- Bitcoin struggled to remain above $60,000, with some analysts forecasting a possible rally to $68,000.

- Whale transactions and a attainable “golden cross” signaled optimistic indicators for Bitcoin’s near-term efficiency.

Bitcoin [BTC] has confronted issue in sustaining a rally above the $60,000 mark, regardless of temporary durations of buying and selling above it final week.

As of the time of writing, the cryptocurrency was buying and selling at $58,947, marking a modest 2.1% enhance over the previous 24 hours.

The market’s present volatility has saved Bitcoin from making a major upward motion, and the asset has now dipped beneath the essential $60,000 degree.

Nevertheless, regardless of this current efficiency, some analysts proceed to specific optimism about Bitcoin’s potential for a rally within the coming weeks.

Rebound amid market uncertainty?

Captain Faibik, a well known crypto analyst on X (previously Twitter), lately shared his optimistic outlook for Bitcoin, suggesting that the asset should still be poised for a major rally. In keeping with Faibik,

“BTC continues to be shifting inside a Bullish Flag Sample. It might take a look at the $54k assist space once more, and it’s essential for the bulls to defend this degree. If Bitcoin bounces again from the $54k assist, it may rally as much as $68k in September.”

For context, a bullish flag sample is a continuation sample that seems after a robust worth motion, sometimes characterised by a quick consolidation or pullback part that kinds an oblong form resembling a flag.

Supply: Captain Faibik/X

This sample means that the asset may resume its upward pattern as soon as it breaks out of the flag formation, probably resulting in a major worth enhance.

Faibik’s evaluation indicated that whereas Bitcoin could face short-term volatility, the general pattern may nonetheless be upward, particularly if the $54,000 assist degree holds.

One other optimistic sentiment within the crypto group comes from Crypto Jelle, who highlighted the formation of a weekly golden cross on Bitcoin’s chart.

Jelle noted,

“Bitcoin is forming a weekly golden cross for the primary time in its historical past. The 100-week MA is crossing above the 200-week MA this week. In conventional markets, these crossovers are thought-about a bullish signal; will it work for BTC too?”

Notably, a golden cross happens when a short-term shifting common crosses above a long-term shifting common, sometimes considered as a robust indicator of an upcoming bullish pattern.

Supply: Crypto Jelle/X

The prevalence of a golden cross on the weekly timeframe for Bitcoin is seen as a probably important occasion that would sign additional upward momentum.

Bitcoin’s rising whale exercise

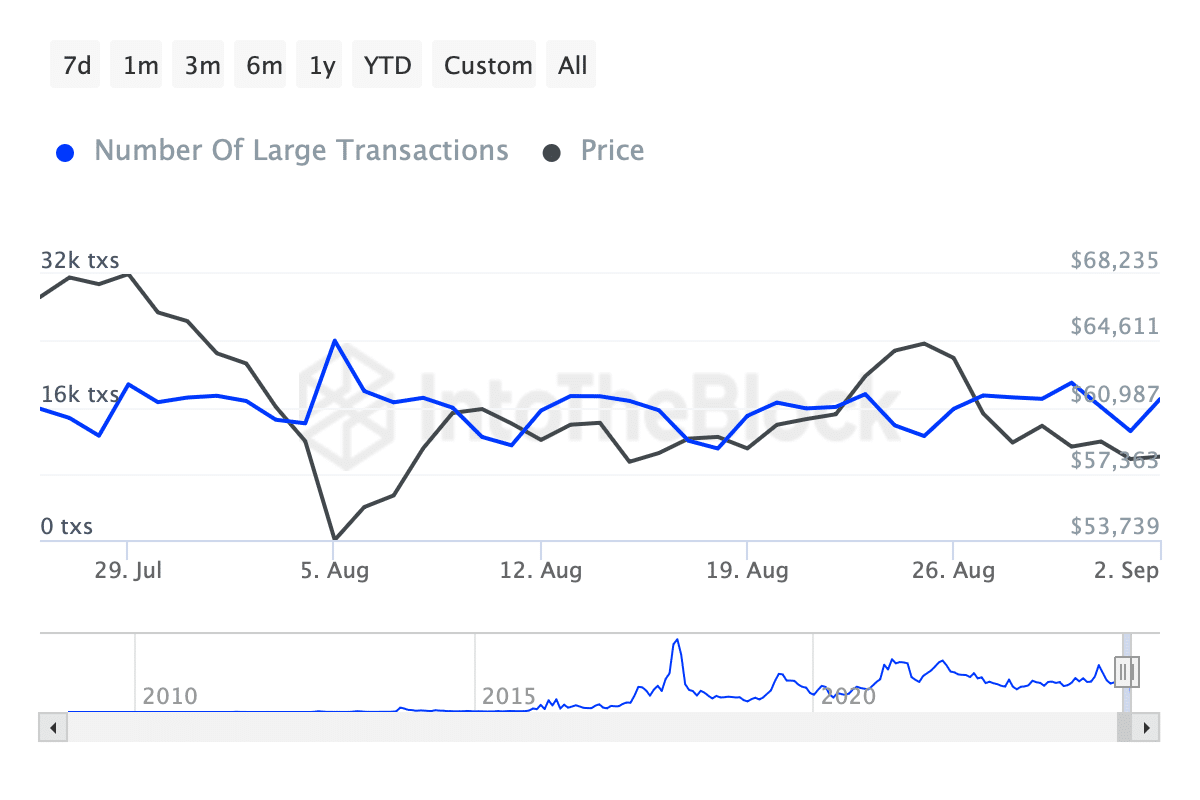

Past technical indicators, Bitcoin’s fundamentals additionally instructed a optimistic outlook. Data from IntoTheBlock revealed a notable enhance in whale transactions—these exceeding $100,000—over the previous week.

