- Shopping for strain on Bitcoin elevated within the final week.

- Technical indicators hinted at a development reversal quickly.

Bitcoin [BTC] has been underperforming for the final seven days as its worth dropped close to $55k. Nonetheless, the final 24 hours had been in buyers’ favor.

Does this pose a possibility for buyers to purchase the dip? Let’s discover out what’s going on.

Bitcoin is in a dilemma

CoinMarketCap’s data revealed that previously seven days, the king of crypto’s worth dropped by greater than 17%. On the time of writing, BTC was buying and selling at $55,128.85 with a market capitalization of greater than $1 trillion.

Since BTC is buying and selling below $56k, this may be the appropriate alternative to purchase BTC. Subsequently, AMBCrypto deliberate to try metrics to seek out out whether or not shopping for strain on BTC was excessive.

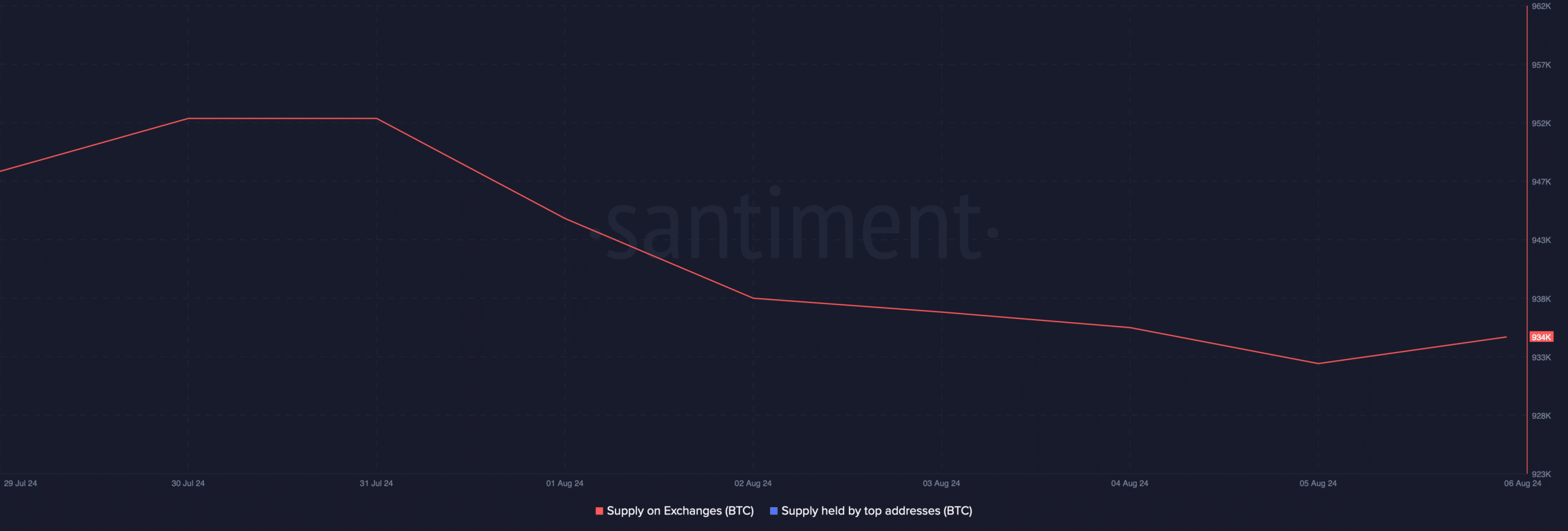

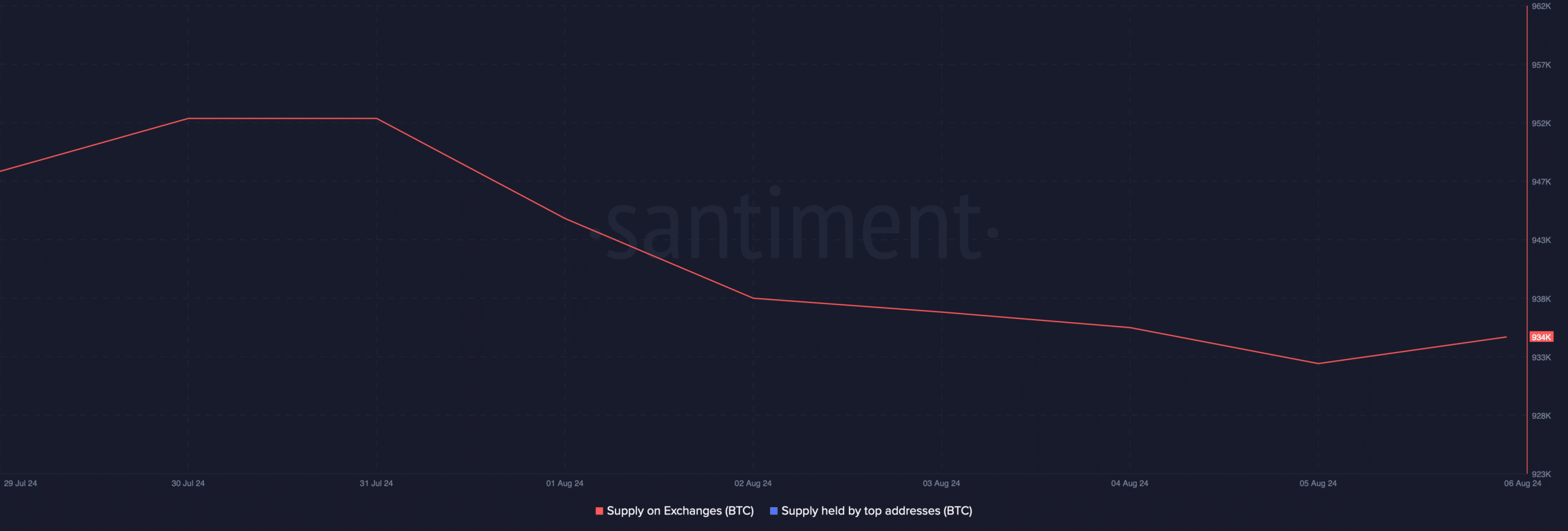

As per our evaluation of Santiment’s knowledge, Bitcoin’s provide on exchanges dropped sharply final week. This meant that buyers had been shopping for BTC at press time.

Supply: Santiment

Equally, CryptoQuant’s data advised BTC’s alternate reserves had been dropping. This additional proves the purpose that buyers had been shopping for BTC.

