- Shedding the historic assist degree places BTC in pole place for an additional fall.

- MVRV Lengthy/Brief distinction revealed that the coin’s worth would possibly get better later within the cycle

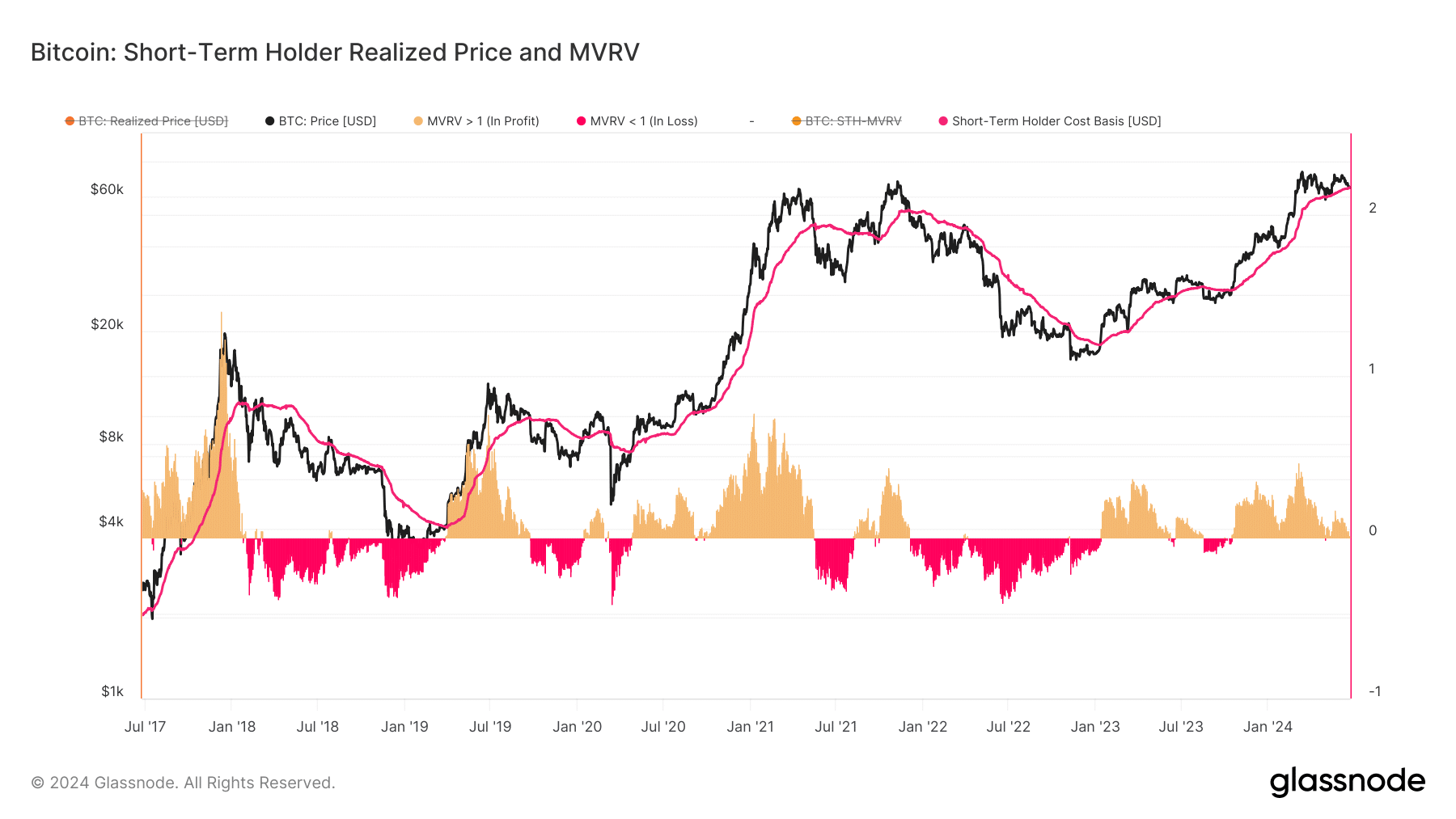

