- Analyst claims that the value affect on BTC from miners has declined.

- Nonetheless, the entire miner provide stood at over $100 billion, therefore a key worth issue.

Bitcoin [BTC] was again to its three-month-long vary lows close to $60K amidst compounding unfavorable sentiment drawn from a number of elements.

Market observers have cited macro uncertainty, the Bitcoin miner disaster, and provide overhangs from numerous entities, together with deliberate Mt. Gox repayments.

Nonetheless, one analyst, Fred Krueger, had downplayed the affect of Bitcoin miners on BTC worth motion based mostly on the quantity held by prime miners and month-to-month provide. He stated,

“These miners not matter to the value of Bitcoin. The highest 5 collectively maintain 34K BTC. Even when they bought half of all the things they’ve, that’s only one billion USD, or 0.1% of the worth of the asset. By way of new provide, these 5 generate 2K BTC monthly. It not issues.”

No, BTC miners nonetheless matter

Marathon Digital, Clear Spark, and Riot Blockchain are amongst the highest public BTC miners per market cap. Nonetheless, different analysts countered Krueger’s argument.

Certainly one of them, James Van Straten, underscored that a lot of the miners’ promoting stress was from unprofitable non-public miners.

“Public miners solely have 20-25% of the hash price. A variety of non-public firms that maintain BTC are going below/spending BTC. This is without doubt one of the main the explanation why BTC struggles after every halving.”