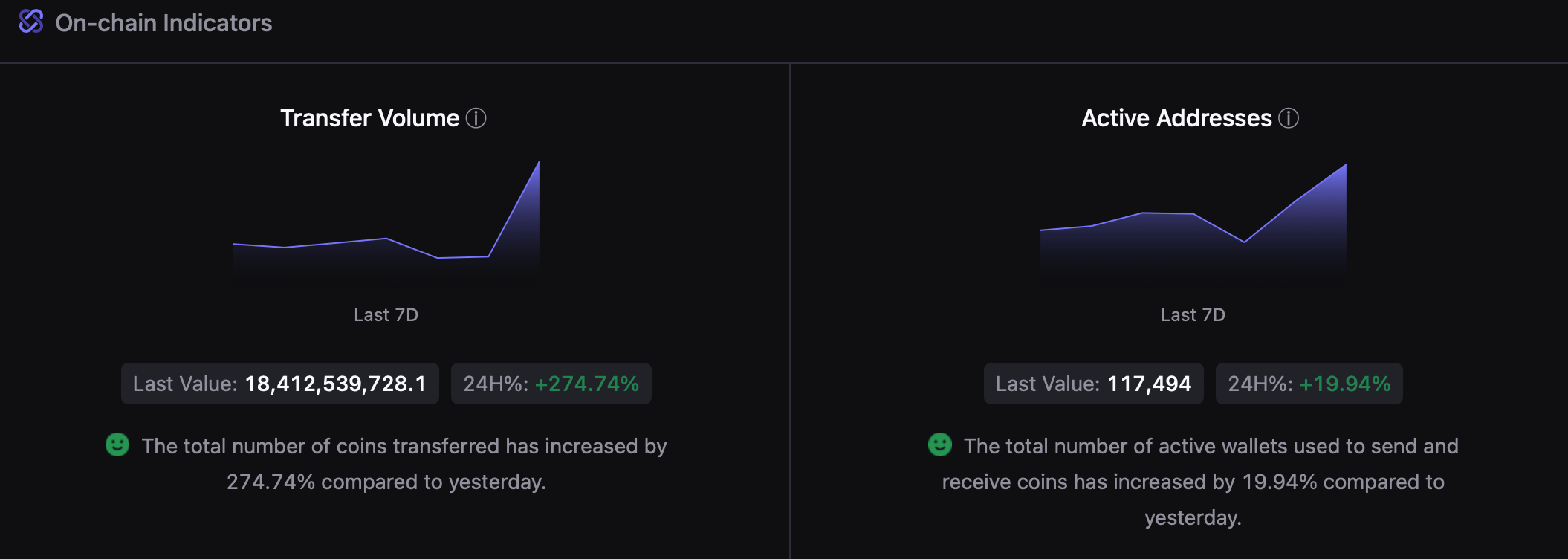

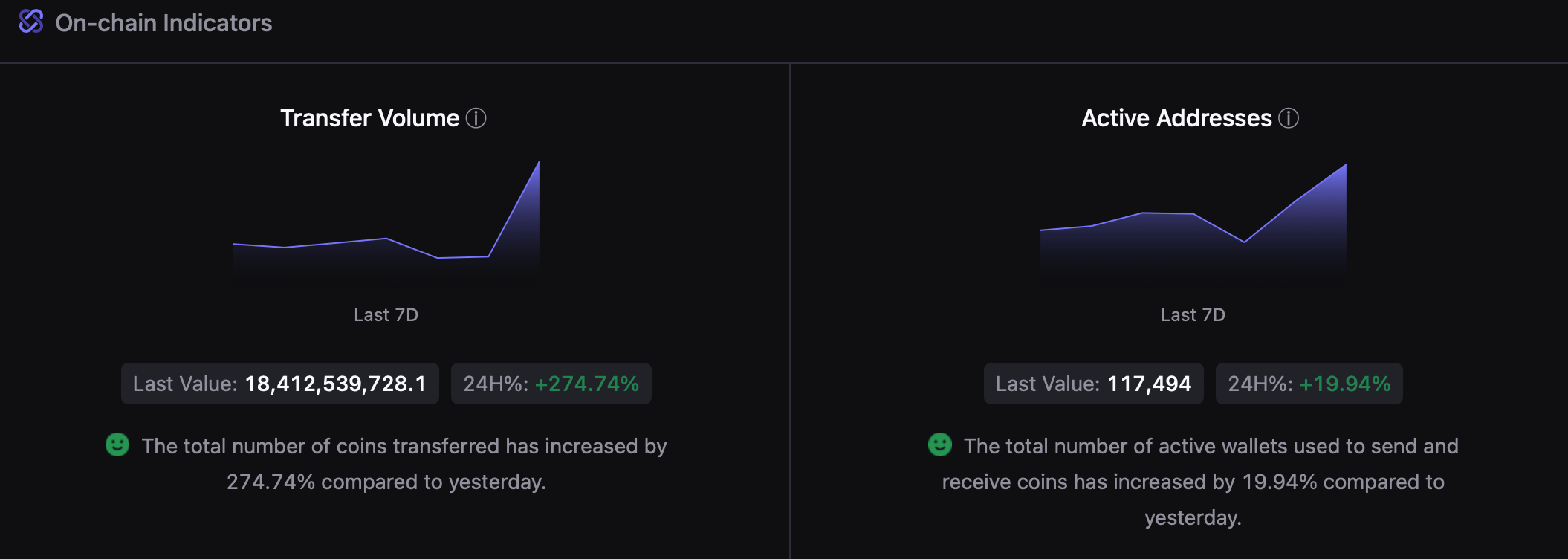

Aside from that, BTC’s switch quantity and energetic addresses additionally elevated, which might be inferred as a bullish sign.