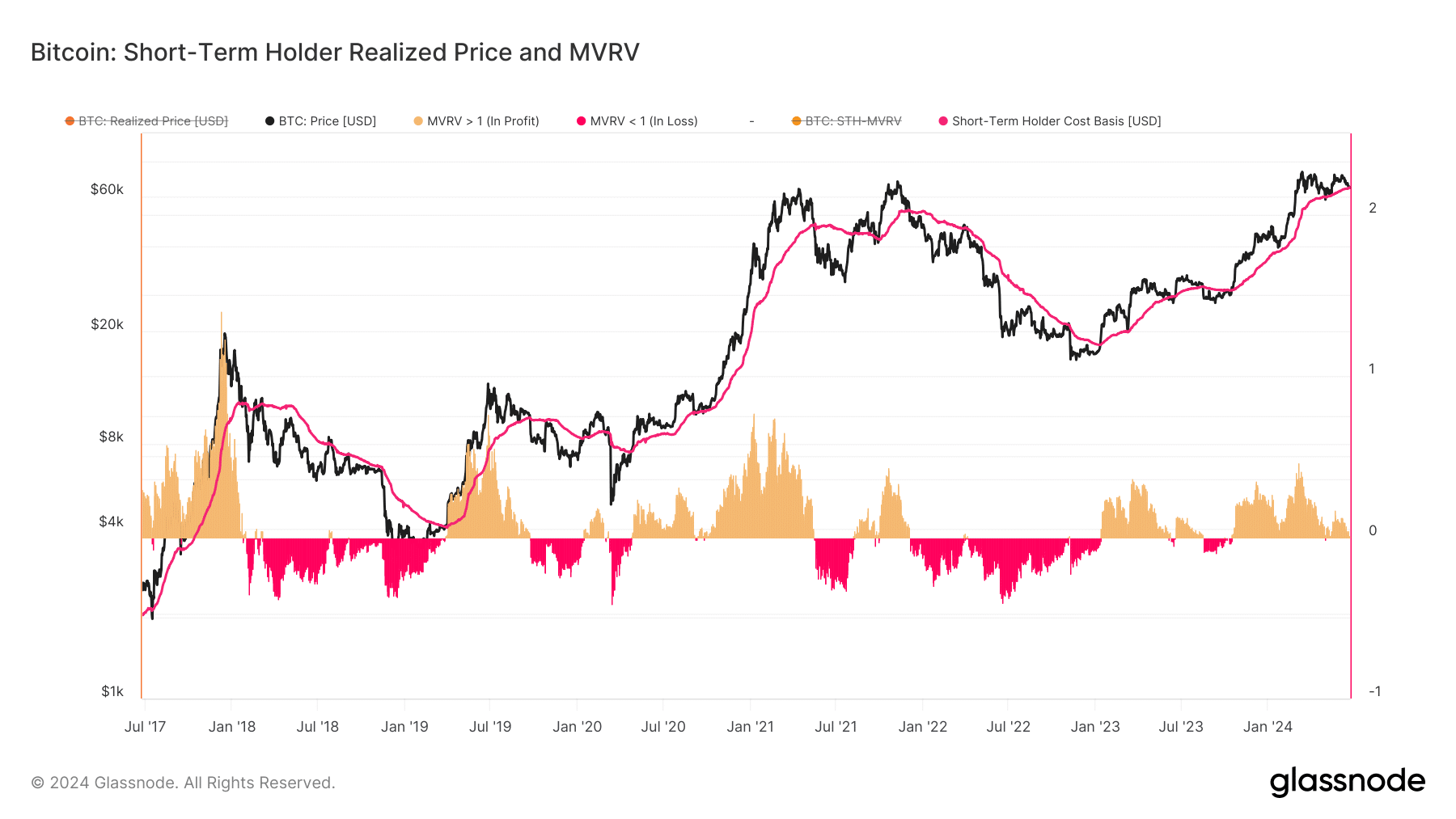

Bitcoin [BTC] has fallen under the Brief Time period Holder (STH) Realized Value, indicating that the worth would possibly drop to $61,000 or under $60,000 within the coming days.

