- BTC’s key metric has offered a shopping for alternative.

- Nonetheless, bearish sentiments stay vital available in the market.

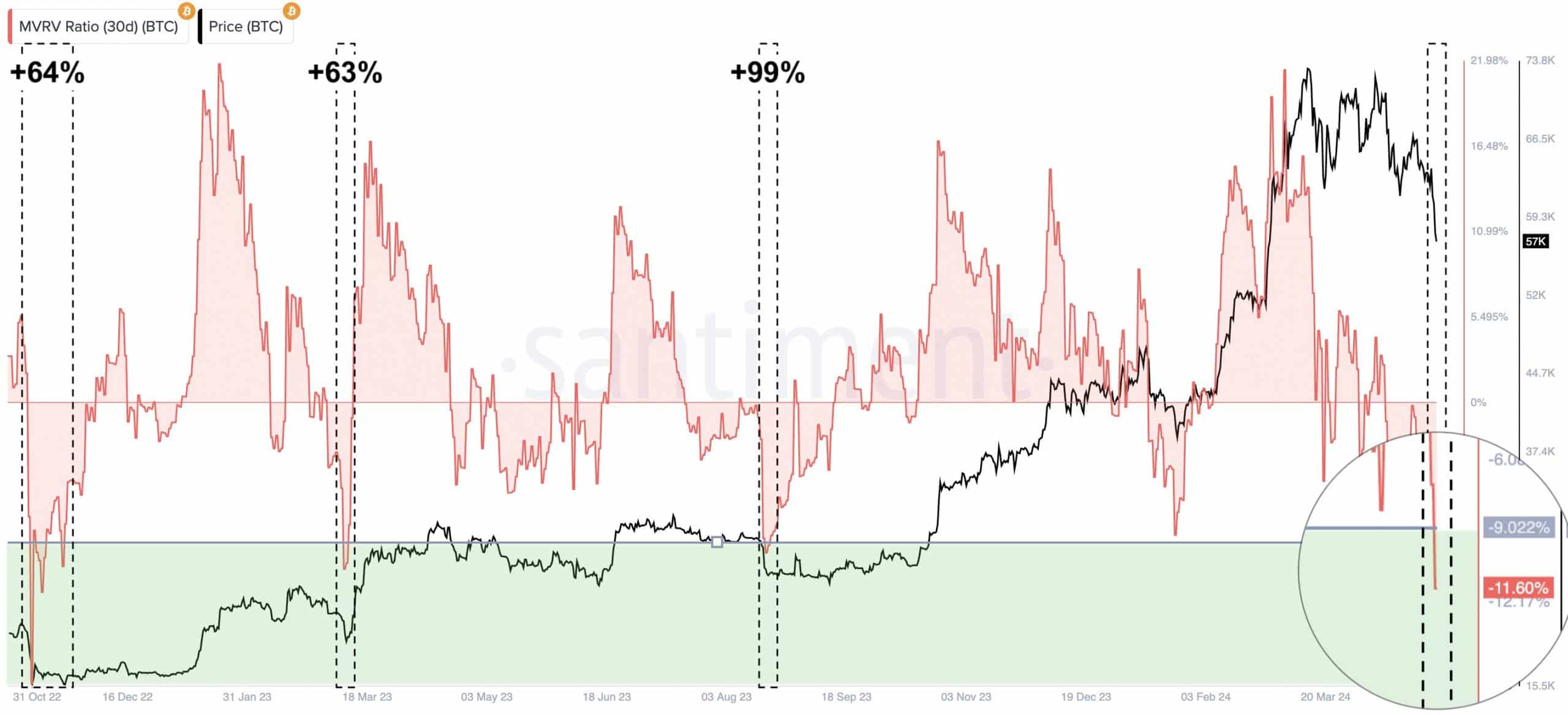

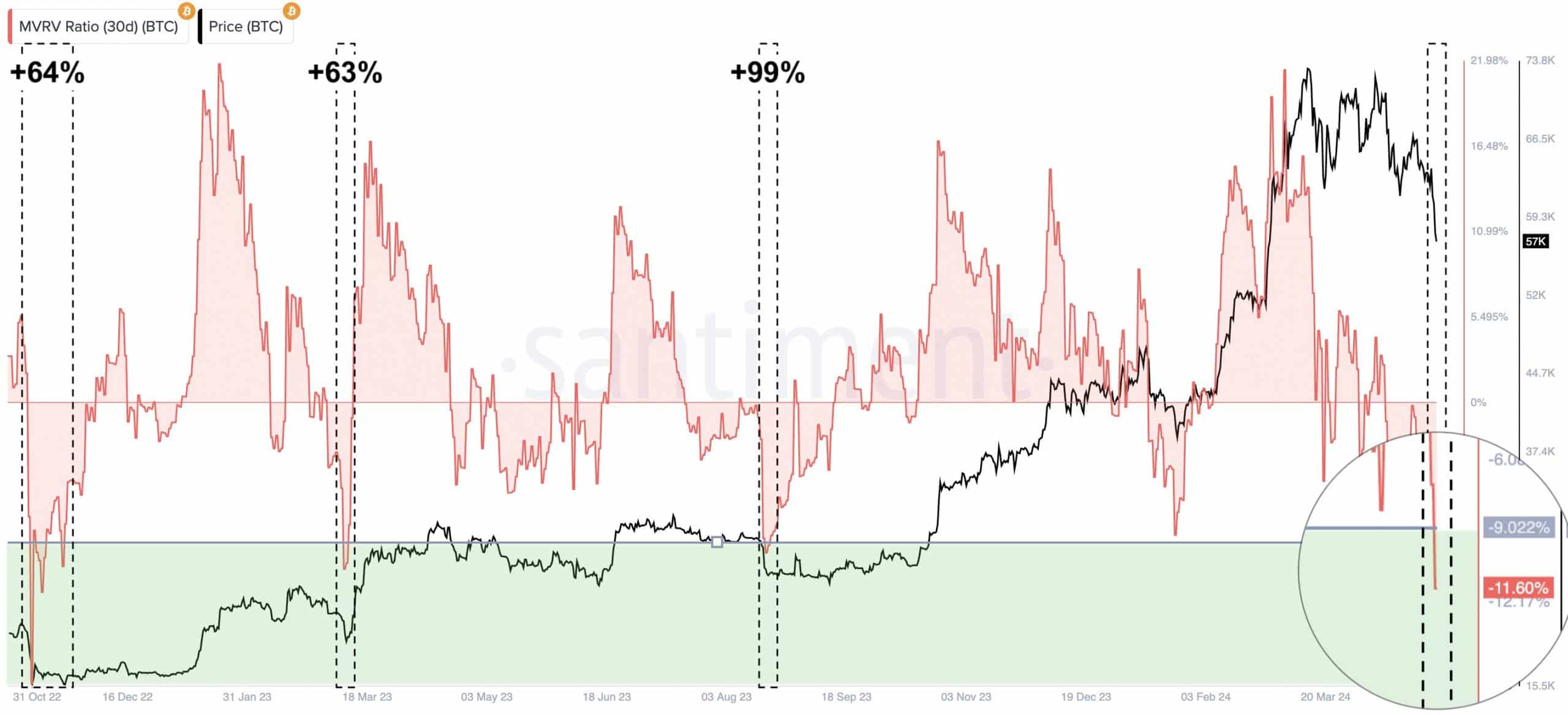

Bitcoin’s [BTC] Market Worth to Realized Worth (MVRV) has flashed a purchase sign, crypto analyst Ali Martinez has noted in a publish on X (previously Twitter).

In accordance with the analyst, the token’s MVRV ratio assessed over the 30-day transferring common returned a destructive worth of -11.6%.

Supply: Santiment

This metric tracks the ratio between an asset’s present market worth and the typical worth of each coin or token acquired for that asset.

When it returns a worth above one, it means that an asset’s market worth is considerably increased than the value at which most buyers acquired their holdings. When this occurs, the asset is claimed to be overvalued.

However, a destructive MVRV worth exhibits that the asset in query is undervalued. It means that its market worth is under the typical buy worth of all its tokens in circulation.

Martinez assessed the historic sample of BTC’s MVRV ratio (30d) and located that the final 3 times the metric dropped under -9%, the coin’s worth surged by 64%, 63%, and 99%, respectively.

In accordance with Martinez, a double-digit rally is likely to be within the books for the main coin as its MVRV ratio now sits underneath the vital -9% mark.

Is a rally possible?