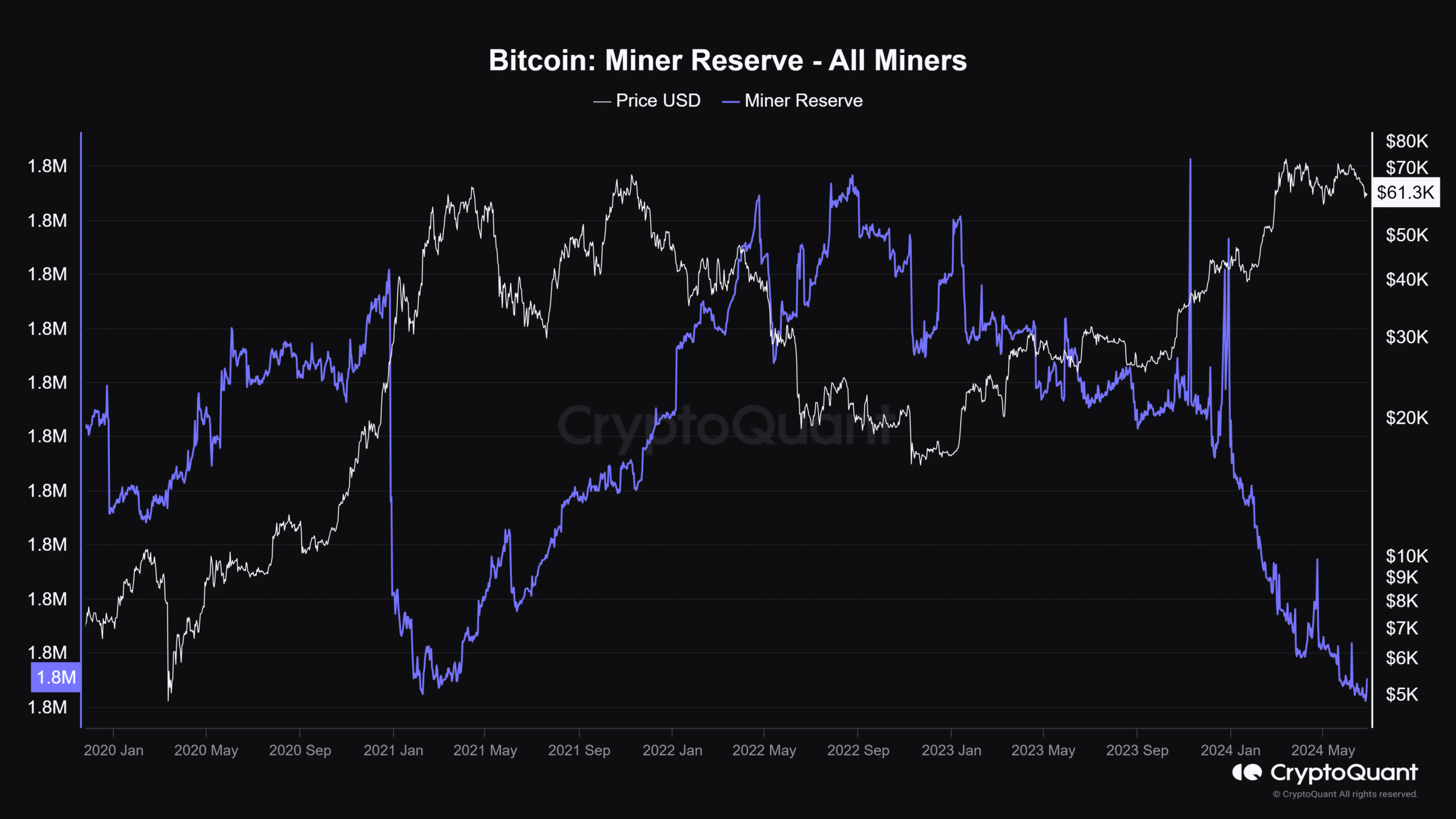

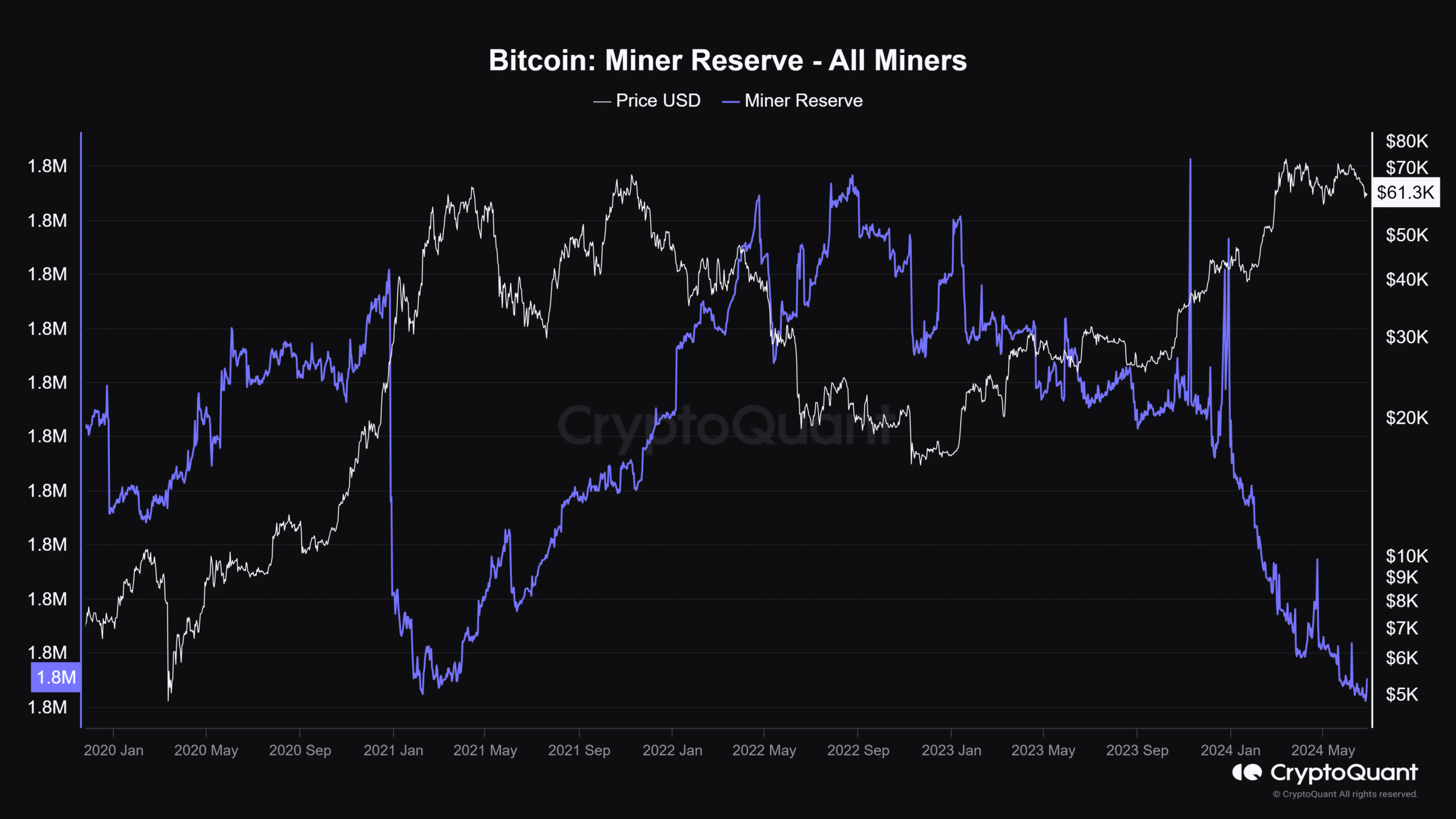

Per Straten, the entire provide held by miners was staggering at 1.8 million BTC, price about $109.8 billion at present market costs.

The analyst added that regardless of a decline within the whole provide held by miners, the staggering quantity was nonetheless a “fixed promote stress.”