In line with Glassnode, at press time, Bitcoin’s STH Realized Value was $64, 372 whereas BTC’s worth was $64,066. Additionally, referred to as the on-chain value foundation, the metric is the common worth of the STH Bitcoin provide.

Right here, it’s price declaring that the STH Realized Value is valued on the day every coin was final transacted on-chain. Usually, STH are those that purchased BTC not later than the final 155 days.

Bitcoin seems set to slip

When Bitcoin rises above the Realized Value, it will increase the prospect of a worth rise. This, as a result of the metric acts as assist for the crypto’s worth. Nonetheless, a fall below the threshold sparks the potential of a correction. This was additionally evident in earlier market cycles too.

For instance, again in 2018, the cryptocurrency fell under the Realized Value of $11,012. A couple of months later, the worth of the coin dropped to $8,455. Within the final days of 2021 when Bitcoin’s worth was $48,962, and the metric was over $53,000, it didn’t take lengthy for the worth to drop to $42,306.

Supply: Glassnode

If we go by this historic information, the worth of BTC is vulnerable to one other correction regardless of its 7.82% fall within the final 30 days.

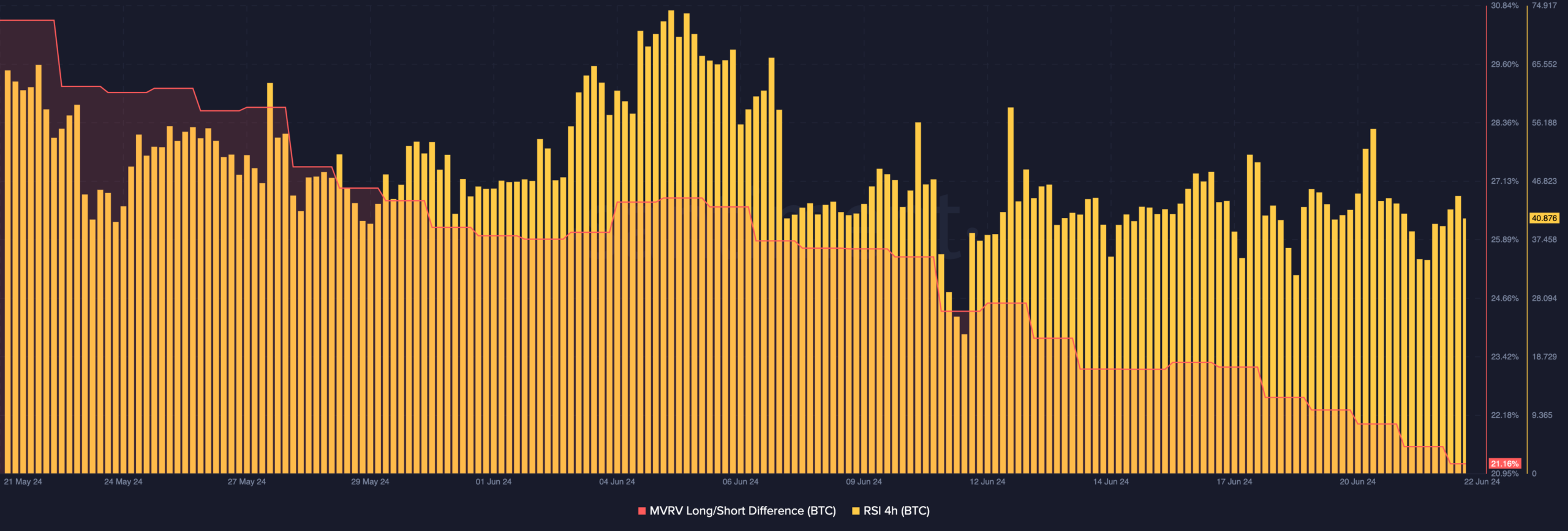

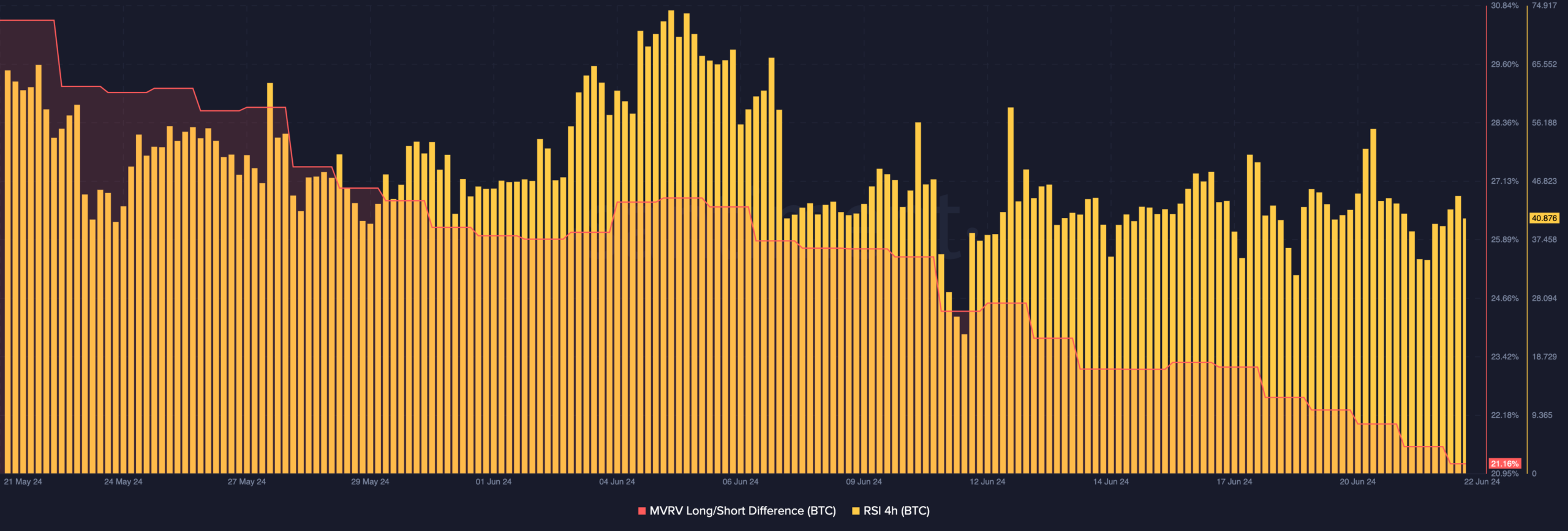

Along with this, AMBCrypto analyzed the Market Worth to Realized Worth (MVRV) Lengthy/Brief Distinction. This metric makes use of the ratio of long-term holders and new cash coming into Bitcoin to find out potential market deviations.