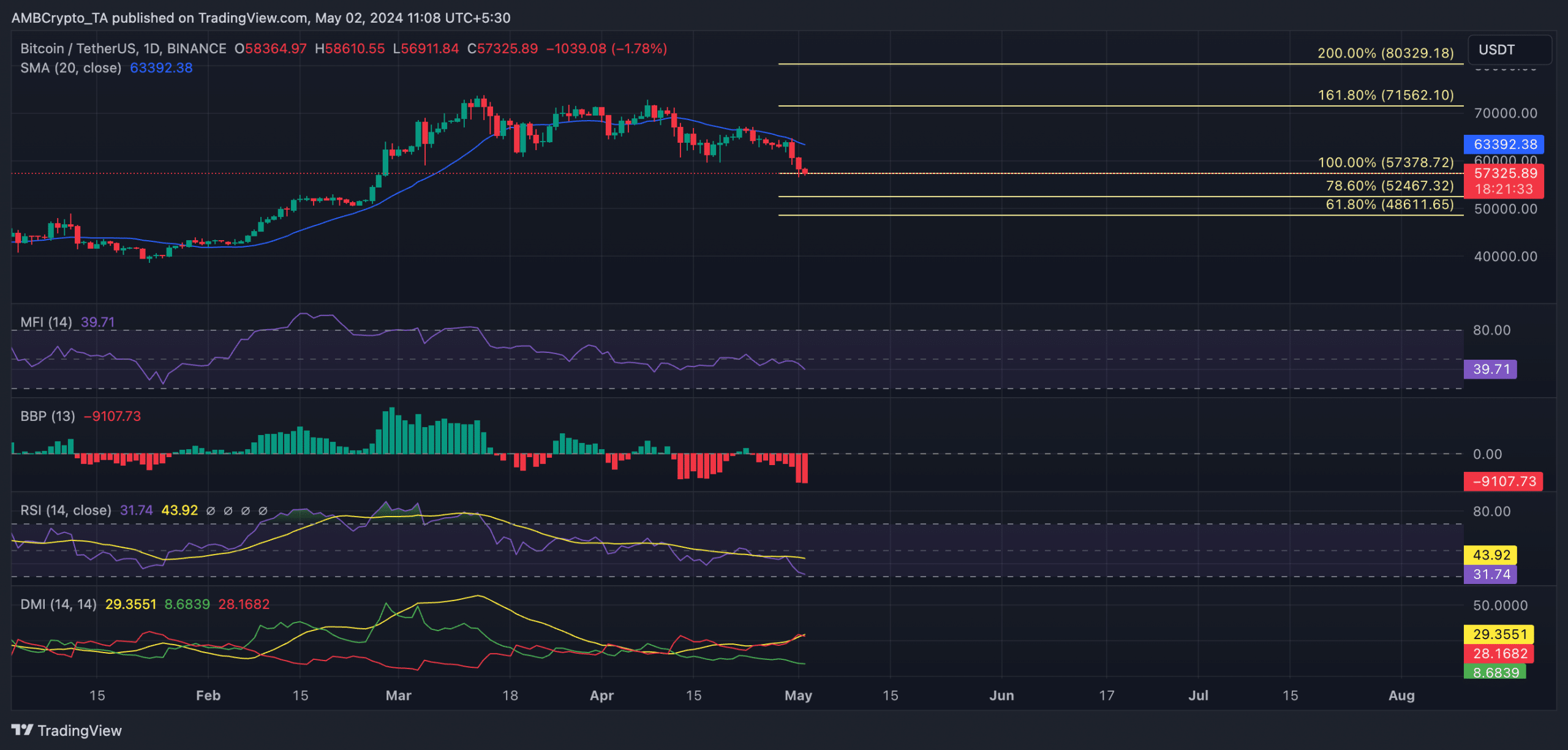

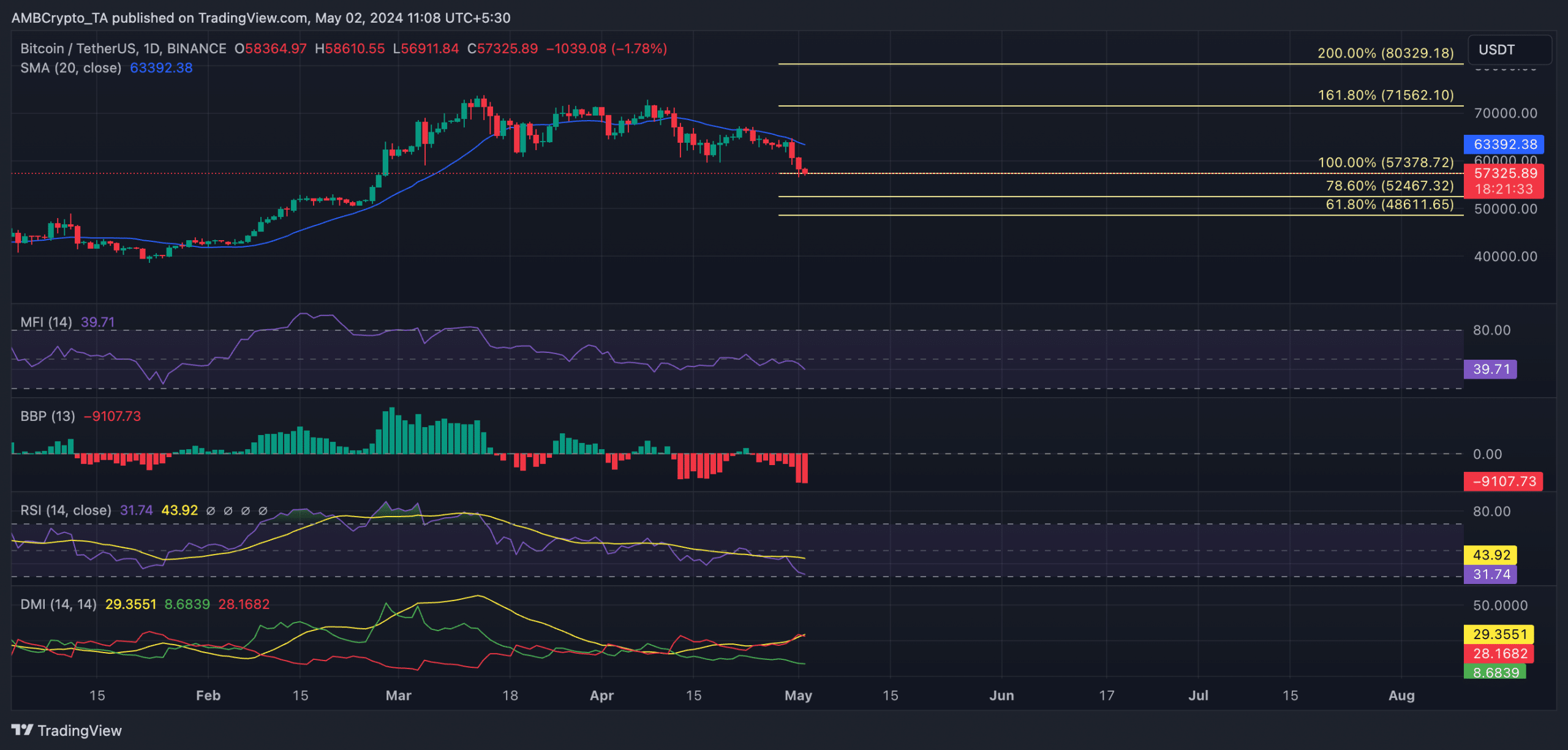

Readings from the coin’s actions on a each day chart revealed that it broke under assist on thirtieth April, signaling that the bears had been in management.

A few of the key technical indicators noticed confirmed the numerous decline in bullish sentiment. For instance, BTC’s Elder-Ray Index has returned solely destructive values since twenty fourth April.

The indicator measures the connection between the power of an asset’s consumers and sellers. When its worth is destructive, bear energy dominates the market.

Likewise, the coin’s optimistic directional index (inexperienced) rested underneath its destructive index on the time of writing. This confirmed that promoting exercise outpaced coin accumulation amongst market contributors.

Is your portfolio inexperienced? Take a look at the BTC Revenue Calculator

Relating to demand for BTC, its Relative Energy Index (RSI) and Cash Movement Index (MFI) trended downward as of this writing. Its RSI was 31.74, whereas its MFI was 39.71. These values confirmed that the coin was making its technique to the oversold zone of the market.

If promoting momentum heightens, the bears could push the coin’s worth downward to $52,000 and, subsequently, to $47,000.

Supply: BTC/USDT on TradingView