AMBCrypto evaluation of the entire BTC miner reserve confirmed Straten’s take. The metric had dropped to 1.8M BTC, which matched the lows seen in 2021.

Supply: CryptoQuant

A current AMBCrypto report established that BTC Miner to Change Circulate has declined, denoting much less BTC being ahead to exchanges for sell-offs.

Nonetheless, this additionally meant that future worth upswings would tip the miners to dump at increased earnings.

One other analyst, Willy Woo, additionally maintained that the miners nonetheless matter.

“Strip that away to get the true long run demand and provide. New buyers, OG sellers, miners promoting new provide in impulses. Seems they nonetheless matter.”

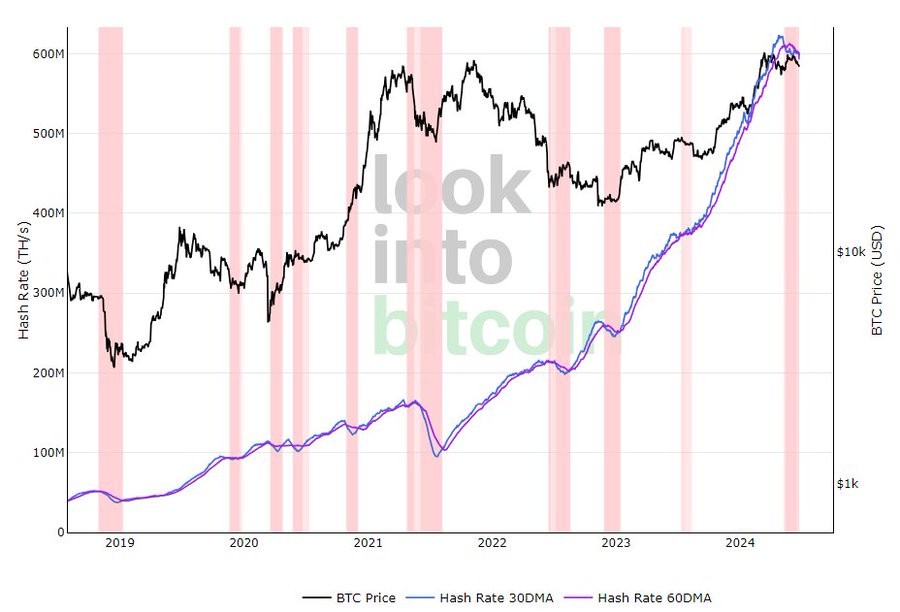

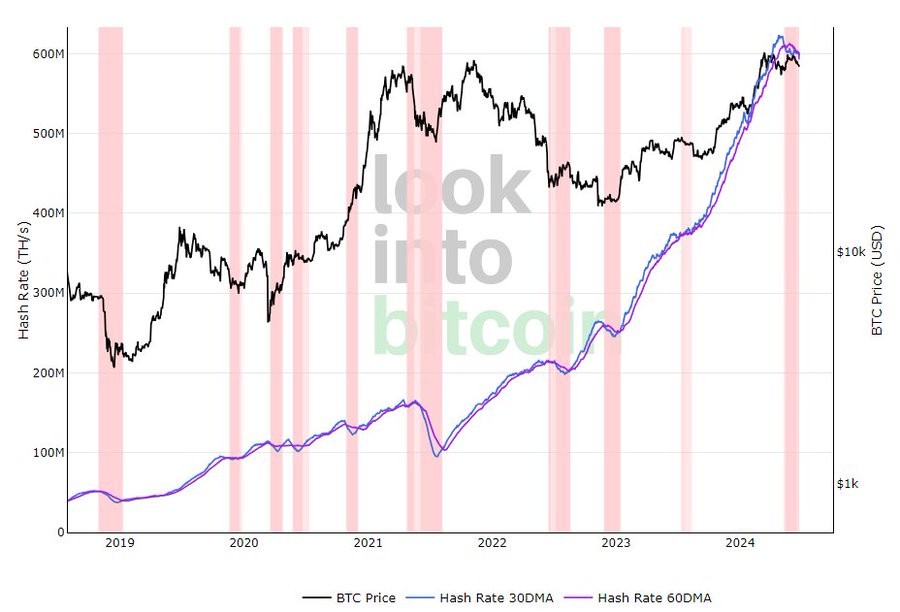

Within the meantime, the miner capitulations have been removed from over, and hashrates remained low. One consumer noted that the present one was the longest capitulation for the reason that 2022 crypto winter.

“Hashrate continues to fall. That is now the longest #bitcoin miner capitulation for the reason that backside of the 2022 bear market.”

Supply: Look Into Bitcoin

Traditionally, BTC costs bounce again each time hashrates enhance. If this development continues, it may reinforce the concept that miners nonetheless have a say in BTC costs.