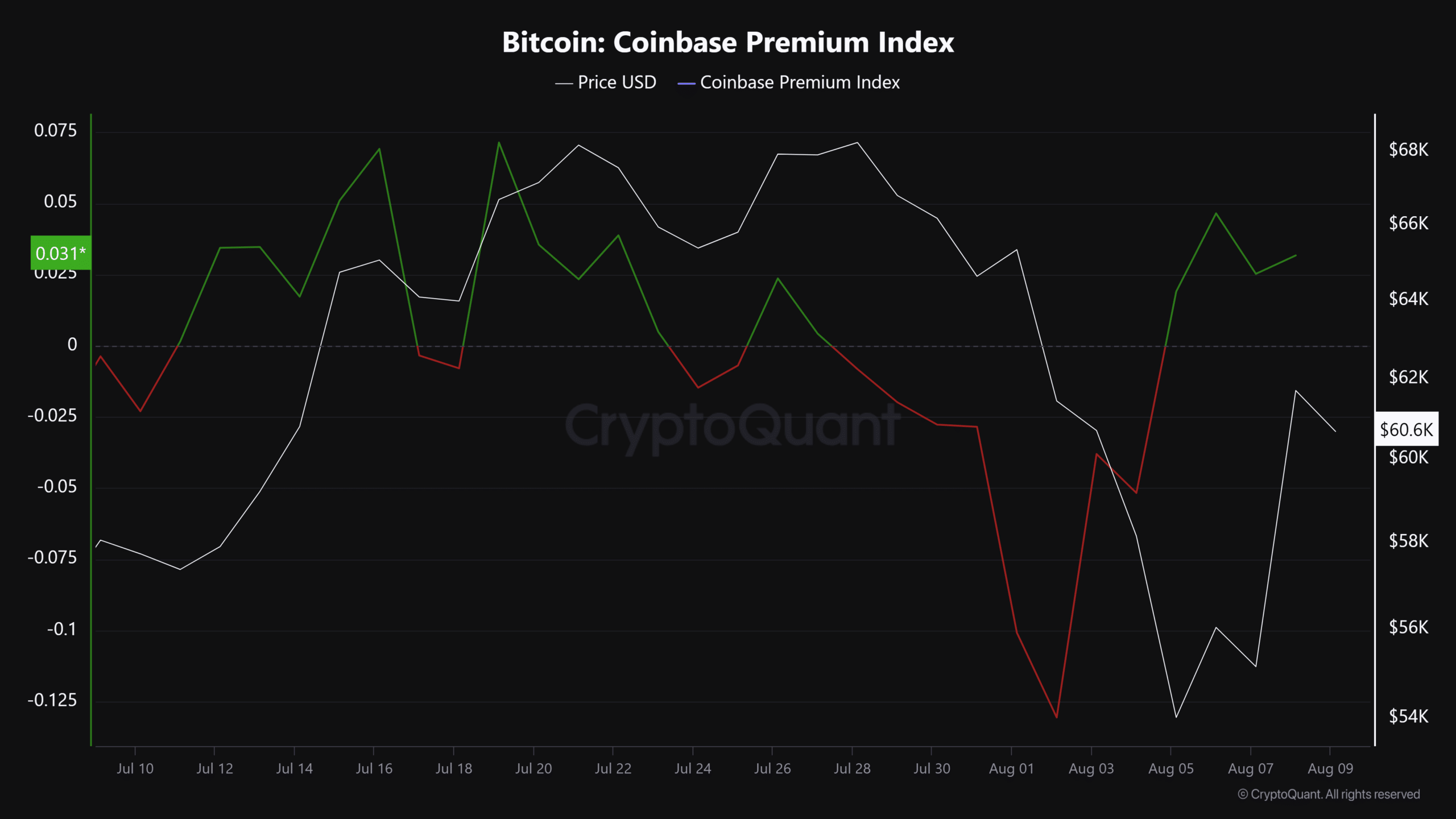

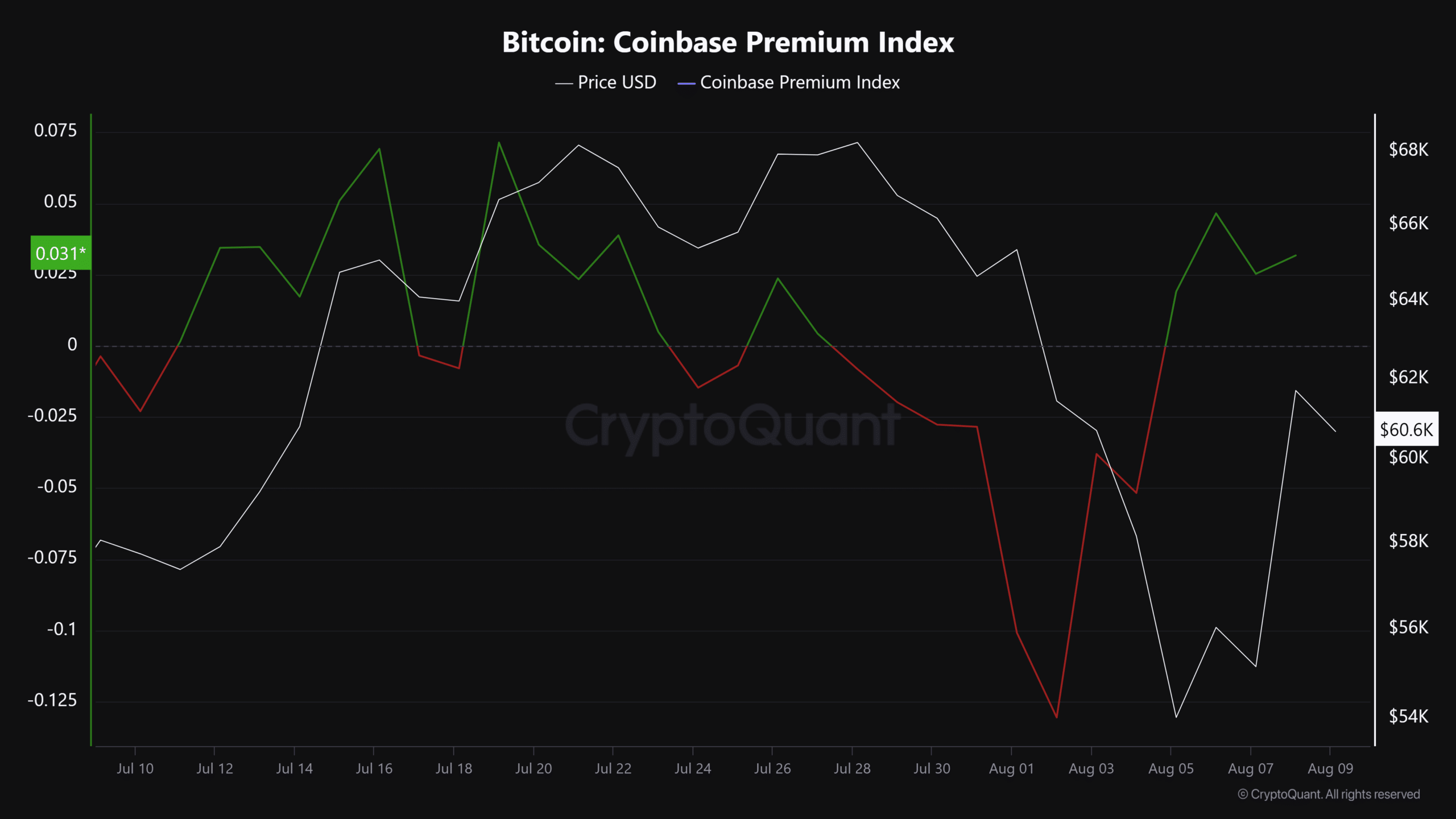

In the meantime, the demand for BTC has strengthened this week, particularly from US traders, as proven by the Coinbase Premium Index, which rose from adverse to constructive.

Supply: CryptoQuant

Low demand from U.S. traders has sometimes coincided with drawdowns for the biggest digital asset. So, on the time of writing, the present robust demand meant that BTC appreciation and restoration might prolong.

Nevertheless, BTC has flashed some bearish alerts, which might unnerve some traders and merchants regardless of the expectation of additional restoration.