It’s nonetheless a bull market!

If the MVRV Lengthy/Brief rises, it implies that new cash is getting into the coin’s market. Nonetheless, a decline implies in any other case. At press time, the metric was all the way down to 21.16%.

This can be a signal that BTC has lacked a high level of capital in latest instances. Therefore, the worth of the coin may drop within the brief time period.

Nonetheless, the metric additionally reveals if a cryptocurrency is in a bear or bull section. For the reason that studying was constructive, it means Bitcoin continues to be in a bull market. As such, if the worth drops to $61,000, the worth could possibly be a lot increased later within the cycle.

Moreover, the Relative Energy Index (RSI) on the 4-hour chart was 40.87. Right here, the RSI measures momentum, exhibiting whether it is bullish or bearish. The studying for a similar was under 50 – An indication of bearish momentum.

Supply: Santiment

Sensible or not, right here’s BTC’s market cap in ETH phrases

Therefore, BTC’s bearish prediction could possibly be validated. That being stated, an analyst on X – Crypto Caesar – predicted that the decline could possibly be a chance to purchase earlier than one other rally start. He wrote,

“Bitcoin‘s short-term holder realized worth usually acts as assist in upward trending markets (see chart). At present sitting at $63,900. Traditionally this has been a great BTFD alternative earlier than extra banana mode.”