Supply: CryptoQuant

BTC’s upcoming days

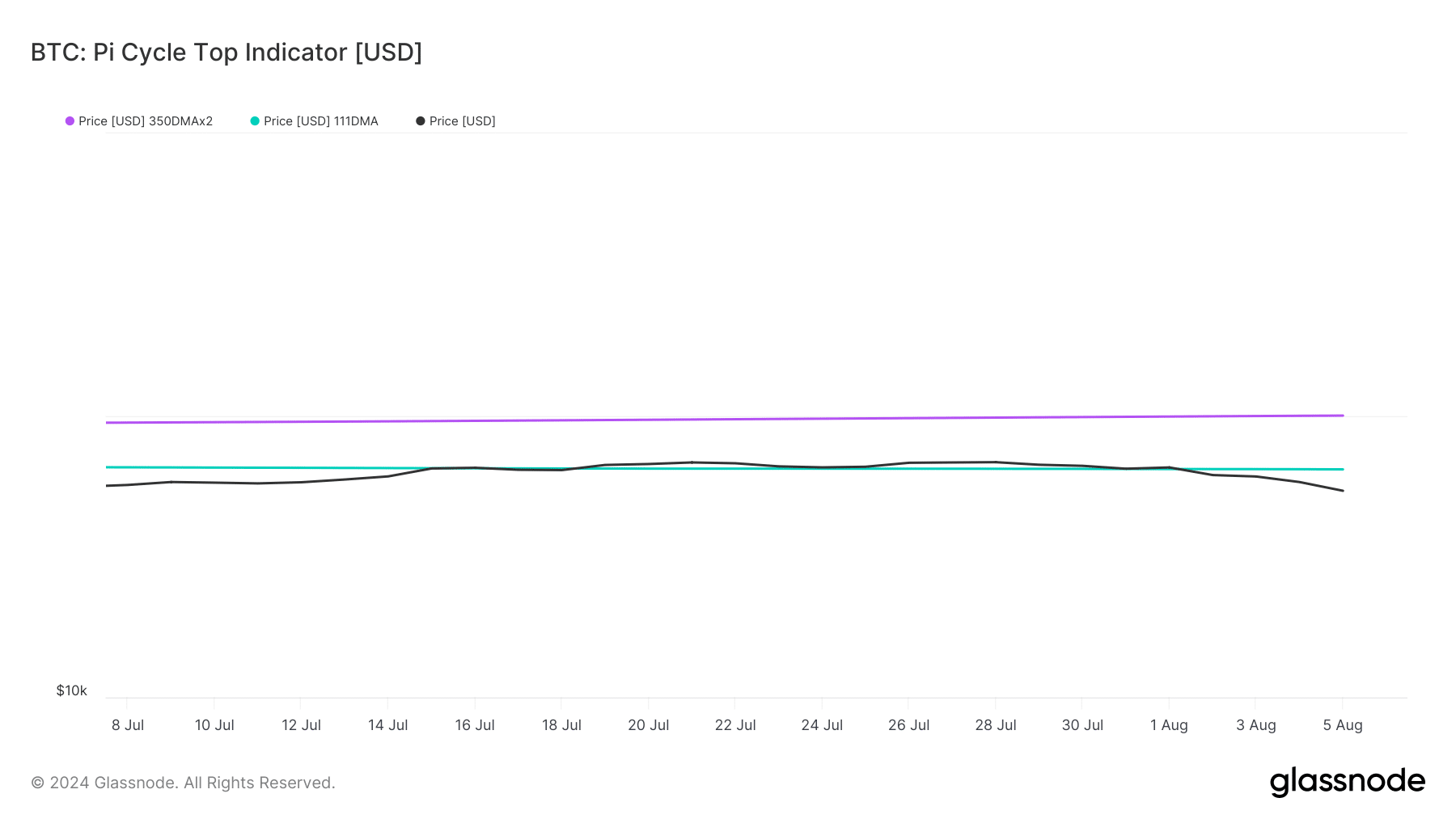

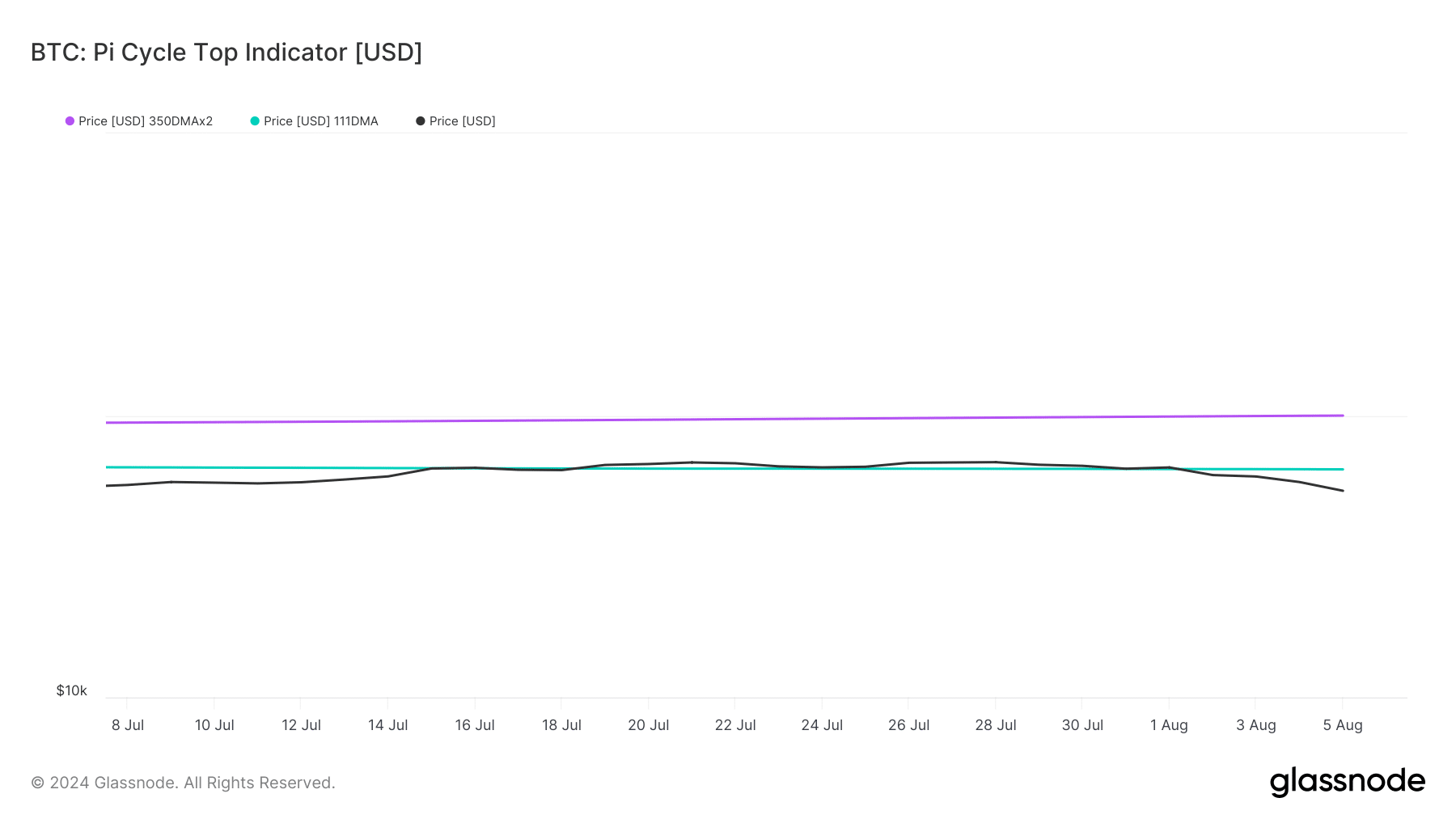

AMBCrypto then checked different datasets to seek out out what to anticipate from the king of cryptos. As per our evaluation of Glassnode’s knowledge, BTC was resting nicely under its market backside.

The Pi cycle high indicator revealed that BTC’s market backside was at $64k. At press time, BTC was resting below that stage. Moreover, if the metric is to be believed, then BTC’s market high could be above $99k.

Supply: Glassnode

AMBCrypto’s take a look at Bitcoin’s Rainbow Chart revealed that the coin was in an accumulation section. Each time the indicator hits this stage, it suggests that there’s nonetheless an opportunity for buyers to purchase the BTC at a cheaper price.