Supply: IntoTheBlock

Particularly, these transactions have surged from beneath 13,000 final week to roughly 16,940 as of at the moment.

This enhance in massive transactions usually alerts rising curiosity from institutional buyers or high-net-worth people, which may drive additional worth appreciation.

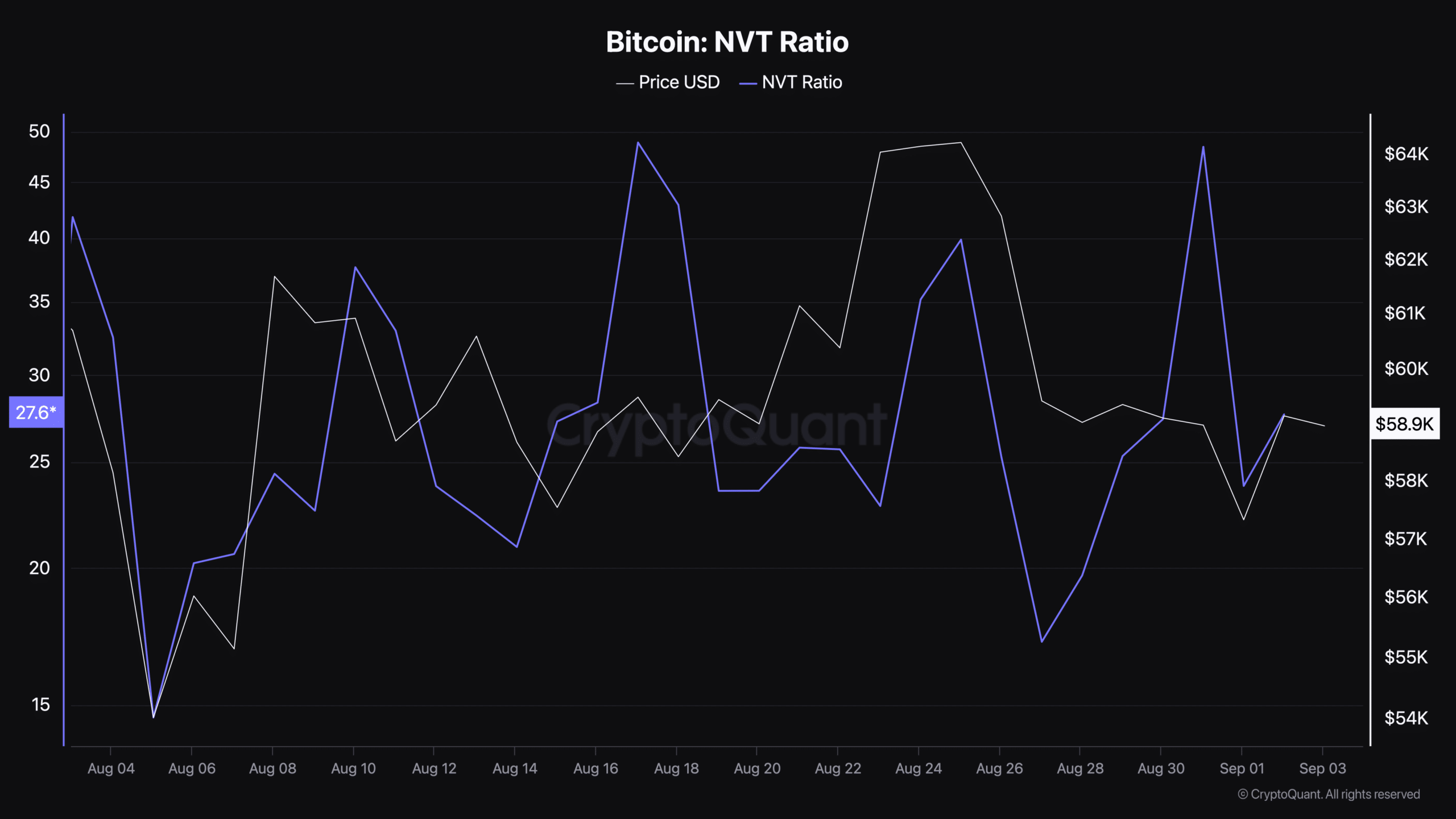

Moreover, Bitcoin’s Community Worth to Transactions (NVT) ratio, used to evaluate the asset’s valuation relative to its transaction exercise, sat at 27.63 at press time, in keeping with data from CryptoQuant.

Supply: CryptoQuant

Learn Bitcoin’s [BTC] Worth Prediction 2024–2025

The NVT ratio is commonly in comparison with the price-to-earnings (P/E) ratio in conventional markets, the place a decrease NVT ratio may point out that Bitcoin is undervalued, whereas the next ratio would possibly recommend it’s overvalued.

With the press time NVT ratio of 27.63, Bitcoin’s valuation gave the impression to be in an affordable vary, probably supporting additional development if transaction exercise continues to extend.