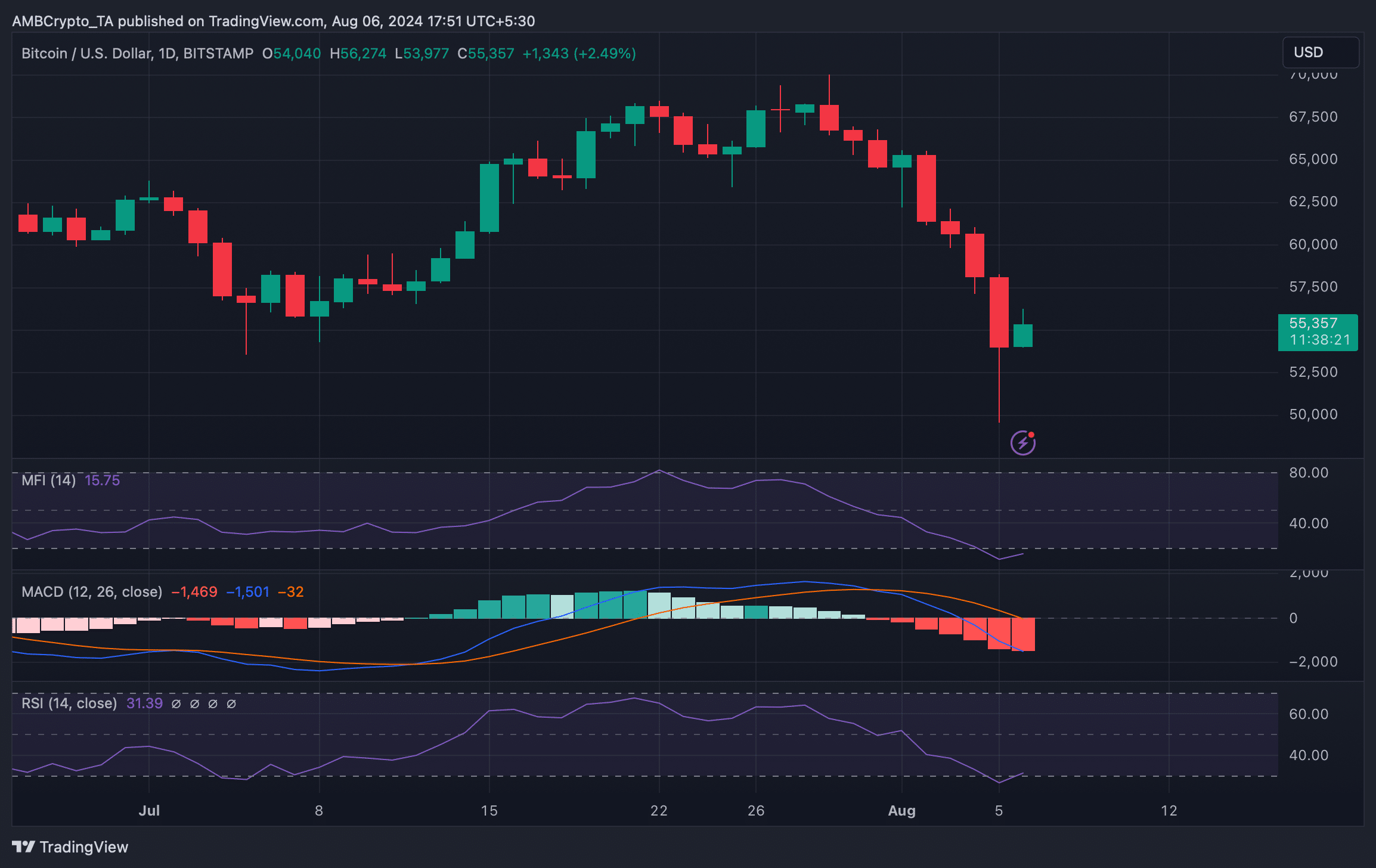

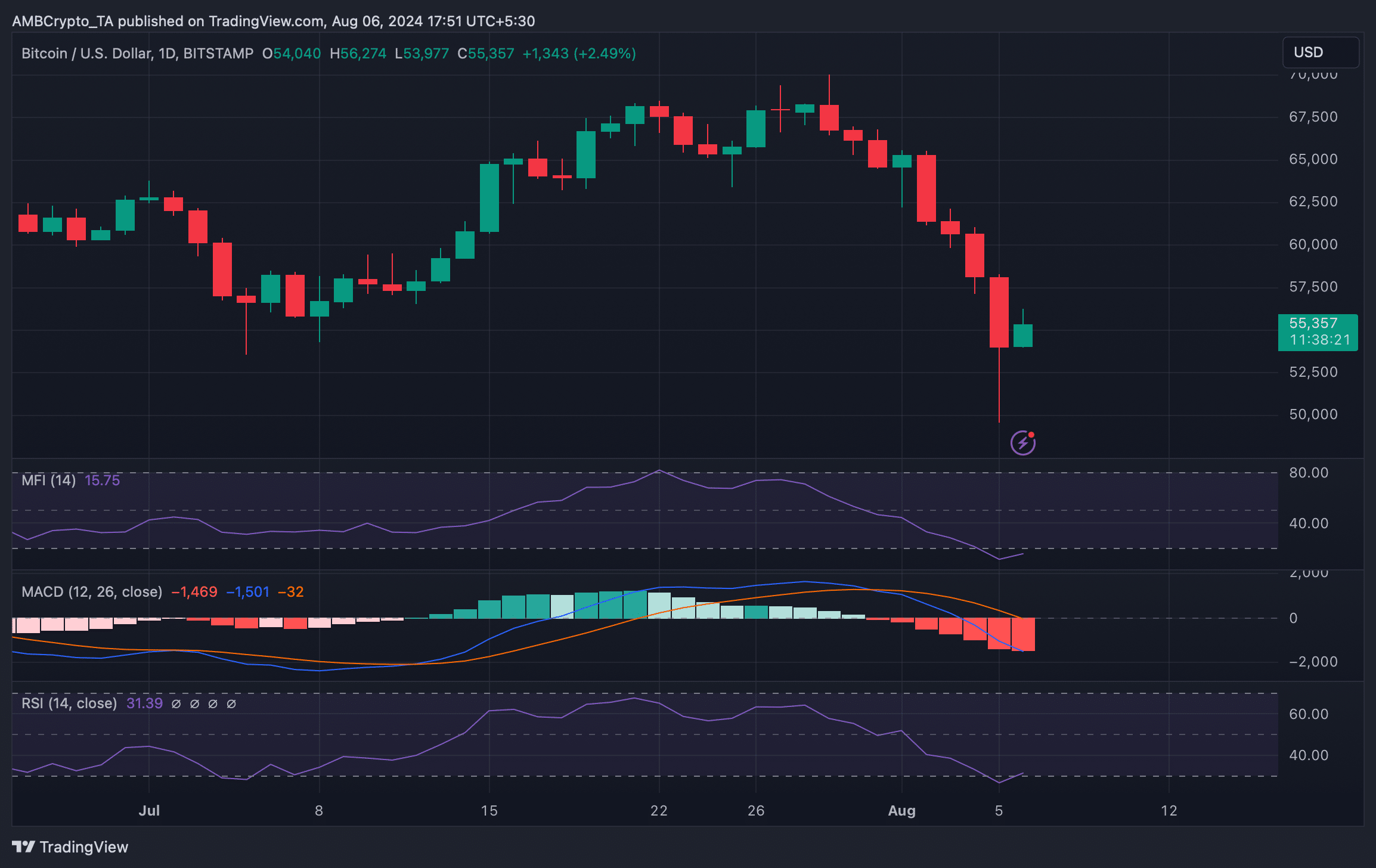

AMBCrypto then checked BTC’s each day chart to raised perceive what to anticipate from the coin within the coming days. In keeping with our evaluation, the Relative Power Index (RSI) registered an uptick.

The Cash Move Index (MFI) additionally adopted the same development.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

These market indicators advised that the possibilities of BTC gaining upward momentum had been excessive.

Nonetheless, the technical indicator MACD displayed a bearish benefit out there, which may prohibit BTC from transferring up within the flooring days.

Supply: TradingView